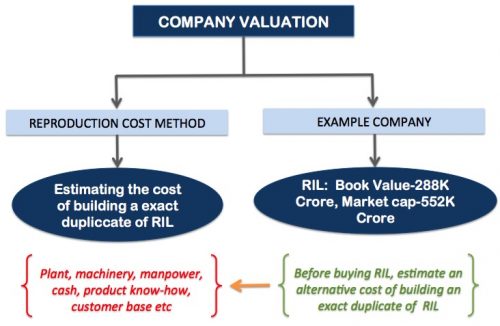

Out of all valuation methods, companies valuation by reproduction cost method is most understandable.

Valuation of a company is perhaps the most critical aspect of value investing.

Value investors tend to value the company more accurately as compared to their inexperienced counterparts.

In order to value a company one must dig deep into their balance sheets, profit & loss accounts, and the cash flow statements.

Let’s see how we can value a company using these financial reports. Valuing a company must start with the balance sheet itself.

There are lots approach to companies valuation.

A company can easily be valued based on its net worth.

Net worth is equal to equity share capital + Reserves.

The logic of valuing a company in terms of its net worth is based on the formula which says total asset is equal to total liability.

Total Asset = Total Liability

Here, the total liabilities = net worth + total debt.

In case total asset of a company is sold, and the fund that is generated is used to pay off all the debt.

Then what will remain balance is equal to the net worth of the company.

This remaining fund will be shareholders money.

But a companies true valuation cannot be limited to its visible net worth alone.

A lot of experts believe that this way of valuation of a company is too generalised.

A lot of important aspects of companies true worth is missed in this approach.

Hence the companies must be valued in a more deeper way.

So let’s see one logical approach which will clearly lay down the foundations of how a company can be valued accurately from its balance sheet.

Reproduction Cost Method

The logic is like this, suppose you want to buy a total company called Reliance Industries Ltd (RIL).

Before you approach Mr Mukesh Ambani (Chairman) and give your offer for Reliance Industries, you must do your homework.

What will be that homework?

That homework will be like this.

You will have to answer a small question to yourself first.

“If instead of buying Reliance Industries, what if you try to build a similar company of similar size by yourself from scratch.”

What will be the cost involved to build parallel company which is as strong as Reliance Industries?

This type of approach gives a very realistic idea of what is the real value of Reliance Industries.

There are some important questions that you will have to answer here. Let’s see them all one by one.

What we’re trying to do here he is to build a company like Reliance Industries from scratch.

#Step A – Estimate the cost of building current assets

A1. Cash reserves of Reliance Industries:

=Rs.1,754 Crore

A2. Investment of Reliance Industries:

=Rs. 51,906 Crore (current) + Rs. 140,544 (non current).

A3. Account receivables of Reliance Industries:

=Rs. 5,472 Crore

A4. Inventories of Reliance Industries:

=Rs. 34,018 Crore

A5. Loans and advances paid by Reliance Industries:

=Rs. 8,272 Crore (short term) + Rs.10,418 (long term).

Total of A (A1+A2+A3+A4+A5) = Rs. 252,384 crore

#Step B – Estimate cost of building other assets

Once you are done with current assets the next valuation should be done about the fixed assets and other type of assets.

In order to build a company which is as big as RIL, one must have a similar manufacturing facility, office spaces, other real estate properties, miscellaneous assets and manpower.

No company can run without these essential prerequisites.

B1. Cost of acquisition of assets inclusive of depreciation (gross block)

=Rs. 258, 029 Crore

B2. Cost of building a brand image like Reliance industries (intangible assets)

=Rs. 16,248 Crore

Total of B (B1+B2) = Rs. 274,277 crore

#Step C – Estimate the cost of product and manpower development

A company may have the necessary infrastructure / manufacturing facility, but to maintain the competitive edge, having necessary research and development work is essential.

A company like RIL, spends reasonably well on its R&D and testing facility.

It is also essential to hire the right people to run the business.

Starting from the Top Bosses, to managers, skilled and unskilled workers, contract labors etc, every body needs to hired.

C1. Cost of R&D and testing Facility

=Rs. 1,448 Crore per year X 5 years = Rs.7,240

C2. Cost of hiring competent employees

=Rs. 4,434 Crore X 1.2 times = Rs. 5,320

Total of C (C1+C2) = Rs. 12,560 crore

#Step D – Estimate the cost of building customer base

D1. Cost of building customer relationship

RIL is a company which started its operations i 1999. So as on today, it is already a 18 year old company.

During these days it has developed its own value chain.

A very important component of value chain is the CUSTOMERS themselves who buy the final products of RIL.

In order to replicate the same type of customer base, the new company must spend some bucks.

I assume that it will take close to 3 years to build the same kind of customer base as RIL’s.

At present, RIL’s is spending close to Rs.8,436 crore as selling and distribution expense per year.

=Selling and distribution exp: Rs.8,436 Crore X 3 years = Rs. 25,308 Crore

#Step E – Find total debt of company

Almost all business need debt to finance its operations. RIL also has a total debt levels of about Rs.1 lakh crore.

A debt is counted as a liability of the company.

Hence it decreases the effectiveness of companies assets.

As a normal understand of items listed in Balance Sheet, estimated valuation of company minus its total debt will give the true valuation of the company.

But here were are not doing calculations as per normal accounting standards.

Instead we are adding up numbers to understand what is the valuation of company like RIL.

We will see in step F, how the value of total debt helps in our valuation calculation of the company.

Total debt acquired by the company =Rs. 105,827 Crore

#Step F – Calculate net value of company by reproduction cost method

Now, our target was to estimate a cost to build a company like RIL from scratch.

To do so, we will have to arrange for the following:

- infrastructure (plant, machines, manpower),

- arrange for liquid capital (cash etc),

- gather product know-how, and

- build a customer base.

To arrange for all of these the estimated cost involved will be A+B+C+D.

But some portion of this financing can also be generated by debt financing.

Means, if one can show to banks that they are already investing an amount of A+B+C+D to build a company like RIL, bank will easily borrow them some money as capital loan.

So the bottom like is, the financing that is required to build RIL from scratch is as below

Total net value = (A + B + C +D) – E = (252,384 + 274,277 + 12,560 + 25,308) – 105,827 = Rs. 458,702 Crore.

#Step F – Compare net value with market capitalisation

Market capitalisation of RIL:

= Rs.552,291.5 Crore.

Book value of RIL:

= Rs.288,310 Crore

Calculated net value of company:

= Rs.458,702 Crore.

This analysis estimates that the current market valuation of RIL is 20% higher than its fair price (net value).

Another assumption that can be drawn here is that, net value of the company (Rs. 458K Crore) makes up for almost 80% of the total market valuation of RIL (Rs.552K Crore).

What does it mean?

It means that the market valuation is pretty well supported by the net value of the company.

If we compare market capitalisation with RIL’s book value (Rs. 288K Crore), we can see that book value makes for almost 52% of its market cap.

Again, it means that even in terms of book value, market valuation is well supported.

So now if we can answer why the market has valued the stock 20% higher than its present net valuation, we can say that we have done our task well.

This premium that market is paying to RIL is probably because of its future growth prospects, profitability index and popularity.

In last 5 years, RIL was able to grow its dividend per share @ 4.1% per annum.

In last 5 years, RIL was able to grow its earning per share @ 8.24% per annum.

Present Return of Equity (ROE) of RIl is 10.89% per annum.

RIL is also the top stock in Indian stock market in terms of market capitalization.