The concept of passive income is not a popular theory among we common people. But among super rich people, passive income generation is a practice which they cannot live without.

Passive income is their secret of becoming & staying rich. It is such a powerful tool. But before we know more about passive income, let’s question an enigma of this world – poverty.

Who are Poor People?

Poor people are those who are not able to generate enough income to even manage their basic necessities of life.

Why they are poor? Because of their limitation to generate more income.

We all have this limitation. Everyone has their own limitation of income generation. But there is a way to overcome this limitation. How? By resorting to passive income.

Who are Rich People?

Rich people are ones whose passive income is high. Rich people may also work for money, but they have almost zero dependency on their income from job/work. The are financially independent.

Even if they stop doing work, their passive income will take care of all needs of life.

It is the passive income that makes a person “really rich”. Why I say really rich? Because to generate passive income, one need not work.

Yes, “no work income” is what gives the passive income an exponential growth capability. Rich people are made this way.

List of 6 Passive Income Ideas for Indians

Each idea suggested in this article will guide you towards an asset. Investing in these assets will start a stream of passive income. Though the initial yield will be low, but it will eventually increase with time.

- Rental Income: This is the best form of passive income. It can be generated from property purchase. But problem is, property purchase requires high capital investment. Nevertheless, it’s still worth it. One can buy two types of property: residential Property and commercial Property. Depending on ones affordability, one can buy any size of property. By putting this property on rent, passive income can be earned each month. Read more about property investment for beginners.

- Dividend Income: Dividend income can be generated from stocks. Dividends are as good as rental income. For me, both are equally desirable. But identifying a good dividend stock is slightly tougher. The key control point is the price of purchase. Stocks must be bought at undervalued price levels. Read more about dividend income from stocks and mutual funds.

- Interest Income: If one cannot think of anything, bank deposits can generate passive income instantly. Bank deposits can be bought from the comfort of home. This can be an excellent source of passive income. While buying FD, ask the bank to pay the interest monthly. Read more about how to value a fixed deposits.

- Royalty Income: People write ebooks and publish it on Amazon. Earlier, writing and publishing a book used to be a big task. But in this internet age, online publishing has made it easy. If you have a concept on which you can write about 10,000 words, I strongly suggest you to put those words in form of an ebook. Upon sale of every ebook the writer gets paid the royalty. Please check my eBooks here.

- Online Income: One straight way of online income generation is by building an “online real estate property”. This property can then earn ‘advertisement’ income (like rent). What is an online real estate property? Example: Website or a blog. I’m a blogger who earns online income.

- Paid Subscription: Become an expert on a topic, and start a paid subscription service. People can subscribe for your services/advice by making payment. Example: Rakesh Jhunjhunwala is an expert of stock market. Suppose he starts a paid subscription service, wherein he will publish names of couple of stock each month for investing. What do you think, how many people will subscribe to this service? Tens and thousands if not less. Read more about how to do stocks analysis.

What you have seen above are 6 forms of passive income and their potential sources.

But knowing only this is not enough. I feel, people must go deeper into the concept of passive income.

Build your own passive income source

People who are really rich, are all thinkers in their own ways. How?

Everyone can generate passive income, but the ways of doing it can differ from person to person. My way of passive income generation may not suit you and vice versa.

So what is essential to become rich is to find your own comfortable way of passive income generation. How to find one? Think, think and think. Dive deeper into your mind, the answer is hidden there.

What is the quick tip? Passive income comes from buying particular types of asset. One’s knowledge of these assets can help in fast growth of passive income (from zero to billions). Deeper will be the knowledge faster will be the growth rate.

How to Start?

Start by asking this question to yourself, “what is the alternative to my salary income“? What happens if I loose my job? How to run the family? Money will come from where?

These questions creates stress. And there are no easy answers. Why? Because only financially independent people can answer these question.

If I will have to guess, I will say that less than 1% people in this world are financially independent. Hence it means, 99% people will not be able to answer these question.

So what we can do? Start with this – “seek deeper understanding of the concept of financial independence“.

What is financial independence?

It is that stage of life where you are no more dependent on your job to manage your needs of life.

Your passive income generates enough cash, which in turn will take care of your daily expenses. You are free.

Why people do not attain financial independence?

If financial independence is all about generating an alternative source of income (like passive income), why there are only so few financially independent people?

Because they cannot get themselves out of the clutches of their job.

Most of the people have zero passive income. Means, they are completely dependent on their job for income.

Even if they start building an alternative passive income source today, it will take 20-25 years to become a ‘job replacer’. It means, anyways they will have to continue doing job for next 20-25 years.

