Namaste friends. So, market mein kya chal raha hai? That’s the question everyone’s been asking me, from my chai-wala to my usually-stock-agnostic uncle! The thing is, the market never sleeps, does it? And recently, it’s been particularly…interesting. It’s like that wedding you attended where there was the super-hyped celebrity guest (AI Stocks), the dependable old aunties singing bhajans (dividend stocks), and the random cousin who suddenly became a TikTok star (hidden growth stocks).

Let’s unpack this whole scene, shall we?

AI Stocks: The Shiny New Toy (But Tread Carefully!)

We can’t ignore the elephant in the room – Artificial Intelligence. Everyone’s talking about it, and for good reason. It’s like that revolutionary new gadget that promises to change everything. And at the heart of this AI revolution? A company called NVIDIA.

[Indian Equivalent of NVIDIA: Moschip Technologies. It is involved in semiconductor and system design services. It has been noted for its activities in the semiconductor industry, which align somewhat with NVIDIA’s broader business of chip design. The company’s stock has seen increased interest due to its semiconductor focus, especially after NVIDIA’s significant market growth.]

NVIDIA, bhai, has become the poster child for the AI boom. It’s like the Mukesh Ambani of the chip world right now. Their chips are the building blocks for these massive AI systems. Recently, there was some news about a Chinese company (DeepSeek) claiming they could achieve similar AI power with fewer NVIDIA chips. Now, this caused a bit of a flutter. The stock dipped, and everyone started panicking.

But here’s my take: This is the nature of the game! These dips are opportunities. Think of it like this: You want to buy gold, but the price is sky-high. Wouldn’t you be thrilled if there was a sudden, temporary dip? That’s how I see these fluctuations with companies like NVIDIA. They’re integral to the AI story, and the long-term potential is HUGE.

However, thoda sambhal ke! Don’t put all your eggs in one AI basket. The tech world is volatile, and things change rapidly. Remember the dot-com bubble? History has a way of repeating itself. Read more about the investment cycles, Howard Marks Insights.

Dividend Stocks: The Steady Eddy in a Crazy Market

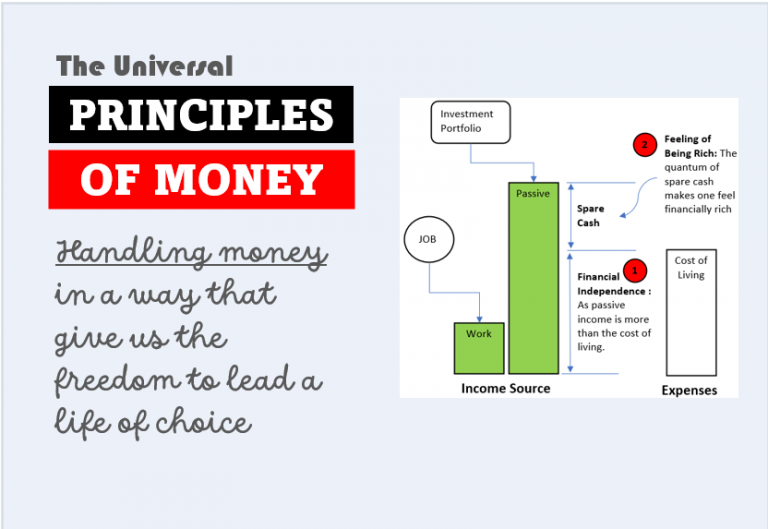

Now, while everyone’s chasing the AI dream, there’s a quiet resurgence happening in the world of dividend-paying stocks. Think of these as your nanus fixed deposit – reliable, steady, and gives you that comforting feeling of regular income.

Companies like Dollar General (DG) and Restaurant Brands International (QSR – the folks behind Burger King) are catching the eye. They’re not flashy, but they offer decent dividend yields. In simple terms, you invest in their stock, and they pay you a portion of their profits regularly. It’s like getting rent from a property you own!

[Indian Equivalent of DG and Restaurant Brands (RBS): I think, DG’s equivalent will be DMart. Its yield is not extraordinarily high, but it is known to pay dividends. An yield of around 0.5% to 1%. However, its focus in still on growth, hence it may not pay as high dividend as other mature companies. RBS’s Indian equivalent will be Jubilant FoodWorks. It has a track record of paying dividends, with yields around 0.5%]

Why this renewed interest in dividends? Well, yaar, the world is uncertain right now. Inflation is biting, and the economy is looking wobbly. In times like these, people crave for stability. Dividends provide that cushion, that regular income stream that can help us sleep better at night.

Also, after the crazy market rally we’ve had, many folks are looking to lock in some profits. Dividends stocks are a great way to do that. Book profits in growth stocks and accumulate a few premium dividend paying stocks. Suggested Reading: Which stocks is best for dividends in India (Answered in FAQ style).

Finding Hidden Growth Gems

Okay, we’ve talked about the hyped-up AI and the reliable dividends. But the market is a vast ocean, and there are plenty of other fish to fry.

While everyone is obsessed with NVIDIA, Tesla, and Apple, I’m looking for hidden gems – companies that are growing steadily but haven’t yet caught the mainstream’s attention.

For example, people in UA are considering Meta (META). It’s not just Facebook anymore! They’re also heavily invested in AI. And if they can leverage cheaper AI technology, their stock could see a significant boost.

What we can do in India?

We can explore a few quality mid-cap and small-cap stocks. There are incredible companies out there in sectors like healthcare, industrials, and consumer. That are quietly powering the world and offering fantastic growth potential. These are the guys developing new medical technologies, and building the infrastructure of tomorrow.

Think of it like this: everyone’s rushing to buy property in Mumbai, Gurgaon, Bangalore, etc. Smart investors are looking at Pune, Indore, and other emerging cities where the potential is immense.

My Investment Strategy: A Balanced Khichdi

So, what’s my personal strategy in this market madness? I like to call it the “Balanced Khichdi” approach. It’s a mix of everything!

- AI Exposure: I have some exposure to AI, but I’m not going all-in. It’s like adding a spicy chili to your khichdi – a little goes a long way.

- Dividend Backbone: I have a good chunk of my portfolio in dividend-paying stocks. This provides stability and a regular income stream. It’s the rice and lentils of my khichdi – the foundation of the meal.

- Growth Sprinkle: I’m always on the lookout for hidden growth gems. This adds excitement and the potential for big returns. It’s like adding a dash of garam masala to your khichdi – it enhances the flavor.

Conclusion

Start informed, stay disciplined and above all stay invested.

The last few months (since Sep’2024) has been a few tough months for the stocks investors.

But remember, the stock market is always a rollercoaster, mere bhaiyo aur behno! There will be ups and downs, twists and turns. But the key is to stay informed, stay disciplined, and stay invested for the long term.

Don’t get caught up in the hype. Don’t panic when the market dips. Do your research, understand your risk tolerance, and stick to your plan.

And most importantly, remember this: Investing is a marathon, not a sprint. It’s about building wealth steadily over time. So, buckle up, enjoy the ride, and remember to add your own personal tadka to your investment journey!

What are your thoughts on the current market? What sectors are you excited about? Let me know in the comments below!

Disclaimer: I am not a financial advisor, and this is not financial advice. Please consult with a qualified financial advisor before making any investment decisions. Aur haan, market mein risk toh hota hi hai! If you want you can use my Stock Engine to get a perspective on Indian stocks.