GOI has announced a pension scheme called “Pradhan Mantri Vaya Vandana Yojana (PMVVY)” for retired people above 60 years of age.

PMVVY scheme was made available for sale since 4th-May’2017. It will remain available for sale only till 31st-Mar’2020.

Only LIC of India has the sole right to operate PMVVY. One can buy online the PMVVY scheme from LIC’s website. Let’s know more about the scheme and its similarities and benefits overs Senior Citizen Savings Scheme (SCSS)…

Topics

General Info About PMVVY

It is a tailor made pension plan for senior citizens (60 years & above). The purchase can be made only by citizens having a resident Indian status.

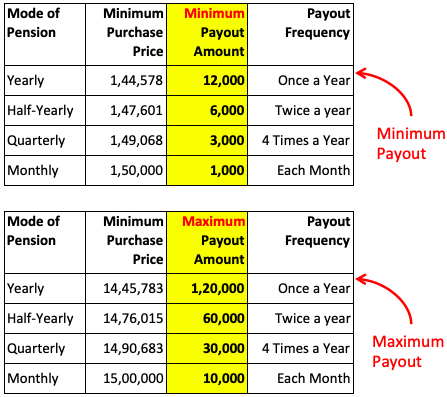

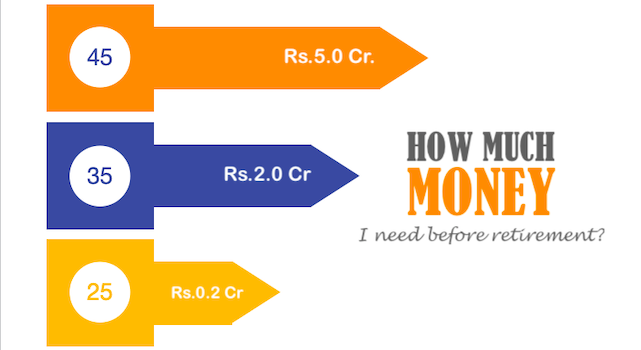

As the name indicates (Vaya vandana: salutation to age), this policy provides social security for aged people. A senior citizen can invest in this scheme by paying a lump-sum amount as shown below:

[Note: In addition to the periodic pension payments, at the end of period the investors of PMVVY also gets back their principal invested amount]

What are the four (4) plans?

A person who is buying PMVVY must first decide how frequently he/she wants to get paid. Here the person has four (4) alternatives:

- Yearly Plan: Here the pension paid to the beneficiary is once in a year. If a person has bought the scheme on 01-Jan-2019, the first pension will be paid on 31-Dec-2019. Subsequently the pension amounts will be paid at the end of each periods.

- Half Yearly Plan: Here the pension paid to the beneficiary is twice in a year. If a person has bought the scheme on 01-Jan-2019, the first pension will be paid on 30-Jun-2019, and the second pension will be paid on 31-Dec-2019.

- Half Yearly Plan: Here the pension paid to the beneficiary is four times in a year. If a person has bought the scheme on 01-Jan-2019, the first pension will be paid on 31-Mar-2019, second on 30-Jun-2019, third on 30-Sep-2019, and fourth on 31-Dec-2019.

- Half Yearly Plan: Here the pension amounts are paid each month to the beneficiary. If a person has bought the scheme on 01-Jan-2019, the pension payment will start from next month itself. The first payout will be on 28-Feb-2019.

Depending on ones cash flow needs, the senior citizen can decide which form of cash flow will suit the requirement.

Generally speaking, people will prefer monthly payments, right? But the monthly cash-flow comes at a price. We will discuss more about it now…

How much is the payout in PMVVY?

As there is a limit on how much money can be invested in PMVVY, it limits the payouts.

Let’s see how.

If one buys a monthly plan of PM’s Vaya Vandana Yojana, the payout will be between Rs.1,000 to Rs.10,000 per month.

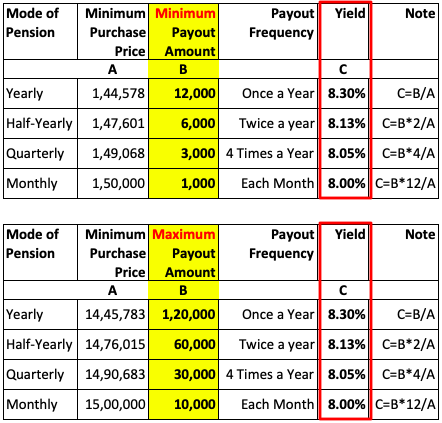

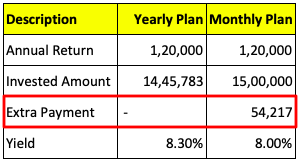

Some might ask, which plan (Yearly/Half-Yearly/Quarterly/Monthly) is better for investors? The yearly plan yields best returns. The monthly plan’s yield is lowest. Lets see how:

To earn the same level of returns (say Rs.1,20,000 each year), the investor has to pay the least in yearly plan.

