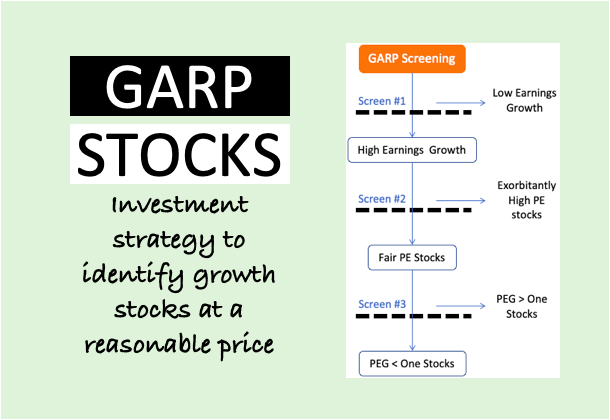

GARP Strategy: Explained [Growth At A Reasonable Price]

In our complex world of stock investing, finding a strategy that balances growth with valuation can be challenging. One approach that has gained significant traction among savvy investors is GARP, which stands for Growth at a Reasonable Price. This investment strategy merges the best elements of both growth and value investing. It aims to identify…