The stock market is like a busy marketplace where people buy and sell ownership in companies. It’s where we can become part-owners of big names like Nestle, TCS, HDFC Bank, etc. Imagine it as a giant auction where shares of companies are traded, and the prices constantly go up and down. There is a correlation between macroeconomy and stock market movements. We’ll learn about their interrelation in this article.

What makes these prices dance? One critical factor is the underlying fundamentals of the company behind its stock. But another big influencer of the prices is the macroeconomics surrounding the stock market. If the earth is a stock market then we people are individuals. Think of the macroeconomy as the weather affecting us people.

The stock market is influenced by big economic forces, like interest rates, inflation, and how the entire country’s economy is doing (GDP) – that’s macroeconomics.

For investors in the stock market, understanding the correlation between the macroeconomy and the stock market is like knowing the weather of our place. If the economic weather is good, companies may thrive, and our investments could grow. But if storms hit, like high inflation or faltering GDP, it could impact our stocks negatively.

Stock market investors must learn to read the macros to make smarter investment choices in the stock market.

Ready to explore the world where our invested money meets the economy? Let’s dive in!

Topics

Point #1: What is Macroeconomics?

Let’s get a feel of the idea of macroeconomics. Imagine you’re looking at a giant jigsaw puzzle. This puzzle represents the whole economy of a country. Now, macroeconomics is like putting together the big pieces of this puzzle. It’s the study of how the entire country’s money stuff works.

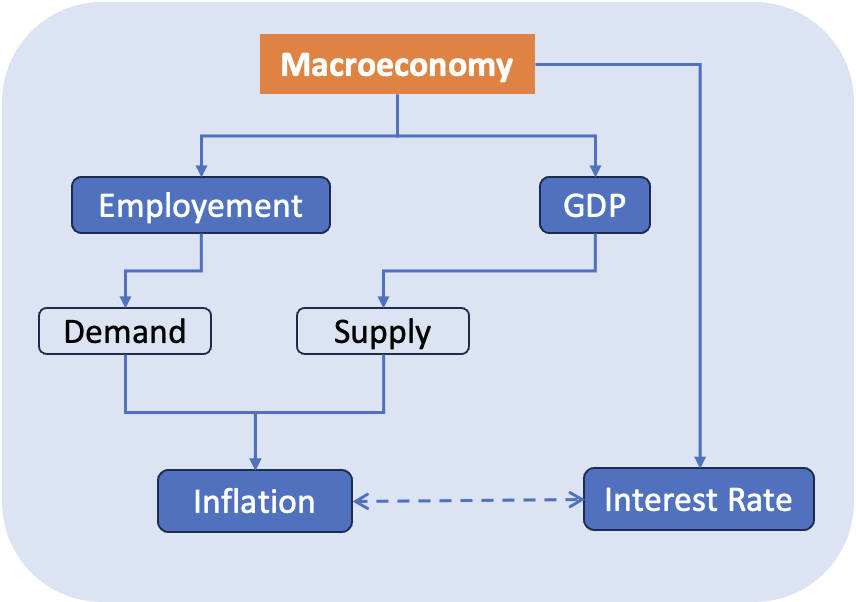

So, in simple terms, understanding macroeconomics is like being the detective of the financial world. It not only looks at the tiny details, it also observes the big picture. It tries to figure out how everything, from jobs to prices, connects and influences each other.

Think about it this way: you know how weather forecasters predict if it’s going to be sunny or rainy for the whole city? Macroeconomists do something similar but for the economy. They look at things like how many people have jobs (employment), how much stuff costs (inflation), and whether the country is getting richer or not (GDP).

Understanding macroeconomics is like having a map. It helps you see the whole economic landscape. The ability to read macros gives us a special pair of glasses. It lets us see the bigger picture (of our economy) instead of the tiny details. It’s like looking at the entire map instead of just one street.

If we learn to see the macro we are more likely to make better choices with our investments. How? That is what we’ll learn in this article.

Point #2: Three Basic Macroeconomic Factors

We’ll explore the fundamental macroeconomic factors influencing the stock market. From interest rates to inflation, GDP, etc – understanding their impact on investments is key for stock investors. But before we comprehend their impacts on the market, let’s learn a few related basics about them.

