How To Calculate The Intrinsic Value In Excel Like A Pro [Beginners]

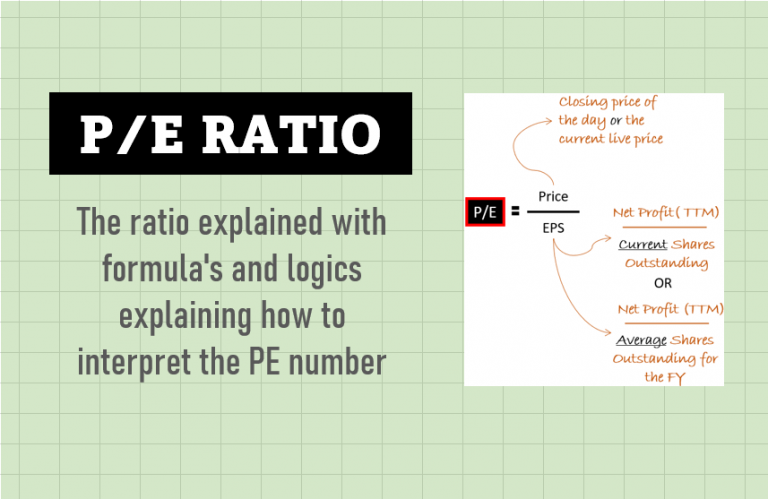

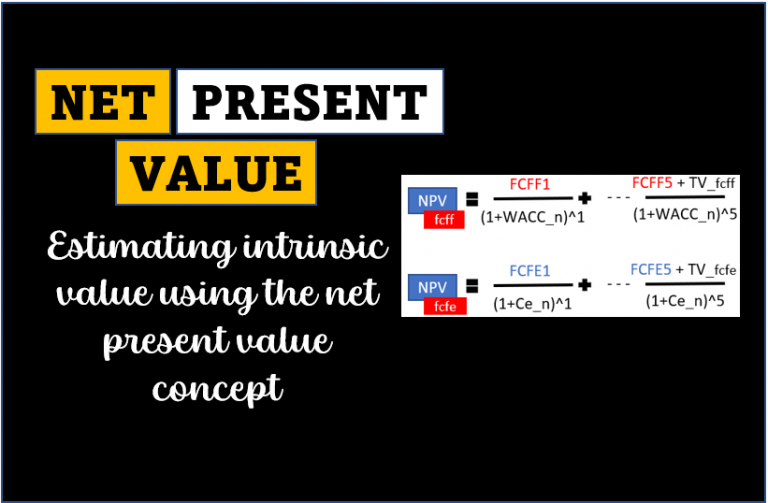

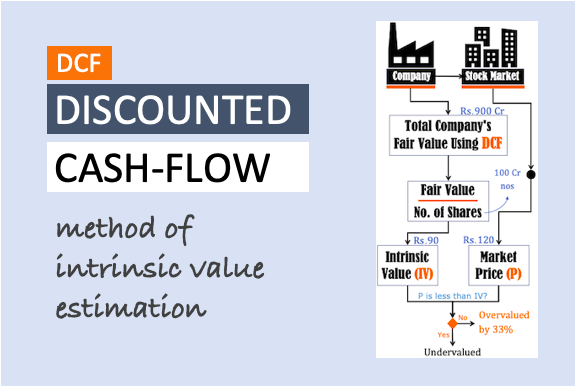

Intrinsic Value in Excel (Guide) This tool calculates a stock’s intrinsic value using the EPS and PE method. Fields are pre-filled with example data; click “Calculate Intrinsic Value” to see a sample result, or adjust the values for your stock. You can use the same method to calculate the intrinsic of a stock in Excel….