Interactive Face Value Tool

Compare two stocks to understand face value, calculate dividend yields, and simulate stock splits. Learn why face value isn’t the key to smart investing!

Stock 1

Stock 2

| Metric | Stock 1 | Stock 2 |

|---|

Test your knowledge: Is a stock with a lower face value always a better investment?

Correct! Face value doesn’t determine a stock’s quality. It’s just a nominal value set by the company. Focus on fundamentals like earnings, growth, and market trends. Learn more in the article!

Explore more about face value and stock investing in our detailed article!

Introduction

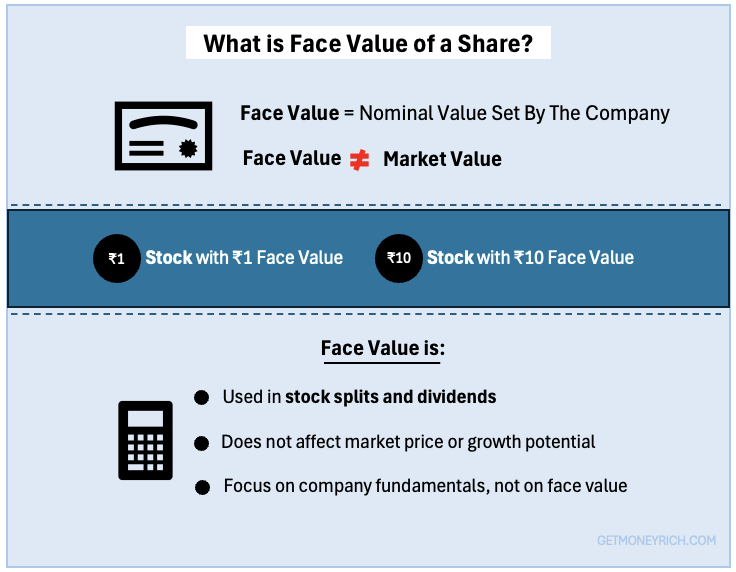

I recently received this interesting comment [see Title] by a young investor in her 20s. I thought it will be better to blog about it. Face value, also known as the par value of a share, represents its nominal value as stated in a company’s books. It is the fixed value assigned when a company first issues shares. The value is often set at ₹1, ₹10. In India, the face value of a share can be different from ₹1 or ₹10. SEBI sets the minimum face value at ₹1. But companies can set a higher face value based on their discretion. The most common face value is Rs 10.

Unlike the market value, which fluctuates based on demand-supply dynamics and company performance, face value remains unchanged over time. Unless there is a corporate action like a stock split, face values of shares do not change.

Generally speaking, face value is just a number. But it also holds some significance as it can have an effect on the investors. How? It affects how dividends are calculated, and certain other financial metrics like earnings per share (EPS). Read here for impact of stock split on dividends.

Face value itself does not determine a stock’s worth or its potential for returns. Investors often wonder if buying shares with a lower face value (like ₹1) is better than those with a higher face value (like ₹10). In reality, the focus should be on the company’s fundamentals and growth prospects rather than its face value.

Understanding this concept can help investors make informed decisions while choosing stocks.

1. Understanding Face Value: ₹1 vs. ₹10

Face value is the nominal value of a share as set by the company at the time of issuance. It is an accounting measure and is usually a small amount like ₹1, ₹2, ₹5, or ₹10.

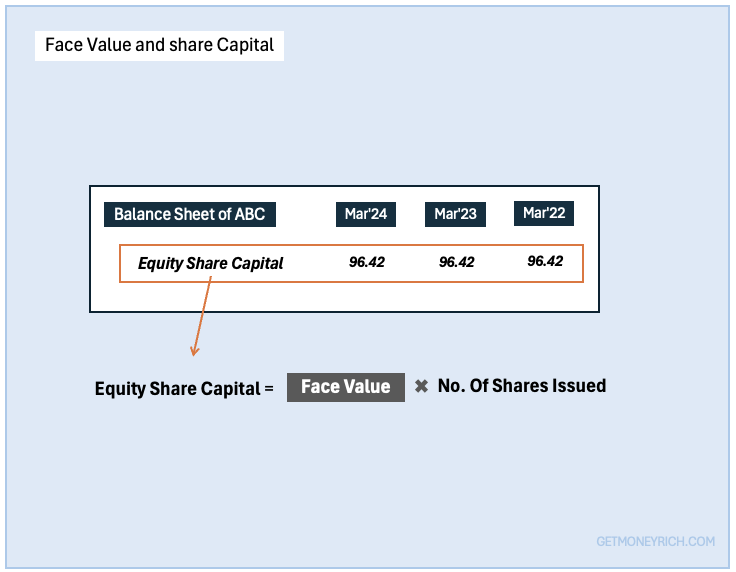

For example, if a company issues 1,000 shares with a face value of ₹10 each, the company’s share capital in its books will reflect ₹10,000 (1,000 shares x ₹10 face value).

