Summary Points:

- Fiem Industries shines in two-wheeler lighting.

- Moneycontrol rates it “Overweight” for long-term.

- My Stock Engine gives it an Overall score of 63.25%.

- Growth and moat are Fiem’s strengths.

- Price looks overvalued, profitability needs work.

- Both analyses offer valuable investment insights. Jump here to see the comparison

Introduction

I’ve poured my heart and soul into building the Stock Engine app. It’s an algorithm I coded myself to analyze stocks and highlight a few quality stocks. Today, I want to show you how does my Stock Engine’s analysis stack up against a big name like Moneycontrol? To test this, we’ll look at Fiem Industries. It is an auto ancillary company which has attracted moneycontrol’s attention recently (read this article). So, allow me to present to you a comparative analysis between what moneycontrol is saying about Fiem and how my Stock Engine sees it.

I consider Moneycontrol as a reliable and go-to portal for stock analysis. It has gained the trusts of people over the last many years. As it is a part of the CNBCTV18 group, gives it that extra bonus points.

On the other hand, my Stock Engine is like my own baby. I built it from scratch to analyze stocks using a special algorithm that looks at six key parameters: Price, Growth, Quality of Management, Profitability, Economic Moat, and Financial Health. Based on these six parameters, it gives an overall score to a stock.

Now, let’s see how Fiem Industries fares in both analyses and whether my Stock Engine can hold its own against Moneycontrol.

About Fiem Industries

Here is a quick picture of Fiem Industries.

It’s a company that makes lighting solutions (auto ancillary), mainly for two-wheelers like bikes and scooters. They’re also stepping into passenger vehicles (PV) and electric vehicles (EV), which are growing markets worldwide.

In India two segment itself rising fast, thanks to rising rural incomes and new model launches. Fiem seems like a company with a lot of potential.

As of date, Fiem Industries is a small Rs.3500 crore market company. I thought, why not take it as an example to display how my Stock Engine’s analysis fare in comparison to what moneycontrol is talking about it.

What Does Moneycontrol Say About Fiem?

The Moneycontrol’s report paints a pretty optimistic picture of Fiem.

They start by saying that Fiem is a good pick because it’s not too affected by global trade tensions. Some other prominent auto ancillary suppliers like NSE:MOTHERSON is effected more severely by the US tariff policies under Donald Trump. Since Fiem focuses on the Indian market, it’s somewhat insulated from all that drama.

They give Fiem an “Overweight” rating, which means moneycontrol think it’s a good to be considered for a long term holding purpose.

Moneycontrol highlights a few key points that make them bullish on Fiem.

- They talk about the company’s strong performance in the two-wheeler segment. Fiem’s sales grew by 22% in Q3 FY25. It was mainly due to the rising demand for LED lights. New clients like Yamaha and Royal Enfield also contributed to the sales growth.

- Moneycontrol also mention Fiem’s entry into the passenger vehicle segment. Apparently, they’ve already delivered their first product to Mercedes and got approval from Mahindra & Mahindra to start production in Q1 FY26.

- Plus, Fiem is tapping into the EV market. They are supplying to companies like Ola and Okinawa, and even collaborating with Gogoro for EV components.

All of these factors makes Moneycontrol believe that Fiem has a bright future.

When it comes to valuation, Moneycontrol says the stock’s price corrected by 23% from its 52-week high, bringing it to Rs.1,373 with a market cap of Rs.3,610 crore. They project that by FY27, Fiem will trade at a price-to-earnings (P/E) ratio of 15.2x, which they call “comfortable” and attractive for long-term investors.

Moneycontrol has also shares a few financial projections:

- Revenue growing from Rs.2,029 crore in FY24 to Rs.2,924 crore in FY27.

- EBITDA margin slightly dipping from 15% to 13.8%.

- Net profit margin hovering around 8.1%.

The report also mentioned risks, like a slowdown in demand or rising raw material costs, but overall, they’re quite positive about Fiem.

What Does My Stock Engine Say?

Now let’s look at how my Stock Engine’s algorithm is viewing the performance of Fiem Industries. It can analyze a company based on its last 5 years plus TTM quarterly data.

I think, myy algorithm is a bit more structured. It scores a company on six parameters, which I’ve mentioned earlier, and gives an overall score out of 100%.

For Fiem, the overall score comes to 63.25%, which is decent but falls short of the 75% threshold mark that my algorithm considers a minimum score for a stock to be “good” for consideration.

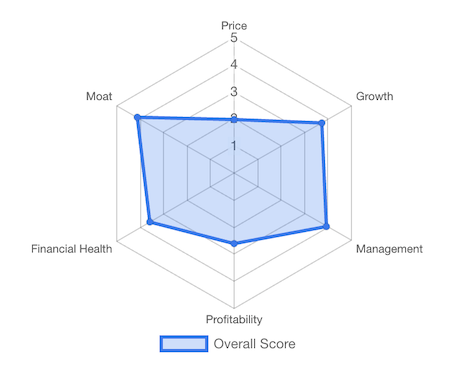

Why this score? Let’s break it down by looking at the spider diagram, which is the heart of my algorithm.