This realisation makes the tough goal of financial independence more difficult. So what is the solution? Take a baby step.

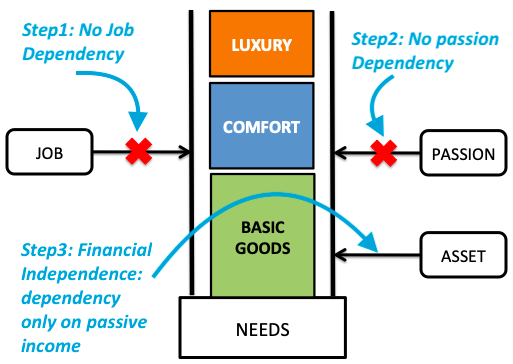

What is the baby step? Change the type of your “income dependency”.

Job dependency to passion dependency

Frankly speaking, attaining financial independence by being in job has low success probability. So if you are serious about financial independence, think about the ways to leave your job.

What is the best alternative of job?

Identify your passion, and convert this passion into a money making machine.

Once you are out of the clutches of your job, financial independence will start looking more real.

But you might ask that, why I am talking about financial independence. People who are reading this article wants to know about passive income (not financial independence).

Generating few penny’s here and there in the name of passive income will not help to improve the quality of life. But building a passive income source with the overall objective of “financial independence” has powers to transform lives for good.

Give it a try, you will be a changed person.

Why ‘passion dependency’ is better than ‘job dependency’?

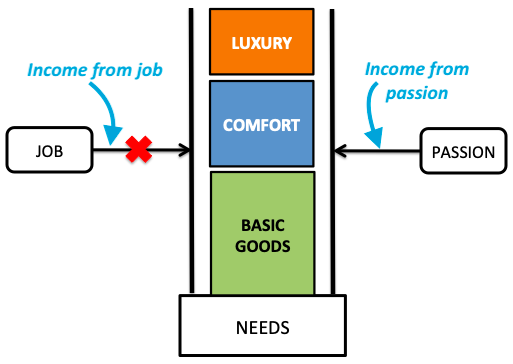

This infographic will help you understand the difference between doing a job and following a passion.

Suppose your income is say Rs.100. While in job, to generate these Rs.100, you have to do 100% effort (say).

Now suppose, you have a passion which can also generate an income of say Rs.100. To generate these Rs.100, you have put 100% effort. But it will not feel like 100%, it will feel lesser (say 20%). Why?

Because you are doing a work which you love.

What is the point? When we love our work, no matter how much effort we put-in, we will never feel the burden.

It is almost like generating income by doing nothing. This is what is passive income, right?

This is why the transition from ‘doing a job’ and ‘doing a thing we love’ is the first essential step towards financial independence.

The person is getting-used-to generating “more income by doing less work“.

Which is the next step of passion dependency?

The next and final step is financial independence. In this step the person has enough passive income yielding from assets. This income is so much that he/she requires neither to work for job nor for passion.

A person can be called truly rich if he/she has reached this final stage.

With this frame of mind, let’s try to answer a very basic question. It will further unlock our hidden inhibitions about financial independence.

What is passive income?

Income generated by applying “negligible” effort.

Income generated by not getting actively involved in any work/job, is termed as passive income. Few ideas of passive income that we have also discuss in this article are as below:

I am sure the above list of passive income ideas are not new to you. Internet is full of online contents, which can boast of even bigger list. But the bigger issue is, “how to use the list?”

I will tell you how I read this list. The way one reads this list will make a lot of difference. Out of the list of all passive income ideas in internet, segregate them into two parts:

- Part 1 (Passion).

- Part 2 (Assets).

For me, my segregation between “passion” and “asset” is like this:

- I earn money from my passion.

- Use a part of this income to buy assets.

- Assets in turn generate passive income.

One day the income generated from the accumulated assets will become big enough to ensure financial independence.

