[List of Dividend Paying Stocks] An example of dividend income: Mr. Mukesh Ambani and his family (HUF) hold about 5.6 crore shares of Reliance Industries (0.85%). As declared in Mar’21 annual report, RIL paid a dividend of Rs.7/share. At this rate, the family would have earned a whopping Rs.39.2 Crore only in dividends of RIL. [For a broader perspective, check out our guide on Top Stocks to Buy in India.]

People like capital appreciation more than dividend income. Why? Because dividend yields are smaller. They can be in tune of 1-2%, but capital appreciation is often in double digits. [Updated list is here] But does that make “dividend” less worthy? Not at all. What comes as a package with capital appreciation is price volatility and associated risk. Predicting capital appreciation is harder. However, dividend income is more rational and predictable. In this article, I will explain what makes dividends so special, irrespective of their limitations.

High-Quality Dividend Paying Stocks

Updated: 20-Sep-2024 Check The Stock Engine

| SL | Name | Price | Market Cap(Cr) | Dividend Yield (%) | GMR Score |

| 1 | Morganite :[523160] | 1680.00 | 940.80 | 2.37 | 99.11 |

| 2 | NMDC:[526371] | 212.55 | 62305.46 | 3.44 | 99.04 |

| 3 | NCLIND:[502168] | 213.30 | 962.46 | 1.87 | 98.97 |

| 4 | HIMATSEIDE:[514043] | 168.65 | 1658.33 | 0.00 | 98.89 |

| 5 | AMBIKCO:[531978] | 1744.25 | 1007.03 | 1.99 | 98.82 |

Favor dividend investing for these 4 reasons:

- It’s Different: Dividend-focused investing is different. Investors who invest in them do it with a different objective. Their focus is regular income. Even if the yield is low, it’s ok for them. Read more about income investing.

- Visible: Things that are visible, are more predictable. Predictability gives a more sense of control. Likewise, compared to capital appreciation as dividends are more predictable, investors feel more in control.

- Foolproof: If the rules are applied properly, it will not be wrong to say that dividend-focused investing is almost foolproof. There are fewer chances that the investor will make a loss with them. Read more about foolproof investing rules.

- Pros Like it: Champion investors like Warren Buffett love dividend-paying stocks. A high growth rate is a priority for the majority. However, expert investors prefer a balanced portfolio. Read about Warren Buffett’s 3 rules.

How to generate dividend income?

Buy dividend paying stocks, and hold them for the long term. What is the point about the long term? A stock that is yielding 0.5% at the time of purchase, can yield much higher with the passage of time. How?

Let’s understand this with a real-life example.

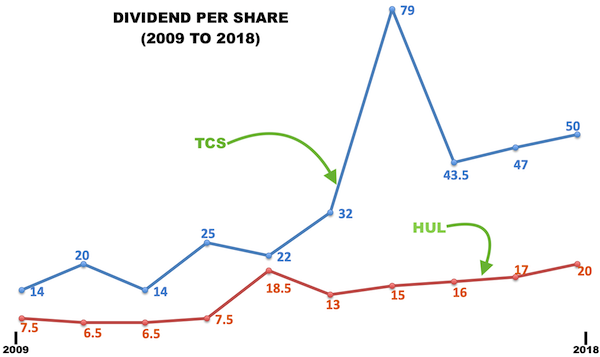

Example: TCS

Suppose a person bought shares of TCS in the year Mar’09. Details are as below:

- March’2009

- Share Price (2009): Rs.260/share (actual price before bonus shares).

- No of shares bought: 10 nos.

- The cost paid to buy TCS: Rs.2,600.

- Dividend paid in 2009: Rs.14/share.

- Total dividend income in 2009: Rs.140.

- Dividend yield in 2009: 5.38%.