2.1 Interest Rates

Let’s dive into the world of interest rates. Do you know that the interest we pay on home loans, and the interest rate we get from banks on our FDs can affect our stock market? Yes, it is a fact. Before making this correlation, consider interest rates as the price tag of borrowing money. It’s like paying a fee for using someone else’s cash.

- Now, picture the Reserve Bank of India (RBI) as the captain steering the economy. During challenging times, like COVID, RBI might decide to lower interest rates (repo rate). Why? Well, when rates are low, it’s like giving a discount on borrowing money. So, people and businesses take more loans for their spending and investment needs. It’s a way to boost the economy.

- On the flip side, when the economy is overheating, with prices rising too fast, RBI might do the opposite. It could raise interest rates, making borrowing more expensive. This cools things down as loans become expensive. During such times, people borrow less and hence spend less too. Companies also do not take more loans and cut their investment (CAPEX) plans.

This way, by regulating the interest rates, RBI keeps control of the economy of our country.

When you hear about interest rates rising or falling next time, recall who is doing it and why it is being done. In the following sections, we’ll see how interest rate changes affect the stock market.

A More Detail Reading: How the rising interest rates impact the Indian Stock Market.

2.2 Inflation

Let’s talk about inflation. It is a crucial metric for the stock market investors. Imagine a balloon slowly getting bigger – that’s inflation. But here, instead of a balloon, it’s the prices of things that are getting inflated with time.

We can also see inflation as a quiet thief stealing the value of your money. When prices rise, our money can’t buy as much as it used to. Now, picture this happening to everything – from our favorite snacks to the gadgets we love. That’s what inflation does.

Now, how does this affect businesses? Well, imagine you’re running a pizza shop. If the cost of raw materials (cheese, flour, tomatoes, etc) keeps going up, you might have to raise the price of your pizzas. But if people find your pizzas expensive, they’ll buy less. This way your business might struggle.

But inflation becomes a problem only when it is too high. When inflation is normal, people do not feel the price rise as much. An acceptable inflation rate in India is about 4 to 5% per annum. In the US, it is about 1% per annum.

How does inflation affect the stock market? We’ll learn about it in the next sections.

2.3 GDP (Gross Domestic Product)

Now, let’s dive into GDP. These three important letters tell a lot about a country’s economic health. Think of GDP like a report card for a whole nation, showing how well it’s doing financially.

GDP measures the total value of all the goods and services a country produces. For GDP to grow fast, the nation has to produce more goods and services year after year. This situation will come only when there is a high demand in the economy. The demand will be high when people have more money to spend.

If a country’s GDP is constantly growing, it’s like the nation is getting stronger and richer. Imagine you have a tea shop. Every day you sell more tea – that’s growth, just like a growing GDP.

Here’s the exciting part, when a country’s GDP goes up, it’s generally good news for businesses. More goods and services mean companies are making money.

So, when you hear about GDP, think of it as a thumbs-up for a country’s financial performance. This feeling of enthusiasm is also reflected in the stock market. We’ll know more about it in the next sections.

Point #3: How Macroeconomic Factors Affect The Stock Markets

Macroeconomics plays a crucial role in shaping stock markets, influencing their highs and lows. Understanding this connection is vital for investors seeking success.

Now, let’s explore the key macroeconomic factors—interest rates, inflation, GDP, and a few extras. These factors hold the power to sway stock markets. In a way, we can say that these factors impact our stock portfolio significantly.

Factor #3.1 Interest Rate Impact on The Stock Market

Interest rates, and the cost of borrowing money, hold significant sway over the stock market. When RBI adjusts the interest rates (repo rate) it impacts businesses and investors alike.

During tough times, like the COVID-19 pandemic, lowering rates encourages spending and investments. Conversely, during inflationary periods, RBI may raise rates to cool the economy.

- For businesses, higher rates mean more expensive loans. In such situations, they are less likely to avail debt for expanding and modernizing their business (CAPEX). Moreover, a high-interest rate market also means a more expensive market, hence their profitability also goes down. As profits go down, stock prices also fall.

- The normal public also behaves similarly to businesses. They also take fewer home loans, car loans, personal loans, etc to buy new things. This creates less demand for goods and services in the market. It affects the profitability of companies which negatively affects the stock market.

