There is a need for people to know about direct plan offered by mutual fund companies. What is the need?

In good old days, mutual fund schemes could be sold to investors only through agents and distributors. Reason being, lack of penetration of internet into the Indian households, hence negligible online transactions.

But today we are in year 2020, and almost all mobile phones has at least 3G/4G internet connectivity. Majority service class people are now accustomed with digital payments.

Internet accessibility has also enabled people to research investments on their own. As a result, people use online trading platforms or portals like MF Utility, Scripbox, Fundsindia etc to buy mutual fund units on their own

What does it mean? It means, there is a big group of DIY investors who are not taking any advice from agents, financial advisors etc. They are taking buy-sell decisions on their own.

For such people, it is strongly advisable to opt for direct plans of mutual funds instead of regular plans. If you are not aware of the difference between a regular plan and direct plan, we will discuss this in this article.

Direct Plan & Regular Plan

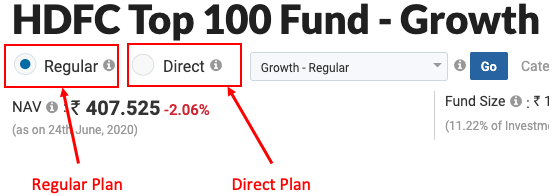

If you will check a mutual fund page on moneycontrol, you will see two options of the same scheme. First is a default page of “Regular” plan. Second, you can use the radio button to switch to the “Direct” plan.

Generally when we buy a mutual fund scheme, unless we have specifically opted for it, we end up buying a regular plan. Even in today’s world where investment transactions have become almost transparent, buying a direct plan is still not as easy. Why?

Because there is a community which wants direct plans to stay hidden. It is in their interest. But it is not in the interest of we DIY investors. Which is this community? They are an association of Mutual Fund Agents and Distributors.

What is their problem with direct plans? They will get zero fees from mutual fund AMC’s (Asset Management Companies) if they will sell direct plans. They get paid only if they sell “Regular Plans”.

Agents & Distributors

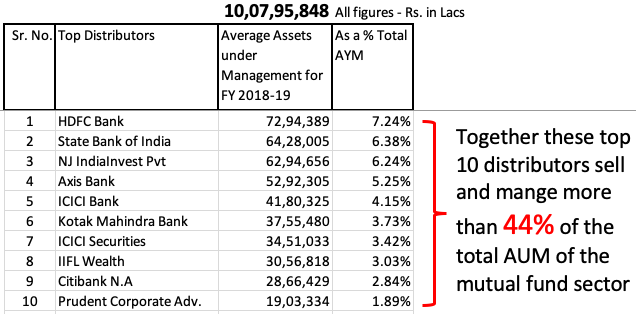

All in all there are 1,000+ numbers registered mutual fund distributors in India. Among them, the big names are all commercial banks like HDFC Bank, SBI, Axis Bank, ICICI Bank, Kotak Mahindra etc. It will not be wrong to say that these are corporate heavyweights.

It is estimated that, out of total Asset Under Management (AUM) of all mutual funds in India, about 44% are sold and managed through the top 10 distributors. List is above.

So not only these distributors are big and powerful, but they also bring majority sales for the mutual fund companies.

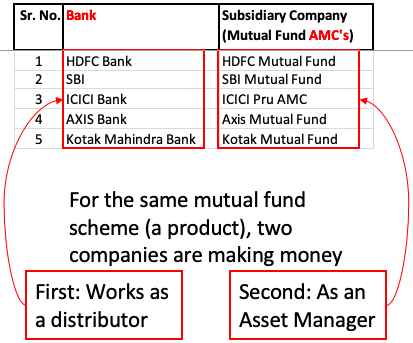

Moreover, in most of the cases, these banks (distributors) are basically the parent companies, and mutual fund AMC’s being their subsidiary company. Example:

It is like a win-win situation for the group. For the same product (mutual fund schemes), two companies are generating revenues. The first one (Bank) works as an agent/distributor. They sell the schemes to public and earn a commission/fees from the AMC.