The spider diagram shows how Fiem scores on each of the six parameters, on a scale of 1 to 5. Fiem does really well in some areas. For example:

- It scores 3.72 in Growth,

- 4.08 in Quality of Management,

- 4.15 in Economic Moat, and

- 3.59 in Financial Health. These are all solid ratings. Not many companies can get a score of “near-four” scores out of the total of five.

But Fiem struggles in two areas:

- Profitability (2.59) and

- Price (2.87) – indicating overvaluation.

Let’s dig deeper into My Stock Engine’s Analysis

Price Valuation

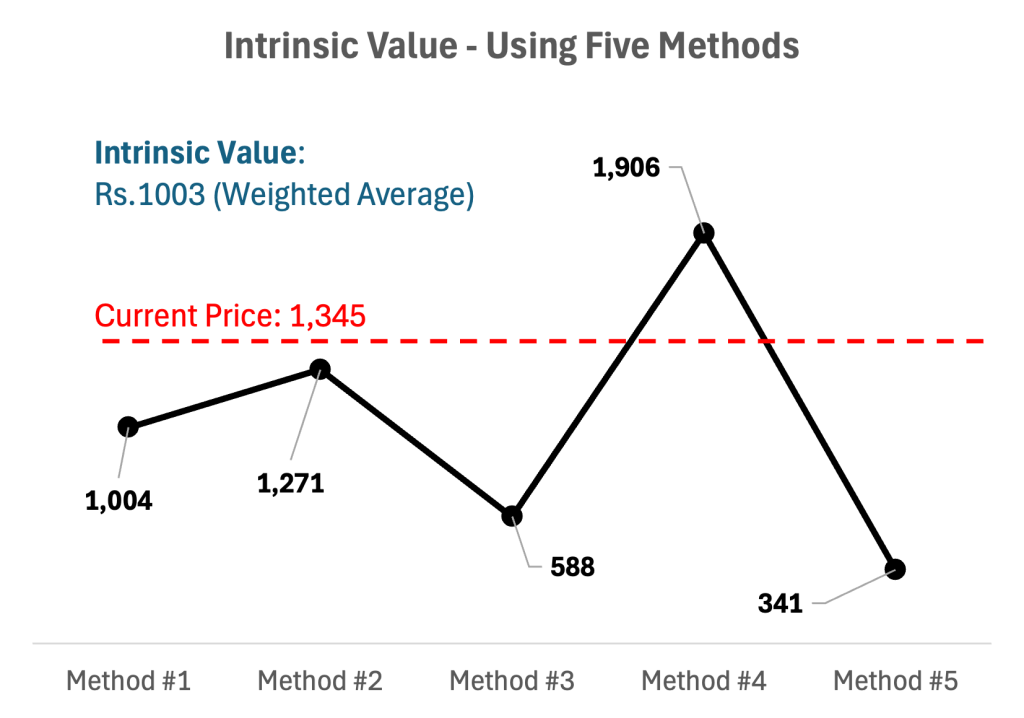

At the current price of Rs.1,374.45 is higher than the algorithm’s estimated intrinsic value of Rs.1003 (about 37% higher). But just to give you an insight into how my algorithm has arrived at the Rs.1003 figure, let’s dig further.

The Stock Engine’s algorithm estimates the intrinsic value based on these five methods: (1) Price to Sales method (industry averages), (2) Price to book value method (again industry average is also taken into consideration), (3) net current asset value method (NCAVPS), (4) DCF, and finally using the (5) PE & EPS trend. The Stock Engine considers the weighted average of these metrics as it estimated intrinsic value.

At the current price levels, the trailing twelve-month (TTM) P/E of Fiem is about 18.00x. Comparing this to Moneycontrol’s projected P/E of 15.2x for FY27, it looks like the company’s earnings (EPS) is expected to grow faster at least till FY27.

Though my algorithm is more cautious about the stock’s pricing mechanism. It relies more on the estimated intrinsic value instead of future projection of the company. Future projected earnings I believe are less reliable. But for perspective, it is a number worth remembering. Though, I’ll not include it in my scoring matrix.

Growth

On Growth, my Stock Engine agrees with Moneycontrol that Fiem is doing well. It gives a score of 3.72 out of 5, which is above average.

- Over the last five years, Fiem’s operating revenue has grown at 11% per year,

- Net profit has grown at 16%.

- But there’s a small red flag, operating cash flow growth is negative at -8%. It means the company isn’t generating as much cash as it should be.