- A higher rate scenario also impacts the stock investors (like FIIs). During these times, government bonds and bank deposits become more attractive. Hence, investors shift a part of their capital allocation from the stock market to risk-free instruments. This negatively impacts the stock price and the overall stock market.

Understanding how interest rates influence these dynamics is crucial for us to play the stock market game for the long term.

Factor #3.2 Impact of Inflation on The Stock Market

Inflation, the price rise over time, plays a pivotal role in the stock market. Comprehending inflation’s impact is crucial.

Inflation affects different types of stocks in various ways. Let’s understand this phenomenon using examples:

- Cyclical stocks, like those related to commodities, often perform well during high inflation. When inflation is on the rise (just started moving from low to high), it is caused by a high demand for goods and services in the market. When demand is high, businesses produce more to cater to the need. During such times, companies like to expand their capacity. As a result, the demand for commodities like energy, metals, cement, and agricultural products, tends to rise. High demand is followed by high prices increasing the profits. For instance, stocks of companies like Tata Steel, Ultratech, etc see a positive impact during high inflation.

- Manufacturing Companies may face challenges during rising inflation. This is because it will lead to rising prices of raw materials that eventually can hurt their profit margins. A company heavily dependent on raw materials might struggle, affecting its stock performance.

- Service-based companies may also face profit margin dips during a rising inflation scenario. These companies are very people-dependent companies, hence their major expense is the labor costs. When inflation rises, the cost of labor also starts to increase, negatively affecting the company’s profits and its stocks.

Wise stock market choices require awareness of these distinctions.

Factor #3.3 Impact of GDP on The Stock Market

Understanding the connection between Gross Domestic Product (GDP) and stock markets is vital.

GDP is the measure of a country’s economic performance. It acts like a barometer for stock market movements. When a country’s GDP is growing (the economy is thriving) stocks generally perform better.

The rationale is straightforward, a growing economy implies increased production of goods and services. This production bump is triggered by a high demand in the market. It will happen when people are feeling optimistic and are consuming more. The vice-versa is also true.

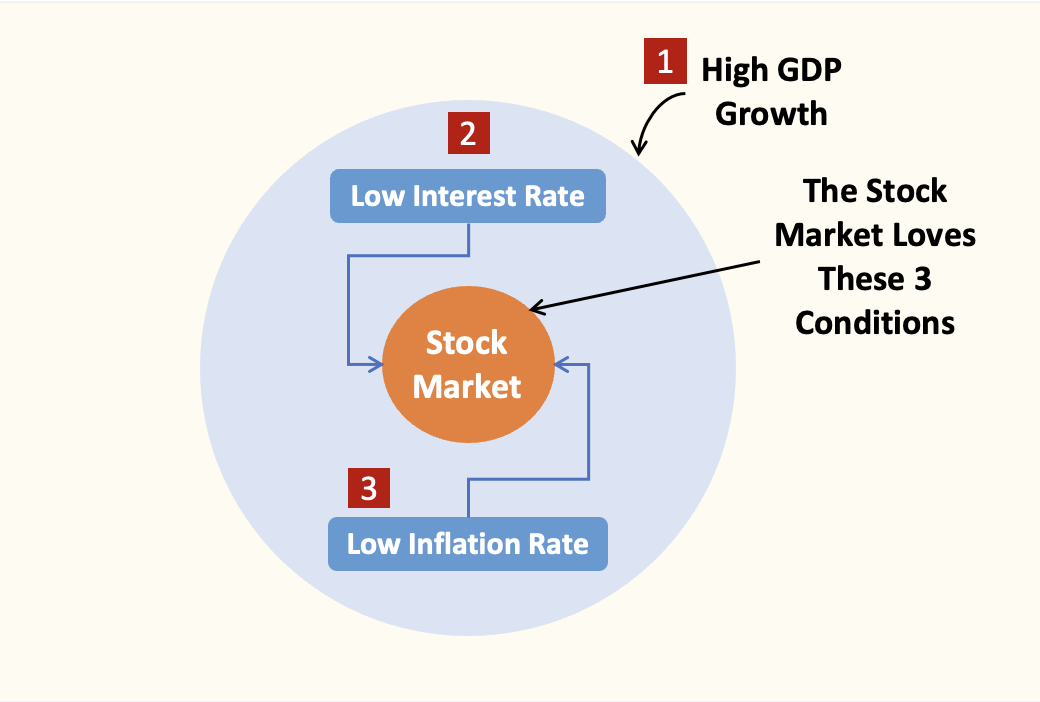

The GDP growth is often triggered by a combination of lower levels of interest rates and inflation. The stock market loves to see the three numbers together. The amalgamation of the three factors (high GDP, low repo rate, and low inflation) can take the stock market index to new highs.