The second one (AMC), they are the main custodian of the assets/funds of the public. They also earn money by charging a fees directly to the investors.

But interesting here is to note that, both the commission/fees of the distributor and the fees of the AMC, are all charged backed to the investor (me and you). We pay it to mutual fund companies by way of what we know as “Total Expense Ratio (TER)“.

Now here comes the utility of a Direct Plan. It dramatically lowers the cost of the investor. How? Before we know this, let’s first know about the various charges and fees we pay when we buy a mutual fund.

Break-up of Expense Ratio (TER) of Mutual Fund

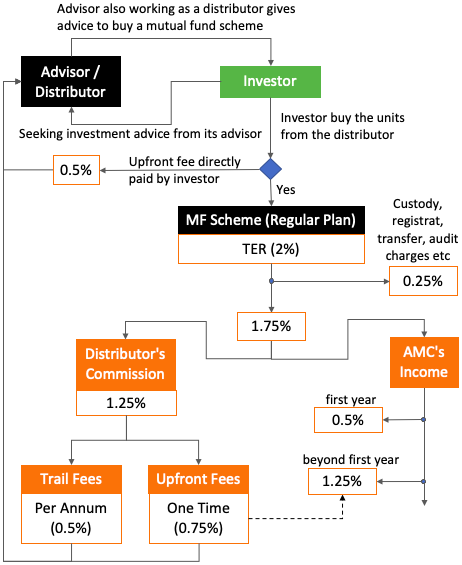

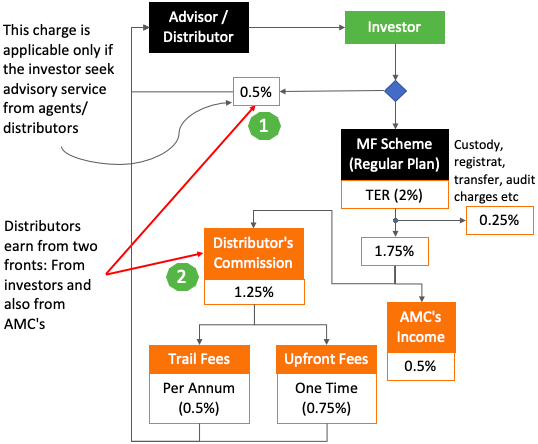

Here is a hypothetical example of expense ratio break-down of a typical mutual fund scheme.

Consider that there is a mutual fund scheme (Regular Plan) which charges a total expense ratio (TER) of 2% to its investors. What does it mean? Out of Rs.100 invested in a mutual fund, Rs.2 is used by the mutual fund company as its fees. The balance Rs.98 is used to buy mutual fund units at its Net Asset Value (NAV).

Out of TER-2%, 0.25% is paid for depository, audit, registrar, and transfer charges. What balance is left is 1.75% with the AMC. Read more about 3 Tier structure of fund house.

From what is left, a portion is AMC’s income and the balance is paid to the distributors as commissions. Consider 1.25% (out of 1.75%) is paid to the distributors and balance 0.5% is AMC’s income.

Income of Advisor/Distributors

As you can see in the above infographics, there can be two source of income for an advisor/distributor. First is directly from the investors, and second from mutual fund AMC’s.

- Advisory Fees (From Investors): This fee is charged to the investors when they seek advisory services from their agents/distributor. On an average, fee for advisory services can range from 0.5% to 1%.

- Commission (From AMC’s): These are like compensation paid to the agents/ distributors for marketing and selling mutual fund schemes directly to the public:

- Upfront Fees: 0.75% is paid as upfront fees. Upfront fees is paid at the time of new investment only. Hence it is one time fees.

- Trail Fees: The balance 0.5% is paid as trail fees. Distributors can claim trail fees once every year. It is payable by the AMC, till the investor holds the mutual fund units. If the investor sells the units in first year itself, trail fees will not be payable.

