The purpose of this blog is to explain the basics of RBI’s CBDC. It is an RBI-issued alternative form of Indian currency. Presently, the Indian Rupee is available in two forms, physical cash and digital money in bank accounts. CBDC will also be a digitized and more cryptographed form of digital money. It will be India’s alternative to Bitcoin.

Introduction

Like Indian Rupee is a currency in paper form, RBI’s CBDC is an Indian Rupee in digital form. Both notes are issued by the Reserve Bank of India. In India, CBDC, a digital Rupee, will be called an E-Rupee (e₹). Presently, we have only mainly two forms of money, paper currency, and coins. RBI states that the E-Rupee (e₹) will work as an “additional option to the currently available forms of money.”

On the face of it, a physical Indian Rupee and E-Rupee are not different. But as the E-Rupee is in digital form, its creation, distribution, use, and monitoring will be substantially more straightforward and faster.

In the last decade, the world has seen the rise of cryptocurrencies like Bitcoin and Ethereum. They can actually be treated as digital assets or as digital money. But the problem with cryptocurrency is that, as they are not issued by RBI, they are not legal tender. As of date, the government has not allowed the use of cryptocurrencies if any form of purchase or transaction. Hence, in a way, their use or accumulation is discouraged by the RBI and the Government of India.

The E-Rupee (e₹) will be like India’s Bitcoin. Over time, E-Rupee will have almost all the features of a cryptocurrency. In the creation of the E-Rupee, the RBI is making sure that it is as close to the Indian paper currency as possible.

All countries adopted the paper currency system as it gels well with the banking system, monetary policy, and financial stability. Moreover, it also ensured the privacy issues of the Sovereign and its holders. The advent of a Digital currency is good, but it must also ensure and improve its functionality over and above the paper currency.

Evolution of Money

One of the core functions of RBI is currency management which includes the design and production of the currency (currently banknotes). The idea is to keep the circulation of good, clean, and genuine notes in the economy.

The history of world economics has seen money evolving from commodity to metal to paper. As these evolutions happened, the use of money became easier and more acceptable. Now in the world of the Internet, 90% of all transactions in this world are happening digitally. Only about 10% of deals are settled in cash. In this ever-growing digital world, it is time for the world currency to take a shift from paper form to digital form.

The advent of Blockchain technology has made it possible to evolve the present Indian Rupee into its new digital avatar, which we are now calling CBDC or E-Rupee (e₹).

At present (Dec-2022), the RBI is testing the use of CBDC as a pilot project. The same is being tested for wholesale and retail transactions.

As RBI says, “we are at the forefront of a watershed movement in the evolution of currency that will decisively change the very nature of money and its functions.”

Let’s know more basics about digital money or digital currency.

Digital Money

In a fully digital money system, all monetary transactions happen through the internet or mobile networks in an electronic form. Here there is no hard cash like a paper currency like an Rs.100 note or an Rs.10 coin.

Here the money is actually electronic codes protected by strong encryption sitting in the servers of the issuer.

The thing that gives these codes a monetary value is a declaration of the government or the central bank (like RBI) confirming/backing the value and authenticity of it to be a legal tender.

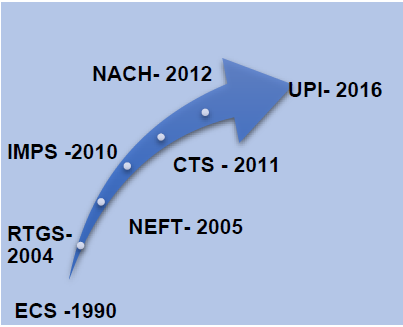

Actually, online money transactions have been happening in India for a long time. ECS and RTGS payments have been happening since 1990 and 2004 respectively. The more famous NEFT system is available in India since 2005 onwards. Bitcoin was invented only in 2009. Even the efficient IMPS system of payment transfer is available since 2010. So we can say that we have actually been using money in its digital form for a long time now. But for sure, Bitcoin has given digital money a new perspective.

CBDC (E-Rupee) is basically a digital avatar of our Indian Rupee. A digitized Rupee can be sent and received electronically using the internet or mobile network-based services like SMS. Today, we are already transferring money using our mobile phones, laptops, debit cards, credit cards, etc.

