We often come across stock metrics like Face Value, Book Value, Intrinsic Value and Market Value. What does these terms mean?

How important it is for us to know the difference between them?

A basic question that arise here is, does these definitions help us to pick better stocks?

So you can see, these terms alone trigger few basic but intriguing questions in our mind.

Out of all the terms mentioned here, my favourite ones are intrinsic value and market value. Why?

Because it is these two terms that basically defines how overvalued or undervalued is a stock.

A stock which is undervalued is certainly a better stock to buy.

Read more about best stocks here…

For the moment lets focus more on establishing the difference (relationship) between face value, book value, intrinsic value and market value.

Key Difference…

Face value and book values are more of a static theoretical numbers.

Whereas intrinsic value and market value are more liquid and real numbers.

Face value and book value are entries made in companies balance sheet for the sake of bookkeeping only.

There are rules, based on which these value shall be recorded in the companies book of accounts.

Hence I called it “theoretical numbers”.

These values may or may-not resemble the “true value”.

This is where it gets confusing, right? So let me bring in examples to make things more clear.

Lets start with the face value first…

#1. Face Value…

To get more clarity about face value, lets see how to calculate face value of stock…

To do this we will need two numbers:

- Equity share capital.

- Number of shares outstanding.

Face Value = Equity Share Capital / Nos. of Shares

In other words, face value is nothing but equity share capital per share.

From where to get these numbers?

Though these numbers are all available in annual report of companies, but I will try to use a more accessible source. Moneycontrol.

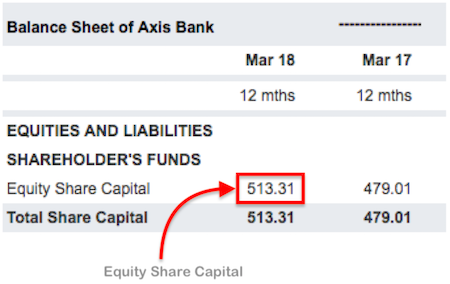

In moneycontrol, equity share capital can be obtained directly from companies balance sheet.

Number of shares outstanding can also be obtained in moneycontrol.

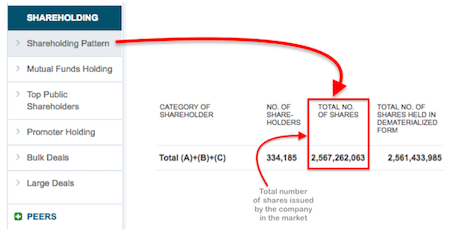

Open the stock page in moneycontrol. Go to Shareholding > Shareholding Pattern.

The required data related to “nos. of shares” will look like this:

So from these reports we have to pick two important numbers:

- Equity Share Capital = Rs.513.31 Crores.

- No of Shares = 256,72,62,063 nos (256.726 Crore nos).

Once we have these two values, its easy to calculate the face value.

Face Value = Equity Share Capital / Nos. of Shares

Face Value = 513.31 / 256.726 = Rs.2 per share.

Now that we know how face value is calculated, it will be easier to establish a difference (or relationship) between face value, book value etc.

So lets proceed with book value calculation. This will establish a clear relationship (also difference) between them.

#2. How to calculate book value stock?

There are two ways to do it. Lets make it easy by remembering two formulas:

(Book Value) per share = Face Value + Reserves Per Share.

Formula_2.1

I generally calculate book value by the above formula.

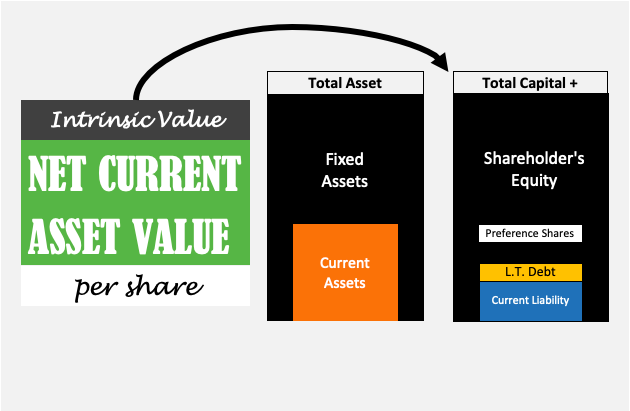

But by definition of book value, its formula should be as below:

(Book Value) per share = (Total Assets – Total Liability) per share.

Formula_2.2

Lets try to calculate book value using both the above formulas.

Formula_2.1

(Book Value) per share = Face Value + Reserves Per Share.

For this, now we need to calculate “Reserves per share”.

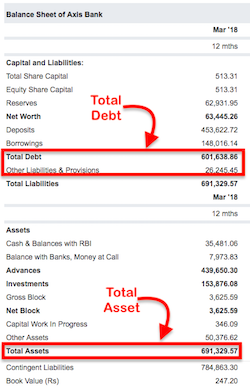

In moneycontrol, Reserves can be obtained directly from companies balance sheet.

So from these reports we have to again pick two important numbers:

- Reserves = Rs.62,931.95 Crores.

- No of Shares = 256,72,62,063 nos (256.726 Crore nos).

Reserves Per Share = Rs.245.13 (62931.95/256.726)

(Book Value) per share = Face Value + Reserves Per Share.

