“Forget the endless parade of bullish forecasts and “can’t lose” stock picks. If you’re serious about navigating today’s market, you need a dose of cold, hard reality. That’s exactly what Lee Munson, Chief Investment Officer at Portfolio Wealth Advisors, delivered in a recent interview. The message is clear, earnings still matter. AI needs to prove itself, and private credit is poised to disrupt the old guard.

The Multiple Illusion: Earnings are King (Again)

We’ve been conditioned to chase growth at any cost.

These days growth is fueled by seemingly endless rounds of quantitative easing and the allure of disruptive tech. But Munson throws a bucket of ice water on that strategy.

He is reminding us that valuation multiples are just a fancy way of asking, “How much are we willing to believe in this company?” When the music stops – as it inevitably does – those beliefs get tested, and earnings are the only things that can keep the party going.

“Nobody cares about valuation until you’re in a bear market,” Munson bluntly states.

It’s a sentiment that should resonate with anyone who remembers the dot-com bubble or the financial crisis. The key takeaway? Don’t get seduced by a soaring stock price if the underlying earnings aren’t keeping pace.

Focus on companies that are actually generating profits, not just promising future riches. This means doing your homework, digging into the financials, and understanding the business model. Do not just blindly following the hype.

Look for companies with demonstrable, sustainable earnings growth that justifies their valuation. Instead of aiming to identify the next big thing, aim to identify the consistently profitable thing.

Nvidia’s CUDA: A Fortress Under Threat?

The AI revolution is undeniably underway, and Nvidia has been its primary beneficiary. Its GPUs are the gold standard for machine learning, and its stock price reflects that dominance.

But Munson offers a crucial caveat: Nvidia’s strength isn’t just about its chips; it’s about its software, specifically CUDA.

CUDA is Nvidia’s proprietary software platform that allows its GPUs to work together seamlessly. It creates a powerful ecosystem for AI development. Think of it as the secret sauce that makes Nvidia’s chips so effective. “That’s what lets Nvidia chips talk to each other and make the magic,” Munson explains. “AMD doesn’t have that software; it stinks.”

However, this advantage isn’t insurmountable.

Munson raises the specter of an open-source alternative to CUDA emerging. It is potentially leveling the playing field and eroding Nvidia’s dominance. “What if something…comes up in a way to make the AMD ships talk back-and-forth with each other?”

This isn’t just a theoretical concern.

The rise of open-source AI tools and the increasing demand for more affordable AI solutions could create a fertile ground for a CUDA competitor to emerge. This means investors need to be aware of the risks to Nvidia’s seemingly unassailable position and consider diversifying their AI exposure.

Munson hints that energy companies may stand to benefit from the increased energy draw from these massive processing plants.

Private Credit

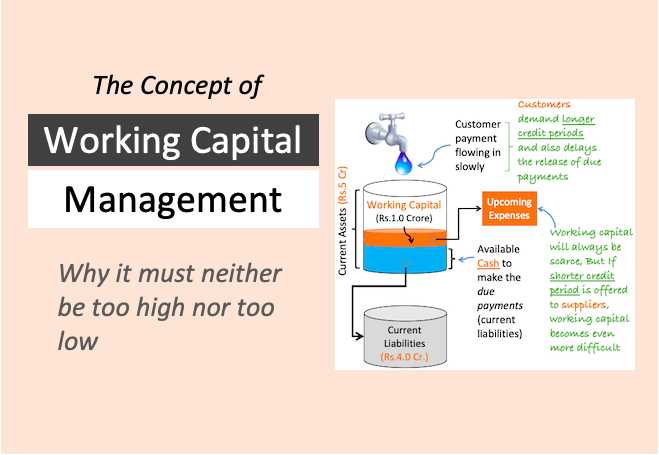

While traditional banks struggle with regulatory burdens and slow decision-making, private credit firms are stepping in to fill the void. They offering higher yields and more flexible financing options.

Munson is decidedly bullish on this trend, arguing that it represents a fundamental shift in the lending landscape.

“Private credit, not only can move faster, not only was it nothing in 2008, now is a major thing,” Munson emphasizes.

This isn’t just about speed; it’s about the ability to cater to borrowers who are willing to pay a premium for access to capital that traditional banks can’t or won’t provide.

Moreover, Wall Street is eager to capitalize on the private credit boom. This way it is creating new investment products and further fueling its growth.

“Wall Street can make a huge amount of fees off of private credit,” Munson notes. This creates a virtuous cycle, driving more capital into the space and further solidifying its position as a major force in the lending market.

Private equity is also attracting some of the best minds, thus leaving traditional banks behind.

However, Munson tempers his enthusiasm with a dose of realism.

Private credit isn’t without its risks, particularly around leverage and liquidity. But he views these risks as potential opportunities for savvy investors who are willing to do their homework and understand the underlying dynamics of the market.

The Bottom Line

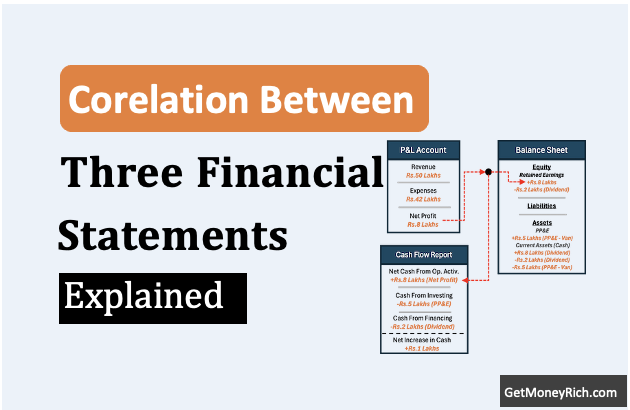

Beyond the tactical advice and market signals lies a deeper, more enduring lesson about the nature of investing itself.

Munson’s skepticism towards multiple expansion and insistence on tangible earnings aren’t just a reaction to current market conditions. They’re a timeless reminder that investing is fundamentally about owning a piece of a real business, not betting on a fleeting story.

The AI narrative, for example, has become so powerful that it’s tempting to overlook the practical challenges of deployment, the competitive landscape, and the very real possibility that the promised productivity gains might not materialize as quickly or as broadly as anticipated. Manthan’s warning about CUDA and the potential for open-source alternatives underscores the importance of thinking critically about the “moat” protecting Nvidia’s dominance. It’s not enough to simply believe in the future of AI, the potential for disruption must also be kept in mind (read about Deepseek as a disruptor).

Similarly, the rise of private credit, while presenting compelling opportunities for yield-hungry investors, demands a rigorous understanding of risk. The allure of higher returns shouldn’t blind investors to the potential for leverage and liquidity constraints to amplify losses in a downturn. The key is to approach private credit not as a simple substitute for traditional bonds but as an asset class with its own unique set of risks and rewards.

Ultimately, the most valuable takeaway from Manthan’s perspective isn’t a specific stock pick or a market forecast but a framework for thinking about investing in a more disciplined and discerning way. It’s about recognizing that every investment is a bet on a future outcome.

The odds of success are greatly improved by a deep understanding of the underlying business.

In a market increasingly driven by narratives and sentiment, Manthan’s voice serves as a valuable counterweight, reminding investors that earnings still matter. We investors should learn to balance hype with skepticism. We must never forget that we are investing to create wealth and just for the sake of buying or selling stocks.

Bottom line is, let’s start practicing value investing again.