The purpose of this blog is to highlight the importance of starting equity investments early in life. If one can start equity investing in the 20s, there are phenomenal benefits. The biggest benefit is in the form of a high risk-free return on investment. Starting early means, one can stay invested for a very long period. In turn, it allows one to negate short-term volatility and earn higher returns.

Introduction

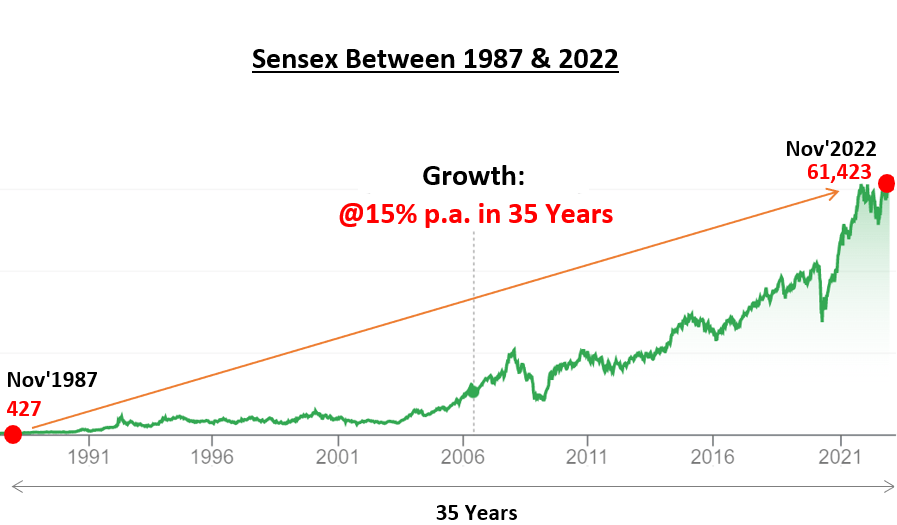

This Sensex chart, shows the index growing from 427 points to 61,423 in 35 years. In annualized terms, it is a growth rate of 15% per annum. When it comes to equity, index investing is considered the safest. It is especially true when the investment horizon is longer. How safe? Let me show you some data.

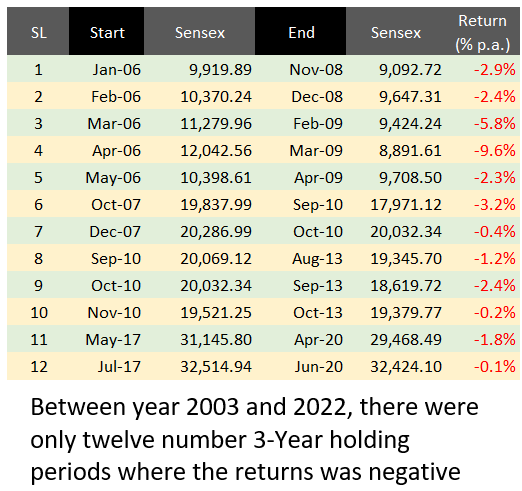

This analysis is between the years 2003 and 2022.

Example#1: Investment Horizon 3-Years

Suppose a person invests in Sensex through an index fund in January’2006. At that time the Sensex was at 9,919 points. Henceforth, the person goes on to hold the units for the next three years (till Nov 2008). In Nov’2008, the Sensex was trading at 9,092 points. On Nov’2008, the investment would have shown a negative return of -2.9% per annum.

Similarly, investing in Sensex in February’2006 and holding the units till Dec’2008, for the next 3 years, would have yielded a return of -2.4% per annum.

Between the years 2003 and Nov-2022, there are 239 number months. Out of all these months, only twelve (12) number months displayed negative returns when the holding time was 3 years. It means, there was about a 5% probability of Sensex yielding negative returns if the holding time was 3 years.

Do you know the reason for these negative returns?

- 2006/07 and 2008/09: Stock market crash. In 2008-09, the world saw one of its worst crashes due to the subprime mortgage crisis. Hence all investments in 2006/07 with a holding time of 3 years showed negative returns. Had the stock market not crashed, these returns would have been positive.

