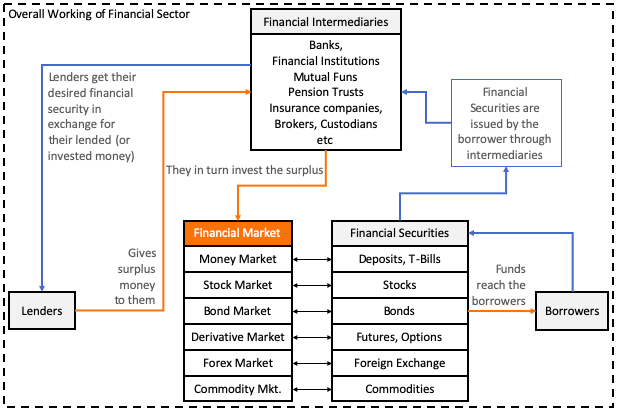

When we buy/sell stocks, this trade happens in a financial market. People trading in forex, derivatives, commodities etc do so in a financial market. Even our banks, insurance companies, mutual funds, pension trusts etc are a participant of financial market.

In simple term, we can say that a “financial market” is a phrase used to denote the total infrastructure which facilitates the trade of financial securities.

Financial securities can be like currency, bonds, stocks, derivatives, commodities, forex etc.

Financial Market

Financial market enables efficient trade of securities, and transfer of funds, between lenders and borrowers. It is the financial market which creates securities for investment. People who have surplus funds invests in these securities to earn return on their investments.

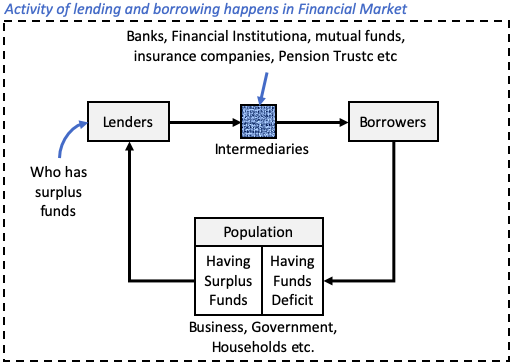

In a financial market, there is an endless activity of lending and borrowing taking place between lenders and borrowers. A typical & simplified representation of financial market is shown below:

- Lenders: These are people who have surplus funds. They invest their money in securities available in the financial market. The lenders in a financial market can be the population of an economy (like business, government, households etc). Read: Where people spend money.

- Borrowers: These are people who are in need of funds. They are in capital deficit. They borrow money from lenders through financial market and market intermediaries. Again, the borrowers in a financial market can be the population of an economy (like business, government, households etc). Read: Becoming Debt Free.

- Market Intermediaries: These are the agencies who work in an assisting role. They execute the function of fund collection from lenders, and disbursement of capital to borrowers. They also handle financial securities (stocks, mutual fund units, bonds, deposit certificates etc) on behalf of the lender and borrowers. In financial market, intermediaries can be banks, brokers, custodians, depository, depository participant etc. Without intermediaries, financial market cannot run seamlessly and efficiently.

Need of Financial Market

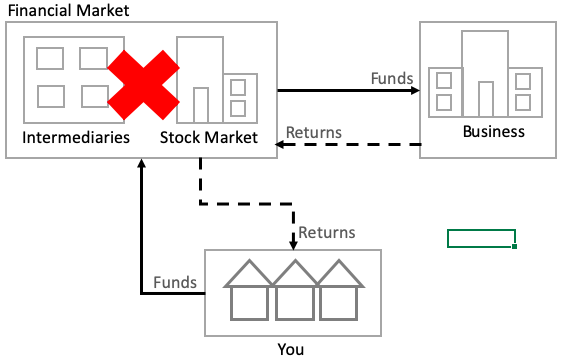

For a moment, imagine a situation where you are living in an economy which has no financial market.

You are a person who has some surplus money. You would like to invest it for growth. Similarly, there is a business which needs funds to expand. The business would like to borrow money, and is ready to pay an interest.

You live in Mumbai and business is located in New Delhi. As there is no financial market, the only way you can invest is by self-searching a worthy borrower. For the business, the situation is same. It can borrow money by only self-search of a good lender.

This kind of market is inefficient. Hence many lenders and borrowers might loose the chance of investing & borrowing. Such markets are not economic-activity friendly.

In presence of an efficient financial market, the same task becomes easy. A financial market becomes a one stop shop for all lenders/investors and borrowers. Hence the market becomes an effective source for capital generation and investment.

