Who will buy ETF in India? These are mainly those investors who want to buy stocks, but lacks the expertise. Who are these people? These are people who do not know how to screen and analyze stocks.

[Check a list of top rated ETFs at the bottom of this post]

Why screening and stock analysis is necessary? Because this helps people to prevent self from buying bad stocks. Read more about those stocks which value investors avoid.

How ETF is suitable for such people? People who are not prepared to buy stocks directly, should invest in them indirectly.

How to buy stocks indirectly? Through equity based mutual funds. Read more about mutual funds here.

Indirect Investing in Equity

How indirect investing in stocks, through mutual funds (or ETFs) help? This way the investor need not decide which stocks to buy, and when to sell. Means, the step of stock analysis can be totally avoided by the investor. This part is taken care by the mutual fund manager.

Investors just need to contribute their money, the fund manager will do the rest. The fund manager will invest the pooled money (wisely), with the objective of good-future-returns. Read more about how to start investing in equity.

Limitation of Mutual Fund

There is a limitation of mutual funds as compared to stocks. While dealing with stocks (or ETFs), one gets an advantage of ‘real time pricing‘.

What is it? Market price of ETF’s change in real time (like stocks). What is the benefit of real time pricing?

If prices change in real time, one can ‘do trading‘ in such securities. Example, one can buy shares in the morning at say Rs.100 per share and sell it at Rs.105 by (say) 3:00 in the afternoon. This is called day trading.

This flexibility of buying/selling at ones will, makes securities like stocks and ETFs a unique investment vehicle. But mutual funds does not have this advantage.

Market price of mutual funds (NAV) changes only once in a day. But ETF and stocks enjoy the advantage of ‘real time pricing’. Read more about why stock price fluctuate.

1. ETF and ‘Real Time Pricing’

Real time pricing is what makes ETF different from mutual funds. ETF’s are exactly like mutual funds, but its market price remains volatile just like stocks. Yes, ETF’s price can fluctuate throughout the trading session, like stocks. Read more about how to buy stock online.

ETF’s pricing is just like stocks. There are

2. What are Exchange Traded Funds (ETF’s)?

ETF’s are basically index mutual funds, whose shares can be traded in secondary market (Stock Market) like shares of companies (day trading is also possible).

Like index funds, ETF’s also simply mimics their underlying index. How they do it? ETF’s buy all securities in the “same proportion” as that of its underlying index.

What means by underlying index? Nifty 50 can be one underlying index. Nifty 50 index has 50 nos stocks as its constituents. Not all 50 stocks has same weightage in the index.

Example, in Nifty 50 index the weightage of its top 10 stocks (as on 30-Apr’19) is as shown below:

| SL | Name of Stock | Weightage |

| 1 | HDFC Bank | 10.53% |

| 2 | RIL | 10.07% |

| 3 | HDFC | 6.95% |

| 4 | Infosys | 6.03% |

| 5 | ICICI Bank | 5.55% |

| 6 | ITC Ltd. | 5.46% |

| 7 | TCS | 5.01% |

| 8 | Kotak Mahindra Bank | 3.91% |

| 9 | L&T | 3.51% |

| 10 | Axis Bank | 3.16% |

| – | Total | 60.18% |

Check weightage of all stocks in Nifty50 and Sensex.

To mimic Nifty 50 Index, the ETF portfolio must be composed of all 50 stocks in the same weightage (proportion). The weightage of top 10 stocks of Nifty 50 Index is shown above.

Index mutual funds also builds their portfolio like this, but units of mutual funds are not traded live in stock market. But shares of ETF’s are traded live. Read more about how stocks are given weightage in Index.

3. Passive Investing and ETFs

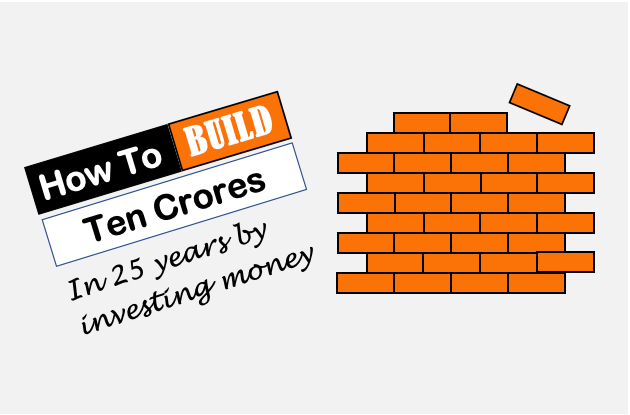

Building right frame of mind for investing is critical. What is the right frame of mind? Practicing passive investing. What is passive investing? No active involvement. Just buy an investment, and forget about it.

ETF in India is one good example of passive investing. Below are the characteristics of ETFs which makes it suitable for passive investing.

