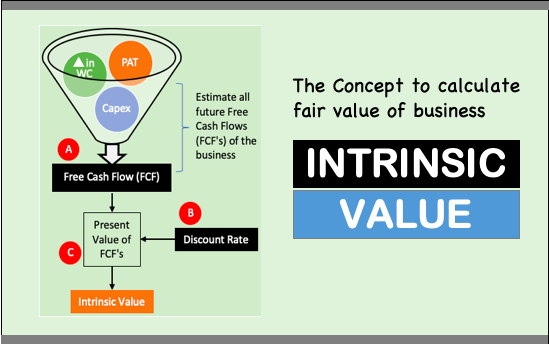

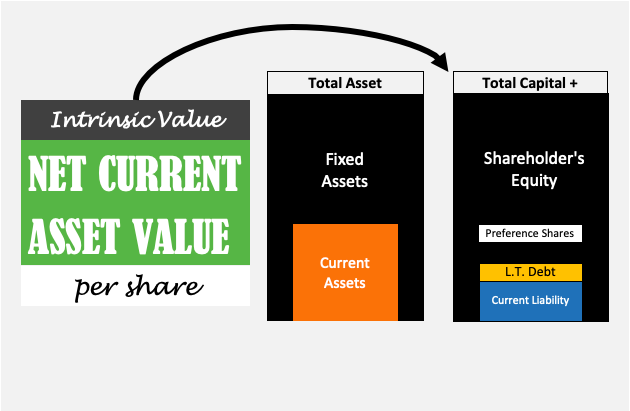

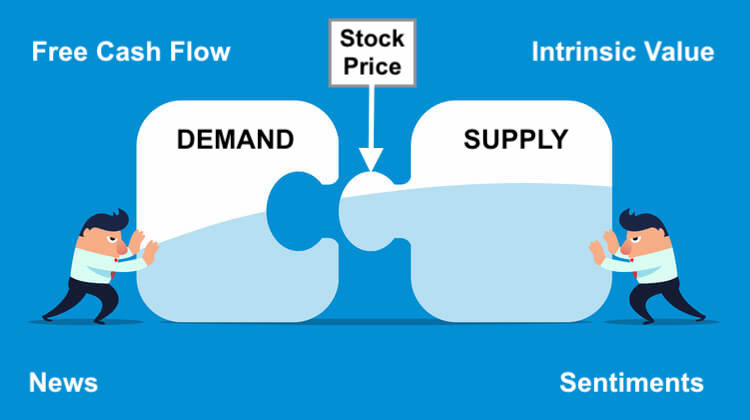

Intrinsic Value: The Concept of True/Fair Value of Business

What is the intrinsic value? It is the inherent value of an asset (business, enterprise, etc.). The essential nature of the asset gives it its intrinsic value. The value is not dependent on external circumstances. We can also understand intrinsic value as a true value of an asset. From an investment point of view, it…