(Book Value) per share = Rs.2 + Rs.245.13 = Rs.247.13

Formula_2.2

(Book Value) per share = (Total Assets – Total Debt) per share.

For this we need to calculate Total Assets minus Total Debt.

In moneycontrol, “total debt & total asset” can be obtained directly from companies balance sheet.

So from these reports we have to again pick three important numbers:

- Total Debt = Rs.6,27,884.42 Crores (601638.85 + 26245.57)

- Total Assets = Rs.691,329.57 Crore.

- No of Shares = 256,72,62,063 nos (256.726 Crore nos).

Total Asset – Total Debt = 63445.15 (691329.57 – 627884.42).

(Total Asset – Total Debt) per share = Rs.247.13 (63445.15 / 256.726).

Using this formula, (Book Value) per share = (Total Assets – Total Debt) per share.

(Book Value) per share = Rs.247.13

Relationship Between Face Value and Book Value…

(Book Value) per share = Face Value + Reserves per share.

#3. Relationship Between Market Value, Face Value and Book Value…

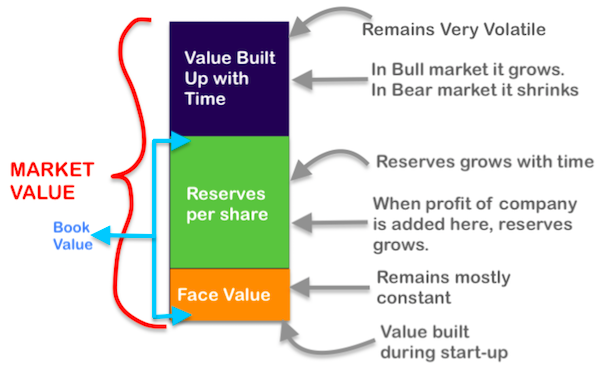

The above picture is a very crude representation of market value of a stock.

Market Value = Book Value + Built-up Value.

A simpler formula of market value of stocks will be this:

Market Value = Market Price X Nos. of share outstanding.

In websites like moneycontrol, market value of share is the most dominantly displayed data.

It is the market price of stocks at which we buy and sell our stocks.

Hence, this is the most important stock metric when it comes to stock trading.

It is this value which actually decides if the investor will make a profit or loss. How?

To understand this, we must understand another important relationship.

#4. Relationship between intrinsic value and market value…

What we have seen till now:

- Face Value can be calculated from data in balance sheet.

- Book Value can be easily calculated from data in balance sheet.

- Market Value is visible everywhere (no need to calculate).

The main difficulty in stock investing arise in estimating intrinsic value of stocks.

What is utility of intrinsic value?

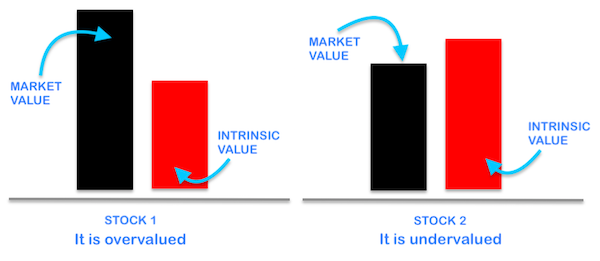

Comparison between intrinsic value and market value decides if the stock is overvalued or undervalued.

Overvalued : Market Price > Intrinsic Value.

Undervalued: Market Price < Intrinsic Value.

What is the difference between intrinsic value and market value?

Ideally speaking, market price of stock should be equal to its intrinsic value.

But in real world stocks do not always trade at its intrinsic value.

In fact in most of the time, good stocks trade at overvalued price levels. Means, they trade at price above its true value.

Intrinsic value is the estimated true value of stocks.

Market value is the value of the stocks at which stocks are currently trading. This may be above or below its intrinsic value (true value).

So you may ask, if a stock is trading above its true value, why people buy them at all?

Because most of the people who trade stocks does so without knowing its true value. Why?

Because estimating intrinsic value of stocks is a special skill and it must be learnt.

I use my stock analysis worksheet to estimate intrinsic value of stocks.

Final words…

Face value of stocks is a value which is used just for bookkeeping purpose.

We can also remember face value as the “original cost” of the stock as issued by the company.

Frankly speaking, remembering face value is of basically no utility for the investors.

People may recall it only for academic reasons.

Book Value of stock is more useful than face value.

Investors can compare market value with book value (P/B ratio), to get a hint about stocks price valuation.

Read more about book value of stock here…

It is the comparison between Intrinsic value and market value of stocks which is most important for investors.

Sir

You have worked so nicely to explain every thing and also real time example/how to see through moneycontrol is really useful.

Great job

Thanks

I came across these terms a time ago. But this is the first time I came to know what it means. Written in very easy to understand language. Enjoyed reading it.

Thanks for the feedback. Keep reading…

I have been reading your articles regularly. I am a business man & very keen to start investing in Stocks.

i am only looking at long term investments.

There are so many stocks available, so how I pick the correct stock to check its Intrinsic Value.

Please guide.

regards,

D.S.

Thanks for your comment.

Frankly speaking, there are no shortcuts.

Though the easiest alternative is to learn “stock screenin.

I will suggest you to read this blog post:

http://ourwealthinsights.com/how-value-investor-screen-stocks/