Example:

PMVVY Vs SCSS – Which is better?

What is SCSS? It is an abbreviation for Senior Citizen Savings Scheme, 2005. Like PMVVY, SCSS is also a tailor made investment product for senior citizens. So an an investor, which is a better investment between PMVVY and SCSS? To understand this lets compare them on the following parameters:

1. Policy Term

- PMVVY: The maturity period for Vaya Vandana Yojana (VVY) is 10 years. It means, the depositors money remain locked for 10 years.

- SCSS: The maturity period for SCSS is 5 years. It means, the depositors money remains locked for only 5 years.

As the policy term (lock-in period) is less in SCSS, it gives more flexibility to the investors.

2. Payout Frequency

- PMVVY: In terms of payouts frequency, PMVVY has 4 options for its investors. One can choose between monthly, quarterly, semi-annually, and annual payouts.

- SCSS: In terms of payouts frequency, SCSS has only one option for its investors. The payouts are made only at the end of each quarter.

[Note: The quarter ends in India on these dates: 31st-Mar, 30th-Jun, 30th-Sept, and 31st-Dec.]

3. Investment Yield

In terms of yield, as this date (Sep’2019), SCSS was yielding better returns than PMVVY. But as checked on today (Updated: 21-May’20), the yield of both the plans are identical:

- PMVVY: The yield of quarterly plan of SCSS is 7.4%.

- SCSS: Here there are only quarterly payouts. The yield of SCSS is 7.4%.

The yield of SCSS scheme far exceeds even the yield of PMVVY’s annual scheme.

In terms of investment yield, SCSS is better.

4. Death Benefit

- PMVVY: In case of death of the pensioner within the policy term of 10 years (VVY), the beneficiary (legal heirs or nominee) will get the full invested amount.

- SCSS: SCSS does not have any death benefit. But they have the following. Provision of joint account (with spouse only) and nomination facility is available.

Hence, while buying SCSS, the investor must ensure that the account is joint or has a nominee.

5. Maturity Benefit

In maturity benefits, both PMVVY and SCSS plans are at par.

- PMVVY: In case the pensioner survives the full policy term of 10 years, the pensioner will get the full invested amount, and the final pension amount due.

- SCSS: After maturity, the SCSS account gets closed and the invested money can be withdrawn. It is also possible to “extend” the matured SCSS plan by another 3 years.

With the extended term of 8 years (5+3), the benefits of SCSS and PMVVY are almost same.

6. Age Limit for Investment

- PMVVY: Only person above 60 years of age are eligible to buy Vaya Vandana Yojana scheme. There is no upper age limit.

- SCSS: There are two age criteria in SCSS. Any individual at 60 years of age (or above) can buy SCSS. People who are above 55 years of age and has retired on superannuation or under VRS can buy SCSS.

Hence, in terms of age limits, SCSS covers a wider age group.

7. Maximum Investment

- PMVVY: The maximum amount one can invest in Vaya Vandana Yojana is Rs.15,00,000 (monthly plan). These Rs.15 lakhs can generate a maximum pension income of Rs.10,000 per month. But the restriction (max limit) of Rs.15 lakhs is per senior citizen in a family. Suppose both the husband and wife is a senior citizen. This family can invest Rs.30 lakhs in PMVVY. In this case the family can earn Rs.20,000 per month income from PMVVY.

- SCSS: The maximum amount that can be invested in SCSS is also Rs.15 lakhs. SCSS accounts can be opened in 25 different banks in India. But the sum total of all deposits in such SCSS accounts should not exceed Rs.15 lakhs.

Post retirement, senior citizens prefer to park their money in only few investment schemes.

As more money can be invested in PMVVY (joint account with spouse), I personally will prefer it over SCSS.

8. Minimum Investment

- PMVVY: Here the minimum investment is Rs.1,44,578. This investment will generate an income of Rs.1,000 per month (paid once a year).

- SCSS: Here the minimum investment is Rs,1,000. This investment will generate an income of Rs.20.15 per month (paid every quarter).

Hence in term of minimum investment, a wide scale of people can utilize the benefits of SCSS.

In the same light, he coverage by PMVVY will be done mostly by the Indian middle class and above.

9. Interest Payment Mode

- PMVVY: The pension amount can be credited to ones bank account by NEFT or Aadhaar Enabled Payment System (AePS).

- SCSS: The interest amount can be credited to ones account. But this account must be opened in the same branch. If SCSS account is in a Post office. Account must be opened in the same branch of the post office. Same is applicable for the banks as well.

In terms of payment mode, PMVVY provides a slightly more flexibility for its investors.

10. Premature Closure

- PMVVY: In normal circumstances, premature closure of Vaya Vandana account is not possible. But under “exceptional circumstances” the scheme can be closed. Exceptional circumstance can be like a serious medical condition which requires more funds. But even if the premature close has been allowed, LIC will release only 98% of the invested value.

