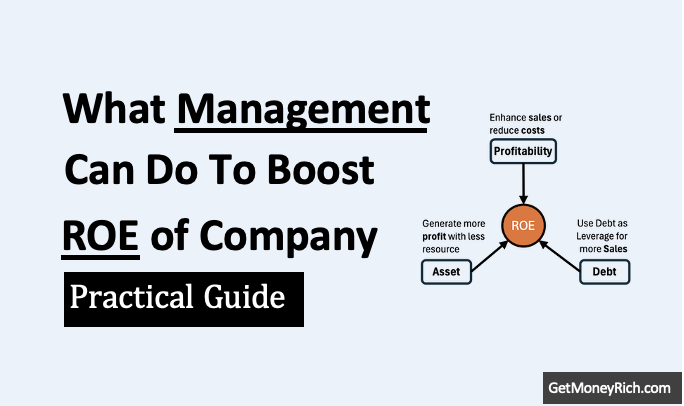

How a Company’s Management Can Boost Its Return on Equity (ROE): A Practical Guide

ROE Boosting Strategy You’re the management of Bharat Industries, an Indian manufacturing firm with a 15% ROE. Adjust the sliders to apply strategies and click Apply Strategies to see how they boost ROE! Profitability Enhancement (0–10) 0 Debt Usage (0–10) 0 Asset Efficiency (0–10) 0 Apply Strategies ROE Impact 15.00% Apply strategies to see how…