Signs of A Market Crash – Look Our For These Warning Indicators

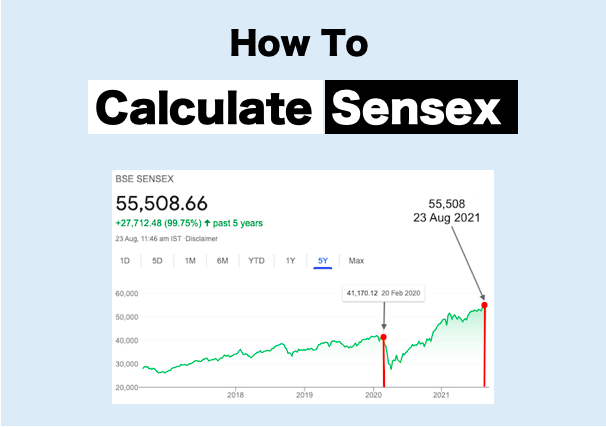

Value investors keep looking at the signs of a market crash. Why? Because they make more money during a crash than in normal times. It will not be an overstatement that they crave for the index to crash. Why? Because it is the time to buy the best shares. The indices move in cycles. There…