One day my Life Insurance agent approached me and informed me about a child insurance plan.

That insurance policy provided insurance coverage of Rs 10,00,000.

Upon purchase of this child plan, the annual premium payment was Rs 52,000 for next 18 years.

The returns will be affected at the end of 18th year, 19th, 20th, 21st, 22nd and 23rd year.

I was supposed to take the decision of buying this policy in a matter of one week.

Considering the investment horizon was 15+ years, I was confused between child insurance plan vs mutual fund investment

Generally, when it comes to future planning of our child, insurance policy sounds more coherent.

In money matters related to child, one does not take risks.

Hence, when my insurance agent offered me a child plan, I was tempted to grab it immediately.

But fortunately I decided to give it a thought. I asked my agent for a weeks time.

Here I present to you the return matrix of the insurance policy:

| Year | Return | Cumulative Premium Paid @ Rs 52,000/year | Return in Percentage per annum |

| 18th | Rs 15,50,000 | Rs 09,36,000 | @ 5.1% p.a. |

| 19th | Rs 01,40,000 | Rs 09,36,000 | @ 5.4% p.a. |

| 20th | Rs 01,40,000 | Rs 09,36,000 | @ 5.6% p.a. |

| 21st | Rs 01,40,000 | Rs 09,36,000 | @ 5.8% p.a. |

| 22nd | Rs 01,40,000 | Rs 09,36,000 | @ 5.9% p.a. |

| 23rd | Rs 04,00,000 | Rs 09,36,000 | @ 6.7% p.a. |

| Total | Rs 25,10,000 | Rs 09,36,000 |

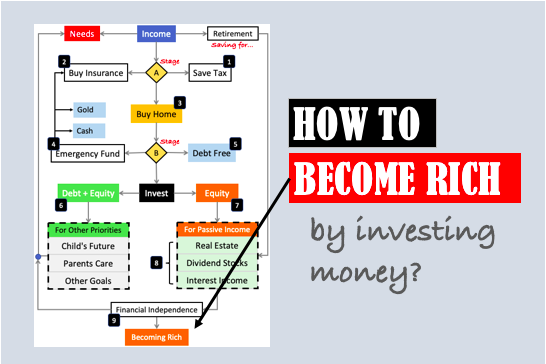

I am a big fan of equity linked investments. I mostly take the equity route when time horizon is more than 4 years.

Hence was reasonably confused with this insurance policy.

The tenure of the policy in consideration was nearly 18 years.

In this holding period equity linked investment can give higher returns (12% per annum).

The only doubtful point was the certainty of returns. It is true that equity linked investment are volatile.

But this is also true that the longer is the investment horizon, more certain is the expected returns.

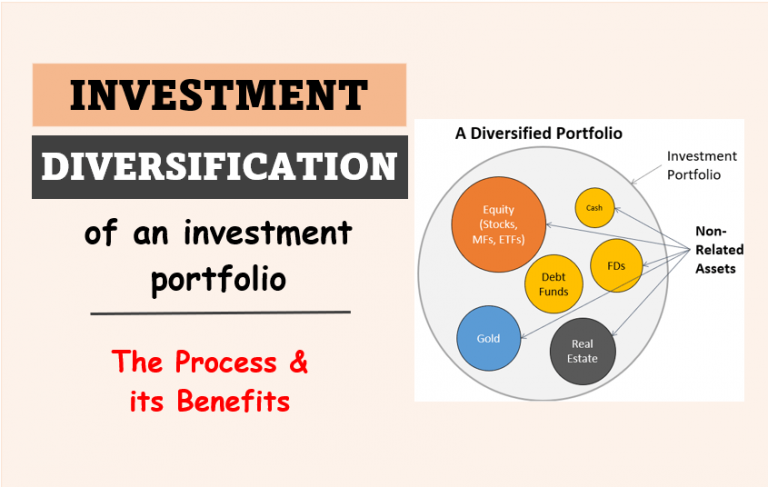

If we keep the portfolio well diversified, we can be very sure of 12% returns in India.

But probably ‘very sure’ was not convincing for me. After all it was the matter of my child’s future.

I needed confirmations that my returns are nearly 100% sure.

