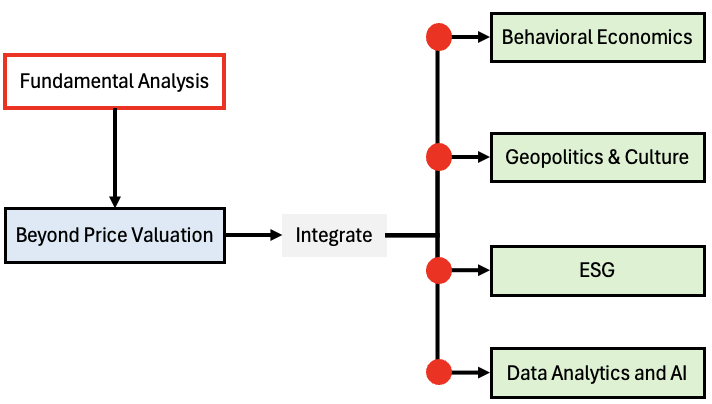

In the world of investing, fundamental analysis is like peering into the DNA of a company. It reveals the true essence of a listed company. Beyond simply assessing stock prices, it offers a deeper understanding of a company’s health, potential, and impact. Fundamental analysis is not just about crunching numbers, it digs deep into the company’s business. It is a multidimensional lens through which we can explore how economics, human behavior, and global dynamics shape a company.

Let’s explore the fundamental analysis unconventionally. We will uncover how fundamental analysis extends beyond mere valuation. We will also touch-base the pulse of industries, societies’ heartbeat, and the global stage’s rhythm.

From the fusion of behavioral economics to the interference of culture and geopolitics, we will unravel the layers of complexity that shape fundamental analysis. We will witness the rising tide of environmental consciousness and ethical governance. We’ll see how ESG is reshaping the landscape of investment decision-making.

We will also witness the emergence of advanced technologies like artificial intelligence (AI). We will see how AI can empower investors with unprecedented insights and foresight.

Topics:

Point #1: Fundamental Analysis Beyond Stock Valuation

Fundamental analysis is often seen as just about fair price valuations. However, it can actually tell us a lot more about the company. Fundamental analysis is like a magic key that unlocks doors to hidden facts about the companies. Let’s explore some alternative ways it can be used.

- Assessing Industry Health: Imagine looking at a forest and seeing not just the trees, but the whole ecosystem. That’s what fundamental analysis can do for industries. By studying the financial health of all companies within an industry, we can gauge its overall strengths, weaknesses, and future prospects. It’s like checking the pulse of an entire sector to see if it’s thriving or ailing.

- Predicting Economic Trends: Picture yourself as a weather forecaster, but for the economy. With fundamental analysis, we can analyze economic data, company performance, and market trends. This is mainly done to predict where the economy might be headed. It’s like connecting the dots to see if stormy clouds or sunshine are on the horizon.

- Evaluating Societal Impact: Think about the impact a company has beyond just making money. Fundamental analysis can help us understand its social and environmental footprint. Though the analysts shall dig much-much deeper to this perspective. What questions it can answer? Does it treat its workers well? Is it eco-friendly? One must try to answer, if the company is a force for good or it’s harmful to society and the planet.

Fundamental analysis is not just about numbers on a spreadsheet. It is also a powerful tool that can help us make sense of the complex world of business analysis and finance in general.

Point #2: Integration of Fundamental Analysis with Behavioral Economics

Think of wearing a spectacle that blends two lenses. The first lense sees the numbers, and another sees how people think and behave. That’s what happens when we combine fundamental analysis with behavioral economics.

Let’s dive into how this fusion enriches our understanding of the market.

- Investor Sentiment: Think of investor sentiment like the mood of the market. Sometimes, people get excited and buy lots of stocks, driving prices up. Other times, they get scared and sell, causing prices to drop. Fundamental analysis helps us understand why these mood swings happen and how they affect stock prices. For example, if investors are feeling optimistic about a company’s future, they might overlook some red flags in its financial statements. This can cause the stock price to rise unrealistically high.

- Cognitive Biases: We all have blind spots in our thinking called cognitive biases. These biases can lead us to make irrational decisions. It is especially true when it comes to investing. Fundamental analysis helps us identify and account for these biases. It allows us to focus on objective data rather than gut feelings or herd mentality. For instance, the availability bias makes us rely too heavily on information that’s easy to recall, like recent news headlines. By using fundamental analysis, we can look beyond the headlines and consider a company’s long-term performance.

- Market Psychology: Markets are driven not just by numbers, but also by human emotions like fear, greed, and optimism. Fundamental analysis allows us to peek behind these curtains and understand the psychological factors shaping market behavior. For example, during a bull market, investors might become overconfident and ignore warning signs of overvaluation. Fundamental analysis helps us stay grounded by focusing on the underlying fundamentals of companies, rather than getting swept up in the hype.

By integrating fundamental analysis with behavioral economics, we gain a deeper understanding of market dynamics. It’s like putting on special glasses that allow us to see not just the numbers, but also the not-so-visible stories behind them.

Point #3: Cultural and Geopolitical Considerations in Fundamental Analysis

When it comes to understanding stocks we can’t ignore the bigger picture. I’m talking about the world that works around around the companies. Let’s explore how cultural and geopolitical factors play a vital role in fundamental analysis. If we can learn to see the bigger picture, it can offer unique insights for stock investing.

