Analysts and discerning investors gravitate towards stocks of debt-free companies. However, appreciating companies without debt doesn’t mean we ignore all companies that have debts listed on their balance sheets. Some companies strategically leverage debt to enhance shareholder value, as evidenced by their impressive Return on Equity (ROE). On the flip side, it’s essential to recognize that not all debt-free companies automatically qualify as good stocks. A list of top debt-free stocks.

So, how one can analyze the debt of a company from the perspective of investing in it? This is what we’ll read in this article.

In my early days, I used to think that debt positively affects the company’s valuations. I assumed that, as debt increases the company’s liquidity, it should positively affect free cash flow and hence the intrinsic value. However, while I was coding the intrinsic value algorithm, I gained a different perspective on debts in the balance sheets.

Let’s explore the details of looking at a company’s debts. The idea is to learn how we investors can make smart choices for stability and growth. Figuring out why expert investors preference for companies without debt isn’t just a financial trick. For me, it’s a way to find companies that are long-lasting and that can survive all economic weather. [For a broader perspective, check out our guide on Top Stocks to Buy in India.]

Let’s get into the details to understand what makes debt-free companies appealing to smart investors and discover the principles behind it.

List of Top Debt-Free Stocks in India 2024

Updated: 20-Sep-2024 Check The Stock Engine

| SL | Name | Price | Market Cap(Cr) | D/E | Debt Minus Cash | Remark | GMR Score |

| 1 | COALINDIA:[533278] | 491.25 | 3,02,559.99 | 0.08 | -23,946.15 | Like Debt Free | 99.12 |

| 2 | HAL:[541154] | 4,336.35 | 2,90,095.75 | 0.00 | -26,431.61 | Debt Free | 99.04 |

| 3 | WIPRO:[507685] | 538.80 | 2,81,742.72 | 0.19 | 4,451.30 | Reasonable Debt | 98.97 |

| 4 | TRENT:[500251] | 7,479.35 | 2,65,851.26 | 0.12 | 201.00 | Reasonable Debt | 98.90 |

| 5 | NESTLEIND:[500790] | 2,699.60 | 2,60,189.64 | 0.01 | -747.71 | Like Debt Free | 98.82 |

Point #1. Benefits of Investing in Debt-Free Companies

Investors often find significant advantages in putting their money into companies that operate without any debt. Here are some key benefits of investing in companies with zero debt on their balance sheets.

1.1 Financial Stability

Companies without debt are less vulnerable to financial crises and economic downturns. Why? Because they don’t face the burden of interest payments, reducing the overall financial risk.

Companies that do not rely on debt have more stable and quick cash flows from operations. This can be one reason why the company does not need to dig into loans.

Companies that are debt-burdened have to allocate a significant portion of their earnings to service debt obligations (principal & interest payments). This additional cash out-flow due to debt further pushes them to take more debt.

1.2 Resilience in Economic Downturns

When a company doesn’t have debts, it can change the way it does things when the economy isn’t doing well. It can make new plans, spend money where it’s needed, and deal with problems without the extra burden of repaying debts. This flexibility allows them to adapt more easily to challenging times.

During economic downturns, debt-free companies may have the financial capacity to make strategic investments. They can acquire assets at lower costs, or even buy back their shares. This positions them to capitalize on opportunities that highly leveraged companies might miss.

1.3 Investor Confidence

Debt-free companies are often considered safer investments. Conservative investors who seek stability and capital preservation are attracted to such companies. The absence of debt-related risks can boost investor confidence.

These companies are better positioned to navigate market fluctuations and deliver consistent performance over time. Hence, long-term investors would prefer investing in debt-free stocks.

1.4 Operational Freedom

Without the constraints of excess debt, companies have more freedom in making strategic decisions. They can freely allocate their capital resource for growth initiatives, research and development, or other value-adding activities. As these companies are not worried about their interest and principal payments, they can focus better on their core business operations and future growth prospects.

Debt-free companies can more readily adapt to changes in the business environment. They can pivot their strategies, explore new markets, or innovate. These companies need not worry about the financial burden that debt might hinder their decision-making.

