Recently a friend asked me about how exit load in SIP is calculated. Before we can answer it, let’s understand a bit about the exit load itself. Check our Mutual Fund Screener.

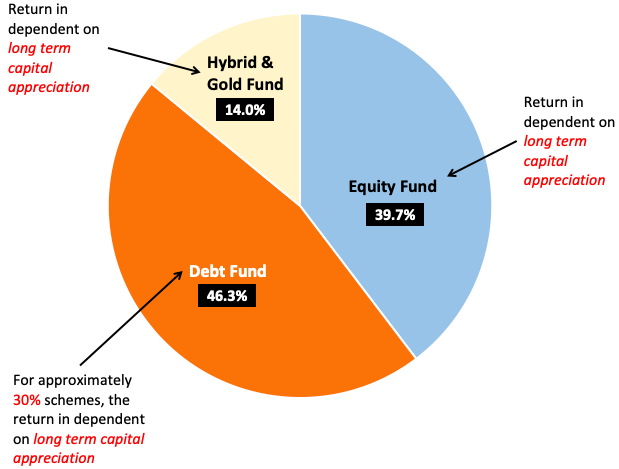

We have mainly four types of mutual funds in India, equity, debt, hybrid, and gold funds. Among these types, the majority carry an exit load. What is an exit load?

It is a fee charged by mutual funds when investors sell the units they are holding. If the investor sells the units too soon, only then the exit load is applicable. Exit load details are available in the scheme information document (SID).

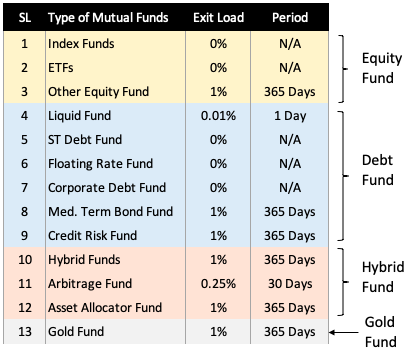

Below is the summary of exit loads applicable to various types of mutual funds. It is just an example to give you an idea of the range of exit loads applicable to different schemes.

The Exit Load is Applicable Only on Some Schemes. Why?

Out of all capital invested in mutual funds schemes, about 60% of it depends on the “long term capital appreciation for their returns.” So the longer the money stays invested, the better. Buying mutual fund units and selling them too soon is not what the fund manager wants us to do. Hence a fee, called exit load, is charged if the units are sold before than expected.

The exit load works as a deterrent for the unitholders. This fee is applied to discourage unit holders from selling the units before a specified period.

You must have seen the names of mutual funds affixed with either of the two-term, growth (G) or dividend (D). These are the two plans offered by mutual funds. All growth focused schemes want their investors to stay invested for a long term. Let’s delve a little deeper into its reason.

All mutual fund schemes have a portfolio behind their back. Equity funds have a portfolio consisting of a list of stocks. The fund manager keeps booking profits from its portfolio and reinvests it for future growth. The booked profit is reinvested and not distributed to the unitholders.

All growth plans depend on this reinvestment philosophy to render high returns. Selling the units too soon will hamper the fund manager’s reinvestment plan. If investors sell the funds too soon, NAV of such funds will never grow and hence will yield negative returns.

Exit loads are applied to protect the interest of the unitholders, mainly ones who are there for the long term. Though SEBI has asked all fund houses to remove the extra load, the exit load remains. Why? Because applicable exit load is beneficial for the growth-oriented funds.

Exit Load in Lump Sum Investing

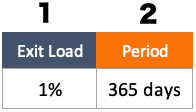

For a lump sum investment, exit load calculation is simple. Exit load of any mutual fund scheme has two components, the fees and the period for which it is applicable.