Suppose this person held on to his shares till the year 2018. What will be his dividend yield as of Mar’18? [Note: Bonus shares 1:1 was also issued to all shareholders between Mar’09 & Mar’18]

- March’2018:

- The cost paid to buy TCS: Rs.2,600.

- No. of shares held in 2018: 20 nos (1:1 bonus share)

- Dividend paid in 2018: Rs.50/share.

- Total dividend income in 2018: Rs.1,000

- Dividend yield in 2018: 38.4%.

Read more about the dividend analysis of TCS stocks here…

Please note how dividend yield improved from the year 2009 to 2018. The dividend yield in 2009 was 5.38% compared to 38.4% in 2018.

What is the point?

Just by holding on to “good stocks” for long term (say 10 years), their dividend yield itself will become high enough to beat the returns of any debt instrument.

Is it that easy? Buy dividend-paying stocks, hold for a long term, and that’s it? Yes, it is this easy. The only control point is, one must buy only “good stocks“.

Good Dividend Stocks…

Not all stocks that pay dividends are good. There are two criteria that makes a good dividend stock:

- Consistent dividend payout.

- Consistent growth in dividend paid.

This is why companies like TCS and HUL are a good dividend paying stock. They not only pay dividends regularly, but it also grows with time.

Do all companies pay growing-dividends to its shareholders? No. This is why identification of good dividend paying companies is not easy. How to do it? By digging into the financial reports.

How to identify them?

What are dividends? Dividends are nothing but a part of companies net profit. A company which make more profits, will pay higher dividends.

Dividend payment is a process by which companies share its net profit with its shareholders. Good company tend to increase its profits over time. As the profits grow, dividend payment by the company also increases.

This is hint which can be used to identify potential dividend stocks. Do the following:

- Step #1: Open the profit and loss account of the company.

- Step #2: Check if the EPS has grown in last 5 years.

- Step #3: Also check if dividend per share has grown in last 5 years.

- Step #4: Compare if EPS growth and dividend per share growth are similar.

[Read more about how to evaluate the financial health of a company]

If EPS and dividend per share growth are similar, it is a good sign. Why? Because of the following reasons:

- EPS growth means, company’s net profit is improving.

- Dividend per share growth mean, company believes in dividend philosophy.

- EPS growth similar to dividend growth means, as company profit will increase in future, its dividend payout will also improve.

Dividend stocks vs fixed deposits

Why I am comparing dividend stocks with fixed deposits? Because starting yield of dividend stocks are even lower than fixed deposits. So some might think that why to invest in dividend stocks?

Good dividend stocks offer two clear benefits to its investors:

- Short term income: Though starting yield of dividend stocks can be low, but it improves with time. Moreover, good stocks can yield very stable dividend income in short term.

- Long Term Gain: There are two types of gains in long term. First, dividend per share will improve hence its dividend yield will also go up. See TCS example shown above. Moreover, there will also price appreciation of these stocks with time.

Though fixed deposits can give fixed interest, it will never grow with time.

The initial yield of fixed deposits can be better than the dividend yield of stocks, but there are some disadvantages as well. Yield from yield reduces with time (lower interest rates). But the dividend yield of a good company will increase with time.

There are ‘hold forever’ stocks

The price of dividend stocks is very stable. Historically, the price of such stocks wavers less than other stocks. They have a lower beta. Do you know why?

Because people tend to continue to “hold on” to their dividend stocks for a longer period of time (sometimes like forever). Why? Because they continue to earn dividends no matter what. There is no need for them to sell their dividend stock holdings.

These stocks tend to yield dividends even during stocks market collapse.

How to plan dividend stocks purchase?

How to plan its purchase? By keeping a past record of companies which has paid decent dividends. These will be your list of the highest dividend paying stocks. (a ready-made list is provided above).

Which records are more important than others?

- Net Profit (PAT): This is the profit earned by the company after paying all its dues like adjusting for depreciation, interest, taxes etc. Read more about analysis of profit margin of companies.

