In a world marked by financial uncertainties and economic complexities, the pursuit of financial independence has emerged as a beacon of hope. It offers the promise of a life unburdened by monetary constraints. Financial independence is a concept gaining remarkable traction in recent times. It holds the potential to transform lives and empower individuals to break free from the rat race.

Imagine a life where you no longer depend on each paycheck to meet your basic needs. Your financial decisions are guided by personal aspirations rather than the constraints of your bank balance. Financial independence paves the way for such a liberating existence, where financial worries take a backseat, and your freedom of choice takes the central stage.

But what exactly is financial independence? This is exactly what we’ll discuss in this article. While discussing its benefits you’ll know about its enormity. You’ll know why nearly everyone should achieve financial freedom as their primary goal.

Let’s discuss the concept of financial independence in more detail.

#1. What is Financial Independence

It’s not just about accumulating wealth or living an opulent lifestyle. Rather, it’s a state of financial well-being where a person no longer works for money. The required money, to live a comfortable life, gets made automatically (from assets) regularly time after time.

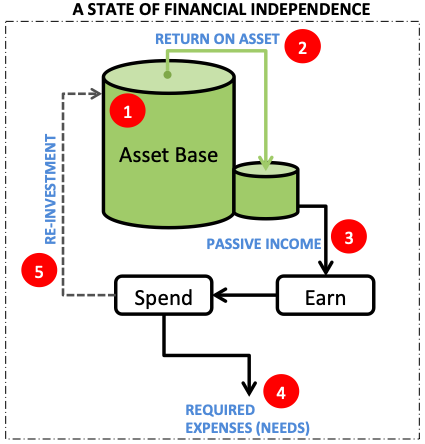

As depicted in this infographic, a person has two sources of income, work (salary) and assets (passive income). The passive income generated from assets is sufficient to manage all expenses of life. The income from work (if any) is all saved. This is a condition where the person is not working for money because his/her life needs are met from passive income.

It takes time to reach a state of financial independence. So as soon as one realizes its need, steps must be taken from that day itself.

This state of financial well-being is achieved through disciplined planning, prudent decision-making, and a purpose-driven approach to money. At its core, financial independence grants one freedom. The person (family) has the freedom to choose, pursue passions, and above all freedom to live life on their own terms.

The significance of financial independence extends far beyond mere financial stability. It transcends the conventional definition of success. It shifts the focus from the rat race of acquiring possessions to the pursuit of meaningful experiences. By gaining control over your finances, you gain control over your life. This is state of a life where your money works for you, not the other way around.

The State of Financial Independence

Financial independence is a state where one’s assets generate enough passive income to pay for the required expenses of life. In this state of independence, people need not work (do a job) to earn money. Let me show you an infographic that depicts the state of financial independence.

The state of financial independence can be broken down into five (5) logical steps. It all starts with having an ample size asset base. The accumulated assets will yield returns in the form of passive income. For a financially independent person, this passive income source is large enough to take care of the spending and re-investment needs. Let me explain to you each step briefly:

The Steps:

- The Asset Base: In this step, the money is invested and asset accumulation is done over time. The trick is to buy quality assets at an undervalued price. The assets can be stocks, mutual funds, real estate property, bank deposits, annuities, etc.

- Return on Asset: The accumulated assets should be capable of yielding regular returns. The returns can be in the form of cash (like dividends, interest, rent, etc) or capital appreciation.

- Passive Income: To achieve financial freedom, passive income is the keyword. It is a source of income that continues to yield on its own without our intervention. But to start a stream of passive income, the right assets must be accumulated. If the passive income is big enough, a person can achieve financial freedom.

- Required Expense: Let’s take the example of two brothers, one lives in a large city, and the other in a small town. In a large city, the cost of living a comfortable life is say Rs.1,35,000 per month. In a small the cost of living is Rs.50,000. So, to achieve financial freedom, the minimum passive income the two brothers will need is Rs.135000 and 50000 respectively.

- Re-Investment: The cost of living increases with time (inflation). Hence, to maintain the state of financial independence, one must re-invest and keep increasing the size of the asset base.

To reach the state of financial freedom, one must never forget the critical step of asset building. Without assets, there will be no passive income hence no freedom from the rat race.

Now that we know about what is financial independence, let’s start to discuss the process of achieving the goal.

#2. The Process To Attain Financially Freedom

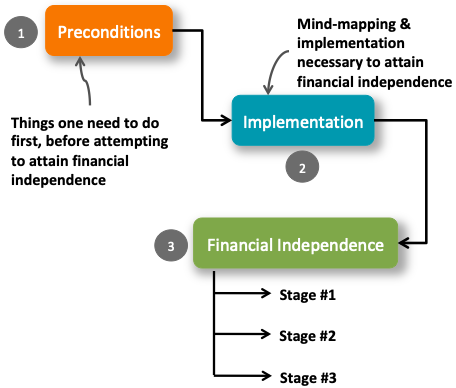

There is a process to achieve financial independence. It is a tough goal to achieve, hence following a process will make it comparatively comprehensible. We can divide the process into three stages. It starts with working on the preconditions. Once the preconditions are met, the actual implementation stage will begin. Finally, the goal of financial independence itself can be achieved in stages.