Let’s use an example to understand the exit load calculation in a lump-sum investment. Suppose two people invested in a mutual fund scheme called Parag Parikh Flexi Cap Fund (direct plan). Both of them hold 302.475 units and have sold them on the same day (13-Oct’21). The details of their investment are as shown below:

| Person | Purchase Date | NAV | Amount | Units | Holding Time (as of 13-Oct’21) |

| First | 26-Oct-20 | 32.73 | 10,000 | 302.475 | 352.00 |

| Second | 02-Dec-19 | 27.25 | 8,342 | 302.475 | 681.00 |

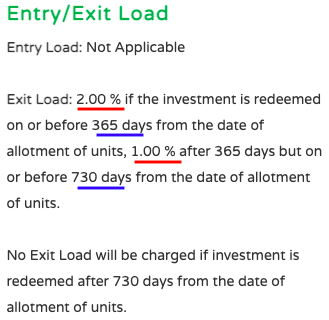

This mutual fund scheme has a typical two-tier exit load (see below). Let’s calculate the exit load for both persons.

First Person

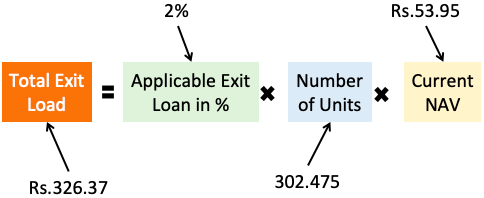

The person has held his units for 352 days. Hence, the exit load of 2% will be applicable. The NAV of the scheme as of 13-Oct’21 is Rs.53.95 / unit. Let’s apply the exit load formula:

The total exit load in Rupees will be = 2% X 302.475 X Rs.53.95 = Rs.326.37. The exit load so calculated will be deducted from the redemption amount. The amount credited into the investor’s bank account will be the net of the exit load (Rs.15,992). See the below calculations for details:

| SL | Person | First | Note | |

| 1 | Units | Nos | 302.475 | |

| 2 | Current NAV | Rs. | 53.95 | |

| 3 | Redemption Amount | Rs. | 16,319 | = 1*2 |

| 4 | Total Exit Load | Rs. | 326.371 | |

| 5 | Net Redeemption Amount | Rs. | 15,992 | = 3 – 4 |

Second Person

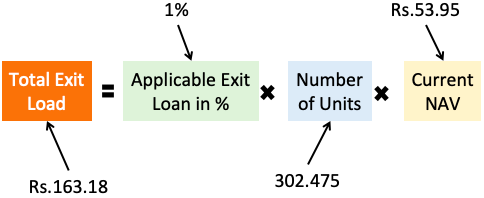

The person has held his units for 681 days. Hence, the exit load of 1% will be applicable. The NAV of the scheme as of 13-Oct’21 is Rs.53.95 / unit. Let’s apply the exit load formula:

The total exit load in Rupees will be = 1% X 302.475 X Rs.53.95 = Rs.163.18. The amount credited into the investor’s bank account is Rs.16,155. See the below calculations:

| SL | Person | Second | Note | |

| 1 | Units | Nos | 302.475 | |

| 2 | Current NAV | Rs. | 53.95 | |

| 3 | Redemption Amount | Rs. | 16,319 | = 1*2 |

| 4 | Total Exit Load | Rs. | 163.185 | |

| 5 | Net Redeemption Amount | Rs. | 16,155 | = 3 – 4 |

How To Calculate Exit Load in SIP

The calculation of exit load in SIP is slightly more complicated than lump-sum purchases. The reason being, in SIP, all units do not have the same holding period. At the time of redemption, there will be clusters of units on which different exit loads are applicable.