In the CBDC avatar, the digital money transaction will happen through government-controlled exchanges like a cryptocurrency exchange.

As CBDC (E-Rupee) will only be an alternative form of the Physical Indian Rupee. It is still not sure if one can convert E-Rupee into cash at bank counters and at ATM machines. But RBI has said that “CBDC shall be one-to-one exchangeable with our present Indian Rupee.” Once this exchange between CBDC to conventional money takes place, CBDC could be converted into physical cash at ATMs, etc.

Video [Hindi]

FAQs on RBI’s CBDC

In which stage of implementation is India’s CBDC

As per RBI, the implementation of CBDC will happen in five phases. It will start with (1) building a prototype, (2) functionality testing of the idea in a controlled environment, (3) testing positive and negative scenarios, (4) Final design of the prototype, and (5) Pilot testing. India is currently conducting the pilot testing of both the wholesale CBDC (CBDC-W) and Retail CBDC (CBDC-R).

Can RBI’s CBDC lead to a Bank Run?

If CBDC will fetch no interest on deposits, people will prefer to keep their money in banks. However, as CBDC is a liability directly of the Reserve Bank of India, people will view it as more secure cash, though it earns zero interest. But in case of economic instability caused by any reason (like COVID), people may try to switch their deposits from a bank to a CBDC wallet. A mass transfer may lead to a bank run. Though it can be prevented by keeping a cap on the maximum amount of money that can be kept in a CBDC wallet.

CBDC is based on which technological platform?

CBDC can be either a distributed ledger (DLT) or a conventional ledger-based system (non-DLT). A Cryptocurrency like Bitcoin is based on a distributed ledger system (DLT). But from the information shared by RBI regarding Indian CBDC, it looks like, DLT is not considered suitable technology. Though it might be included in the future.

How CBDC will ensure financial inclusion?

As RBI’s CBDC is digital money, it looks like it can be accessed only over the internet. But the substantial population of India either does not have internet access or is not able to use it. How these people will access and use the CBDC is a question. For CBDC to work seamlessly for everyone, it must work offline as well.

What security is required for CBDC?

Control protocols and Cryptography should ensure the safety of both CBDC data and CBDC-linked transaction data. The CBDC system should operate in a trusted environment where it cannot be hacked and manipulated. If a token-based CBDC is issued, it should be ensured that only RBI’s issued tokens are circulating in the CBDC’s ecosystem.

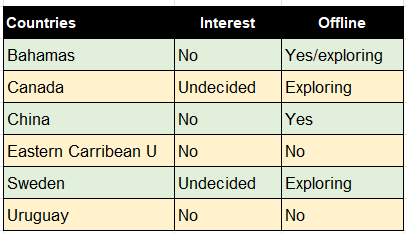

Which countries already have a CBDC? Do they offer interest, and offline functionality?

Bahamas, Canada, China, Eastern Caribbean Union, Sweden, and Uruguay have their own CBDCs. Presently, RBI’s CBDC is currently being tested in India as a pilot.

Will RBI directly issue and distribute the CBDC to the users?

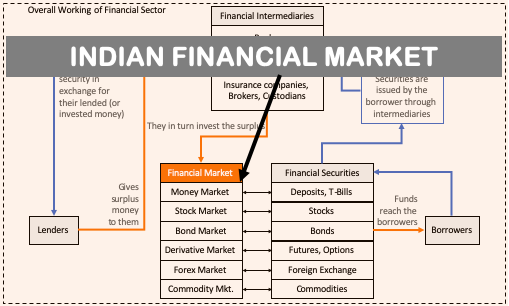

RBI will issue the CBDC but most likely the distribution will be done through intermediaries.

CBDC, a Digital Currency, will be issued in which denominations?

RBI is thinking of issuing the E-Rupee in the same denominations as the physical banknotes. RBI says, “introduction of CBDC with fixed Denomination as in physical currencies in denominations of Rs. 500, 100, 50, etc., shall facilitate in building the same level of trust and experience among public albeit in digital form.”

A digital currency will have the same level of anonymity as physical cash or not?

