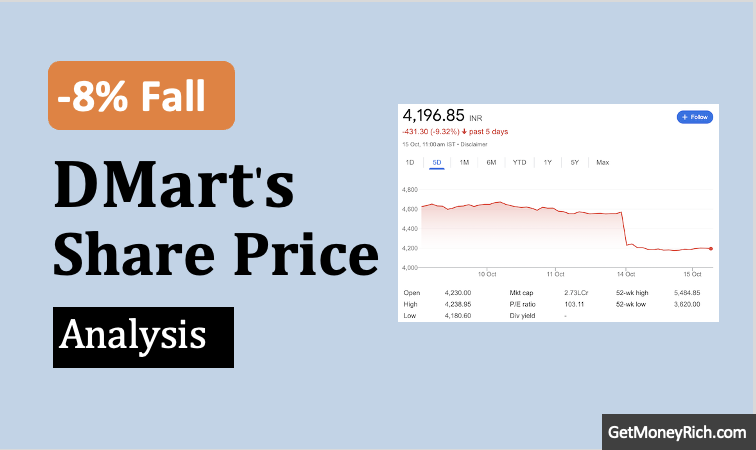

Why Market is Falling in India? [2024]

The Indian stock market has experienced significant volatility and downturns due to a confluence of several global and domestic factors. In this blog post, I’ll try to cover various reasons that are kind of collectively contributing the recent fall in the Indian market. Suggested Reading: Signals of a stock market crash. Reason #1 Global Economic…