- 2017 and 2020: The stock market crashed in 2020 due to COVID-19. The Sensex crashed from 41,000 to 28,000 between Jan’2020 and Apr’2020. This was one of the steepest index declines in history. Had the market not crashed, their 3-Year period returns would have been positive.

Example#2: Investment Horizon 5-Years

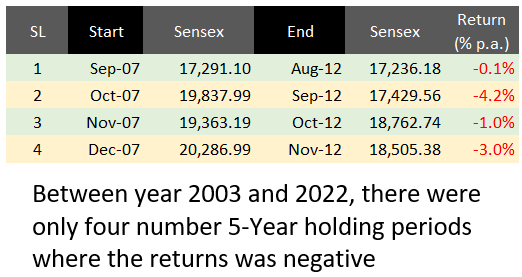

Suppose a person invests in Sensex through an index fund in Sep’2007. At that time the Sensex was at 17,291 points. Henceforth, the person goes on to hold the units for the next five years, till Aug’2012. In Aug’2012, the Sensex was trading at 17,236 points. As of Aug’2012, the investment would have shown a negative return of -0.1% per annum.

Similarly, investing in Sensex in Oct’2007 and holding the units till Sep’2012, for the next 5 years, would have yielded a return of -4.2% per annum.

Between the years 2003 and Nov-2022, there are 239 number months. Out of all these months, only four (4) number months displayed negative returns when the holding time was 5 years. It means, there was about a 1.68% probability of Sensex yielding negative returns if the holding time was 5 years.

In fact, when the time horizon is above ten years, there is less than a 1% probability that the returns will be negative. It also proves that, when the time horizon is longer than 10 years, the chances of making a 10% plus return is more than 99%.

These two examples prove that when the investment horizon is longer, index investing is safer. If people can start equity investing in their 20s and can stay invested for long periods, the chances of above-average returns are very high.

Fact: Between the years 1987 and 2022, 35 years, Sensex yielded a return of 15.1% per annum. Between the years 1999 and 2022, 23.9 years, Nifty50 yielded a return of 13.45% per annum.

Video

Investment Calculator

| Lumpsum Investment (Rs.) | |

| Monthly Contributions (Rs.) | |

| Rate of Return (% p.a.) | |

| Investment Horizon (Years) |

| Final Lumpsum Amount (Rs.Lakhs) | |

| Fianl SIP Amount (Rs.Lakhs) | |

| Total Amount (Rs.Lakhs) |

We saw that if the investment horizon is very long, like 20 to 30 years, earning a return of 13-15% per annum comes almost risk-free. Index investing can give this kind of risk-free return. Though equity is risky, by extending the holding periods we can make it almost risk-free. Who can afford such longer holding times? People who started equity investing in the 20s.

In a growing economy like India, expecting 13% to 15% per annum returns from an index will not be out of place.

In this segment, we will try to understand how these return numbers of 13 to 15% can benefit our investments.

Lumpsum Investment

There was a young man of age 25 years. He received Rs.75,000 as a gift from his parents to buy a smartphone. But he decided to use this money wisely. He bought an Index ETF and held on to it for the next 35 years, till he was 60 years of age. In this period, 35 years, the Index grew at a speed of 15% per annum. The final appreciated amount of his investment at the end of the period will be Rupees one crore.

Use the above calculator to check the maths.

Monthly Investments

There was a young man of age 25 years. He got his first job and he decided to invest Rs.1,000 per month in an index mutual fund. He kept on investing it for the next 35 years, till he was 60 years of age. In this period, 35 years, the Index grew at a speed of 15% per annum. The final appreciated amount of his investment at the end of the period will be Rupees 1.48 Crores.

Use the above calculator to do your own calculations.

Other Options in Equity Investing

Till now we’ve discussed investment in equity from the perspective of index investing.

But for people who would like to explore more, there are other investment options in equity suitable for beginners. Here are the most common three:

- Stocks: Equity investing started with people buying stocks of listed companies. Young people can invest in stocks but with caution. One must first learn to analyze stocks. The objective should be to buy stocks of strong companies at the right price. The idea shall be to first avoid weak stocks. Second, one must buy stocks that are undervalued. If one can master these two steps, direct investing in stocks can be practiced. Else, check the other two options. In most cases, a beginner in their 20s shall start with an index, and then gradually shift to stocks.

