Emami Limited, founded in 1974, is a household name in India’s Fast Moving Consumer Goods (FMCG) sector. Known for its iconic brands like Navratna, BoroPlus, Fair and Handsome, and Zandu. The company has successfully carved a niche in personal care and healthcare products. Let’s explore the business fundamentals of Emami to understand what makes it tick and where it faces challenges.

Emami was started by R.S. Agarwal and R.S. Goenka started a modest operation in Kolkata. Since then, Emami has evolved into a multinational conglomerate. The company’s portfolio now spans over 450 products, catering to diverse segments like skincare, hair care, health supplements, and personal care.

Emami’s reach extends far beyond Indian borders. It’s products are sold in over 60 countries, including regions like the Middle East, North Africa, and Southeast Asia.

Topics:

1. Business & Financial Performance

1.1 Strong Revenue Growth

In FY24, Emami reported income of Rs.3,624.89. Interestingly, 45% of this revenue came from brands that Emami acquired over time. The company has used acquisitions strategically to expand its product range and market reach.

Emami has strategically acquired several well-known brands over the years to expand its product range and market presence. Some of these notable acquisitions include:

- Zandu Pharmaceutical (2008) – Strengthened Emami’s presence in the healthcare and wellness segment with popular products like Zandu Balm and Zandu Chyawanprash.

- Kesh King (2015) – A leading ayurvedic hair care brand, known for its hair oil, shampoo, and capsules for hair fall and growth.

- Dermicool (2022) – A popular prickly heat powder brand acquired from Reckitt Benckiser, enhancing Emami’s presence in the cooling powder segment.

- HE Deodorants (2015) – A men’s grooming and deodorant brand, adding to Emami’s offerings in the personal care category.

- Creme 21 (2019) – A German skincare brand, expanding Emami’s international footprint in the personal care market.

These acquisitions have helped Emami diversify its portfolio and strengthen its market share in niche FMCG categories.

1.2 Profit Margins and Dividend Trends

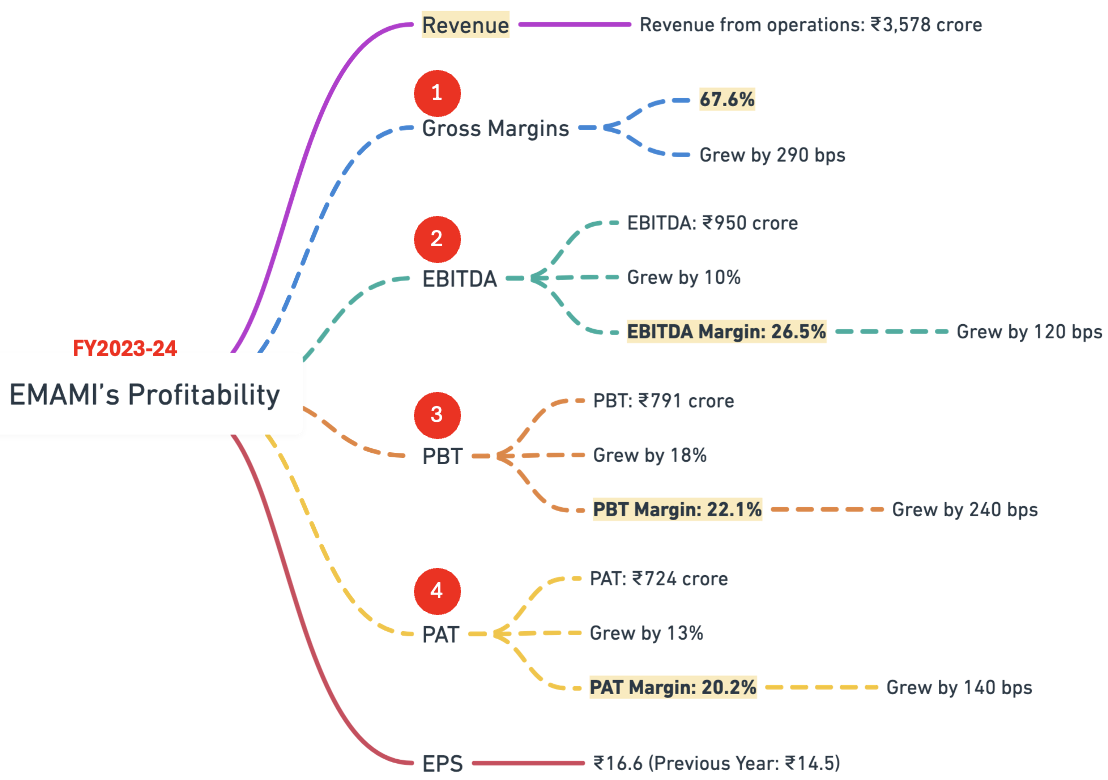

Emami’s profit margins have shown a notable improvement in FY24, reflecting efficient cost management and steady revenue growth.

- The gross margin expanded to 67.6%, marking an increase of 290 basis points (bps) over the previous year. This growth highlights the company’s ability to maintain pricing power and optimize production costs. The strong performance was driven by a combination of domestic and international sales, with international business showing a robust 12% growth in constant currency terms.

- The company’s EBITDA margin rose to 26.5%, improving by 120 bps, supported by strategic cost controls and effective marketing investments.

- Profit Before Tax (PBT) margin also grew significantly to 22.1%, up by 240 bps, indicating increased operational efficiency.

- The Profit After Tax (PAT) margin improved to 20.2%, reflecting a growth of 140 bps.

Eventually, the rise in profitability translated to an Earnings Per Share (EPS) of Rs.16.6, compared to Rs.14.5 in the previous year (14.5% up from FY2022-24). In the trailing twelve months (TTM), the reported EPS of the company is Rs.17.7, whic 22% up as compared to FY2022-24.

These consistent margin expansions demonstrate Emami’s ability to compete in the tough FMCg sector while enhancing shareholder value.

2. Market Position

2.1 Dominating Niche Segments

Emami leads in several niche categories, such as:

- Cooling Oils: Navratna dominates the cooling oil segment with a 62.8% market share and availability in 4 million outlets. Strategic campaigns, rural outreach, and digital marketing have strengthened its brand presence. Emami’s focus on innovative features, low-unit packs, and new variants like Navratna Cool Talc ensures continued market growth and penetration.

- Antiseptic Creams: BoroPlus, with a 67.7% market share in the antiseptic cream segment, reinforces Emami’s leadership in skincare. Despite market challenges, it achieved growth in emerging channels and expanded its product portfolio. Trusted by 6.6 crore households, BoroPlus drives consistent performance through innovation, affordability, and a fusion of modern science with Ayurveda.

- Balms: Zandu Balm, with a legacy of trust and effectiveness, holds a strong position in EMAMI’s pain management portfolio. It contributes significantly to EMAMI’s balm category, with a 22.5% penetration. Through continuous innovation, brand-building, and targeted activations, Zandu Balm strengthens EMAMI’s market share, driving growth and consumer loyalty..

- Male Grooming: Fair & Handsome leads India’s male grooming market with a 67.3% share in the men’s fairness cream segment. Its innovative products, strong brand promotion, and celebrity endorsements ensure relevance. With 61.6 lakh households using the cream, it strengthens Emami’s market position in the growing male skincare category..

2.2 Global Reach

Emami’s global presence is a key driver of its business resilience.

It exports to over 60 countries, including the following:

- SAARC nations,

- Middle East and North Africa (MENA),

- Southeast Asia,

- Eastern Europe, and

- CIS countries (Commonwealth).

This way, the company has strategically reduces dependency on the Indian market.

This diversified reach helps mitigate risks posed by regional economic fluctuations, regulatory changes, or market saturation.

Regions like the Middle East and North Africa provide significant demand for personal care and wellness products. Eastern Europe and Southeast Asia present opportunities for growth due to increasing consumer spending.

Emami’s strong brand portfolio, including Navratna, BoroPlus, and Zandu, caters to diverse cultural and demographic preferences, enhancing its global appeal.

3. Business Strategy

3.1 Innovation and Acquisitions

Emami’s business strategy revolves around an approach of innovation and strategic acquisitions to drive growth and maintain market leadership. This dual focus has enabled the company to consistently expand its portfolio, enter new categories, and enhance its competitive edge.

- Innovation and R&D: Emami invests heavily in Research and Development (R&D) to introduce innovative products, particularly in the natural and ayurvedic segments. It aligns with consumer preferences for wellness and traditional remedies. The company’s R&D capabilities allow it to develop new formulations and modernize existing products. For example, products like Navratna Oil and Zandu Balm have maintained relevance through continuous innovation in formats and benefits. Emami’s focus on natural ingredients and ayurvedic principles appeals to both domestic and international markets, reinforcing brand trust and loyalty.

- Strategic Acquisitions: Emami’s acquisitions play a pivotal role in diversifying its product offerings and expanding market reach.

- The purchase of Zandu Pharmaceutical in 2008 allowed Emami to strengthen its healthcare portfolio and tap into Zandu’s century-old legacy.

- Similarly, acquiring Kesh King in 2015 helped Emami enter the premium hair oil segment, addressing a new consumer base focused on hair fall solutions.

- The acquisition of Dermicool in 2022 bolstered Emami’s presence in the prickly heat powder segment, enhancing its summer product portfolio.

- These strategic acquisitions not only expand Emami’s product range but also create synergies in distribution, marketing, and R&D. It enabled the company to leverage established brands and penetrate deeper into various market segments.

By combining innovation and acquisitions, Emami ensures sustainable growth and adaptability in a dynamic market.

3.2 Marketing

Emami’s business strategy is anchored in aggressive marketing and diversification, ensuring sustainable growth, risk management, and a competitive edge in the FMCG sector and beyond.

- Aggressive Marketing Emami allocates 17-18% of its sales revenue to advertisements and promotions. This significant investment ensures robust brand visibility and consumer recall in a competitive marketplace. The company leverages multiple marketing channels, including:

- Celebrity Endorsements: Emami collaborates with well-known personalities like Amitabh Bachchan, Shah Rukh Khan, and Sonu Sood to enhance brand credibility and reach.

- Multi-Channel Campaigns: Emami uses a mix of television, digital media, print, and on-ground activations to maintain high visibility across urban and rural markets.

- Localized Promotions: Initiatives like bus branding, mela sponsorships, and sporting event promotions help Emami connect with diverse consumer groups.

- This aggressive marketing approach strengthens customer loyalty, expands market share, and sustains Emami’s leadership in categories like personal care, healthcare, and grooming.

- Diversification Beyond FMCG: To mitigate risks associated with the FMCG sector and explore new revenue opportunities, Emami Group has strategically diversified into various industries through its group companies:

- Real Estate: Emami Realty focuses on residential and commercial real estate projects, primarily in Eastern India. This sector provides long-term growth and capital appreciation.

- Paper: Emami Paper Mills is a key player in the paper and packaging board industry. It caters to the growing demand for eco-friendly packaging solutions, especially in the FMCG and e-commerce sectors.

- Biofuel: The company’s foray into renewable energy aligns with global sustainability trends. Biofuel investments support environmentally friendly energy solutions and reduce dependency on fossil fuels.

- Cement: Emami Cement, later sold to Nuvoco Vistas, demonstrated Emami’s ability to capitalize on high-demand sectors like infrastructure and construction.

This strategic diversification reduces Emami’s reliance on a single industry, spreading risk and creating multiple income streams, ensuring the group’s overall financial stability and resilience during market fluctuations.

4. Strengths and Weaknesses

Emami’s business success is shaped by a combination of its key strengths and strategic challenges. Acknowledging these factors helps in understanding the company’s market positioning and growth potential.

4.1 Strengths

- Strong Brand Equity: Emami has cultivated a reputation for trust and quality, particularly through its focus on natural and ayurvedic formulations. Brands like Zandu Balm, BoroPlus, Fair & Handsome, and Navratna are household names, reflecting deep consumer loyalty. Decades of delivering effective products have reinforced Emami’s credibility in the personal care and healthcare sectors.

- Extensive Distribution Network: Emami’s products are available in over 4.5 million retail outlets across India, including urban, semi-urban, and rural markets. The company also exports to 60+ countries, covering regions such as SAARC, MENA, Southeast Asia, Eastern Europe, and the CIS. This robust distribution network ensures easy access to Emami’s products, supporting consistent sales and market penetration.

- Effective Leadership: Emami’s growth has been driven by the visionary leadership of its founders, R.S. Agarwal and R.S. Goenka. Their strategic focus on innovation, professional management, and market expansion has propelled the company forward. A blend of family leadership and professional expertise ensures agility and sustainability in decision-making.

4.2 Weaknesses

- Rural Dependence: A significant portion of Emami’s revenue is derived from rural markets. While this ensures reach in India’s vast hinterlands, it makes the company vulnerable to rural economic fluctuations, such as poor monsoons, inflation, and reduced disposable income. Dependence on rural consumers can impact growth during periods of rural distress.

- Intense Competition: Emami operates in a highly competitive landscape, facing challenges from industry giants like Hindustan Unilever (HUL), Dabur, Patanjali, and numerous local and regional players. These competitors often have greater financial resources and larger product portfolios. Maintaining market share and customer loyalty in such a competitive environment requires continuous innovation and aggressive marketing efforts.

By leveraging its strengths and addressing its weaknesses, Emami aims to maintain its leadership position while navigating industry challenges effectively.

5. Peer Comparison

Emami operates in a competitive FMCG market alongside major players like Hindustan Unilever (HUL), Godrej Consumer Products, Dabur, and Marico.

Despite being smaller in market capitalization (Rs.26,415.61 crore), Emami maintains a strong position due to its niche offerings in ayurvedic and natural products.

Emami’s revenue of Rs.3,624.89 crore is significantly lower compared to HUL (Rs.62,707 crore), Godrej Consumer (Rs.8,867.36 crore), Dabur (Rs.12,886.42 crore), and Marico (Rs.9,795 crore). However, Emami’s PAT (Profit After Tax) of Rs.727.86 crore highlights efficient operations, with a TTM P/E ratio of 34.16, making it more attractively valued than HUL (53.64) and Godrej Consumer (213.05).

Emami’s Return on Equity (ROE) of 31.81% outshines most competitors, reflecting strong profitability and effective use of capital. Only Marico has a higher ROE of 43.14%.

Additionally, Emami’s Overall Score of 72.12% surpasses all peers, indicating a well-rounded performance despite its smaller size.

While Emami faces intense competition from these giants, its focus on ayurvedic, personal care, and healthcare products, along with aggressive marketing and strategic acquisitions, positions it for sustainable growth and profitability.

5.1 Price Valuation Perspective on Emami

When analyzing Emami’s price valuation relative to its peers, key metrics like Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios offer valuable insights. Emami’s P/E ratio stands at 34.16, which is notably lower than Hindustan Unilever (53.64), Dabur (50.24), Marico (50.47), and Godrej Consumer Products (213.05).

This lower P/E suggests that Emami’s stock is trading at a more reasonable valuation compared to its peers. This makes it relatively attractive for investors seeking value opportunities.

Additionally, Emami’s Price-to-Book (P/B) ratio is 10.8, which is competitive compared to Hindustan Unilever (10.76) and Dabur (9.1) but significantly lower than Marico (21.51) and Godrej Consumer Products (11.89).

This indicates that Emami’s market valuation is balanced relative to its book value, suggesting a fair valuation given its return on equity (ROE) of 31.81%—the second-highest after Marico (43.14%).

The combination of a moderate P/E, reasonable P/B, and strong ROE implies that Emami is priced attractively, considering its profitability and growth potential.

A purely speculative guess, not a recommendation: For long-term investors, the above numbers indicates a potential for capital appreciation. If Emami continues to grow its revenue, expand its market reach, and maintain efficient operations, its future looks bright.

Conclusion

Emami stands out as a resilient player in the FMCG sector. It has achieved this status by leveraging its focus on ayurvedic and natural products to carve out a unique identity.

Its ability to consistently innovate while expanding its product portfolio has allowed the company to cater to both traditional and modern consumer needs. The combination of strong brand loyalty, an extensive distribution network, and a growing global presence. These factors reinforces Emami’s ability to mitigate market-specific risks and pursue diversified revenue streams.

The company’s emphasis on acquisitions has strengthened its position in niche segments like pain relief, male grooming, and antiseptic care. This strategy has not only diversified its product offerings but also reduced dependence on any single category.

Emami’s aggressive marketing efforts, including both digital and traditional channels, ensure the brand remains relevant in an increasingly competitive landscape.

However, Emami faces challenges that need attention. While its rural market penetration is commendable, balancing urban growth is essential for long-term stability. Additionally, navigating competition from larger players like HUL and Dabur requires sustained investment in innovation and customer engagement.

- For long-term investors, Emami’s strengths in brand equity, profitability, and strategic diversification provide a promising outlook. If the company maintains its growth trajectory, optimizes urban market potential, and continues leveraging natural and ayurvedic trends, it could deliver consistent value and wealth creation over time (not a recommendation).

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.