[P.Note: In Oct’18 SEBI has banned the upfront fees. SEBI has asked all fund houses to now follow ALL TRAIL FEE model for distributors. Henceforth, distributors cannot charge upfront fees directly or indirectly to their subscribers. Upfronting of commission is allowed only in SIPs. Read more about it here]

You can note that, out of total expense ratio (TER), which we pay to mutual fund companies, 60%-65% of TER goes into the hands of advisor/distributors. Is there any way we can save this expense? Yes it is possible, How? By investing in direct plan of a mutual fund scheme.

Direct Plan: What is it?

Generally how we buy mutual funds? Majority buy mutual fund units through their banks. People also buy mutual funds using their online trading platforms. People also buy mutual funds through “online portals” like Scripbox, FundsIndia etc. A small group of people also hire “Financial Advisors” who in turn assists people to buy mutual fund units from AMC’s.

In this case all the entities: banks, trading platforms, web portals, financial advisors etc works as an intermediaries. In simple language they are working as agents/distributors for the Mutual Fund company. They intermediaries sell ONLY regular plan of mutual fund schemes.

But we also have a choice to buy Direct Plan offered by mutual fund companies. In direct plans, roles of agents/distributors is completely eliminated.

Direct Plan Vs Regular Plan

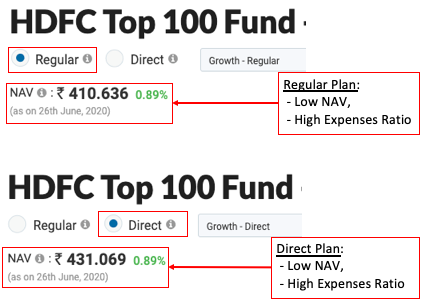

Suppose there is mutual fund scheme called “HDFC Top 100”. For this scheme there are two plans: Direct and Regular. Both these plans share the same portfolio. But they have a different expense ratios and NAV’s.

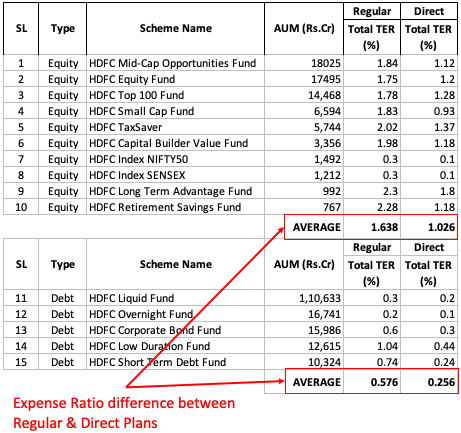

Direct plan have a much lower expense ratio than regular plans. On an average, if a regular plan (equity) has an expense ratio of 1.638%, then its direct plan will have an expense ratio of 1.026%. Below is a list of few top mutual fund schemes offered by HDFC. Their expense ratios (Regular vs Direct) is mentioned.

Comparative

| SL | Description | Direct Plan | Regular Plan |

| 1 | Portfolio Composition | Identical | Identical |

| 2 | Fund Manager | Same | Same |

| 3 | Expense Ratio | Low | High |

| 4 | NAV | High | Low |

| 5 | Comparative Price Appreciation | Higher | Lower |

| 6 | Role of Agent/Distributor | NIL | Yes |

| 7 | Advisory Service | N/A | Provided |

Why expense ratio of direct plan is low?

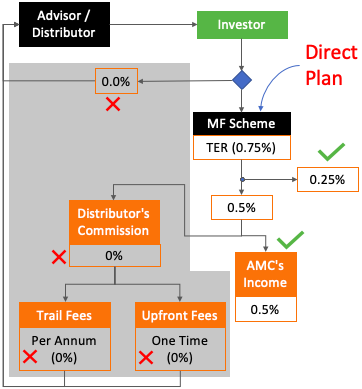

The expense ratio of direct plans are low because all expenses related to distributors/agents become zero. How?