Structure of Financial Market in India

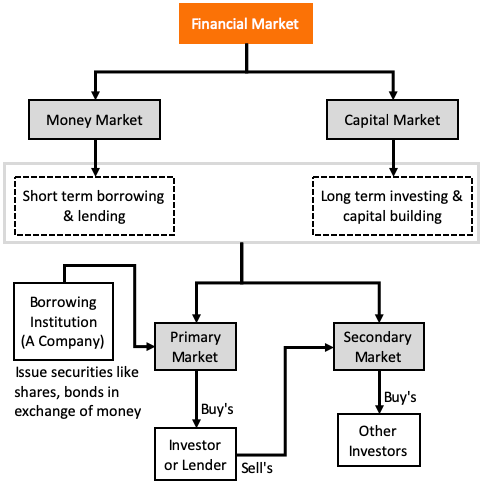

There are two main types of financial market where majority of trading is happening. The first one is money market and second one is capital market.

1. Money Market

Money market is a type of market which trade in such securities which has a short maturity periods (less than one year). Such securities are often risk free. As their maturity periods are smaller (more liquid), and the risk of loss (volatility) is also smaller, hence their yield is also less. Common men generally invest in money market through money market mutual funds.

Securities which trade in money market are T-Bills, Certificate of Deposits (CD’s), Commercial Papers (CP’s) , Repo etc. Read: Invest risk free & earn high returns.

2. Capital Market

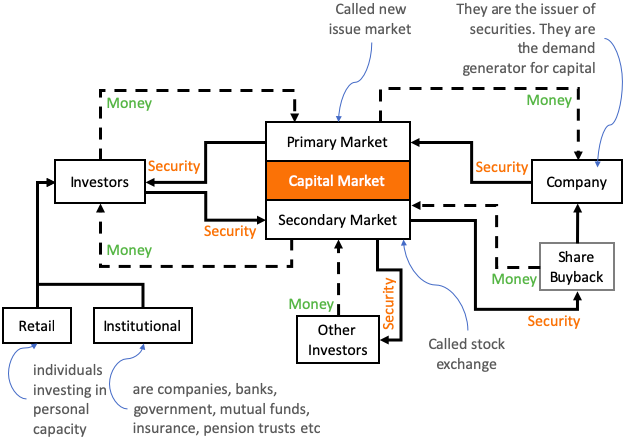

On one hand Indian household has small savings. On other other hand corporates need funds to meet their capital requirements. If an Indian household want to invest in business, it can be done through the security market. How? By buying stocks, bonds from the capital market (stock market). Capital market has further two branchings. Read: How to buy bonds.

- (a) Primary Market: This market is also called the new issue market. Company raise capital here to fund its business activity. In the primary market, companies issue their securities for the first time to public (in form of shares or bonds). It is here where the IPO’s are issued by companies. Read: What is oversubscribed IPO?

- (b) Secondary Market: Households who’ve bought the security in primary market can sell (exit) it in secondary market. When we say “stock exchange” we are actually referring to the secondary market. Here the already issued securities are traded between buyers and sellers independent of the issuers intervention. If the issuer (company) wants to buyback its shares, they have to do it in secondary market.

3. Banking System

Banks and financial institution is a part of financial market. The banking system consists of commercial banks, co-operative banks, payment banks, small finance banks etc. All the banks are overall regulated by the Reserve Bank of India (RBI). All types of banks along with RBI makes a banking system.

The primary function of banks is to collect deposits from public (lenders with surplus money), and give credits. The credits are offered in form of loans to individuals, companies etc who need capital. In this role, the bank acts as an intermediary.

While issuing the loans, banks also checks the borrowers credit worthiness. If a borrower is credit worthy, loan will be disbursed.

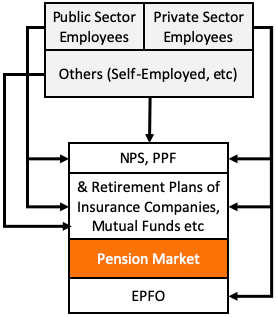

4. Pension Market

This market caters to the need of elderly. It provides securities tailor made to benefit the elderly population. As on today, still majority of Indian customers do not avail retirement benefits. Pension market aims to include all such people who has still not come under the ambit of retirement benefits.

People who work for government, or are employed by private companies are covered under NPS, EPF or PPF. But a large majority of self-employed people do not avail the retirement benefits. Pension market aims to include even them here. Read: About best investments after retirement.

5. Insurance Market

Like pension market, insurance market also has a small penetration in India. People who buy insurance mainly do it to get tax benefits (like life insurance). There are other who buy insurance as it is obligatory (like motor insurance). But insurance market is growing. With rise of financial literacy, and rise in purchasing power of the population, insurance products are selling more these days. Insurance products like medical policies, motor policies, term plans etc are picking demand.

6. Foreign Exchange Market

Forex (Foreign Exchange) Market is an online place where people can trade in currencies. As this market deals with currencies, it is the most liquid market of all. Hence traders and speculators love Forex market.

As exchange rate of currencies vary, people trade between currencies to take advantage of the rate fluctuations. The trade happens in Foreign Exchange Market. Every country has their own Forex market. All such markets are connected online – giving rise to a giant, decentralised global forex market.