- No Active Management: The best part of ETF is, there is no active fund manager who is taking decisions on which stocks to buy and sell. How this is a best part? Because here the decision maker is one who is in some ways wiser than the traditional ‘fund managers’. Who is the decision maker? The decision maker is Mr. Market.

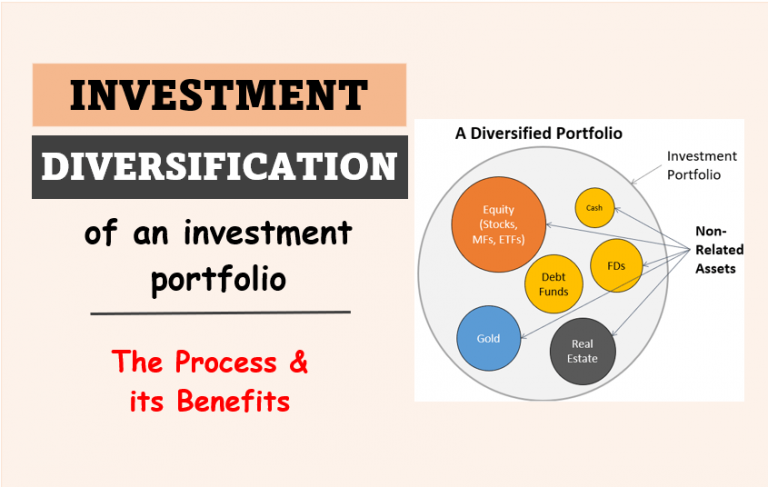

- Less Risky than Stocks: Chances of a loss when one is investing in a single stocks is high. But as portfolio of ETF consists of several stocks, hence it gives the advantage of diversification. Hence ETF are less risky than direct stocks. Read more about diversification.

- Buy Best Stocks at low cost: Suppose you want to buy best blue chip stocks. Do you know what is the best way to do it? Buy a Nifty or Sensex based index fund or an ETF. Another example, if you want to buy stocks of best banks, buy a Bank ETF. Read more about blue chip stocks.

- Very Long Term Holding: There is risk involved when a person is holding stocks for very long term. Why? Because the business fundamentals of individual stocks may go down with time. But business fundamentals of an index (say Bank Nifty), will remain intact always. How? Because index necessarily includes only the best stocks. Read more about how long should be long term.

- Low Cost: As there is no active fund management involved, ETFs are most cost effective for investors (even compared to index funds).

4. How to select a good ETF in India?

So now we know that what are ETF’s and its advantages over traditional stocks and mutual funds. But how to pick a good ETF? Which are the parameters one must look in a mutual fund before buying its shares?

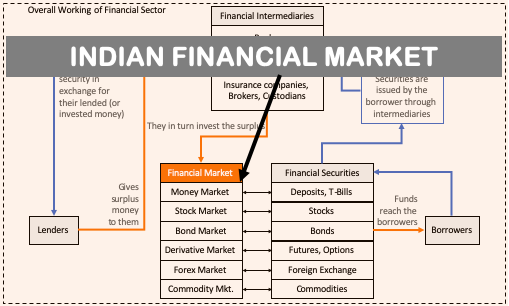

- Preferred Benchmark: There are mainly 4 types of ETFs available in India. Equity based, debt based, gold and world indices based. Inside equity based ETFs we have ETFs which track main indices, banks, mid cap stocks, infrastructure stocks etc. So before one buys an ETF, he/she must select the preferred theme. We will know more about types of ETFs below. Read more about types of mutual funds.

- High Trading Volume: Investors must take care to buy an ETF whose trading volume is high. Why? Because for traders, low trading volume will result in higher bid-ask spread, leading to more cost of investment. Example: trading volume of ‘ICICI Pru Nifty ETF’ as on 7-May’19 was Rs.164 Lakhs. Similarly, trading volume of ‘MOSt Shares M50 ETF’ as on 7-May’19 was just Rs.1.45 Lakhs. So what do you think, which ETF will be better? ICICI Pru will be better. Read more about how low trading volumes of ETF is not a problem for common men.

- Low Tracking Error: Suppose there is an ETF which tracks Nifty 50 index. In last 1 year, Nifty has appreciated by 11.11%. In the same period, the ETF has appreciated by only 10.99%. The difference between returns generated by ETF and Nifty’s appreciation is called tracking error. Investor must pick the ETF with minimum tracking error.

- Low Expense Ratio: As ETF’s track an index, hence they are not actively managed. This substantially brings down their expense ratio. A typical Nifty 50 ETF will have an expense ratio as low as 0.55%. But ICICI Pru Nifty ETF has declared its expense ratio as 0.05% as on 31-mar’19. Read more about expense ratio of mutual funds.