The insurance scheme was offering a minimum return of 6.7% per annum.

There was no equity linked investment scheme that could guarantee returns with such certainty.

As this money was planned for my child’s future, I wanted to be more sure before taking any decision.

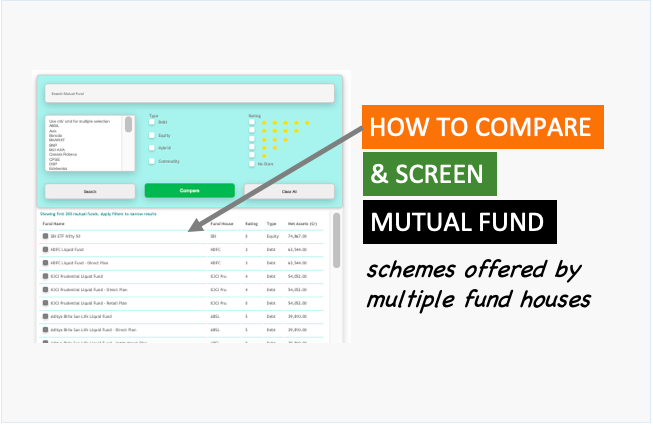

I decided to do the study myself and dig into the history of returns given by mutual fund companies.

I wanted to compare a child insurance plan vs mutual fund with a backdrop of 18 years as time horizon.

My first step was to know what type of mutual funds are available in line with my investment goal (child plan).

With my limited knowledge of equity market, I was sure that I will certainly not for small cap or even mid cap linked equity plans.

But when investment horizon is more than 15 years, riskier investment can give higher returns, right?

But my mind was telling me to take it easy as this money was for my child.

So I decided to narrow down my research to the following types of mutual fund alone.

| Sl | Fund Category | Approx. 5 Year Return by top CRISIL ranked funds | Comparative Risk Rating |

| 1 | Large Cap Fund | ~ 7.10% | High |

| 2 | Banking and Finance Fund | ~ 11.47% | Medium |

| 3 | Balanced Fund | ~ 08.57% | Medium |

| 4 | Long Term Debt Funds | ~ 07.24% | Low |

| 5 | Monthly Income Plan (Aggressive) | ~ 07.62% | Low |

LARGE CAP FUND

I then researched and generated Top 10 Large Cap Funds and their annualized returns

| SL | Fund Name | CRISIL | AUM | 3YR (%) | 5YR (%) |

| 1 | ICICI Pru Focused Bluechip Eqty (G) | Rank 1 | 3,809.54 | 15.5 | — |

| 2 | Fidelity India Growth Fund (G) | Rank 1 | 292.65 | 13.9 | — |

| 3 | Fidelity Equity Fund (G) | Rank 1 | 3,001.08 | 14 | 6.1 |

| 4 | UTI Opportunities Fund (G) | Rank 1 | 1,422.50 | 15.2 | 11.6 |

| 5 | HDFC Top 200 Fund (G) | Rank 2 | 11,189.82 | 12.4 | 9.8 |

| 6 | HDFC Index – Sensex Plus Plan | Rank 2 | 83.78 | 11.4 | 5.9 |

| 7 | DSP-BR Top 100 Equity – RP (G) | Rank 2 | 3,119.27 | 11.1 | 7.6 |

| 8 | Franklin India Bluechip (G) | Rank 2 | 4,565.20 | 12.9 | 7 |

| 9 | JPMorgan India Equity Fund (G) | Rank 2 | 289.6 | 11.5 | 3.1 |

| 10 | SBI Magnum Equity Fund (G) | Rank 2 | 507.62 | 12 | 5.7 |

| Average Return | 7.1 |

BANKING AND FINANCE FUND

My next step was to research and generated Top 10 banking Funds and their annualized returns.

My logic says that the banks and financial institutions have a very sound knowledge of money management.

Hence the returns they are giving in long term horizon will be sure and above average.