- Preconditions: There are a few things that need to be done before attempting to attain financial independence. In this stage, one tries to improve one’s financial health. These improvements in turn help one to climb the peak of financial independence. Read more.

- Implementation: This is where the core action of asset building & passive income generation is implemented. Here we will discuss how one needs to map the mind to successfully implement the idea of achieving the goal. Read more.

- Stages of Financial Independence: All financially independent people (families) are not the same. Out of 10,000 people, only one (1) can reach the first stage. Even a lesser number of people (families) can read the second stage. The third stage is rare. Maybe, only one in 10,00,000 can ever reach there. Read more to know what are these stages and how to achieve them.

Let’s start discussing the whole process with stage one, preconditions.

#3. Preconditions for Achieving Financial Independence

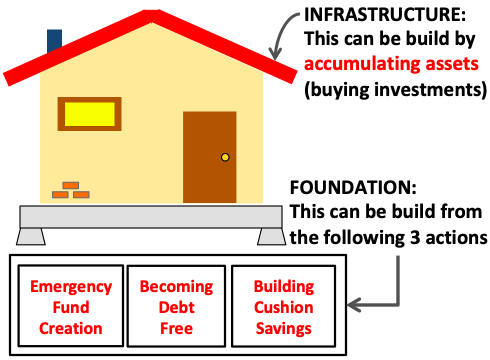

If financial independence represents a house, then these preconditions are the foundation of the house.

The goal of financial independence is such that many aspire to achieve it. But it is no ordinary goal. To achieve this goal, it is necessary to follow a process. If financial independence is the superstructure, then the foundation of this superstructure is the preconditions that we will discuss now.

There are three preconditions that one must take care:

- Emergency Fund Creation: The asset purchase should start only after a minimum-size emergency fund is created. The emergency fund consists of three components, cash, life cover, and health cover. The size of each component is linked to one’s monthly expense (E). The cash should be at least six times E. Health coverage should be at least 15 times E, and the life cover should be at least 120 times E.

- Become Debt Free: Get rid of all debt and then start accumulating assets. How to become debt free? The easiest way is to list down all debt/loans that one is carrying. Start by pre-paying the costliest debt first and then continue till all loan outstanding is zero.

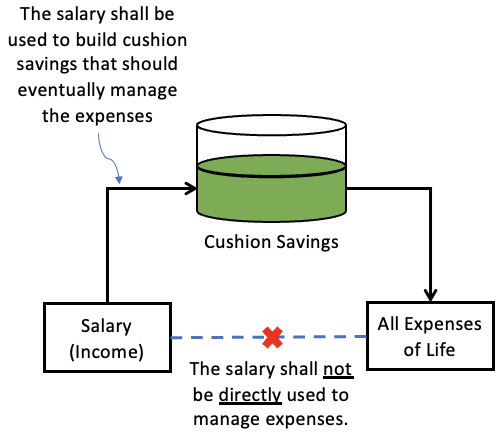

- Cushion Savings: The size of the cushion savings should be at least six times one’s monthly expenses (E). The cash component of the emergency fund will come in handy when emergency strikes. Cushion savings will be used to manage daily expenses. Save your monthly income, instead use cushion savings to manage regular expenses. Use monthly income to replenish the depleted cushion savings. In your mind, the way to manage expenses should look like this.

#4. Implementation of Financial Independence

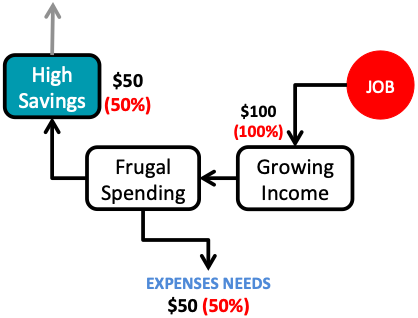

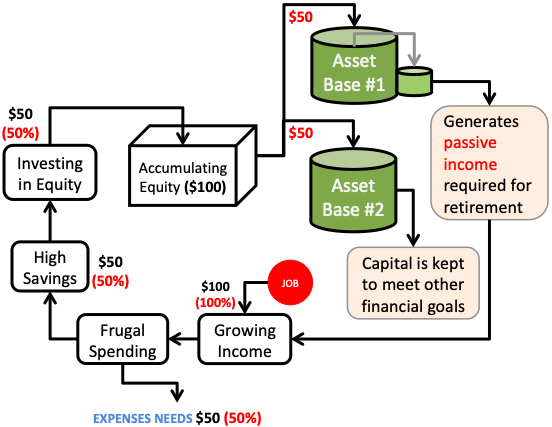

The above flow chart is a representation showing how one can visualize the implementation of financial independence. Earning money is the first step and then living a frugal life will lead to more savings. Investing the saved money to buy assets can ultimately lead to financial freedom.

Financial freedom is only one goal. In real life, one needs to manage other goals as well. So, one must simultaneously invest to manage other financial goals as well. With this simple mind-mapping, let’s proceed and see the actual implementation process of this step.

Income, Frugality, and Savings

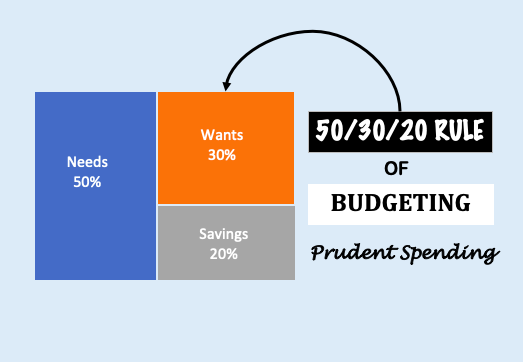

In our endeavor toward financial independence, we must learn two things, how to make our income grow continually and frugality. What is Frugal living? Maintaining a lifestyle that is lower than what one can actually afford. Our frugal habits give us the ability to save a majority portion of our income. Combine frugal living with income growth, and it becomes an endless source of savings.

Let’s understand it using an example. Suppose there is a person who earns Rs.100,000 per month. He lives frugally (saving 50% of his income). His income increases by 10% per annum. Let’s see his savings pattern for the next 5 years.

In 5 years the savings of the person rose from Rs.50,000 to Rs.73,205 per month. The person was anyways saving heavily (50%). But as the quantum of savings is increasing every year, its impact on one’s ability to invest is phenomenal.

Accumulate Equity

This is a critical milestone in the journey toward financial freedom. It must be implemented intelligently as equity investing involves a high risk of loss. But if invested properly, equity can yield high returns. In the long term, properly invested money in equity can grow at a rate of 18-20% per annum. One can accumulate equity either by buying stocks directly or through the mutual fund route.

One must continue to buy and hold equity for at least 30-35 years. When quality equity is given such longer holding times, the capital actually begins to compound. For example, investing two lakhs in equity for the next 35 years at 22% per annum will grow to become Rs.20 Crore.

It is advisable to keep two separate asset bases, one for financial independence and the second to manage other financial goals.

Keep feeding both asset bases regularly. I mean, keep buying quality undervalued equity time after time. In asset base #1, which is for financial independence, try to buy quality equity which also pays dividends. A few examples of such equity is dividend paying stocks, and dividend-paying mutual funds. Eventually, at the last few years of investment tenure, funds can be redeemed from equity to buy pure passive income-generating assets like real estate, band deposits, annuities, monthly income plans, etc.

In asset base #2, one can keep it well diversified. On one side it can be heavy on quality buy undervalued mid and small-cap stocks. On the other hand, it must also contain non-equity assets like debt funds, bank deposits, gold, REITs, etc.

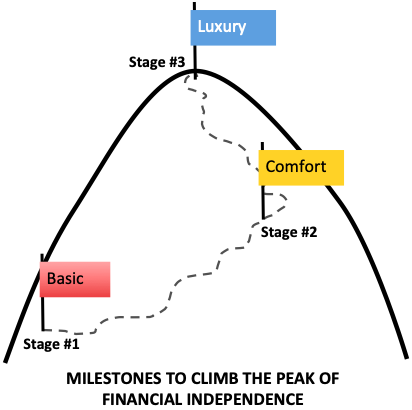

#5. Stages of Financial Independence

Breaking down financial independence in stages can help achieve it easily. Financial freedom is a goal that is like a full marathon. One cannot sprint and reach the finish line. It can be achieved only slowly, in stages. There can be three stages of financial independence:

- Stage 1 (Basic Independence): In this stage, the passive income generated from assets can fund all basic necessities of life. The basic necessities can be food, clothing, accommodation, utility bills, fees, basic subscriptions, etc. After paying for all these necessary expenses, only little is left to spend on the comforts and even less on the luxuries. For example, in this stage one’s passive income = 1.5x times the basic expense needs.

- Stage 2 (Comfort Independence): In this stage, the passive income becomes large enough to take care of all comfort needs. Comfort needs can be like a bigger house, car, etc. It can also be full-time house help, air-conditioned rooms, gymming expense, dining out, entertainment, etc. For example, in this stage one’s passive income => 3x times the basic expense needs.