- Mutual Funds: For a person in their 20s, whose investment horizon is very long, starting to invest in a multi-cap fund will be a fair choice. But one must avoid lumpsum investing. Investing gradually through the SIP route will be better.

- Exchange Traded Funds (ETFs): This is an investment option that combines the benefits of both mutual funds and stocks. ETFs can be purchased from the stock market just like stocks. But like a mutual fund, ETFs also have a composite portfolio. It includes a basket of stocks. In an index ETF, quality blue chip stocks are included.

Starting equity investing in the 20s has phenomenal benefits. Staying invested for a long in good stocks or mutual funds can give market-beating returns. In short term, there will be volatility, but in larger time horizons, the trend will be upward. Check the Sensex chart shown above.

My Personal Preference

I think a beginner should start with index investing. Start with a small monthly SIP in an Index fund. Continue investing in it for the next 12 months. At this time, do not invest elsewhere. Just observe the Sensex, Nifty50, and S&P BSE100 indices. If possible, build a watch list and track all Nifty-50 stocks. The purpose should be to build a feeling about different moves in the market.

After the first year of observation is complete, take the second step. It will have two sub-steps. Start and new SIP in a multi-cap fund. As you’ve already observed the market for the last 12 months, make sure that the market is not at its peak. Start when the index is 5-6% below its previous all-time high. Simultaneously, the person can also invest, a lumpsum amount of say Rs.5000, in an index-based Exchange Traded Fund.

At this stage, the person will have three investments, SIP in an index fund, SIP in a multi-cap fund, and a lumpsum investment in an Index ETF.

Again, at this stage, do not invest elsewhere. Just observe your investment portfolio and stocks of Nifty 50. Continue observing for the next 12 months.

During this period, you can also build your equity know-how. Read about the stock basics and fundamental analysis of stocks.

A Diversified Portfolio

Experts would not advise limiting the portfolio composition to equity alone. Ideally, it should be a clever mix of equity, debt, gold, and real estate. Young investors should not ignore investment diversification while building an investment portfolio.

As a rule of thumb, people in their 20s, who are investing with a long-term focus, can keep their portfolio composition as follows:

- Equity (60%): The inclusion of equity will ensure above-average returns. If the investment horizon is 30-35 years, earning a 15% per annum return is possible. One can include index funds, multi-cap funds, and index ETFs in the portfolio. If the person can follow the principles of defensive investing, stocks can also be included.

- Gold (10%): Gold shall be considered more as a savings option. In a longer time horizon, its returns will be to the tune of 7-8% per annum. Gold ETFs will be easier to manage (buy and sell). But if one wants, physical gold or silver (bullion) can be purchased and put in bank lockers.

- Debt (20%): Debt shall be included to give stability to one’s investment portfolio. Equity will remain volatile in shorter time horizons. The presence of debt will lower the portfolio’s beta. Debt mutual funds can be a good inclusion. Else, one can also park money in bank FDs or in savings accounts

- REITs (10%): Investing in REITs will enable easy inclusion of real estate in the portfolio. As the physical purchase of a real estate asset is capital intensive, REITs become a great alternative.

Even a diversified portfolio has the risk of loss. Why? Because of the presence of equity. In short term, there will be some downward movements resulting in the portfolio going into the red. But people who’ve started equity investing in their 20s should not bother about it.

Conclusion

Equity investing in the 20s is a great starting point for long-term investors. Why? Because such young people can take maximum advantage of the power of compounding. An example of the power of compounding was explained above in an example. Investing just Rs.1,000 per month in an index fund for 35 years can build a corpus of Rs.1.4 crores.

Only people in their 20s have the ability to continue investing for longer periods like 30-35 years. Hence, they must take full benefit of it by investing in equity. It is risky, but when the time horizon is so long, even equity investing can be made risk-free. How? By opting to invest in an index fund or index ETF.

If one wants to earn better returns, multi-cap mutual funds or stocks can also be considered. But in dealing with stocks, the investor must ensure that they are investing in only fundamentally strong companies. Moreover, buying these stocks at an undervalued price level will ensure even higher gains. No matter if it is multi-cap funds, stocks, or indices, staying invested for longer periods will be a priority. Otherwise, equity becomes risky and chances of losses can increase dramatically.