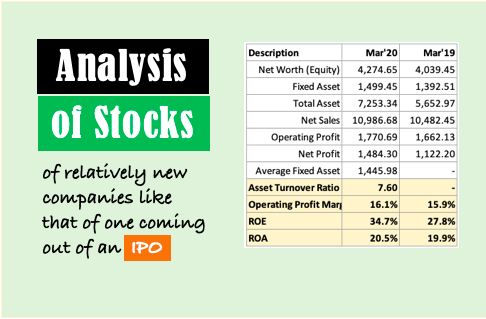

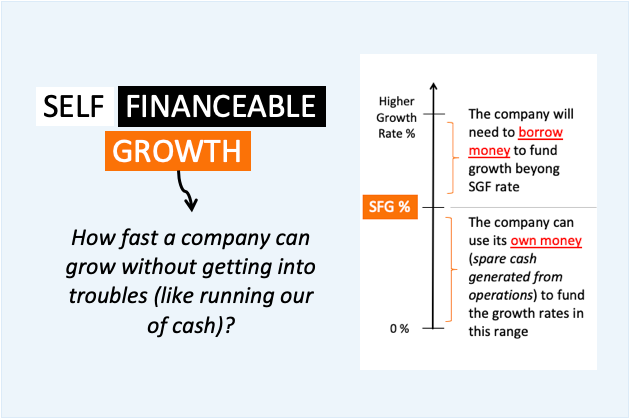

Self-financeable Growth (SFG) – How Fast A Company Can Grow On Its Own?

Here is the concept of self-financeable growth. I first read about it on Harvard Business Review (HBR). The write-up was interesting. Hence I thought to write about it, in my words, for my readers. How I landed up on HBR? Recently Indian stock market is buzzing with IPO’s. Most of the IPO’s attracted the attention of…

![Compare Indian Banks: A Quick Fundamental Analysis [2023]](https://ourwealthinsights.com/wp-content/uploads/2021/05/Compare-Indian-Banks-Image4.png)