Though, Moneycontrol doesn’t mention these metrics in particular, but they do talk about Fiem’s growth in the two-wheeler segment (22% sales increase) and new opportunities in PV and EV, which aligns with my algorithm’s findings of revenue and net profit growth.

Management

When it comes to Quality of Management, my Stock Engine gives Fiem a high score of 4.08 out of 5. The algorithm is coded in a way to estimate this “quality” parameter and converts it into a quantifiable number.

- This is because the company has grown its operating profit and earnings per share (EPS).

- It has also used its capital wisely, and can comfortably pay its dividends.

- However, the growth in operating profit and EPS isn’t consistent, which is a slight concern.

Moneycontrol doesn’t directly score management, but they imply that Fiem’s leadership is strong by highlighting strategic moves like entering the PV segment and securing big clients like Mercedes.

Profitability

Profitability is another area where Stock Engine raises another concern (like price). It gives Fiem a score of 2.59 out of 5, which is average.

- The profit after tax (PAT) margin has been steady at 6.79% over the last five years.

- The EBITDA margin is 13.17%, with a small improvement over time.

As per Moneycontrol’s projections, the net profit margin is around 8.1% and the EBITDA margin is 13.8% by FY27. Even if you compare the Stock Engine’s estimate, the algorithm too estimates the value very much like moneycontrol. But as per it, profitability is a weaker area of FIEM.

Why there is a difference between PAT Margin? I think Moneycontrol is focusing on future potential, while my Stock Engine looks at historical data and flags that the current profitability isn’t as strong as it could be.

Economic Moat

Economic Moat is another area where Fiem scores good in my Stock Engine (score of 4.15 out of 5). It is a stong sign of a wide moat.

Wide moat means Fiem has a strong competitive advantage. Stock Engine’s algorithm compares it to its competitors like Motherson Sumi and Varroc Engineering.

Moneycontrol doesn’t use the term “moat,” but they imply something similar by talking about Fiem’s leadership in two-wheeler lighting and its growing client base, like Yamaha and Mercedes.

Financial Health

Financial Health gets a score of 3.59 out of 5 in my Stock Engine.

- Fiem has high liquidity (current ratio of 1.74).

- Its also displays a very low debt dependency (debt-to-equity ratio). Currently it is debt-free, even in the last 5 years, it has managed with only very low debts.

- It also has a good return on capital employed (ROCE) of 20.51%.

- But there are concerns as well. ROCE and return on equity (ROE) are trending downward, and the debt-to-equity ratio is growing fast. This is the reason why the algorithm has given it a score of 3.59 out of 5. Otheriwse, from these

Moneycontrol doesn’t dive into these metrics, but they do mention risks like a potential demand slowdown or rising raw material costs, which could indirectly affect financial health.

A Comparison Table

| Parameter | Moneycontrol | Stock Engine | Similarities | Differences |

|---|---|---|---|---|

| Price | P/E 15.2x (FY27E); "comfortable" valuation. | Overvalued (Intrinsic Value Rs.1003); TTM P/E 19x. | – | Moneycontrol sees it as attractive; Stock Engine flags it as overvalued. Though the analysis of Stock Engine looks more grounded |

| Growth | 22% sales growth in Q3 FY25; PV & EV potential. | Stock Engine gives it a growth score of 3.72/5 | Both see strong growth in two-wheeler, PV, and EV segments. | Stock Engine provides specific growth rates, notes negative cash flow. |

| Quality of Management | Implied as strong via strategic moves (e.g., Mercedes order). | Score: 4.08/5; good capital use, inconsistent growth in profit/EPS. | Both recognize effective management through strategic decisions. | Stock Engine gives a detailed score, highlights inconsistency. |

| Profitability | Net profit margin: 8.1% (FY27e); EBITDA margin: 13.8%. | Score: 2.59/5; PAT margin: 6.79%; EBITDA margin: 13.17%. | Both note stable margins over time. | Moneycontrol projects higher future margins; Stock Engine sees it as average. |

| Economic Moat | Implied via leadership in two-wheeler lighting, big clients. | Score: 4.15/5; wide moat, high TTM EPS vs. competitors. | Both agree on competitive edge through market position. | Stock Engine explicitly scores moat, compares with competitors. |

| Financial Health | Mentions risks (e.g., demand slowdown, raw material costs). | Score: 3.59/5; high liquidity, low D/E, but rising debt. | Both see a stable financial base for growth. | Stock Engine provides metrics (e.g., liquidity, debt trends); Moneycontrol focuses on risks. |

Where Do They Agree, and Where Do They Differ?

Now that we’ve seen both analyses, let’s talk about where Moneycontrol and my Stock Engine agree and where they differ.

One thing is clear: both reports see Fiem as a company with strong growth potential.