As there was no CRISIL ranking available for research for these banking funds, I decided to rank the fund on basis of their Asset Under Management (AUM).

| SL | Funds | CRISIL | AUM | 3YR (%) | 5YR (%) |

| 1 | Reliance Banking Fund (G) | Not Ranked | 1,671.49 | 20.4 | 14.9 |

| 2 | UTI Banking Sector (G) | Not Ranked | 358.29 | 17.2 | 10.3 |

| 3 | Sundaram Fin-Serv. Opp.-RP (G) | Not Ranked | 207.87 | 13.3 | — |

| 4 | ICICI Pru Bkg & Fin Serv-RP(G) | Not Ranked | 143.94 | 17.3 | — |

| 5 | GS Bank BeES | Not Ranked | 53.3 | 16.8 | 9.2 |

| 6 | Religare Banking Fund -RP (G) | Not Ranked | 41.22 | 18.8 | — |

| 7 | Reliance Banking Fund – IP (G) | Not Ranked | 33.09 | — | — |

| 8 | Sahara Bkg & Fin. Services (G) | Not Ranked | 20.36 | 17.4 | — |

| 9 | Kotak PSU Bank ETF | Not Ranked | 12.05 | 12 | — |

| 10 | Reliance Banking ETF | Not Ranked | 11 | 17.1 | — |

| Average Return | 11.5 |

BALANCED FUND

As per my investment logic, this type of fund was my instant choice.

But I decided to evaluate other investment option.

My Child’s plan should give me capital protection against inflation and also a small capital appreciation.

A good mix of debt and equity in the portfolio of balanced funds gives me exactly this possibility.

| SL | Fund | CRISIL | AUM | 3Yr (%) | 5Yr (%) |

| 1 | HDFC Prudence Fund (G) | Rank 1 | 6,040.55 | 17.6 | 10.8 |

| 2 | HDFC Balanced Fund (G) | Rank 1 | 630.44 | 18.9 | 11.8 |

| 3 | Tata Balanced Fund (G) | Rank 2 | 329.4 | 15.4 | 8.6 |

| 4 | Can Robeco Balance (G) | Rank 2 | 185.82 | 14.7 | 9.2 |

| 5 | Reliance RSF – Balanced (G) | Rank 2 | 571.16 | 13.1 | 12.4 |

| 6 | ICICI Pru Balanced Fund (G) | Rank 2 | 334.11 | 13.6 | 5.2 |

| 7 | ICICI Pru E & D-Volatility Adv. (G) | Rank 3 | 156.38 | 12.8 | 6.1 |

| 8 | FT India Balanced Fund (G) | Rank 3 | 208.09 | 9.8 | 5.8 |

| 9 | Birla Sun Life 95 Fund (G) | Rank 3 | 519.08 | 12.3 | 8.3 |

| 10 | DSP-BR Balanced Fund (G) | Rank 3 | 647.3 | 11.5 | 7.5 |

| Average Return | 8.57 |

LONG TERM DEBT FUNDS

These funds are great for your long term capital protection.

Given a choice I will certainly go for this type of mutual fund after balanced funds.

The main advantage of this fund is above average returns (considering it is debt linked fund) and almost risk free.

| SL | Fund | CRISIL | AUM | 3Yr (%) | 5Yr (%) |

| 1 | Principal Income – Long Term (G) | Rank 1 | 41.99 | 7.3 | 8.3 |

| 2 | SBI Dynamic Bond Fund (G) | Rank 1 | 1,256.41 | 8.6 | 4.8 |

| 3 | UTI Bond Fund (G) | Rank 1 | 824.47 | 7.5 | 7.7 |

| 4 | Birla SL Short Term Fund (G) | Rank 2 | 742.27 | 7 | 8.4 |

| 5 | SBI Magnum Income Fund (G) | Rank 2 | 54.87 | 7.1 | 5.8 |

| 6 | IDFC Dynamic Bond -RP A (G) | Rank 2 | 419.59 | 6.3 | 9.2 |

| 7 | HSBC Flexi Debt Fund – RP (G) | Rank 2 | 95.01 | 6.8 | — |

| 8 | Religare Active Income-RP (G) | Rank 2 | 2.32 | 6.4 | 5.5 |

| 9 | BNP Paribas Bond Fund -RP (G) | Rank 2 | 325.62 | 7.3 | — |

| 10 | HSBC Income Fund – IP (G) | Rank 2 | 33.31 | 6.8 | 8.2 |

| Average Return | 7.24 |

MONTHLY INCOME PLANS (AGGRESSIVE)

These monthly income plan funds are focused to maximum returns with minimum of risk.