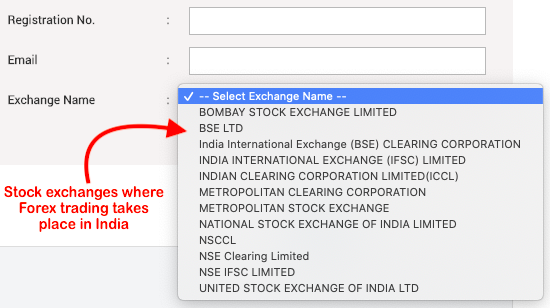

Indian law permits forex trading only in currency derivatives. In India, RBI and SEBI strictly controls trading in foreign currencies. Hence, Forex Trading in India is not as popular as stock market or money market.

But Forex trading still happens in India. As per RBI rules, forex trading through currency derivatives is allowed. Currency pairs available for derivative trading are USDINR, EUROINR, GBPINR, JPRINR.

Currency trading is allowed in NSE, BSE and MCI etc exchanges in India. Other exchanges which deals in forex treading are shown below.

To start trading, one must open the accounts with those brokers who have been permitted to trade in currency derivatives. Few such approved brokers are listed below. A more comprehensive list is available in SEBI’s website.

- Angel Broking Limited.

- Axis Bank.

- Bajaj Financial Securities.

- Bank of India.

- Bank of Baroda.

- ICICI Bank.

- HDFC Bank.

- Etc…

7. Commodity Market

Commodity trading takes place in the following exchanges in India:

| SL | Name | Traded Commodities |

| 1 | MCX : Multi Commodity Exchange | Bullion, metals, fibre, energy, spices, plantations, pulses, petrochemicals, cereals among others |

| 2 | ICEX : Indian Commodity Exchange | Gold, silver, diamond, copper, lead, crude oil, natural gas, mustard, soya bean, jute, iron ore. |

| 3 | NCDEX : National Commodity and Derivatives Exchange | Cereals, pulses, fibres, oils & oil seeds, spices, gold, silver, steel, copper, crude oil, and brent crude oil among others. |

| 4 | NMCE : National Multi Commodity Exchange | Castor seeds, rapeseed, mustard, soya bean, sesame, copra, black pepper, gram, gold, aluminium, rubber, copper, lead, zinc, jute, and coffee among others |

Who are the Regulators of Financial Market?

The process of regulating the Indian financial market is a Top Down approach. It starts from the Finance Ministry of India. The head of finance ministry is the Finance Minister. Under the umbrella of Finance Ministry comes the following regulatory bodies:

- RBI: Reserve Bank of India (RBI) makes and regulates the Monitory policies, Forex policies, Credit policies, and also regulates all banks. The control of RBI over these policies in turn influences the supply of money & credit in the market. This control in turn influences the interest rates (of deposits, loans etc). Read: About a flaw in banking system.

- SEBI: The Security and Exchange Board of India (SEBI) is the main regulatory which regulates the primary and secondary market (stock exchange etc).

- IRDAI: The Insurance Regulatory and Development Authority of India (IRDAI) regulates the insurance sector of India. It also gives licence to insurance companies. IRDAI also controls the “Tariff Advisory Committee”. This committee in turn decides the price of general insurance products. IRDAI also regulates how the insurance funds should be invested by insurance companies.

- PFRDA: The Pension Fund Regulatory and Development Authority (PFRDA) regulates the pension sector of India. It was PFRDA who has designed the structure of pension products like NPS, EPF and PPF. It is PFRDA which has decided the constituents of National Pension System (NPS). PFRDA has the responsibility of registering participants of pension fund like custodians, CRA, trustee bank, fund managers etc.

Conclusion

The Indian financial market is structured in a way to promote saving, investment and resource utilisation. Finance ministry of India makes financial policies for the public.

The participants of the financial market implements those policies for the larger good of the public and the economy as a whole. A robust and efficient financial market is not only good for the home country, but it also helps other economies of the world (as all are connected these days).

The Indian financial market has developed a lot over the past 70+ years. The way Indian economy handled the global economic meltdown of 2008-2009 is a big example.

Suggested Articles:

THANKU . IT IS EXPLAINED IN SUCH A SIMPLE LANGAUGE THAT IT CAN EASILY BE REMEMBER AFTER GOING THROUGH IT JUST ONCE

Thanks

Very well presentable infographics, as a financial adviser I have gone through your content and just want to share my opinion:

Thank you.

I’m thankful for finding your blog post. I’ve bookmarked this site and will return again soon.

Thanks

This is really interesting. There is nonetheless an existential demon within, who trembles with the realization that without the ascribed value, money, and all these institutions mean literally nothing. Or im just overwhelmed seeing such a great elaboration which you have given. Maybe as a Financial Advisor, i’m just worrisome.

5/5

Thanks for the awesome representation of your feedback.

well explained..with much information.

Thank you for sharing.

You’r welcome. Thanks.