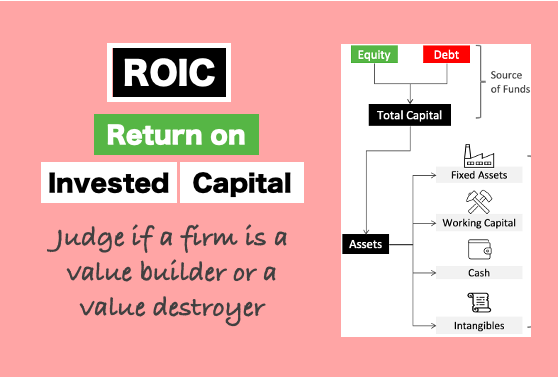

Return on Invested Capital (ROIC): Your Guide to Smarter Investing

If you’ve ever scratched your head wondering how to figure out if a company is actually worth your hard-earned cash, you’re in the right place. Today, we’re diving deep into something called Return on Invested Capital (ROIC). It’s one of those metrics that sounds fancy but is actually super practical once you get the hang…