Factor #3.4 Impact of Unemployment on The Stock Market

Employment or unemployment is another crucial macroeconomic factor influencing the stock market.

- When unemployment rates are low and job creation is robust, it signifies a strong economy. In such conditions, consumers have higher disposable income, leading to increased spending. When consumers are spending more it means higher corporate profits and positive market sentiment. This often results in a bullish stock market. Investors are more optimistic about companies’ performance during such times.

- Conversely, high unemployment and job market instability can lead to reduced consumer spending, lower corporate profits, and a bearish stock market. In such scenarios, investors become more cautious and take a cautious stance in the market. This often leads to bearish sentiments.

Interest rates, inflation numbers, and GDP growth rates are a few metrics that governments of nations cannot hide. But there is more leeway with the government to suppress or less publicize the unemployment figures if they are not good.

I would personally give the number one priority to the employment rate before considering the above three factors (interest rate, inflation, and GDP). If the employment rate is high, there is more money in the economy which automatically triggers the other three indicators. But of course, as the government cannot control the employment of the whole country (the private sector is also involved), they may prefer to highlight the employment rate less vividly. It’s understandable.

Employment trends must be closely monitored by the investors as they can provide insights into broader economic health and stock market expectations.

Factor #3.5 Additional Factors

Other macros can also influence the dynamics of the stock market. Let’s know more about them:

- #3.5.1 Oil Prices: The cost of crude oil has a great influence on various industries. Spikes in oil prices can lead to increased expenses for businesses. It can increase their energy cost, transportation cost, etc potentially affecting their profitability and stock prices. Soaring oil prices also have a very negative influence on consumer sentiments.

- #3.5.1 Currency Fluctuations: Exchange rates also play a crucial role. Changes in currency values can impact the competitiveness of multinational companies, influencing their stock performance. Businesses that export their goods and services will do well when the exchange rate increases. Conversely, companies dependent on the local economy do poorly when the exchange rate is increasing. Accordingly, their stock prices are influenced. Read more about the strength of currency and its effects on the market.

- #3.5.1 Interest Rates in The US: We’ve discussed how interest rates domestically impact our stock market. The interest rate in the US also has repercussions in India. When interest rates rise in the US, FIIs take their money from the stock markets of developing countries (like India) and put their money in US bonds which is considered a safer investment option.

Point #4: Long-Term Perspective: Navigating Market Fluctuations

For beginners, navigating the stock market landscape involves embracing a long-term perspective. While day-to-day market movements can be unpredictable and influenced by various short-term factors, a sustained commitment to a long-term investment strategy often yields better results.

- Market Volatility: It’s crucial to recognize that markets can be volatile in the short term. Prices might swing based on news, events, or sentiments, causing fluctuations that can be unsettling for short-term investors.

- Investment Horizon: A long-term investment horizon allows investors to ride out these short-term fluctuations. Instead of being swayed by momentary market turbulence, investors can focus on the underlying strength and growth potential of their chosen investments (like stocks).

- Compounded Growth: The power of compounding is a key advantage for long-term investors. By reinvesting dividends and allowing investments to grow over time, investors can benefit from compounded returns, potentially enhancing the overall portfolio value.

- Diversification: Spreading investments across different sectors and asset classes helps manage risks. A diversified portfolio can be resilient in the face of sector-specific challenges, contributing to more stable and consistent returns over the long term.

Conclusion

Understanding the correlation between macroeconomics and market movements is essential for stock investors. We’ve explored three pivotal macroeconomic factors – interest rates, inflation, and GDP. We’ve also seen how the unemployment rate is perhaps the most important macro to watch. A decreasing unemployment rate can give a more sustainable push to GDP growth and hence the stock market.

In the stock market, we must remember that understanding the macroeconomics equips us to make informed decisions. As an investor, we cannot afford to look only at the business fundamentals of our companies to comprehend the stock price movements. The above-discussed macroeconomic factors also influence the stock’s price.

Have a happy investing.

Suggested Reading: