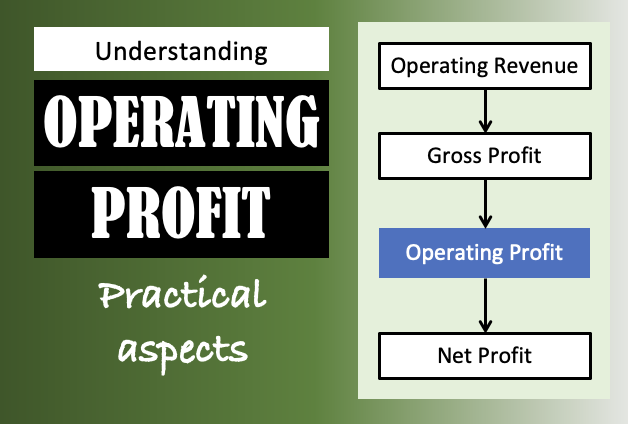

Understanding Operating Profit: A Key Metric for Assessing Business Performance

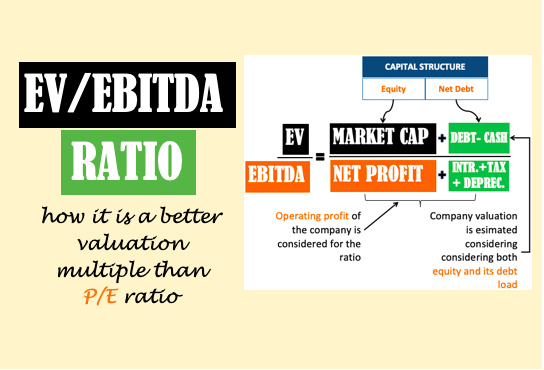

In the realm of financial analysis, understanding operating profit is crucial. It serves as a key measure of a company’s operational efficiency and profitability. However, it is essential to grasp its limitations and consider it in conjunction with other metrics. This article explores the significance of operating profit, its components, calculation, and interpretation. It will…