When it comes to shares with a face value of ₹1 versus those with a face value of ₹10, many wonder if one is inherently better than the other. In reality, the face value itself does not directly impact the share’s market value or investment potential. The market value of a stock is driven by the company’s financial performance, growth prospects, and market sentiment, not by the face value.

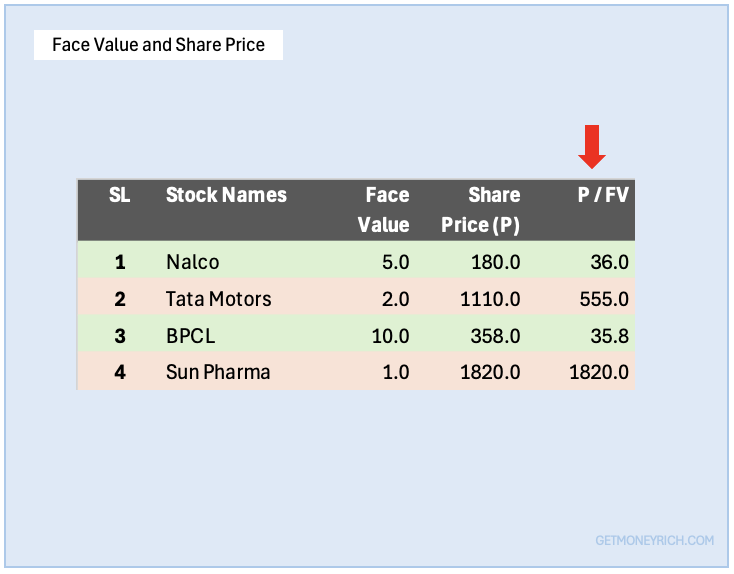

For instance, consider these four stocks: Nalco, Tata Motors, BPCL, and Sun Pharma. Face value of these companies are ₹5, ₹2, ₹10, and ₹1 respectively. Had there been any influence of face value on the market price, price of Sun Pharma shares would have been lowest, right. But check this table for their Price to Face Value ratios.

BPCL, whose face value is highest at ₹10, has the lowest share price (P/FV ratio os 35.8). Whereas, Sun Pharma, whose face value is lowest at ₹1, has the highest share price (P/FV ratio os 1820).

What does this data tell us about share price and face value? The share prices are influenced by factors like earnings, growth expectations, and investor sentiment, not by their face values.

Face value is more relevant for corporate accounting and internal financial management.

For we investors, what matters more are the following:

We must not break our bones over whether to buy share of face value of ₹1 or ₹10.

Understanding this distinction can prevent misconceptions about stock pricing.

2. Key Differences and Considerations

2.1 Impact on Stock Splits

Face value plays a crucial role in corporate actions like stock splits and dividend calculations. When a company decides to split its stock, it reduces the face value to increase the number of shares. Stock split makes a share more affordable for investors. Stock spilt increases the number of shares outstanding in the market, thereby decreasing the per share price.

For example, Suppose there is a stock with a face value of ₹10. At this point suppose the share price is ₹5,000 each and number of shares outstanding is 1 crore. Let’s say that the company decides to split one share into ten shares with a face value of ₹1 each. This action will increase the outstanding shares from 1 crore to 10 crore and decrease the share price from ₹5,000 to ₹500 each.

So you can note that stock split doesn’t change the company’s market capitalization or the total value of an investor’s holdings. But what it does is that it makes the shares more accessible by lowering their individual price. Moreover, as more number of shares are available in the market, the share’s trading volume may also increase.