Because these are plans that we buy directly from mutual fund companies (AMC’s). We do not use any intermediaries (like banks, online web portals etc) to buy. Read: How to buy direct plans?

You can see in the above infographics, all expenses which is marked with a cross, is not applicable for direct plans. Only expenses with a tick mark will be charged in a direct plan.

Benefits of lower expense ratio

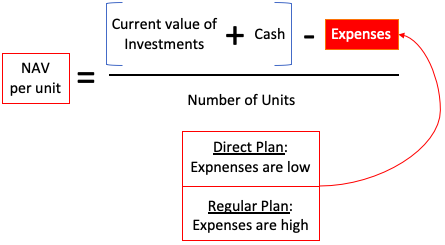

You can understand the benefit of lower expense ratio from the above formula. Lower expense ratio means higher NAV. As expense ratio of direct plans are lower, hence their NAV is always higher compared to their regular plan.

It is also important to understand that expense ratio is an annual expense. It is deducted from the scheme’s total asset (current value of investment plus cash) each year.

So expense ratio is not a one time cost for investors. Mutual fund companies charge their expense on daily basis to the asset base. Thereby reducing the NAV. If expense is high, NAV will be lowered more. Lowe NAV eventually means lower returns for the unitholders. Read more about Net Asset Value (NAV).

Suppose there are two mutual funds (A & B) with identical portfolio. They are expected to give the same returns, right? It is not the case. Suppose mutual fund B has a lower expense ratio than A.

In this case returns of B will be higher than A. In this example, B is a direct plan and A is a regular plan. Though both have an identical portfolio but their NAV’s are different.

At a point of time, NAV of Direct Plan will always be higher than a regular plan. Moreover, NAV of Direct Plans also grows at a faster rate as compared to their sibling – regular plans.

Return Comparison: Direct Vs Regular Plan

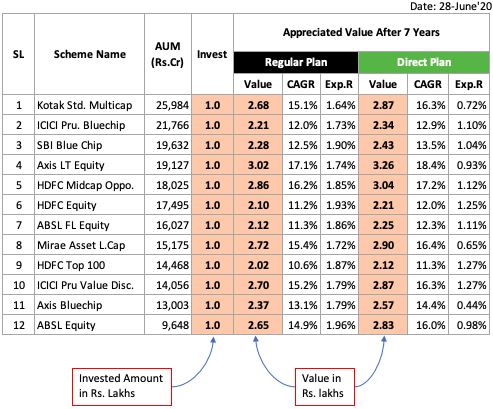

Here is a comparison of returns generated by a scheme’s direct plan and regular plans in a time horizon of 7 years. It is necessary to keep the time horizon longer to see the compounding benefits of direct plans over regular plans.

It must also be noted that the difference in returns between a regular plan and its direct plan in not so high. On an average, direct plans yields 1% higher returns as compared to its regular counterparts. So if the difference is so small, why to consider direct plans?

The reason is simple, it yields higher returns. Even if the different is as low as 0.5%, I think DIY investors should still go for direct plans. For Do-it-Yourself (DIY) investors, going for regular plans is like an unnecessary unnecessary thing.

Tips on investing in direct mutual funds?

Direct Plans are for Do-it-yourself (DIY) investors. These people do not need advice of some external experts to buy and sell mutual funds.

Here are few tips about how to approach DIY investing in direct mutual funds:

- Study Your Needs: Why you are investing? What is the goal? Is the goal long term or short term? Depending upon your goal and available time horizon, what should be a realistic return expectation? These are type of questions one must answer before starting to invest. Read: About goal based investing.

- Type of Mutual Fund: Which mutual fund scheme is suitable for the goal? There are debt, equity and hybrid schemes offered by mutual funds. Depending on the type of goal, and time horizon in hand, one must know which type of fund is best suitable. Read: Types of mutual funds.

