Financial planning for doctors is essential, why?

We know that good doctors earn lot of money. So does it mean that all good doctors are rich?

Not necessarily.

Doctor is a professions which is a combination of personal skill and knowledge.

A perfect balance of both makes a doctor good or average.

Any work which is an outcomes of good skill and sound knowledge, is bound to be acknowledged.

Hence a skilful and knowledgeable doctor makes loads of money.

But does this earned money makes the doctor rich?

The doctor may have lavish lifestyle.

He may be travelling on BMW’s and Bentley’s, but he may still not be rich.

So the question remains, who is rich?

Rich people have massive investment portfolios.

These investment portfolios generates returns for them.

These returns in turn makes them financially independent which eventually supports their lifestyle (even if it is lavish).

So, in order to become rich a person must have a sizeable investment portfolio and must also be financially independent.

What are the routes in building an investment portfolio?

It is important to have a plan.

Yes, I am talking about financial planning for doctors.

It is common to find high earning doctors almost alien to the concept of financial planning.

What is the first step?

Doctors must understand that their income alone does not guarantee their financial well being.

They must start building an investment portfolio.

Why Investment Portfolio?

Earning: gives cash in our hands.

Spending: takes cash out from our hands.

Saving: tell us to spend less and earn more (living within our means).

Investing: asks us to lock our savings, and also earn higher returns (than savings).

So, earning more money is only the first step of becoming rich.

What is essential ultimately is to invest money in right investment options.

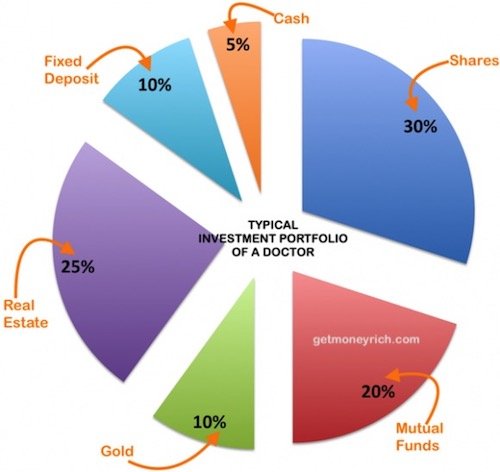

A combination of several investment options is collectively called an investment portfolio.

But why one need to buy several type of investments?

Why we cannot buy only shares (say)?

Putting all eggs is one basket makes it risky.

This is an easy and more bookish explanation.

More practical understanding of why combination of different types of investment options makes good portfolio is this….

One must always be in a look out for good investments.

Always means, every day, 365 days a year.

But if ones focus is only shares, it will be difficult to find one, more often.

So better is to keep our attention on more things than one.

When a good real estate property is available, buy one.

When gold is available at a nice rate, buy it.

Mutual funds one can keep accumulating every month through SIP.

When market is not behaving properly, buy fixed deposits.

To maintain a reasonable liquidity in your investments, keep some money parked in cash.

During stock market crash, there are no better investment options than quality stocks.

The point is, accumulating different type of investment options will make the creation of an investment portfolio more like a smooth progression.

Core Strength of Doctors

Doctors know the healthcare sector more than the others.

So will it not be right for the doctors to take an investment call in this sector?

I personally think that doctors have an edge here.

#1. Shares:

Talking about shares, following sectors is specifically assigned to the health care sector:

- Drugs and Pharmaceutical Companies

- Hospitals Chains

- Clinic Chains etc.

It will not be a bad idea for doctors to buy stocks of these companies.

But this is also a fact that any stock must be first researched thoroughly before commitment.

So how doctors, who are professionally like alien to the world of finance and investing can research stocks?

There are no easy answers. But it is also a fact that learning this skill is not impossible for doctors.

A person who has qualified all exams of MBBS/MS/FRCS etc, has such an high level of IQ that learning this new skill becomes more possible for them.

Read more about the Stock Analysis Worksheet.