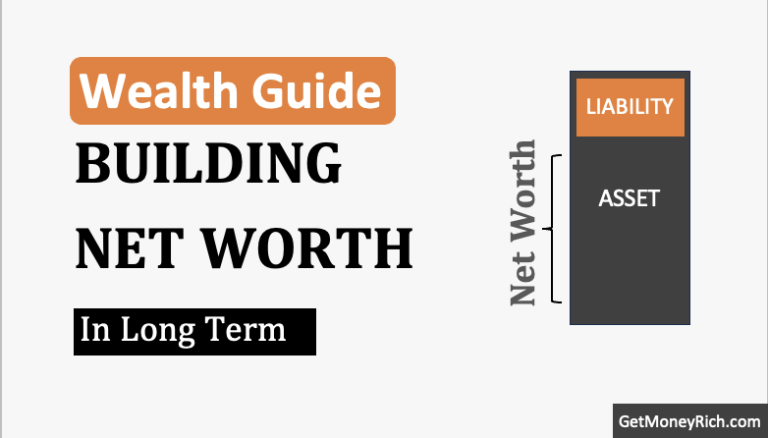

- Income from assets: It is the income from assets that is the real passive income. Passive income is very “asset intensive”. What it means by asset intensive? One must have an investment portfolio full of quality assets. What are quality assets? High and consistent income yielding assets. The more are the “quality assets” in portfolio, the better. To accumulate more quality assets, it takes time. Hence achievement of financial independence if difficult.

Asset building needs a different frame of mind…

I have written a separate blog post on how to build assets from little money. I will request you to read this blog post as well. It helps the cause of financial independence.

It is said that Warren Buffett earns billions of dollars in dividends alone. Sounds amazing, right?

Some will say that how easy is the life of Warren Buffett because he earn those billion dollars as passive income.

But some will also appreciate the other side of the story. How Warren Buffett accumulated those stocks, which today are earning him billions?

Let me tell you, asset accumulation is not easy. Not that locating an asset, or purchase of asset is difficult. The problem lies in our head. Yes.

Our psychology is not trained well to handle passive income flow. Why?

Because passive income drips only slowly.

We have a habit of handling money in a lump-sum. Example: How we earn money?

- Salary gets dumped into our savings account on a specific day.

- When we sell investment, lump sum amount gets unloaded in our bank account.

- At the end of the year, company pay us bonus. This also comes in heaps. 🙂

You can see the point? Our mind is trained to handle money in bulk. But passive income drips only slowly.

It is much harder for us to manage passive income than we can imagine.

Let me make you aware of another aspect of passive.

You have two investment alternative available in front of you:

- Stocks : Which yields 15% p.a., but holding time is 5 years.

- Bank Deposit: Which yields 7% p.a. every month.

You are more likely to choose which alternative? Majority picks stocks. Why? Because focus is more on returns than on income generation.

But when it comes to passive income, focus cannot be only on returns.

Here the priority must be on “stability of income”. This is where the problem is, “income” based investment options yield low returns.

Hence people choose to skip-it, thinking that they are a bad option. But this thought process is not correct.

What is the point?

Investment options which cater to monthly income generation are different.

People who invest in growth stocks, gold, art, futures & options etc cannot expect these investment options to generate stable monthly income.

If one wants to generate passive income, only certain types of assets can be accumulated.

But I personally think that, even if one knows about those investment options which are suitable for passive income generation, they will still not like it. Why?

Because people who like passive income, think psychologically differently.

Who likes passive income?

Passive income lovers are those people who believes in financial independence. These are people who seek early retirement from their jobs.

But before adopting passive income ideas, two points of caution:

- Passive income is not like a lottery.

- Passive income will not bring a tsunami of money in your life.

Instead, passive income will begin like a light drizzle. This slow, pleasant drizzling will continue till eternity. Unless you cut the source, passive income drizzling will not stop.

If you want more drizzles, increase the number of source-points.

To really like passive income, it is necessary to understand this aspect of it very well.

How to start earning passive income?

Start by giving oneself a target. The target can be like this:

“Generate your first passive income of Rs.1 in next 30 days”.

Yes, I am talking about Rs.1. Is it too small? But this first Rs.1 of passive income will teach you a lot about financial independence.

Generating even Rs.1 as passive income (consistently) is not easy. So even if the start is slow, do not get somber. Give yourself the breathing space.

Focus should be on the following:

- Identifying quality asset: Not all assets are good investment.

- Buying them at undervalued price: Buying assets at any available price is not good.

- Keep accumulating such assets all life: Target should be, “to only buy and never sell”.

This should be the mind-set during the starting phase. Once this is set, you will be on the course to financial independence.

You are a great professor of Finance ! You explain difficult topics in such an easy manner, even a novice can understand. Many thanks for making the mass wiser !

Thanks

Awsome article, very relevant

The article is really good and very informative for novice like me. I am thinking to generate passive income but couldn’t really think of anything. But after reading your article I am a bit confident on my options.

I am soooooo much dependent on my job which is scaring me these days as on the name of cost cutting, many employees are loosing their jobs.

So I really need to generate some passive income to sustain the coming uncertain conditions.