In physical cash spending, complete anonymity is possible. Cash can be spent without maintaining any evidence of the transaction. But CBDC being in digital form, its anonymity is questionable. But it must also be remembered that the potential to keep digital transactions anonymous might encourage and flourish illegal transactions and black money hoarding.

What are a token-based CBDC and an account-Based CBDC?

A token-based CBDC will behave like a banknote. Here, the holder of the token will be considered the rightful owner of the E-Rupee. If the token is authentic, the transaction will go through regardless of which parties are using it. In account-based CBDC, records of the account holder must also be maintained to establish if the holder of the CBDC is its rightful owner or not.

What are the pros and cons of interest-bearing CBDC?

Interest-bearing CBDC will make it more attractive for its users. CBDC stays in a wallet that users can directly access and use. Hence, an interest-bearing CBDC can improve the effectiveness of the monetary policy. But this will lead to a loss of deposits by banks thereby hampering their credit creation capacity. It will disrupt the whole banking system. To prevent it, banks may increase their interest rates to attract deposits. This will result in higher interest rates charged on loans. This type of system will make it difficult for RBI to control interest rates and the supply of money. A non-interest-bearing CBDC will not compete with banks. Interest-free CBDC will still be attractive as a payment system.

Will RBI’s CBDC be of multiple types?

There can be primarily two types of CBDC, Retail (CBDC-R) and Wholesale (CBDC-W). As RBI says, “CBDC-R is potentially available for use by all private sector, non-financial consumers and businesses.” While CBDC-W will be for financial institutions only (interbank payments). CBDC-R will be the electronic version of the present cash. CBDC-R will mainly work as a payment system for the public and businesses. In addition to RTGS, NEFT, IMPS, and UPI, CBDC-R will work as a safer digital payment instrument directly backed by the RBI.

Who will administer the CBDC?

RBI has indicated that there could be three models of CBDC. Out of these three, one will be finally implemented. The first model could be a single-tier CBDC or Direct CBDC. Here RBI will do everything like issuance, account-keeping, transaction verification, KYC, etc. Here the central bank will interact directly with the end customer. The second model could be an indirect model. Here the CBDC wallets will be with the banks. Hence, the banks will work as intermediaries or service providers to the CBDC users. The third model will be a Hybrid model where the RBI will issue CBDC to multiple entities. These entities would then be responsible for all customer-associated activities. As per RBI, “the Indirect system may be the most suitable architecture for the introduction of CBDC in India.”

Why CBDC is required for India?

RBI has multiple reasons to adopt CBDC. (1) Public needed a new currency in its digital avatar. It was evident from the way the public accepted cryptocurrencies like Bitcoin, Etherium, etc. Hence, to prevent any future damaging disruptions, RBI preferred having its own digital currency. (2) Issuance of cash for RBI becomes efficient in CBDC mode. (3) Over the last few years, the usage of physical cash was anyways seeing a downfall. Hence, cash in form of CBDC might rekindle cash usage. (4) The cost of physical cash management is very high. CBDC will lower this cost. (5) Indians still prefer physical cash for small-value purchases (below Rs.500). Hence cash in the form of CBDC might fulfill the public urge to spend in cash.

What is the advantage of CBDC over other digital payment systems?

As CBDC is directly a currency, a legal tender in digital form, payment settlements in CBDC will be comparatively more risk-free compared to conventional payment systems. CBDC will also ensure more real-time, cross-border payment settlements.

How CBDC will be different from money sitting in our bank accounts in digital form?

Physical cash and money in bank accounts is a legal tender. CBDC will also be a legal tender. But the difference will be in the way they are accounted for. The former is recorded as a liability of the commercial banks. The CBDC will be a direct liability of the RBI.

Will CBDC and Banknotes be independent of each other?

No. RBI Says, “CBDC will be exchangeable one-to-one at par (1:1) with the fiat currency.”

Suggested Reading:

![How Wealth Accelerates After Reaching One Crore [Compounding]](https://ourwealthinsights.com/wp-content/uploads/2024/09/How-Wealth-Accelerates-After-Reaching-One-Crore-Thumbnail-768x443.png)