- Dividend paid (D): Here we will have to compare two things. Out of the total PAT, how much lump-sum dividend the company has paid. Read more about dividend yield formula.

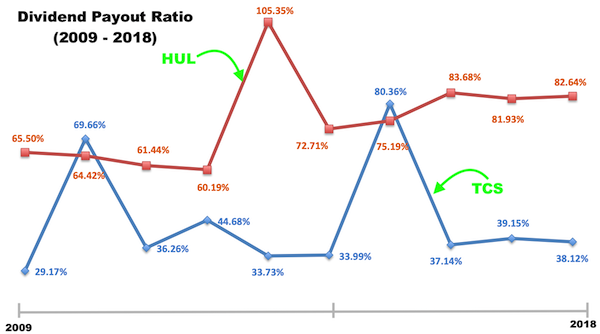

- Dividend Payout % (D / PAT): Dividend payout suggests, what portion of PAT was paid out as dividend to the shareholders. Record keeping of “dividend payout %” will give a good insight. Good companies try to mimic their past dividend payout ratio.

Example:

The above chart is showing a trend of dividend payout ratio for TCS and HUL. What is the trend?

HUL: If HUL will follow this trend, most likely it will give 80% of its PAT as a dividend to its shareholders in times to come.

So if we can extrapolate PAT of HUL for the next 3-5 years, we will approximately know what can be a potential “dividend income” out of HUL.

TCS: If TCS will follow this trend, most likely it will give 35% of its PAT as dividends to its shareholders in the next years.

How else to earn dividends?

In India, there are only a few avenues to earn dividends: stocks and dividend mutual funds.

In Europe and America, dividend-paying exchange-traded funds (ETF’s) are also available. At the moment India does not have such ETFs.

People can buy stocks using an online trading account. These days mutual funds can also be purchased using online trading platforms.

[Read more about REITs. They can also be a good source of dividend income]

Limitations of dividend…

If dividend-paying stocks are so good, why everyone does not only buy them? Enough of only good things about dividend stocks. Here are some limitations of dividend-focused investing. I feel, being aware of these limitations will further enhance the benefits of dividend-focused investing for the investors…

- High Dividend Yield is not reliable: Dividend yield is not a sufficient indicator to identify good dividend paying stocks. Stocks paying high dividend one year, and nothing the following year, is also not good. It may happen that a stock which is yielding 8% dividend today, may yield only 0.5% in next FY.

- Dividend is high but fundamentals are weak: Few years back Strides Pharma was yielding dividend close to 33% per annum. On Mar’14 it paid dividend of Rs.505 per share. On Mar’18 it paid dividend of only Rs.2 per share. Why it happened? Because EPS of this stock fell from Rs.593 (Mar’14) to Rs.99 (Mar’18).

People who bought this stock then, for dividend yield, must be feeling disappointed today.

Moral of the story: It is important to look at dividend yield, but in conjunction with other fundamentals like sales, profit, EPS, dividend payout %, etc.

Read more about value investing here…

Final Words…

Reinvesting the earned dividends can further increase the yield. People must invest systematically to accumulate dividend stocks. Then the earned dividends from such stocks must be reinvested.

One can think it like this, ‘use the dividend income to buy more dividend stocks. Let this cycle continue for the next 10/15 years. This will be a great way of wealth generation.

It is said that Warren Buffett earns billions in dividends alone.

Set a personal target for yourselves. In the next five years, let your dividend income reach the Rs 5,000/month mark.

Handpicked Articles:

Thanks for such a simple and wonderful article. Great and thanks for your effort

Hi Mani, Great article.

I have a question though.

“March’2009

Share Price (2009): Rs.132/share.”

I checked the price chart on google and see approximately Rs. 130s

From my understanding, this price chart from google is bonus/split-adjusted.

As you mentioned there was a 1:1 bonus in 2018. Therefore, the actual price, had I been living in March 2009, would be Rs.260 right.