- Which scheme: Within a mutual fund type there can be various schemes. Like within debt funds there are liquid, money market, floating rate etc schemes. Within equity funds, there can be large cap, mid cap, multicap, focused, value etc schemes. Depending on ones quantum of expected returns, one needs to pick the correct scheme. Read: Investment options in mutual fund schemes.

There will be times when the market is not doing well. These are moments when novice investors, who pose as DIY investor, tends to panic. This is a dangerous situation. A DIY investor must always try to avoid this case.

How to avoid it? By keeping oneself first updated about what is happening in the economy, market, sectors etc. Second is to build an understanding, which will tell you that though the mutual fund is not performing well now, but eventually it will recover all its losses.

But if you think you do not have time or interest to build these understandings, it is better to seek advice of a “SEBI registered investment adviser”. They will help you in picking a right mutual funds. But through them, you will have access to only regular plans. I personally think that, for novice or busy people, this mode of investing is a wise option.

How to invest in direct plan?

One of the best way to invest in direct plans offered by mutual fund companies is through a website called MF Utility. This website is managed by a company called MF Utility India Pvt. Ltd. This is a company which is currently managed jointly by 39 numbers mutual fund AMC’s.

It is a joint initiative of these AMC’s under the supervision & control of AMFI to help investors to buy mutual funds directly from the fund house instead of routing through an agent/distributor etc.

Though MF Utility’s web interface may not look as neat as that of other websites or mobile apps, but it is free.

There are also service providers like Kuvera who allow investors to invest in Direct Plan through their portals. They charge a very nominal annual fee (like Rs.2,500 per year, when invested amount crosses Rs.1.0 lakhs). It means, for small investors, Kuvera works almost like MF Utility but with a much better user interface.

[Update: As advised by one of my readers “Sudeesh Babu” I’ve checked the FAQ’s of Kuvare. As on today, they charge nothing to their subscribers for Direct Plans]

I must say, we investors must promote the initiative like MF Utility and Kuvera who are really providing a unique service to the investors community.

Conclusion

When I first opened my MF Utility Account, I was surprised to see Rs.8,700 already showing as present value of my holding. When I looked into it closely I could figure out that these are those mutual fund investments which I bought between year 2009 and 2011 and forgot.

It was a pleasant surprise. As all mutual fund AMC’s are listed under MF Utility, hence when we open a MF Utility account, it pulls our holdings from all companies (both new and old) and show them all together in one interface. This pulling of data is done automatically. We just need to provide our PAN number and that’s it.

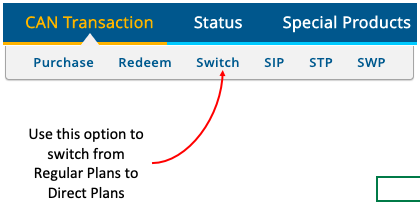

I’ve also used my MF Utility account to switch my old mutual funds investments from regular plan to direct plan.

I personally like Direct Plans over regular plans. The reason being, I plan most of my investments on my own. Hence why I should pay unnecessarily for a regular plan. Direct Plans suits investors like me for sure.

I m investing through MyCAMS directly & they donot charge anything but some AMCs are not accessible under MyCAMS that is the only problem.

What do you suggest for me.

Regards

You can also try MFUtility. It is free and almost all schemes are loaded in one place.

are u implying MF utility over kuvera?

I use MF Utility.

Hello Manish..

Can we expect Dividends from PSU companies in 2020( post June)?

NHPC,NTPC,NLC,SJVN,Coal India, Oil India, etc…

I think companies may start paying dividends from Qtr-4 starting Jan’21.

**FAQ from kuvera website **

I read somewhere that you charge Rs 2,500 a year after investment crosses Rs 1 lakh. Is that true?

This is the article you are referring to we suppose. Please read till the end for – “Update: In October 2017, Kuvera stated to have updated their pricing and now the Mutual Fund investing platform is free to use regardless of portfolio size.”

Indeed. Thanks for the Update. They are not charging for anything for Direct Plans (FAQ’s)