The world of cryptocurrencies always remains volatile and super dynamic. In this space, the Ripple’s XRP is trying to find its feet in presence of other cryptos like Bitcoin and Ethereum. Ripply XRP has a technological prowess and hence, experts say, it has potential to disrupt traditional banking systems.

XRP’s journey has been marked by highs and lows. It has to face regulatory battles, and a strong community of supporters and skeptics. As we look towards the future, understanding XRP’s price prediction involves delving into multiple layers of economic, technological, and regulatory factors.

1. What XRP Design

At its core, XRP was designed to facilitate fast, low-cost international money transfers.

It is a vision that sets it apart from many other cryptocurrencies.

This utility, particularly in cross-border payments, forms the backbone of any price prediction.

2. XRP Acceptance

Ripple’s collaborations with financial institutions worldwide have been a cornerstone of XRP’s value proposition. These partnerships suggest a practical application for XRP.

It potentially increases the demand for XRP as more banks and payment providers integrate RippleNet (Ripple’s payment network) into their operations.

3. Hurdles and New Life for Ripple XRP

Developments in Ripple’s ongoing legal tussle with the U.S. Securities and Exchange Commission (SEC) have had a profound impact on XRP’s valuation. The SEC’s allegations of unregistered securities sales by Ripple have been a significant overhang on XRP’s price.

However, recent judicial outcomes that have provided partial clarity on XRP’s status have sparked renewed optimism among investors.

This regulatory clarity could pave the way for broader adoption and institutional investment, potentially driving up the price.

4. Ripple XRP Price Chart

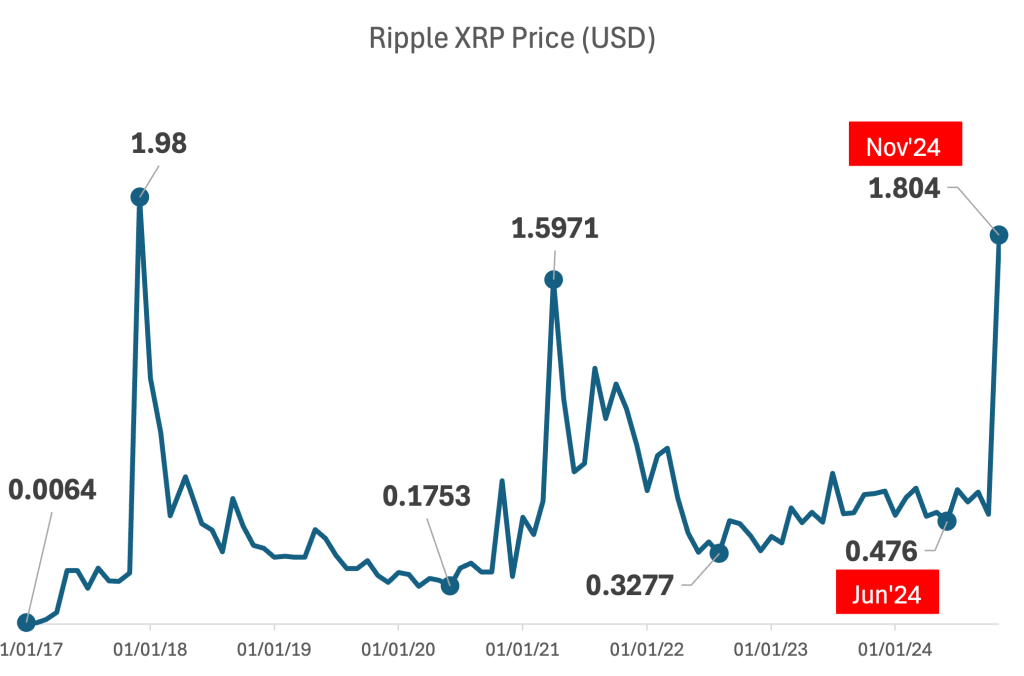

Based on the above data of Ripple’s XRP from January 2017 to November 2024, several trends and patterns are visible. I think they are crucial for understanding its price dynamics and for formulating a perspective on future price predictions.

4.1 Historical Trends and Analysis:

- Volatility and Growth Patterns: The data shows significant volatility in XRP’s price over the years. There are periods of sharp increases followed by corrections. Notably, there seems to be a substantial growth spurt between June 2024 and November 2024. Here the price increased by approximately 3.8 times. This period is of interest as it indicates a strong bullish trend or a significant event driving the price up.

- Key Growth Periods: Historically, XRP has seen considerable growth in specific windows. For instance, from late 2017 to early 2018, there was a notable peak, coinciding with the general crypto boom. Another period of growth appears, in years between 2020 and 2021, it was when the world first saw the COVID-19 pandemic.

- Post-Correction Stability: After each major peak, there’s usually a correction period where the price stabilizes. This pattern is visible in the data after the 2018 peak, where the price stabilizes with minor fluctuations over the next few years. This trend is also visible after the 2020-21 peak, where the price peaked and then consolidated.

4.2 Donald Trump’s Influence on Future Ripple Price Movements

A potential link to Donald Trump’s actions or policies affecting XRP’s price growth is speculative. However, several points could be considered:

- Regulatory Policy: If Trump, as the new upcoming President of US, pushes for more favorable cryptocurrency regulations, XRP price will surge. I think, Donald Trump is a kind of US president who is more likely to favour crypto than other democratic party presidents of the past.

- Public Statements: Indirect public statements are generally made by Trump in favour of Bitcoin abd other cryptos. If he does it being the US president, it will certainly help the Ripple XRP price surge.

- Economic Policies: Broader economic policies could indirectly affect cryptocurrencies. For instance, if policies aimed at reducing the power of traditional banking or promoting digital currencies were introduced, this could also benefit cryptocurrencies like XRP.

5. Future Predictions:

Predicting future prices based solely on past trends is tricky due to the crypto market’s volatility and susceptibility to external news.

However, if the growth from mid-2024 continues, and assuming no major negative regulatory setbacks or market crashes:

- Short-term: If the upward trend continues due to positive developments or broader market bullishness, XRP could maintain its momentum or stabilize at a higher level.

- Long-term: The long-term growth will depend heavily on Ripple’s success in expanding its network, overcoming regulatory hurdles, and actual utility in financial transactions. If these factors align positively, XRP could see further highs, potentially reaching new peaks if the crypto market as a whole also trends upwards.

Conclusion

A recent analyses by technical experts have suggested that XRP might reach significant milestones if it sustains its current momentum. Some are predicting levels between $2 to $5 in the near term, based on bullish market conditions and favorable legal outcomes.

However, it’s crucial to consider broader market influence on Ripple XRP.

The crypto market’s volatility means that XRP’s price can be influenced by the overall market cap of cryptocurrencies, Bitcoin’s dominance, and shifts in investor sentiment towards digital assets.

If the crypto market cap hits new highs, XRP could benefit proportionally.

Some experts are even predicting that XRP could reach $10 or even beyond by 2030. This growth will be driven by increased adoption in financial sectors globally.

Conversely, XRP could struggle if regulatory hurdles persist or if Ripple fails to expand its technological footprint.

The supply dynamics of XRP also play into its price prediction.

Unlike Bitcoin, which has a mining process to introduce new coins, XRP’s total supply was released at inception itself. A significant portion of XRP is being held by Ripple Labs.

Ripple Labs controls a significant portion of XRP’s total supply. If they release tokens slowly, it might make XRP seem rarer, potentially increasing its value. Conversely, if they release too many at once, this could oversaturate the market, possibly driving the price down.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.