Therefore I cannot buy 10 shares of TCS for Rs.1320 back in March 2009.

is my understanding right?

Thank you for pointing out the error. I’ve corrected it.

Fantastically explained.

Engineers always rocks.., if possible send your links to my mail id

vin_mit@hotmail.com

Cheers

Vinayak

very well explained with good example. very much of my appreciation.

keep doing.

Thanks for posting your feedback

Best article I have read so far.

Thank You Mani Sir for the great post. I have read 20+ posts on the web but your article is really awesome.

Hi Manish,

The Data you pick for the companies seems to be standalone data. Why don’t you take consolidated data which includes its subsidiaries as well ?

Also, I am observing, the current June and Sept Quarter results are skewing Intrinsic value, health, grown projection etc everything for the companies which may not be true reflection of the company’s value. This is specially true for worst affected companies during this pandemic. Do you have some way to have option to ignore last 2 quarter result and calculate overall things ?

Idea is to analyze the core business of the company. Hence standalone data.

Intrinsic value will not be unduly skewed by quarterly data.

Thanks for your comment.

Hi Mani – Been following your site for some time, very informative. I need help on finding the top stock in your dividend stock list? I assume that we should consider Sl.no column as rank of the stock? The only problem is that the same stock has different order/Sl.no in updated list and complete list of stocks. Pls help.

Thanks for the info, it was published in 2018. Post COVID-19 scenario, can you share changes in strategy/stocks paying better dividends. Thanks.

Can you/someone name the Indian stocks which gives stock dividends instead cash dividend

How do we find out face value of a share without buying it? The dividend percentage is always relative to face value, but this figure is not provided on websites.

Use Money control website.

Face value of every stock is shown on nseindia.com

Sir I would like to know, on the app money control app dividend is specified like “dividend (%)”

2500.00

Is it in money terms?

It is expressed as % of face value of the share

Sir in which type share we should invest to get a constant dividend and if I plan

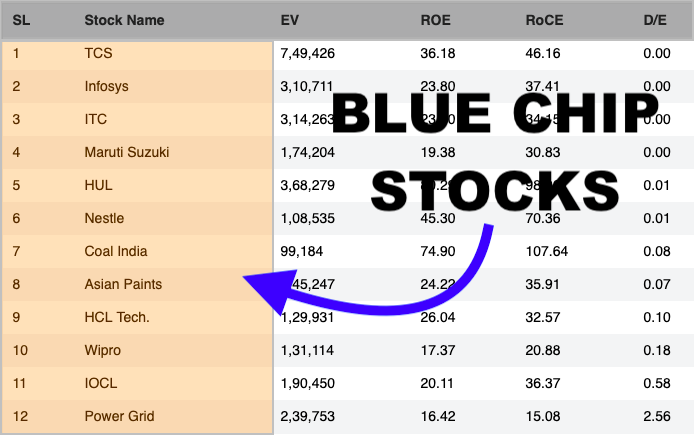

Big blue chip stocks tend to pay consistent dividends

Dear Sir,

Will the list of companies change every year?

Largely it remains the same.

Hi Mani, rarely I have seen such simple yet detailed concept briefing. What is the basis of order of the list ? is it random ?

thanks

With recent change in DDT, do you still think dividend stocks are worth investing?

as a retail investor, what are the pros and cons of buying a dividend stock especially when it comes to taxation?

Hi I would like to purchase calculators ( Bundle pack of 10). Pls provide the link an price for the same

Hey Mani,

One of the most simplest site I found that explains the funda. Only an Engineer could reengineer the words n formulas to make it easy for all.

By the way….

Kindly change the date of UPDATE in your above article…..