- SCSS: The premature closure term is not as strict in this case. Here the premature closure is allowed after lapse of 1 & 2 years under following conditions:

- Premature Closure after 1 year: 98.5% of the invested amount will be released.

- Premature Closure after 2 years: 99.0% of the invested amount will be released.

11. Income Tax Benefits

- PMVVY: There are no tax benefits (deductions) offered by PMVVY. Moreover, the pension received in the hands of the person is taxable. Though it is not clear, but I think TDS deduction is not applicable here.

- SCSS: Contribution to SCSS qualifies for deduction under Section 80C. But the interest earned on SCSS is fully taxable. Moreover, if the annual interest amount is more than Rs.10,000, TDS will be deducted at source.

In terms of tax benefits, SCSS is more tax friendly as it allows deductions.

Final thoughts…

Earlier, the maximum investment limit in Pradhan Mantri Vaya Vandana Yojana (PMVVY) was only Rs.7.5 lakhs. But in May’18, the union cabinet extended this limit to Rs.15 lakhs per person. This step is certainly a welcome move by GOI.

The last date of subscription has also been extended from May’18 to Mar’20. This will also help more senior citizens to subscribe to this plan.

People who have already bought PMVVY must also note the following benefits:

- Benefits #1: Max investment of Rs.15 lakhs is allowed per senior citizen of family. It means, now PMVVY can also be purchased for the spouse. This will help the family to generate Rs.20,000 per month (Husband + Wife).

- Benefits #2: In times to come, the interest rate in India will surely fall to the range of 6-7% per annum. But the PMVVY scheme will continue to yield 8.3% return till maturity (10 years).

- Benefits #3: As a comparison between PMVVY and SCSS, PMVVY scores higher. Why? Because it enables a family to invest Rs.15 lakhs per senior citizen.

My father is 60 and my mother is below 60. can we invest 30 lakhs in joint account in PMVVY Scheme?

thank you.

PMVVY is more secure than small financing institutions since it is guaranteed by the LIC and the government. You can also earn fixed pension payments for ten years without having to worry about rate changes. Parking in up to one year bank deposits in a rising rate situation will help you gain immediately from higher rates.

An army person can retire after 15 years of service and invest in PMVVY ?

Hi

Can you provide the calculations for the latest revised scenario for PMVVY and the maximum amount it can invested. Also I request you to compare the latest Jeevan Akshay series of LIC.

thanks

Sha

1. Can I subscribe for PMVVY more than once e.g. 5L now and 5L after 6 months?

2. Can I subscribe as first holder & my wife as second holder & also another policy

in which my wife is first holder & myself as joint holder?

Both are above 60 years of age.

The investment is capped at Rs.15 lakhs is per senior citizen. I think this can be reached in multiple steps.

The maximum 2 senior citizens can invest in PMVVY is Rs.15×2 lakhs.

Thanks for asking.

I understand that the PMVVY scheme has now been extended.

Please compare the interest rates now between SCSS and PMVVY Schemes.

Is max limit increased due to lower interest rate in PMVVY?

Thanks

Sivaramakrishnan

Dear Sir, To avoid TDS on the quarterly returns /pension for SCSS /PMVVY respectively, when the limit exceeds 50000 per year, does providing Form 15H to LIC/Bank avoid the hassle of TDS deduction and further avoiding filing ITR.

Thank you.

Santhosh George, Kerala

Can one person with age 60+ invest in both PMVVY and SCSS?

These are two different schemes. It can be done.

1. Is PMVVY applicable for retired(govt/corporate) senior citizens only or any senior citizen can apply?

2. Interest/pension earned on this plans is tax free till 50000 for senior citizen? https://cleartax.in/s/section-80ttb

Non government employees can also invest in PMVVY scheme. Interest earned on PMVVY is taxable.

My mother was a school teacher. She get her retired amount 3 months ago. My father was also a school teacher and expired 2 months ago. Shall my mother invest Rs. 15 lakhs in each PMVVY and SCSS separetly.

Both the plans are good in their own ways

Can a senior citizen with spouse (both above 60 year) can invest jointly in two SCSS accounts by investing Rs. 15 lakh in each account(total 30 lakhs) by mentioning each of both as first investor in two joint accounts? PL clarify… regards..Man

One account (even if joint) can have a maximum of Rs.15 Lakhs.

But you can have two accounts like this:

– A/c 1: You (First Depositor) + Spouse (Second Depositor) – Value Rs.15.0L

– A/c 2: Spouse (First Depositor) + You (Second Depositor) – Value Rs.15.0L

P.Note: There is also a nomination facility for SCSS accounts

Can my wife invest 15 Lakh Rupee in PMVVY by issuing two cheques?.

Sir

My father was a school teacher and expired 3 years ago. My mother is getting family pension from Government Of Rajasthan.

Can my mother invest 15 Lakh Rupee in PMVVY and 15 Lakh in SCSS ?

Total 30 lakh to invest .

I suppose there should not be any problem. These schemes are for any Indian national senior citizen.