2.2 Impact on Dividends

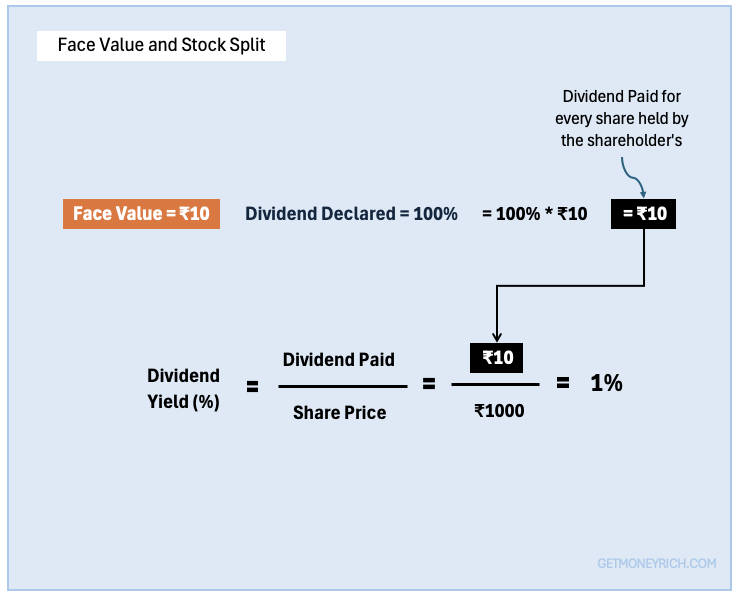

Dividends are often declared as a percentage of the face value. Hence, dividend payout’s are also influenced by the face value of its share. How?

Suppose there is a company that declares a 100% dividend. The share of this company has a face value of ₹10. 100% dividend on a face value of ₹10 means that a dividend of ₹10 per share will be paid to the shareholders.

Similarly, another company declares the same 100% dividend, but its face value is only ₹1. In this case only ₹1 per share will be paid as dividend to the shareholders.

It is also a point worth noting that, for we as a shareholder of a company, our interest and focus is dividend yield. We need not worry about the face value of share or what percentage of dividend is declared by the company. Yes, the decision will impact our dividend yield, but for me, keeping our focus on dividend yield is more efficient.

Conclusion – Beyond Face Value

Now that you understand the concept of face value and its limited impact on market price, it’s essential to think deeper.

What truly matters in stock investing? Rather than getting caught up in nominal values like face value, we’ll focus on understanding the company’s growth strategy, competitive position, and industry dynamics. We shall pay attention to the company’s profit consistency, revenue growth, and how well it can manage its expenses over time (profitability).

Also, consider the impact of corporate actions, like stock splits or dividends. See them not just from a face value perspective but in terms of how they reflect the company’s financial health and strategy. A stock split may signal management’s confidence in future growth.

A stock split often indicates the management’s focus on shareholder’s value. One way to do it is by taking steps that can influence the share price growth. As stock split can make a share more affordable, a broader range of investors will start participating in it. This corporate action (split) is a way to increase liquidity and attract more shareholders.

Similarly, Dividends can indicate strong cash flow and commitment to returning value to shareholders.

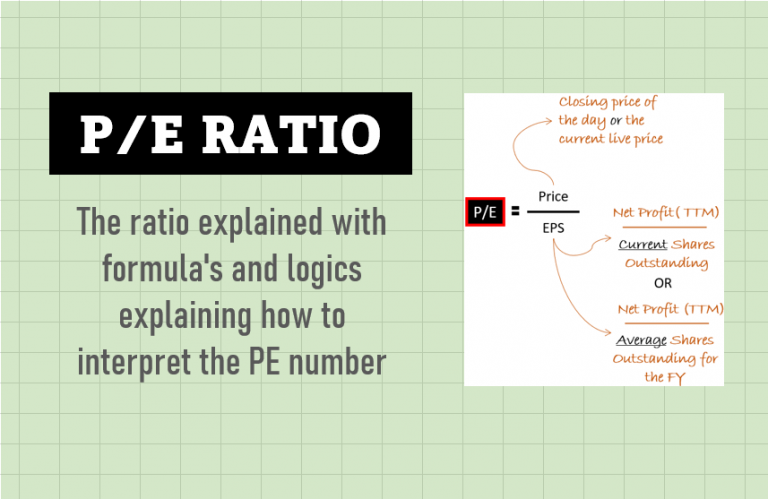

Engage with the company’s annual reports, management discussions, and industry analyses. The idea is to understand the factors driving its performance. Use metrics like P/E ratio, ROE, and D/E ratio to evaluate if a stock aligns with your investment goals. You can also use our Big Screener to create such custom filters on your own.

We must look beyond the face value and consider the bigger picture. What is the bigger picture? The company’s potential for long-term growth and value creation. This approach will help us make a more robust stock portfolio.

Have a happy investing.

Suggested Reading: