Engineers India ltd is a Government of India Enterprise. Its main business is “Engineering Consultancy” and EPC (Turnkey Projects) services.

Engineers India Ltd (EIL) comes under the Ministry of Petroleum and Natural Gas. The consultancy and EPS services rendered by EIL caters mainly to Oil and Gas and Petrochemical sector.

The revenue break-up of Engineers India between its ‘Engineering Consultancy’ services and ‘EPC services’ are as below:

- Engineering Consultancy: 53.2%

- EPC Services: 43.8%

Few key customers of EIL which engages in keeping its new order book sufficiently loaded are BPCL, HPCL, IOCL, GAIL etc.

It will not be wrong to state that EIL almost has monopoly business in execution of public sector projects of Oil & Gas, and Petrochemical sector.

FUTURE GROWTH PROJECTIONS

The future growth projections of Engineers India Ltd for next two FY’s are good. As the company is mainly dependent of government spendings, it next quarter may also be weak. Till May’2019, due to Lok Sabha Elections, the government spending is expected to be low. But from second quarter of FY’19, the spending will pick-up.

EIL’s Growth projections for next 2 years are like this:

| Business Fundamentals | FY19E | FY20E |

| Revenue | 40% | 11% |

| PAT | 25% | 20% |

| EPS | 26% | 15% |

PROS & CONS OF EIL’S BUSINESS

Cons: The order booking of EIL is sluggish since last 3 quarters. This is mainly due to the upcoming Lok Sabha elections. Among the two lines of business of EIL, turnkey EPC projects can fetch a max of 5.9% EBIT Margins. This is in sharp contract to the high EBIT Margins (27.9%) of the consultancy services. In recent times, the trend towards EPC contracts are increasing.

Pros: EIL almost has a monopoly business in its segment. Most of orders from public sectors enterprises like HPCL, BPCL, GAIL etc falls almost by default in EIL’s order books. Future expansion of public sector business in petrochemical, and oil & gas sector is inevitable. EIL is bound to benefit in long term.

RECOS

Last year in 2018, Kotak Securities and ICICIdirect has issued a BUY/HOLD rating for EIL.

In Aug’18, when EIL’s price was @Rs.127, ICICIdirect issued a HOLD advice.

In Oct’18, when EIL’s price was @Rs.117, Kotak Securities issued a BUY advice.

| Date | Company | Broker | Reco | Buy Price | Target Price | Hold | |

| 10-Aug-18 | Engg India Ltd | ICICIdirect | HOLD | 127 | 135 | Report | 12 Months |

| 16-Oct-18 | Engg India Ltd | Kotak Securities | BUY | 117 | 155 | Report | 12 Months |

Stock Analysis

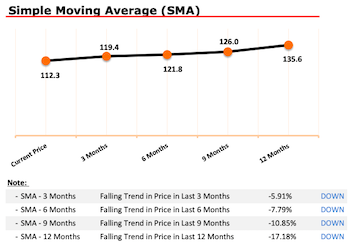

The current price of Engineers India Ltd (EIL)’s stock is trading at Rs.112 levels. This is below the price at which the Recos reports has been issued by the following companies:

- ICICIdirect: Hold @Rs.127.

- Kotak Securities: BUY @Rs.117

Hence I thought to double check the fundamentals of EIL using my stock analysis worksheet.

The result of my study can be accessed from here…click here (pdf copy).

I provide you few key insights from my report…

#1. Quality…

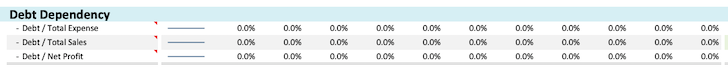

EIL has remained debt free in last 10 years. It has zero dependency on debt to finance its total expenses. This is phenomenal considering that 43.8% of the business of EIL is coming from EPS (Turnkey Project) services.

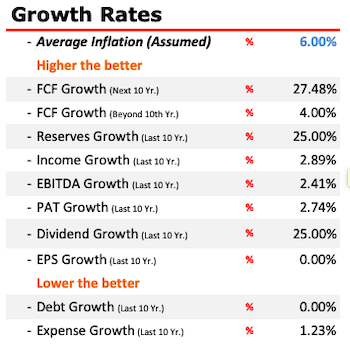

In last 10 years, the growth trend of EIL is only mute. This can be mainly because it is a public sector undertaking, which mainly execute projects for government companies.

But the subdued growth in Profits & EPS has been well balanced by reasonable growth in Net Worth, Dividend Payout and FCF etc.

#2. Price Valuation…

As per Discounted Cash Flow Model, the estimated intrinsic value of EIL is Rs.128-130. My stock analysis worksheet considers hosts of other valuation methods as well. Hence the estimated intrinsic value of EIL comes out as Rs.98.2.

Though the current price level of EIL is above the Rs.98 levels, but I still think that EIL is trading at good buy levels. In last 12 months, the share price of EIL has been consistently falling from Rs.135 levels. This has brought its price very close to its fair value.

Overall Score…

I personally think that EIL’s shares, at its current price levels should be a good buy. A holding period of next 18-24 months should give a reasonable exit point.

The overall score of Engineers India Ltd is very good. My stock analysis worksheet is giving a 94%+ rating for EIL. Generally a 85%+ rating is good enough.

Though I will not instantly buy EIL stocks now because I foresee a further price correction in next 4-6 weeks time. For the moment, I am adding EIL in my most preferred watch list.

![How To Build A Winning Stock Portfolio [India]](https://ourwealthinsights.com/wp-content/uploads/2010/06/Stock-Portfolio-Image.png)

Great article clarified in a definite and straightforward ways

Is this analysis still valid?

sir im vijay arora senior citizen 69 year old sir mere paas 3 lakh rpower 4 rs m buy h pls advice me .ager aap ki koi fees h to muje mere fone k watsup m beta do i pay u or muje ager rpower sell kerna ho to or kon sa stock buy keru mob 8104242754 navi mumbai

Dear sir,

At the outset of this letter I would like to congratulate on your magnanimous mind for sharing riches with others.most of them may be expert stock analysis but have narrow mind with the intention of keeping it secret.

But I am glad to see your broader mind to give guidance to others who fumble in the stock market .really your message is informative and helpful to investors similar to my case who find difficult to find out the right stock.i wish you all success in your endeavour of helping investors to get the valuable stock.

Yes i agree

good article explained in a detailed and simple ways will follow more of yours thanks a lot mr mani

Thanks for your comment.