5. Types of ETF’s in India

[Note: Approximate size of ETF market in India is shown in terms of Total Asset Under Management (AUM).]

Out of all the ETFs which operate in India, it can be classified into the following 3 broad categories (and sub-categories):

- EQUITY

- Index.

- Bank.

- Midcap.

- Infrastructure.

- Dividend Based.

- World Indices (like NASDAQ 100 & HangSeng)

- DEBT

- Money Market,

- Gold.

There are close to 65+ number ETF in India. The total asset size (AUM) of all these ETFs is close to Rs.69,000 Crores. Compare this with Mutual Funds, and you will know why I say that ETF in India has not evolved as much. AUM of all equity based mutual funds in India is approx Rs.12 lakhs Crore. Read more about mutual funds.

6. Limitations of ETFs in India…

Why ETFs are more popular in USA than in India? As a matter of fact, in all developing economies, ETFs are not as popular. What is the reason?

- Average Returns: When a financial product tracks an index it means, its price can rise or fall only as much as the index rise or fall. It means, ETFs can yield only average returns (as offered by the indices). Read more about how to measure investment returns.

- Beating Market in India is easy: In developed economies like USA, companies which trade in stock exchange have already become global giants. Growth prospects of such companies are low. Moreover, the economy of these countries are also not as buoyant as that of developing countries. So there are two factors in India: (a) Economy itself is growing fast, (b) Companies are relatively smaller and hence have bigger growth prospects. In such a scenario, fund managers have more chance of beating the market. But in developed market, even best fund managers find it hard to beat the market in long term. Read more about index funds vs actively managed funds.

7. Comparison Between Index Funds, ETF’s, and Stocks

Why an investor should care to know about the difference between index funds, ETF and stocks? Because it will help one to pick the best alternative.

So which is the best alternative between these three options? Allow me to explain it in following four heads:

- Novice but passionate about stocks: This is that investor who is so passionate about trading stocks that, for him/her nothing else works. But the person lacks the expertise of stock analysis. This type of investor can go with Index ETFs. Read more about risk free investing to earn high returns.

- Interested in equity (but can do only passively): Who are these investors? These are people who are busy. They cannot actively manage their investment portfolio. They neither have time to learn stock analysis. But they would like to take advantage of equity investing (in terms of high returns). This type of investor can go with index funds. Read more about passive income ideas.

- Knows Stock Analysis: Who are these people? These are people who have figured out how to analyze stocks. Hence they have a knack to pick stocks. Such type of investors should go with direct stock investing. People who know how to handle stocks, can generate much higher returns than ETFs and Index Funds. Read about a MS EXCEL based stock analysis tool.

- Cost Sensitive Investor: You can see the above table. Index funds are the most cost effective investment option among ETFs and stocks. In long term, lower cost of index funds can ensure higher returns than ETF. Both ETF and Index Funds track an index. Hence they can yield only averaged returns. But as index funds has a lower cost, it will generate better returns than ETF in long term.

List of Best ETF in India

One of the best resources to get a reliable info about ETFs in India is a website managed by BSEINDIA and MORNINGSTAR.

I have used the above tool to prepared a list of few ETFs based on the following five (5) screening criterias:

- Good Morningstar Rating.

- High 3Y Return.

- High Trading Volume.

- Low Tracking Error.

- Low Total Expense Ratio (TER).

Handpicked Articles:

Tata Motors (416) b/w 407-416 sl 401 Tgt 440. Tata Motors looking strong after a long time

Hi sir i had one question in mind do ETF and index funds gave the benifit of devidend and stock split or bonus shares?

ETF – Dividend is credited into the bank account of the investor. The effect of the stock split/bonus will reflect in the ETF’s market price over time.

Index Funds – Dividend is reinvested to buy more units of shares. The effect of the stock split/bonus will reflect in the NAV over time.

Can Index ETFs go bankrupt? What to do them.

I’m not sure how bankruptcy will happen in an ETF. May be, if the issuer bank (fund house) itself fails…there is a risk. But the thing is, these funds are very closely regulated by SEBI etc. Before there is an impact on the investors, the fund house will go (or will be asked to close down) – Example: Franklin Templeton with debt funds during COVID-19 crisis.

Dear Mani,

Is there any indian govt regulatory body for ETF ?

eg IRDA for Insurance co, SEBI for stocks no regulatory body for MF. otherwise Franklin Debt MF would not have happened.please revert

SEBI is the regulator for the total equity market

I am a keen follower of your blog. At a time at least three or four blogs articles are always open on my laptop. It is so existing to read all those articles that i started writing down my take away points from it. I request please start private personal financial planner type of service, this will help lot many people. Please keep writing and publish you book, i will your first customer to buy

Sir, I’m currently pursuing my research work on ETF as part of M.Phil. Can suggest some directions in order to study the performance of Index ETF.