1.5 Creditworthiness and Cost of Capital

A track record of being debt-free enhances a company’s creditworthiness. This can lead to better credit ratings, and lower borrowing costs if they choose to take on debt in the future. Such companies, generally, also have better relationships with financial institutions.

Debt-free status allows for more efficient allocation of capital. Funds that might have been earmarked for debt repayment can be directed towards business expansion, dividends, or share buybacks. All these three actions contribute towards the enhancement of the shareholder’s value.

Investors recognizing the above five advantages may find debt-free companies appealing. The business behind these stocks offers a robust foundation for stability, resilience, and sustainable growth. If not during good times, these factors especially sound meaningful in challenging economic environments.

Point #2. Types of Debt

Companies typically have two types of debts: short-term and long-term. Short-term debts are like quick loans that need to be repaid within the next 12 months. They help with immediate cash flow needs and make the working capital more liquid. Companies avail it to ensure day-to-day operations run smoothly.

On the other hand, long-term debts have a longer repayment time, usually more than 12 months. Companies often take on long-term debts for big plans, like expanding their business or investing in major projects.

Now, how do these debts impact a company’s financial structure differently? Let’s break it down:

3.1 Short-Term Debts

Short-term debts make the company’s working capital more liquid, ensuring there’s enough cash for everyday needs. Companies use these short-term borrowings to enhance their liquidity position.

The enhanced liquidity is handy for managing immediate cash flow requirements. It can help the company handle current liabilities.

Companies also use short-term debts to handle regular operational expenses and keep the business running smoothly.

3.2 Long-Term Debts

Long-term debts play a crucial role in a company’s growth plans. They provide the necessary funds for significant endeavors, such as expanding & modernizing operations, investing in new technologies, or acquiring other businesses.

Companies can strategically use long-term debts to make substantial investments that contribute to their long-term success. These investments can be in stocks of other companies or total acquisitions.

Long-term debts affect the overall capital structure of a company. The capital structure in turn influences how it balances debt and equity to finance its activities. The mix of equity and debt in the balance builds the company’s cost of capital. This cost plays a vital role in the overall profitability of a business.

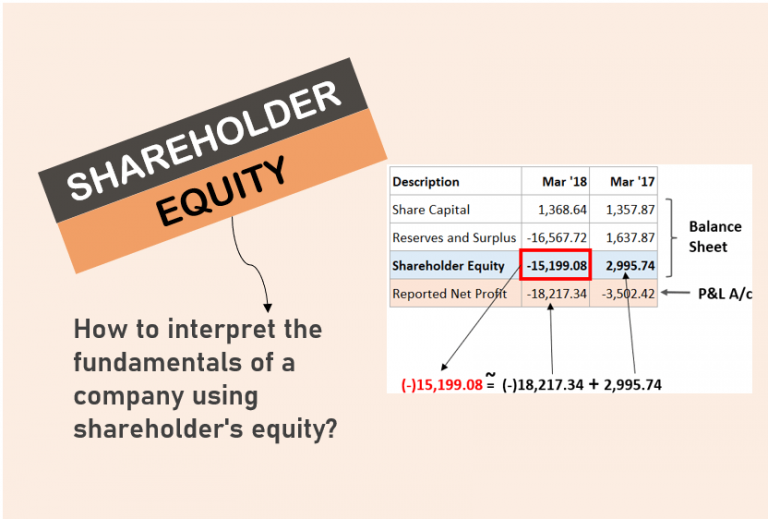

Point #3. Impact of Debt on Intrinsic Value

Let’s see the debt of companies through the lens of intrinsic value. To understand this, we must first know two basics about debt:

- Types of debt: There are two types of debts visible on companies’ balance sheets, (a) Short-term debt (under current liability), & (b) Long-term debt (under non-current liability).

- Why companies avail debt: Companies generally resort to short-term debt to manage immediate cash flow needs. Short-term debts make the working capital (WC) more liquid. Long-term debts are availed more for the company’s expansion plans (CAPEX). Know more about if debt is good or bad for companies.