- Stage 3 (Luxury Independence): In this stage, the passive income becomes large enough to take care of the temptations to spend on luxuries. Luxury spending can be big vacations, a posh house, fast cars, binge purchases, etc. For example, in this stage one’s passive income => 10x times the basic expense needs.

#6. Balancing Financial Independence and Other Life Goals

Achieving financial independence is an important goal. But there are other goals that are equally important:

- Car purchase.

- Annual Vacations.

- Home purchase.

- Higher Education.

- Marriage.

What about these goals?

It is equally important to manage other goals along with financial independence. Why? Because if not done, they will eventually eat into your built ‘financial independence assets’ anyways.

So the right strategy will be to put money proportionally in each goal separately. The idea is to keep the goal of financial independence isolated from other goals.

Final Words

Financial independence can be achieved when “required” income will continue to drip-in even when we are sleeping. We should not be required to work to generate income to manage our expense needs.

Income generated from a job or business is not passive income. It is active income. The idea is to work and generate active income. Then divert at least 50% of the active income to accumulate assets (equity).

But equity accumulation is not enough. It is more important to convert equity into a pure passive income-generating asset. Which are such assets? A few best examples of such assets are the following:

| Asset | Passive Income Form |

| Deposits | Interest |

| Stocks | Dividend |

| Real Estate | Rent |

| Annuity | Pension |

Quick Tip:

A sure way of becoming financially independent starts with living a frugal life. Frugality does not mean leading a life of misery. It means, diverting a bigger proportion of one’s income towards the net worth building.

A person who lives a frugal life ensures that a big chunk of his/her income is available as savings. This is a huge advantage. Why? Because this available liquid cash can be used to invest in equity. As equity earns higher returns, over the long term such investments can build a sizeable corpus.

- The first part of this corpus shall be used to manage the “other financial goals” of life.

- The second part shall be used for “retirement” (financial independence}.

Have a happy investing.

this post is a valuable resource for anyone looking to take control of their financial future and live life on their own terms.

You really teaches well in your blog. I have read many articles about investment but you are the best.

Awesome feedback. Thanks

Sir, Your blog post writing skill clearly proves that you are an iconic engineer.

Very good infographics explanation.

Keep it up.

love from Kerala, India.

Jai Hind!

Thanks Manish for the lovely article, can you please suggest any accounting software for individuals? Because with the fast moving world and bouquet of investments it becomes impossible to track on paper. Awaiting suggestions or perhaps worth writing an article too.

Thanks

Raj

The easiest method to track one’s investment portfolio (of stocks) is using a combination of “Google Finance + Google Sheets“. It’s free and effective.

Thanks for asking.

Hi Sir,

You are truly a gem. This is what I was searching for a long time.

Thanks for writing such a wonderful article. It can act as a life saviour for many.

Thanks,

An Engineer(*_*) craving for financial freedom.

Super feedback. Thanks

Hi Mani,

Though i have mentioned in my earlier communications,would like to mention again that i have benefited and learnt(learning) alot.Thanks to your blogs.

However,have a small clarification with regards to the difference between emergency fund(cash) and cushion savings.To me it seems the same,but,i guess not.So could you tell me what is the difference.

great article,really helpfull

Superb Article to become Financially independence.

Thanks

Dear Mani,

You really write very well.

I have a small querry. Can you please tell that equity mutual funds must be receiving dividends from the stocks in their portfolio. What do they do with these dividends.

Regards

It adds to their NAV. If you want to know about NAV of mutual funds – please read this. Thanks for your comment.

I read all articles of this blog. All are Nice & valuable articles. I cant believe that, anyone can get this much valuable information in free of cost. I always feels that, all articles proven your Name MANI i.e. MONEY.

We were slave before 1947. Bhagatsingh, Rajguru fights for our people & nations independence. Gandhi, Subhashchandra Bhos shows the way to India for Independence. Now, I am a slave of my job & Money. By implementing thoughts in articles, on every day I m feeling that, I m going near by near my goal of achieving financial independence. For Me u r my Rajguru & Bhagatsingh for showing way to financial independence. Because, you given your more than 10 Yrs Experience, Time & Effords for preparation of this Blog & showing the way of Financial Freedom to Indian People.

Now, I am 100% confidence that, if I follow Money Rules in articles, I will be definitely become financially free within next 10 Years till the age of 45 Yrs. Thank u very much for sharing path of Financial Freedom through valuable articles.

Super like

Hello Mani Sir, I am beginner stock market. How to learn stock market A to Z? Please Suggest me

Super

Hello, Tax and inflation component is not considered in the asset size calculation?

Yes this is another variable. But the point that is being conveyed is the necessity of financial independence and how should be the thought process to reach the goal.