- Political Stability: Imagine investing in a company located in a country with a shaky government. Political instability can create uncertainty, making it harder for businesses to thrive. For example, if a country experiences frequent protests or changes in leadership, companies may struggle to make long-term plans or attract investment. On the other hand, stable political environments provide a fertile ground for business growth and development.

- Cultural Norms: Every culture has its own way of doing things. This can impact businesses in profound ways. For instance, in some cultures, there may be a strong emphasis on family-owned businesses. In other, entrepreneurship may be more celebrated. Understanding these cultural nuances helps investors to judge companies based on the local culture.

- International Relations: The relationships between countries can have far-reaching effects on businesses and industries. Trade agreements, tariffs, and diplomatic tensions can all influence market dynamics. For example, if two countries impose trade barriers on each other (like USA and China), companies that rely on international trade may face challenges. On the flip side, improved diplomatic relations can open up new opportunities for businesses. It gives an opportunity to expand business and source raw materials.

Considering these cultural and geopolitical factors is like adding pieces to a puzzle. It helps investors see the full picture and make more informed decisions in an increasingly interconnected world.

Point #4: Incorporating Environmental, Social, and Governance (ESG) Factors

Suppose, you’re considering investing in a company, and you want to know more than just how much money it makes. You also want to know if it’s safe for the planet, if it treats its employees well, and if its management is honest and fair. That’s where ESG factors come in.

It is a compass guiding investors toward companies that are not just profitable, but also responsible and sustainable.

Let’s take a closer look at how ESG factors are changing the game of fundamental analysis. I will use the Tata Group companies – like Tata Steel, TCS, and Tata Motors – as examples to make my point.

- Environmental Sustainability: Tata Steel, for instance, has been making strides in reducing its carbon footprint and embracing renewable energy sources. By prioritizing environmental sustainability, the company not only minimizes its impact on the planet but also positions itself as a leader in a world increasingly concerned about climate change.

- Social Responsibility: TCS, part of the Tata Group, is known for its strong commitment to social responsibility. Through initiatives like community development projects and employee welfare programs, TCS demonstrates its dedication to making a positive impact beyond just financial returns. This not only boosts employee morale but also enhances the company’s reputation and brand value.

- Corporate Governance: Tata Motors places a high emphasis on corporate governance practices. By maintaining transparency, accountability, and ethical standards in its operations, Tata Motors builds trust with investors and stakeholders. This solid foundation of good governance not only reduces the risk of corporate scandals but also fosters long-term sustainability and growth.

By considering these ESG factors in fundamental analysis, investors can gain a more comprehensive understanding of a company’s long-term viability and investment potential. It’s like looking under the hood of a car – you want to make sure everything is running smoothly and responsibly before you decide to invest your money.

Point #5: Fundamental Analysis and the Role of Advanced Data Analytics and Artificial Intelligence

I would love to have a super-smart assistant who can crunch numbers faster than I can blink. That’s what advanced data analytics and artificial intelligence (AI) are doing for fundamental analysis. They are turbocharging our ability to understand companies and make smarter investment decisions.

Let’s take a closer look at how these cutting-edge technologies are reshaping fundamental analysis:

- Advanced Data Analytics: Think of this as a super-powered magnifying glass. It helps us dig deeper into mountains of data to uncover hidden insights and trends. For example, instead of manually reading the financial statements, advanced data analytics can quickly scan and analyze vast amounts of data to identify patterns and anomalies. This can give the investors a clearer and deeper picture of a company’s financial health.

- Machine Learning: This is a smart assistant who learns from experience. Machine learning algorithms can analyze historical data to identify patterns and make predictions about future trends. For instance, they can analyze past stock performance to predict how a company might perform in the future. This type of analysis can help investors spot opportunities and risks ahead of time.

- Artificial Intelligence: Imagine having a virtual investment advisor who can sift through endless data and offer personalized recommendations. That’s what AI does for fundamental analysis. It can analyze news articles, social media posts, and other sources of information to gauge market sentiment and identify investment opportunities. For example, AI-powered algorithms can analyze social media chatter about a company’s fundamentals to predict price movements.

Investors can use AI to analyze fundamental data more efficiently and accurately than ever before. It’s like having a crystal ball that helps us see into the future of finance. This will make data-driven decision-making not a reality.

Conclusion

These days, fundamental analysis isn’t just about crunching numbers. It is a multidimensional tool that offers insights into the intricate world stock analysis. By exploring unconventional perspectives, such as industry health and economic trends, investors can gain a deeper understanding of market.

Integrating behavioral economics provides a lens into investor sentiment and cognitive biases. It offers a more holistic view of market behavior.

Cultural and geopolitical considerations highlight the interconnectedness of global markets and the impact of societal factors on investment decisions.

Moreover, incorporating ESG factors emphasizes the importance of responsible investing and long-term sustainability.

Advanced data analytics and artificial intelligence are revolutionizing fundamental analysis, enabling investors to make data-driven decisions with unprecedented speed and accuracy.

Together, these elements paint a comprehensive picture of fundamental analysis, empowering investors to navigate the complex landscape of finance with confidence and clarity.