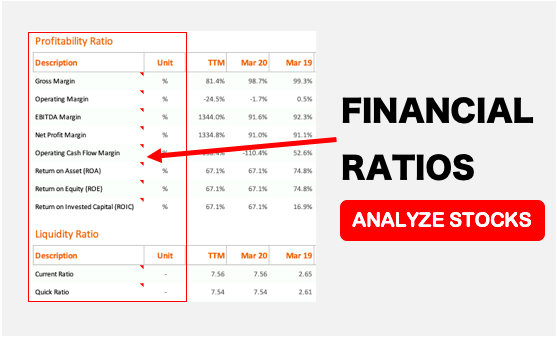

Do ROE and ROCE Drive Long Term Stock Returns?

Recently, I got a query from one of my young reader (in 20s). The question says: “I have heard that ROE and ROCE are important metrics for evaluating stocks. But do they really influence long-term stock returns? If I look at last 10-year period, will it prove that high ROE and high ROCE stocks generate…