Return on Equity (ROE) – Understanding & Interpretation of The Ratio

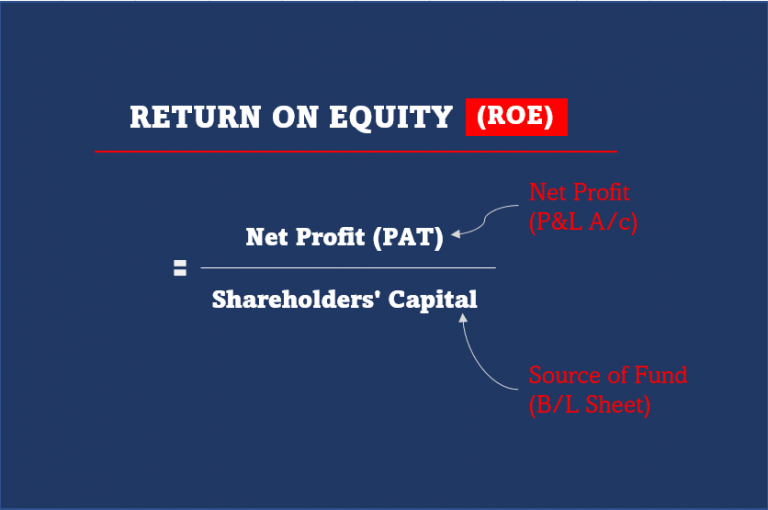

What is Return on Equity (ROE)? It is a financial ratio that is calculated by dividing net profit (PAT) by the total shareholder’s funds (Net Worth – NW) of a company. ROE is the measure of the company’s efficiency that highlights how well the company is using shareholder capital to yield net profits. A list…