I have been looking for this article since long time. Thanks dear author.

The world has changed in 2020 due to global pandemic, and so are the options for passive income. Though what is mentioned here by the author is very relevant, this has to look into a new perspective. Financial insecurity is at its highest point. The economy across the globe is crashing. The new risk is now even on maintaining those assets build through passive income. Real estate is crashing so is the interest rates.

At this juncture, we at Learnersociety.com engaged with global experts to define that more than building a passive income the need of the hour is to realign the career goal and quickly develop an alternative career, that strengthens the financial stability of individuals.

Hi,

I was just searching for a ways of my financial independence and I came across this article. It was really good and the way our your example are good. I gained something from this article,

Thank you.

I just stumbled across your blog yesterday, and have been “binging” the posts in a way. There’s so much valuable information here, for free, it is unbelievable. Good job buddy, love to read about these concepts from an Indian perspective, which is very scarce online.

Thanks.

Since I have discovered the passive income my life has changed completely. Now I’m more relaxed knowing that I can put my shoulder on something else other than my main job.

your article is very useful.i read lot of articles on passive income but is more indepth informative. thank yo very much for your financil literacy.

Thank you. Appreciate your feedback.

Very nice article sir.

very useful and informative article.thanks for give such type of knowledge

Amazing .. thanks for such a beautiful article.

I am astonished that i have read this article because i never get such of knowledge from any other article. so grateful to you keep inspire us.

Thanks for your comment.

Really very informative. Thanks to you.

Read book “Rich Dad Poor Dad”

I READ MANY ARTICLES OF YOUR WHERE EVALUATION OF SHARES ARE CARRIED OUT BUT ARTICLE DOES NOT HAVE ANY DATE MENTION ON IT. IT IS DIFFICULT TO CONSIDER THE EVALUATION FURTHER. KINDLY MENTION DATE IN ARTICLE TO GET THE LATEST UPDATE ON EVALUATION OF STOCK

I can understand your concern. But due to SEO issues the dates has been removed. Thanks for understanding.

Mani, I am very Stingy when it comes to subscribing or even otherwise 😉 but after reading your couple of articles/blogs , I can say the best explanations I have ever got in my 20 yrs of IT career. Superb work! That’s called passion!!

Thanks for the awesome comment.

Very good article. I am in the progress of generating huge passive income from no of shares from stock market. Each and every tips you provide is really helpful and i know the pain of it. But still never give up is my policy. I want to generate 2 persons income as passive income. I am investing almost 75% of my income into good stocks lets see.

75% wow, that’s a lot of self control

I think online trading is a great source of earning passive income. The trick is to find the right platform for you, I would recommend using binomo. It has a user-friendly interface and it is fairly easy to use. It also has demo account, tutorial videos and a great customer support team.

Hey Mani,

I like the way you wrote this post. This is really worth reading for the one who really want to generate passive income. I have also written some good points on passive income. You can check mine. Anyways, Good Job! Keep sharing such good content. I will come again to read more articles. Thanks.

Hi Mani

that’s an informative article..good to see you planned to pursue your passion full time, that’s the way to live..

What are your next plans.. would like to know more about that

Very Useful & Inspiring Article , From last 03 years I am thinking and following this early retirement concept. It is my desire to be financial independent. Your blog add value to my thoughts & fill positive.

Converting the dream of Financial independence into reality takes time. Keep pushing in right direction, it will happen. Thanks for posting your comment.

Hi Mani, Can you suggest any good book/website on financial education for kids?

I believe for kids, it will be better to practice. Give then a token pocket money each week (like Rs.10), and ask them to save 50% of it in a piggy bank. This one act can built a solid foundation of financial intelligence in their mind.

Another super Article Mani. You really inspire the lives of many like me. I sincerely appreciate your journey and efforts to create financial literacy amongst us.

Super feedback. Means a lot. Thanks

Wouldn’t investing in treasury bills and government bonds/securities be a better option than Fixed deposits as a passive income source?

Hi, a very useful and an informative blog. Apart from the six ideas of making a passive income i have come across another one and that is called the PAMM otherwise the Fund Management Solution offered by the Forex brokers. Here experienced traders trade on behalf of you and give you a consistent monthly return. So all you have to do is just sit and watch them trade for you. It is the best way to make a passive income but the right Forex broker is the major task.

Great read. I’m straight away subscribing to your blog. Keep posting.

The post is really good, I learned a lot about passive income ideas which I did not know earlier.

How do I earn consistent income every month online or offline? Is that possible?