Both the above type of debt affects the company’s intrinsic value in their way. Let’s know more about it.

Impact of Debt On FCF Formula

The debts that will be settled within the next 12 months from the date of borrowing are short-term (ST) debts. And debts with longer repayment time, greater than 12 months, are long-term (LT) debts.

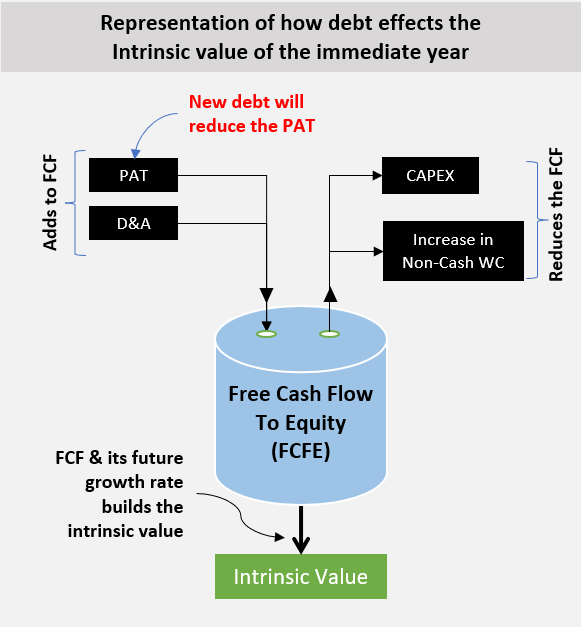

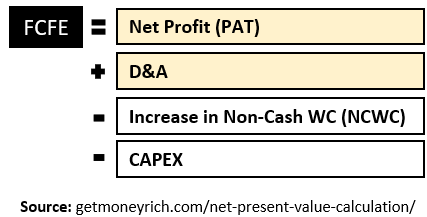

The impact of both ST & LT debts can be understood more clearly using the FCF formula. Intrinsic value is derived from free cash flow to equity (FCFE). Higher will be the free cash flow to equity (FCFE), and more will be the intrinsic value. The formula to calculate FCFE is this:

[P.Note: In the FCFF formula, net new debt is one of the components. But again, while calculating the intrinsic value from FCFFs, the total debt load of the company is first deducted. So in a way, we can say that the influence of debt on intrinsic value is not major. Read more: Difference between FCFF and FCFE]

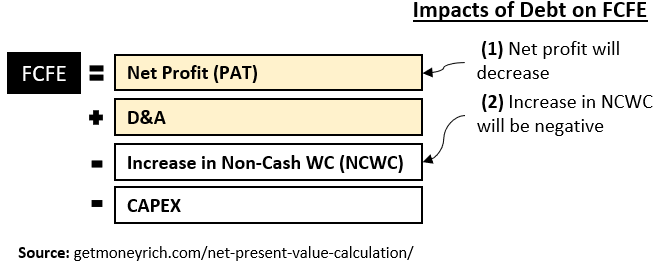

How does debt affect this FCFE equation? It will have two effects

- First: The interest bearing on the debt will reduce the net profit (PAT). Reduced PAT will result in lower FCFE, hence lower intrinsic value.

- Second: Due to debt, the current liability (CL) will increase. An increase in CL will reduce the Working Capital. As a result, the change in non-cash working capital will be negative. It will result in higher FCFE, hence higher intrinsic value.

So, the net effect on FCFE due to new debt is negligible. A decrease in PAT is offset by the negative change in NCWC. As a result, we can say that the intrinsic value, which is derived from FCFE, remains mostly unaffected by new debt. Read more about the intrinsic value formula here.

Point #4. Debt Analysis Metrics

While I was coding an algorithm for debt-free companies for my Stock’s Engine, it was clear that I’d include only FCF-positive companies. A debt-free company will be of no value if it is not yielding a positive free cash flow.

People who are not conversant with FCF or intrinsic value estimation can use my “Stock Engine” to find quality Indian zero-debt companies. It has a prebuilt stock screener that filters fundamentally strong debt-free companies.