LIST OF TOP DIVIDEND PAYING STOCKS IN INDIA 2020

(Updated as on 29-Feb-2010)

Updated as on 2010 to 2020

Thanks….

would it be wise to buy Tcs now

Thanks for the list ,i am looking to start investing in india,is there a good brokerage.I have been doing it in US

SIR MAKE A EXCEL SHEET OF SECTOR ANALYSIS TO CHOOSE BEST STOCK FROM SECTOR

AND

Yo Mani, great article man, will surely keep a lookout on updates on your page. Man cant argue with TCS its a great company to even Dollar Cost Average. Buy it little by little and let the compounding take place.

In the 5th point maybe its wrongly written as 50,000. It should be 5000.

Hi, I’m sure it will be Rs.50K. Can you please clarity why you think it should be Rs.5K? Thanks.

Brother, i like to invest in one stock with (high dividend and spilt).Kindly advice to keep for life time.

Dividend yield in 2019 . Which stocks are paying more than 15% like NALCO ?

Sir your articles are very helpful.

Can you please write about coal India stock from a dividend stock perspective.

Hi Mani, yet another good article ! Thanks ! Just wanted to add few more pointers that may help analyse dividend paying stocks :

> Analyse the debt burden for dividend paying stocks. Ideally there should be minimal or close to zero debt. Using debt cashflows to maintain dividend payout is not uncommon.

> When it comes to PSU – check if dividend payout is unusually high – it might be possible that the government is demanding high payout for a particular year(s).

> the current asset value per share and free cash flow to Equity are good indicators of cash position of a company.

Thanks a lot for adding your insights.

BEST – VERY GOOD SITE

keep doing it bro. i love this article.

Very nice content. Easy to understand. Thanks for the list.Which companies are consistently paying dividends for the last ten years?

Hi thanks for a great article,

One thing though how important is dividend payout ratio when deciding to invest ?

Is high divided payout ratio good ? Like Coal India with 153% or would you rather invest in IOCL with low dividend payout ratio 23%

Which would be good for long term investing?

Again thanks a lot for great article.

Looking at dividend payout ratio is important. When payout ratio is like 153%, for sure it is not sustainable for long term. My thumb rule is, for a growing company dividend payout ratio is maintained at <30%. For matured companies it can he more, but <75%. Why? Because reinvestment of profit is also essential for companies.

Thanks for your question.

Sir need email subscription for ur great articles

You can subscribe us here:

http://ourwealthinsights.com/free-email-subscription/

Some problem with the email subscription link. Unable to subscribe sir can u reassess. It says invalid mail id while it is correct

Please try again. I’ve checked, it is working. Thanks.

Thanks a ton Mani, for sharing valuable information. Unable to subscribe for email.

Page not found, Error 404.

Thank you so much for sharing an Eye opener article on this subject… Appreciate your hard work and time taken to do…

Thanks for your awesome feedback.

How to calculate the dividend amount.

For example the share price of Oil India is 192 per share and its dividend yield is shown as 11.75%. That means the dividend amount will be 11.75% of 192 or what? which is 22.56 per year.

Formula is like this: Dividend Yield = Dividend per share / Price

Thank you sir….

Good analysis. Informative article. I bought TCS at the same time u mentioned n still holding it. Enjoyed dividend all these years.

Superb. 2008-09 was the great time to pocket TCS. Thanks for your comments.

I just went thro the link – first of all thanks for sharing– you have done lot of good work.

One doubt – SBI is shown to have div, yield of more than 6 %– I do not think this is correct. So I did a little analysis. I see that you have taken the ratio of average dividend recd in last 5 years to the CMP. But while taking the average dividend amount (which is shown as Rs.16.67) you have I think ignored the stock split from Rs.10.00 to Rs.1.00. Now the dividend is in single digit whereas before the split it was in double digit. So while the dividend percentage remains the same, because of the split the dividend per share reduced. You should take the impact of this in calculation of dividend yield. Please let me know whether I am correct. I think SBI’s dividend yield will be in the region of 1 to 2 %.

Tks again…but the link to list of stocks is missing

Sorry. Now the link is working….Thanks