Moneycontrol highlights the 22% sales growth in the two-wheeler segment and new opportunities in PV and EV, while my Stock Engine gives a solid growth score of 3.72 (out of 5).

Both also agree that Fiem has a competitive edge. Moneycontrol points to its leadership in two-wheeler lighting and big clients, while my Stock Engine gives a wide moat score of 4.15 / 5.

But there are some big differences too, and this is where I want you to focus your attention.

- The biggest disagreement is on Price. Moneycontrol says Fiem’s valuation is “comfortable” after a 23% correction, with a projected P/E of 15.2x by FY27, making it a good buy for the long term.

- My Stock Engine, on the other hand, flags the stock as overvalued. Its current price of Rs.1,374.45 is about 37% above the estimated intrinsic value of Rs.1003. On TTM basis, the P/E of the stock is about 19x.

This makes me wonder, is Moneycontrol being too optimistic about the future, or is my algorithm being too strict by focusing on the present?

- Another difference is in Profitability. Moneycontrol projects a net profit margin of 8.1% and an EBITDA margin of 13.8% by FY27, which they see as healthy.

- My Stock Engine, however, gives a profitability score of 2.59 out of 5, calling it average, with a historical PAT margin of 6.79%. I think this difference comes down to perspective. Moneycontrol is looking at what Fiem could achieve in the future, while my Stock Engine is grounded in what the company has done so far.

But it does make me question, are we missing something in the historical data, or is Moneycontrol banking too much on future growth?

My Stock Engine also digs deeper into areas like Financial Health and Quality of Management, giving scores and pointing out concerns like negative cash flow growth (-8%) and rising debt.

Moneycontrol doesn’t go into these details, focusing more on the big picture and future potential. I think, this makes my Stock Engine’s analysis more comprehensive, but also more cautious – maybe too cautious?

How I use this information?

The stocks which gets highlighted by portals like moneycontrol etc, I make it a point to check how my Stock Engine views the numbers of the company. As its analysis is based on last five years data (not on last quarter number only), I find it more reliable.

Having said that, it is also true that the Stock Engine sees the companies only in the rear-view mirror. Which analysis (like the one in moneycontrol) has some future perspectives and feelings built into their analysis. Hence, I never ignore their reports. I combine it with the report of Stock Engine, then do a few of my calculations on pen and paper. Once I start feeling comfortable about the stock, I start reading any latest or past news about it. I give myself at least one day of full reading time. On this day, I do nothing else. I do not even write a blog post on this day. After reading, I again question, is stock worth a buy?

Which Analysis Feels Fairer?

Now comes the big question, which analysis feels fairer to me?

As the creator of Stock Engine, I might be a bit biased, but I’ll try to be as honest as I can.

I think both reports have their strengths.

- Moneycontrol’s analysis is optimistic and forward-looking, which is great if you’re a long-term investor who believes in Fiem’s growth story. They make a strong case for why Fiem could be a good buy, especially with the stock price correction and the projected P/E of 15.2x by FY27. Their focus on new segments like PV and EV, and big clients like Mercedes, shows they’re thinking about the future.

- But I also think my Stock Engine offers a more balanced and detailed view. By scoring Fiem on six parameters, it gives a clearer picture of the company’s strengths and weaknesses. Yes, Fiem has great growth, a wide moat, and strong management, but the overvaluation and average profitability are real concerns.

The negative cash flow growth and rising debt, which Moneycontrol doesn’t mention, are also red flags that investors should know about. I feel like my Stock Engine’s overall score of 63.25% is a fair reflection of where Fiem stands today “I’ll Add to My Watchlist & Wait For Correction [Price is Overvalued But Fundamentals are Reasonable].”

I agree, it is a company with potential if the price corrects further or profitability improves.

What Should Be Your Priority?

So, what does all this mean for you (my readers)?

Well, if you’re considering investing in Fiem Industries after reading the moneycontrol’s report, see both the reports.

- Moneycontrol’s report might make you feel more confident about the long-term story.

- While my Stock Engine reminds you to be cautious about the current price and profitability.

Together, they give you a fuller picture to make an informed decision.

Conclusion

I wrote this blog post with purpose.

For me, this comparison is about more than just Fiem Industry’s analysis.

It is more about showing you (my readers) how accurate and reliable my Stock Engine can be (with its own set of limitations). Moneycontrol is a trusted name, and I’m thrilled to see that my algorithm aligns with them on key points like growth and competitive positioning.

Where we differ, I believe my Stock Engine adds value by being more detailed and transparent. It gives clear scores and metrics to back up its analysis.

If you’re intrigued by this, why not give Stock Engine a try? I’ve built it to help investors like us make sense of the stock market, one analysis at a time.

I’d love to hear your thoughts, jot it down for me please in the comment section below. Until next time, happy investing, and take care.