Allow me to give you an introduction to the parameters used to filter debt-free stocks:

We take a small hypothetical example of two companies and do an example debt analysis. Suppose there are two companies ABC & XYZ. Just note how the debt of these two companies is compared using the parameters listed below:

Stage #1 Screening

- Free Cash Flow (FCF): No company will pass through the filter if its FCF is not positive. This is the first limitation. What’s the logic? There is no point in investing in a company if its FCF, also called the owner’s income, is negative.

- Absolute Debt: ABC has a debt of Rs.80 Crore and B has a debt of Rs.120 Crore. Which company looks better here? If we have to look only at debt, Company ABC looks less risky, right? My algorithm uses the debt-to-market cap ratio to make the absolute debt more comparable with other companies. The lower the D/Mcap ratio the better.

- Debt Minus Cash: Suppose Company ABC and XYZ have cash/cash equivalent reserves of Rs.75 Crore and Rs.132 Crore respectively. Debt minus Cash for Company ABC is Rs.5 Crore (80-75). Debt minus Cash for Company XYZ is Rs.-12 Crore (120-132). A negative value for Company XYZ indicates that the company has enough cash to pay off all its debt. Such companies, even if they carry debt, can behave like zero-debt companies. Suggested Reading: Difference between enterprise value and market cap.

Stage #2 Screening

- Debt Equity Ratio (D/E): Now suppose the net worth of ABC is Rs.80 Crore and the Net worth of XYZ is Rs.120 Crore. This means, that the debt-equity ratio (D/E) of ABC is 1 (80/80) and that of XYZ is also 1 (120/120). So which company is better? The Thumb rule is that the lower the debt-to-equity ratio the better. Zero DE companies are called zero-debt stocks. Read more: Debt to equity ratio interpretation.

- Interest Coverage Ratio (ICR): It is a ratio between EBIT and Interest. The higher the ICR ratio the better. Generally speaking, the ICR above three is considered safe. Companies having double-digit or higher ICR can behave like zero-debt companies.

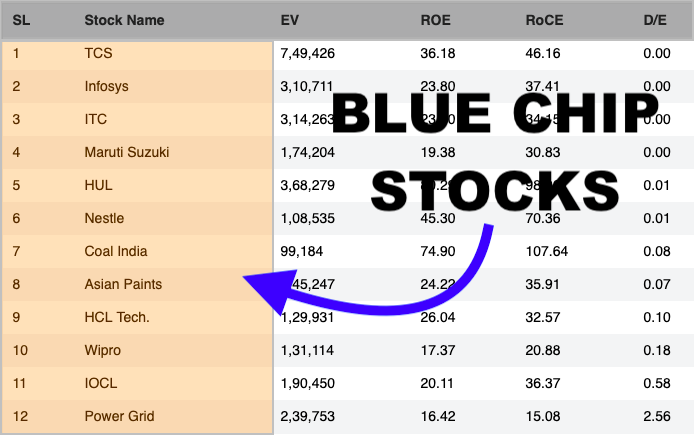

- Return on Equity (ROE): Good companies take debt to improve their shareholders’ returns. A high ROE, with debt, is an indicator that the company is using its debt well. Read more about ROE calculation.

- Return on Capital Employed (ROCE): Too much debt can hamper the company’s D/E, ICR, and also its ROCE. ROCE is a measure of the company’s profitability. A company with debt but displaying a higher ROCE can be treated as a zero-debt company. Read more about the ROCE formula.

Debt-Free Small Cap Stocks

Here is a short list of 10 number debt free small-cap Indian stocks

Updated: 20-Sep-2024 Check The Stock Engine

| SL | Name | Price | Market Cap(Cr) | D/E | Debt Minus Cash | GMR Score |

| 1 | CARTRADE:[543333] | 986.30 | 4673.96 | 0.00 | -27.87 | 68.14 |

| 2 | SHANTIGEAR:[522034] | 610.80 | 4671.22 | 0.00 | -7.91 | 68.07 |

| 3 | HARSHA:[543600] | 507.60 | 4634.15 | 0.15 | 55.06 | 67.99 |

| 4 | BALMLAWRIE:[523319] | 266.50 | 4548.70 | 0.00 | -524.46 | 67.92 |

| 5 | BHAGCHEM:[531719] | 363.30 | 4541.87 | 0.15 | 50.50 | 67.84 |

Point #5. Steps on How To Identify Quality Debt-Free Companies

Finding quality debt-free companies involves a systematic approach that should align with one’s investment strategy. Here’s a step-by-step guide that can assist us in identifying these promising companies:

Step#1 – Identify Cash Rich Companies

- Step #1.1 Leveraging Stock Screening Tools: Utilize a stock screening tool (like Stock Engine) that is equipped with a relevant database. Screeners enable us to filter companies based on specific financial parameters.

- Step #1.2 Positive Free Cash Flow Criterion: Set a primary criterion for positive Free Cash Flow (FCF). This ensures that the company is generating surplus cash, which can be used for dividends, expansion, or debt reduction.

- Step #1.3 Debt Minus Cash Analysis: Compare a company’s total debt against its available cash reserves. A negative value implies that the company has ample cash to cover its debts, resembling a debt-free profile.

Step#2 – Identify Companies with Optimim Debt

- Debt Equity Ratio (D/E): The D/E ratio shows the proportion of debt used to finance a company relative to its equity. A low D/E ratios (below 0.3) indicate a healthier financial structure.

- Interest Coverage Ratio (ICR): The ICR is a measure of a company’s ability to meet interest payments. A higher ICR suggests a lower risk of default.

- Analyze ROE & ROCE Side by Side: Examine ROE & ROCE together. High ROE, coupled with manageable debt, indicates the effective use of borrowed funds (high ROCE). Such funds, though a part of it is borrowed, are used to enhance shareholder returns.

Following the above steps, one can filter and identify quality debt-free companies. These will be such companies that will pose a minimum financial risk and will be a stable constituent to our investment portfolio.

Point #6. Misconceptions Related To Debt-Free Companies

Common misconceptions surround the concept of debt-free companies, warranting a closer examination for a balanced perspective. One prevalent myth suggests that debt-free companies lack growth opportunities. Contrary to this, many thriving businesses manage to expand without relying on external borrowing. It is demonstrative of this fact that sustainable growth is achievable through prudent financial management.

Another misconception involves the assumption that all debt is inherently bad. While excessive debt can indeed pose risks, responsible borrowing driven by a financial strategy can contribute positively. It’s essential to distinguish between the purpose and management of debt to comprehend its impact accurately. If debt is employed for strategic, growth-oriented purposes, it is generally considered good.

Additionally, some believe that debt-free status equates to a lack of financial sophistication. This notion overlooks the strategic decision-making required to maintain a debt-free profile. Successful debt-free companies often employ sophisticated financial strategies, emphasizing efficient capital allocation and risk management.

There is another common belief that debt-free companies are inherently risk-free. People are made to think that nothing will happen to them during economic downturns. But this is an oversimplification of the intricacies of financial stability. All companies, regardless of debt status, will face volatility in demand. The key lies in the comprehensive evaluation of a company’s financial health and its ability to weather economic uncertainties. This can be done by going beyond mere reliance on debt metrics.

Conclusion

Understanding debt-free companies goes beyond just looking at numbers. It’s like figuring out a puzzle. Debt-free doesn’t mean risk-free, but it can be a smart move for stable investing.

We learned that short-term and long-term debts play different roles in a company’s plans. Finding quality debt-free companies involves using tools wisely, looking at cash flow, and understanding financial ratios.

We must remember that not all debt-free companies are the same. A careful analysis is the key.

So, whether you’re a seasoned investor or just starting, keep exploring and learning about the companies you invest in.

Have a Happy investing!

Frequently Asked Questions (FAQs)

While debt-free companies are often viewed as secure investments, there are potential risks. One risk lies in missed growth opportunities, as these companies might rely solely on internal funds. This can limit their capacity for strategic expansion. Additionally, during economic downturns, debt-free firms may lack the cushion that debt can provide. It can impact their ability to navigate challenges.

Debt-free companies showcase resilience during economic downturns. For instance, HUL successfully weathered the 2008 financial crisis by relying on a robust cash reserve. It allowed it to make strategic acquisitions when competitors struggled. Similarly, TCS has demonstrated agility during the COVID phase by swiftly adapting its business model to changing consumer demands.

DMart has reported zero debt on its balance sheets since March’2020. In March’19 it reported some long-term and short-term debts. Even then its debt-to-equity ratio was 0.08 only. Post that, it has remained debt-free.

Investors should scrutinize the company’s dependence on a single revenue stream and assess its diversification strategies. Additionally, analyze the management’s ability to adapt to market changes. A company’s historical response to economic downturns can also offer valuable insights. Look for signs of conservative financial management and the company’s track record in maintaining profitability amidst adversity. We can also examine industry-specific challenges and how the company performed during the crisis as compared to its peers.

Companies with debt on their balance sheet, during troubled times, are more likely to turn bankrupt. Hence are considered a more risky investment. Debt-free companies with healthy fundamentals are more secure for investing.

In terms of cash and cash-equivalent, these five companies most cash on their balance sheet. HDFC (Rs.2,43,218 Crores), Reliance Ind. (Rs.1,44,296 Crores), Max Financial (Rs.1,10,593 Crores), Tata Motors (Rs.63,378 Crores), and L&T (Rs.48,745).

Very Good article.

Post article on purchasing of commercial property.

Instead of purchasing of bigger size house can we diversify it as small size + 1 commercial property ? What is your opinion ?

Shree Digvijay Cement Co. Ltd. Is this good one invest ..

I like the article on this website very much. Very important information is found in this blog. Which is much better than other blogs.

sir my small suggestion to identify the stock selection some of the other criteria we can look on it 1.Institution holdings,2.promoters pledge,3.market cap.please give me the advice apart from excel sheet we will check these things sir and also final query regarding these stock selection once we bought how random again we have to check please revert back to me i am beginner i spent around thousands of rupees to learn fundamentals but not worth it. i spent two days on your blog and article really very informative and i wanted to purchase the excel software.can i have your contact no sir

I am reading a blog on this website for the first time and I would like to tell you that the quality of the article is up to the mark it is very well written. Thank you so much for writing this article and I will surely read all the blogs from now on. Thank you so much for caring about your content and your readers.

Very useful information

Thanks

Hi Mani, By reading your article I understood technically what is debt free stocks actually. Thanks for sharing information. Quite helpful and easy to understand

Very nice information, helpful for investirs. Thanks

Thanks for taking time to post your comments

Sir earlier there were excel sheets of these debt companies, fastest growing companies and highest return on capital companies. Can you please start uploading those excel sheets again? They become handy and useful. Thanks

its very informative sir. it helped me a lot as i am starting beginner , the information about fundametals of company is most important auspect for investment in equity market. plz continue your valuable research on financial market

Thanks Nabi for liking the work.

Good article

CAN YOU PLEASE CLARIFY IN THE FORMULAS, WHAT ARE THE LINE ITEMS FROM THE BALANCE SHEET THAT HAVE BEEN CONSIDERED FOR DEBT AND CASH CALCULATION

Please add the Current Market Price (CMP) tab in the below LINK which will help us to evaluate the prices of stocks and pick up a stock as per our Financial condition……Or else one has to Google every-time to know the prices of individual stock which is tiring.

http://ourwealthinsights.com/stocks-study/debt-free-companies-list/

So nice information a guide for the new investor like

From where do we get this data?

Very very good information and explanation.

As a new investor, i could understand how to find a quality stocks in a lucid manner.

Adding more parameter for value investing is welcomeworthy.

Thanks for taking time to post your valuable comment.

Very much informative details. Thank you.

Please add details of 5, 10 & 15 year growth rate%. It will more informative.