My objective is more or less the same.

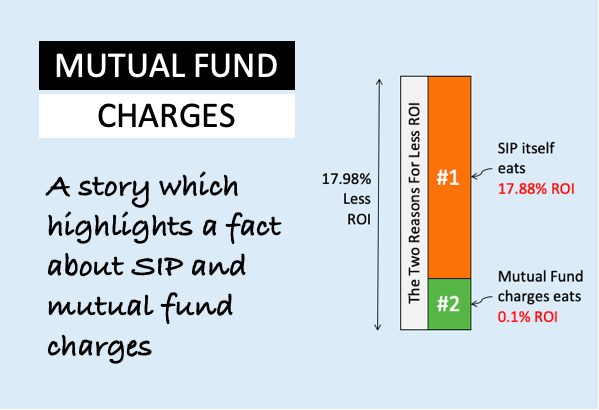

The only difference is I do not need that monthly income to support my living, I will simply re-invest the income to maximise the returns.

The reason why this MIP has been tagged as aggressive as its portfolio consists of approx 16% of equity.

So in long term it is possible to get better returns than long term debt funds.

| SL | Fund | CRISIL | AUM | 3Yr (%) | 5Yr (%) |

| 1 | HDFC MIP – LTP (G) | Rank 1 | 5,878.88 | 9.6 | 9.5 |

| 2 | Reliance MIP (G) | Rank 1 | 3,617.77 | 10 | 11 |

| 3 | Can Robeco MIP (G) | Rank 2 | 293.37 | 8.5 | 8.6 |

| 4 | DSP BlackRock MIP Fund (G) | Rank 2 | 229.39 | 8.4 | 7.8 |

| 5 | Birla SL MIP II-Wealth 25 (G) | Rank 2 | 213.1 | 7.6 | 6 |

| 6 | ICICI Prudential MIP 25 (G) | Rank 2 | 481.51 | 8 | 7 |

| 7 | Kotak Monthly Income Plan (G) | Rank 3 | 39.43 | 7.6 | 4.5 |

| 8 | Tata MIP Plus Fund (G) | Rank 3 | 74.49 | 7.6 | 6.6 |

| 9 | UTI MIS – Advantage Plan (G) | Rank 3 | 693.06 | 7.5 | 7.5 |

| 10 | HSBC MIP – Savings Plan (G) | Rank 3 | 241.77 | 8 | 7.7 |

| Average Returns | 7.62 |

Conclusion

I am a big fan of equity linked investment plan.

Funds linked to Banking/finance companies has medium risk level. I

t is impossible to ignore its long term advantages and certainty of returns specially when time horizon is like 15 years.

I decided to put 35% of money in this fund.

My second choice will be balanced funds.

I decided to put 50% of money in this fund.

Balance 15% I decided to allocated to MIP (aggressive plan) Fund.

Inclusion of MIP will give more stability to my portfolio & returns will also not get compromised much.

In a nutshell I can say that my expected returns will be approximately 9.5% per annum.

(Note: I plan to invest Rs 5,000 per month for my Child’s Future Planning)

| % Weight | Rs per month | Fund Category | Approx. 5 Year Return by top CRISIL ranked funds | Comparative Risk Rating |

| 35% | 1,750 | Banking and Finance Fund | ~ 7.10% | Medium |

| 50% | 2,500 | Balanced Fund | ~ 11.47% | Medium |

| 15% | 0,750 | Monthly Income Plan (Aggressive) | ~ 08.57% | Low |

| Average Return | ~ 9.5% |

Nice Article & compared all type of investments.

I didnt understand one thing. Insurance is required only for earning member. Then is it required for childrens which are not earning.

What if unfortunate event happens ? Is mf pays the amount now and at maturity also if that person is no alive…

Mutual funds units must be sold to access the funds.

Hi Mani,

Is it old post? Shall i consider to include it in my portfolio ? because i need to have safe ride which is more than 20+ years for my children’s education goal. Please suggest me.