Great article..

But the recommendation of Index funds for cost-sensitive long term investor may be relooked at. If someone already has a Demat account, ETFs are more cost effective if held for 2 years or more. The Expense ratio of 1.25% of index funds applies every year against .08% of ETF. The buy and sell costs are one time costs in ETF. Thus if held for more than 2 years, ETF will be cheaper.

Thanks.

For a one time investment, no mutual fund can charge expense ratio every year. It’s a one time cost.

Such a lucid article. Everything clearly explained. Enjoyed reading it. It helped me a lot.

Thanks

ETFs are marketable security which tracks stock market elements like index, commodity, index funds, and bonds. An ETF stock can be traded like a common stock on a stock exchange. Due to the high frequency of trade, the price of ETFs keeps constantly changing throughout the day. ETFs are traded like stocks. They’re priced based on what investors think the market value is and you can buy and sell shares throughout the day.

I liked the way you have mentioned it. I think that the Index Fund and ETFs invest in stocks in the same proportion as the underlying index. So a Nifty 50 Index Fund or ETF will aim to keep the weight age of stocks inline with the Nifty 50 constituents.

Well-researched article on ETFs in India. Liked it very much. There are a lot of takeaways for beginner investor as well as the experienced ones.

Thanks for the appreciation.

Hai

Can nris invest in these etfs as a long term holding strategy, if so which isnthe cheapest online broker u recommend for etfs for nris.

Thanks

Hello Mani,

I live in Australia as one of many NRIs and recently found your blog realistic and valuable. Your simple and easy explanation of complex financial jargon and products deserve appreciation. Income and corpus fund thereof one require that you blogged are made so simple and appealing to me, being a passive investor, as I plan to part retire in India and part here. Keep blogging, Mani. Many thanks.

Hello Dr Tapas, thanks for posting such a lovely feedback. It means a lot.

Great explanation with appropriate steps and statistics. Keep up the good work. And thank you.

Thanks a lot for your feedback. It means a lot. Keep reading.

Hello mani,

Great Article on ETF.

Earlier the MF is regular, then the era evolve for the regular scheme to direct.

I am expecting the future will be narrowing down to world of ETF, while finace experts may look forward and managing the funds for the ETF category.

I have handsome amount of investment in HDFC equity fund that is multicap category.

I am interested to switch to the same category ETF. which of the scheme is been offered from HDFC fund house? or any other ETF universe.

Waiting for your response.

Thanks a lot.

If I am not wrong, HDFC has only Sense, Nifty & Gold focused ETF’s…check this

But there is a ETF called “ICICI Prudential S&P BSE 500 ETF INR”. This is a multi-cap fund. This fund has been launched only in May’18…Check this

Thanks for posting your comment.

Hi, Very Good info on ETFs.Its Very Usefull.

one thing while reading Difference between MF , ETFs ,Stocks .its Mentioned Entry load as YES, it might be Typro Error. Now entry load is not applicable.

You are right, entry load on mutual funds were applicable sometime back. These days, mutual funds run with zero entry loads as per SEBI’s directive. Thanks for posting your comment.

I recently discovered and started investing in ETF as a trial to understand more about it. It was like a basket of ETF my broker’s platform provided in its related thematic investment site (Smallcase).

I noticed, three types of ETF there: Equity (niftybees and juniorbees), Gold (goldbees) and liquidbees. All seem to be managed by Reliance.

Now liquidbees seems to generate fractional daily dividends and its price seems to remain constant at 1000. Is this what you have referred to as “dividend ETFs” in this article? or is this Debt based ETF?

Also, how are the earnings taxed on ETFs in India? Would all of them, irrespective of the type (gold/equity/debt/dividend) be taxed similarly?

Looking forward to your answer

very good analytic post. I never knew difference between ETF and Index Fund. Thanks for your post.

Hello Mani,

i realy appriciate it! thanks for sharing this information.

Please shed some light on liquidity of an etf. Since they are traded like stocks while selling would there be adequate buyers for it? The volume of transactions for some top etf is in the range of 400 to 500 in a day. Will this be an issue while selling the etf?

Good question. Liquidity of ETF has two parts.

(1) Price Liquidity: As ETF’s are intrinsically linked to the stocks in its portfolio, hence its price liquidity is not an issue at all.

(2) Trading Volume each day: As ETF’s has this factor low. So it is better to look for broadly traded ETF, like index ETFs

I really like this post on ETF. It gets you started on ETF. But need more information on ETF trading like brokerages, Stamp duty, dividends, stock split or bonus etc. Also when I sell who is going to buyback the ETF – the AMC or stock market?

I wanted information , about ETF

Investment

I got the necessary information

Thanks