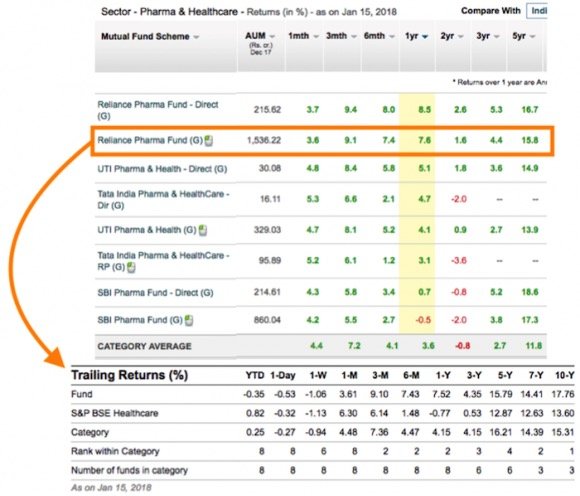

#2. Mutual Funds:

There are mutual funds which predominantly invest in the healthcare industry:

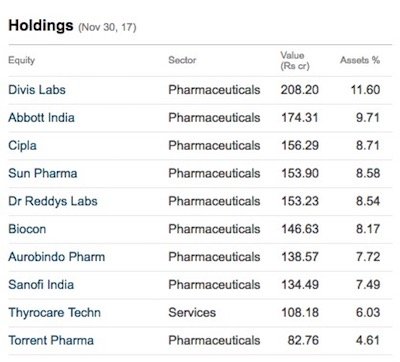

It will be a good idea for the doctors to look inside the holdings of a mutual fund.

If those holdings match with their idea of a good businesses, then they can invest in that mutual fund.

Just for example, I have provided here top holdings of “Reliance Pharma Fund”:

Doctors can consider investing in such sector funds. This will be also like investing within ones circle of competence.

#3. Retirement Plans:

Established doctors like to have their own clinics/medical centres.

This is a very direct hint that the Doctor’s community prefers the idea of financial independence more than others.

This is why majority good doctors works as consultants for hospitals and not as full time employees.

But one small limitation of being self-employed is that, one needs to take care of the retirement linked savings themselves.

For such doctors, I would coin the idea of accumulating retirement savings as below:

- Gather balanced mutual fund units through SIP route (frequency: monthly).

- Accumulate gold in form of Gold ETF’s (frequency: annually).

- Keep accumulating bank/corporate deposits (frequency: semi annually).

- Maintain 20% of investment portfolio as cash.

#4. Real Estate:

Real estate is one investment options that is a perfect inflation hedge.

Doctors can buy a real estate property as efficiently as any expert.

The care that must be taken are the following:

- Buy the property during its project launch phase.

- Property must me located in area which is very accessible.

- Go for a reputed builder.

- Try to buy the property by paying maximum portion from self contribution (loan component should be less than 50%).

Final Words…

Investment of money is easy.

The only care one must take are the following:

A) Before investing, build an emergency fund (minimum size : 6 x present monthly income).

B) The emergency fund must be ever growing.

C) Invest regularly.

D) Always buy investments with self research.

E) Never buy overvalued investments.

F) Never touch your investment portfolio (even during emergency).

G) Sell your present investment holdings only to buy a new undervalued one.

H) Set short term and long term goals for your investment portfolio (like: Rs.50 lakhs in 7 years and Rs.1 crore in 10 years).

A doctor who is skilful, well educated and is also rich, is good for our society.

I personally feel that our farmers, teachers, doctors and scientists are those people who deserves to live a fuller life.

This can be made possible only if they start investing their money.

The best investment for doctors can be in sector funds and healthcare stocks.

Doctors investing in real estate sector is also common.

Investing in real estate is easy but is more capital intensive.

Doctors for whom fund is not a problem, must consider buying residential or commercial properties.

A sound financial planning for doctors should be directed towards building an income generating investment portfolio.

Following investment options can generates regular income:

- Dividend paying stocks.

- Dividend paying mutual funds.

- Rent yielding real estate property.

- Interest yielding bank deposits.

So at the end, what is that one financial advice for doctors that can change their lives forever?

“In addition to earning more money, doctors should also focus on creation of a very sizeable investment portfolio”.

Have a happy investing.