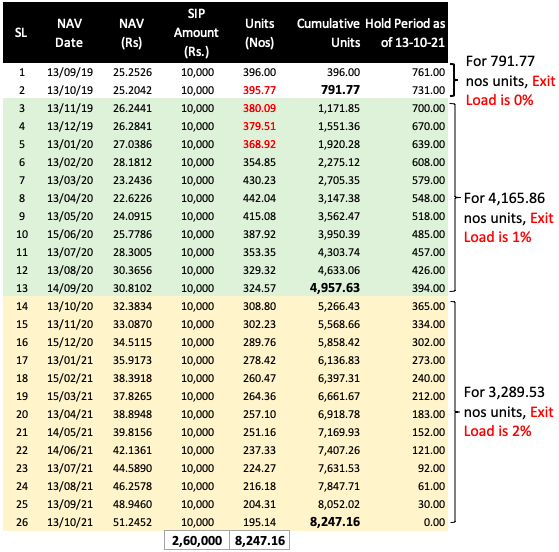

To understand it, let’s take the example of a mutual fund called Parag Parikh Flexi Cap Fund (direct plan). The person started buying units of this scheme from 13-Sep-2019 with a SIP amount of Rs.10,000 each month. On 13-Oct-2021, almost after two (2) years of investing, the person has decided to sell his units. Let’s calculate how much exit load applies to his SIP scheme.

[Note: Exit load applicable on this mutual fund scheme is here]

Please see the above table. There were 26 instances of mutual fund units purchase. It also shows how many days the units have complete, as of 13-Oct-2021.

- Exit Load 0%: Total units purchased on 13-Sep-19 and 13-Oct-19 were 791.77 numbers. These units have completed a holding period of 731 days or more. Hence for them, no exit load is applicable.

- Exit Load 1%: Total units purchased between 13-Nov-19 and 14-Sep-20 was 4,165.86 numbers. These units have completed a holding period of 365 days or more. Hence, for these units, the exit load of only 1% is applicable.

- Exit Load 2%: Total units purchased between 13-Oct-20 and 13-Oct-21 were 3,289.53 numbers. These units have a holding period of 365 days or less. Hence, for these units, the maximum exit load of 2% is applicable.

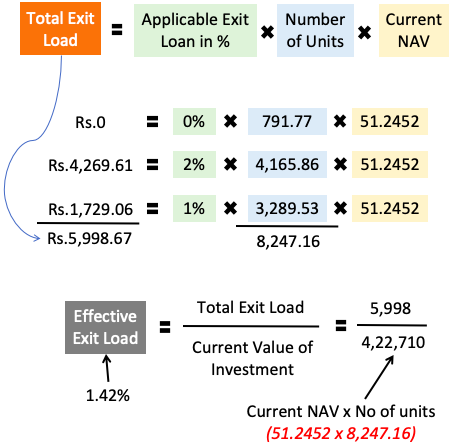

The exit load calculation for all the redeemed units (8,247.16 nos) is below:

The calculation

The total exit load in Rupees will be Rs.5,998.67. Hence, the effective exit load applied to the whole investment corpus is 1.42%.

The amount credited into the investor’s bank account is Rs.4,16,628. Please see the below calculation:

| SL | Person | Second | Note | |

| 1 | Units | Nos | 8,247.16 | |

| 2 | Current NAV | Rs. | 51.2452 | |

| 3 | Redemption Amount | Rs. | 4,22,627 | = 1*2 |

| 4 | Total Exit Load | Rs. | 5,998.67 | |

| 5 | Net Redeemption Amount | Rs. | 4,16,628 | = 3 – 4 |

Conclusion

Exit Load is applicable even if the mutual fund unit’s sale happens at a loss. Hence to avoid the exit load cost, the only way is to sell after the exit load period. Generally, for the majority of schemes, the exit load period is one year. But like our example scheme, the exit load period can be longer.

Suggested Reading:

How does the calculation work if exit load is applied in a bit more complicated fashion? For example, consider ICICI Pru BAF which states exit load condition as “For units in excess of 10% of the investment,1% will be charged for redemption within 365 days”.

What counts as “investment” here?

It would be great if you can provide solution to the above case.

Hi Mani(sh),

Well written article on MF Exit load. Appreciate all your articles which are excellent and investment thought provoking.

I would appreciate your views and writeup on selection of MF like Debt or Equity based on SIP and STP. What exactly should be the portion of Debt and Equity so that an individual can mitigate or reduce his risk exposure.

Keep up the good work

Hi Sir, you may like to read this article on STP. It has some explanation on the topic. Thanks for your query and feedback.