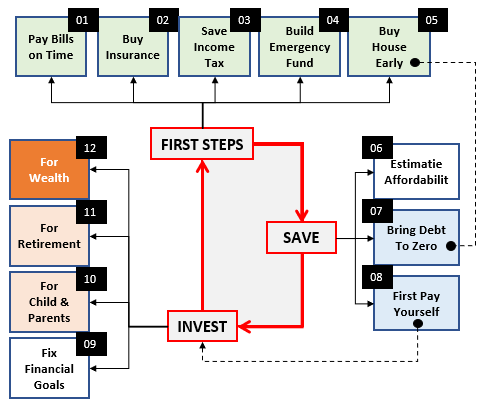

The objective of this blog post is to highlight the requirement of the 12 steps of financial planning in Your 20s. There are three stages to financial planning shown in this post. It starts with taking the basic first steps. Then the person should graduate to the savings mode and finally to the investment mode. All 12 steps are part of these three stages. For quick answers, please read the FAQs.

Introduction

To lead a decent life one needs money. Financial planning deals with the money management required to plan for future needs. One must have sufficient money to meet the current expenses and also the forthcoming future expenses.

The current expenses can be managed from the income (salary) we generate from our job/business. A predictable income makes the current expense management even more sure. Generally, people focus more on their immediate needs. Hence, for the majority, their job and business take priority. It is common for people to lose track of their future needs.

But people cannot fail to foresee their future expense requirements. Most of the time, these future requirements are very cost-intensive and unavoidable. Due to the capital-intensive nature of these requirements, it is imperative to start financial planning very early in life, like in the 20s. A few examples of such requirements are higher education fees for children, medical emergencies, retirement funds, etc.

An early start in the 20s can make these cost-intensive goals easily achievable.

Video [Hindi]

A 12-Step Financial Plan

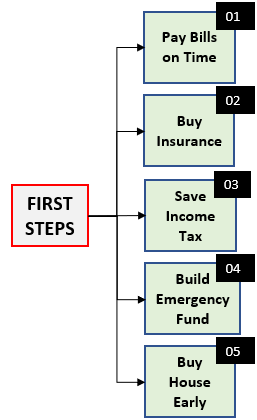

The whole process of financial planning can be clubbed into three MODES (Categories), First Steps, Save Mode, and Invest Mode. Before we go into the saving and investment mode, it is necessary to first build the basics. It is done in the first steps. The first five (05) steps of the financial planning process are like building a strong foundation of a tall structure. The success of a financial plan is deeply rooted in these first five steps.

Once the first steps are complete, the next steps deal with SAVING and INVESTING. The activities of the SAVE and INVEST modes can be executed in parallel. In the SAVE mode, the activities will help one to plan and extract a few savings from one’s income streams.

The money set aside in the SAVE mode is then invested in the INVEST mode. Here the money is invested to make it grow over time. It is a wealth-building mode. The wealth accumulated in these steps can then be used to manage future needs.

Let’s know more about these three modes in more detail.

THE FIRST STEPS

The first steps are like a financial foundation-building mechanism. What we’ll do in these steps is taking care of the basics of our finances. It starts will exposing people in their 20s to get into the habit of paying bills regularly. It will also ask them to start planning their tax liabilities. Finally, it will expose them to managing emergencies in life.

Habit Building

- #01 Pay Bills On Time: This is the first step. Learning to clear the dues on time is essential for people in their 20s. One must have a pre-prepared list of bills that must be paid by the first week of each month. The billing cycles can be monthly, quarterly, semi-annually, or annually. Preparing a list and reviewing it at the start of every month is the key. I have a phone alarm that reminds me to review my bill list on the third of each month.

Safety Net Building

- #02 Buy Insurance: It is essential to buy at least three insurance covers, life, health, and auto in one’s 20s. Out of the three, the most relevant to the majority is health coverage. One must also buy a term plan as their cover for life. Though third-party auto insurance is mandatory, a comprehensive or a zero-dep policy will be a better value for money. The health coverage must be half of one’s annual income. Life cover must be at least 10 times the annual income.

- #03 Save Income Tax: It is mandatory for everyone to clear their income tax dues. But one can reduce tax liability by following government-allowed methods. It is the government’s way to incentivize people to save & spend money in a certain way, thereby rewarding them with tax deductions. As far as possible, one must fully utilize all methods so as to keep their tax liability to a minimum.

- #04 Build Emergency Fund: The size of the emergency fund must be at least 6 times the monthly income. If the monthly income is Rs.1 lakhs, the minimum size of an emergency fund is Rs.6 lakhs. The emergency fund acts like a cash safety net to care for the unplanned exigencies of life.

Build A Shelter

- #05 Buy A House: People in their 20s must buy their first house at this age. At this age, a majority will not have the capital to fund a house purchase. Hence, opt for the most affordable house. Even if the budget house is not available in the current city, try it in your native place or elsewhere. Do not hesitate to take a home loan and ask your parents for partial funding. Even if you cannot live in the house, buy & put it on rent. Idea is to have a real estate property in one’s 20s.

THE SAVE MODE

In the SAVE mode people are doing their best to spare a little cash from their income. In the FIRST STEPS mode, people learn to spend money in a certain way. Here, one learns to build savings. The ability to save here will enable investments in the next step. This step is most crucial for people in their 20s as it does not talk about traditional saving methods. In the SAVE mode, one has to do only three things:

What is My Affordability?

- #06 Estimate Affordability: First list down all expense line items. Suppose you’ve identified ten expenses and your monthly income is Rs.1,00,000. Now, allocate a suitable expense estimate against each expense line item. The total of all these estimates must equal your monthly income. Suppose you’ve allocated an expense estimate of Rs.8,000 for groceries. This value of Rs.8.000 indicates your affordability limit for groceries. Though your monthly income is Rs.1,00,000, your actual grocery affordability is only Rs.8,000 per month. Read more about the concept of affordability.

I’ve A Home Loan, What To Do?

- #07 Bring Debt To Zero: One bought a budget house in step #05. To cut down on the interest expense load, now, the loan prepayment becomes essential. The more one will prepay the home loan, the sooner he/she will become debt free. The bigger purpose of loan prepayment is to become debt-free, but prepayments can also save one lakh of rupees over time. So, taking a home loan in step #5 was a kind of compromise. But combining it with your ability of loan prepayment will make it a blessing in disguise in times to come. How? Prepayment will make you debt-free faster, plus you’ll also have a real estate property. In the later years, you can leverage this early-bought house to buy a bigger house.

How To Fund Investments?

- #08 Pay Yourself First: It is a concept of Robert Kiyosaki. Like a company pays salaries to their employees, one must pay self a specified amount of money each month. As soon as the salary gets credited into one’s bank account, transfer a pre-decided amount each month to your investment account. From that account, all investments shall be financed. It might look like a simple step, but its effectiveness is pristine. Read more about the pay yourself first concept.

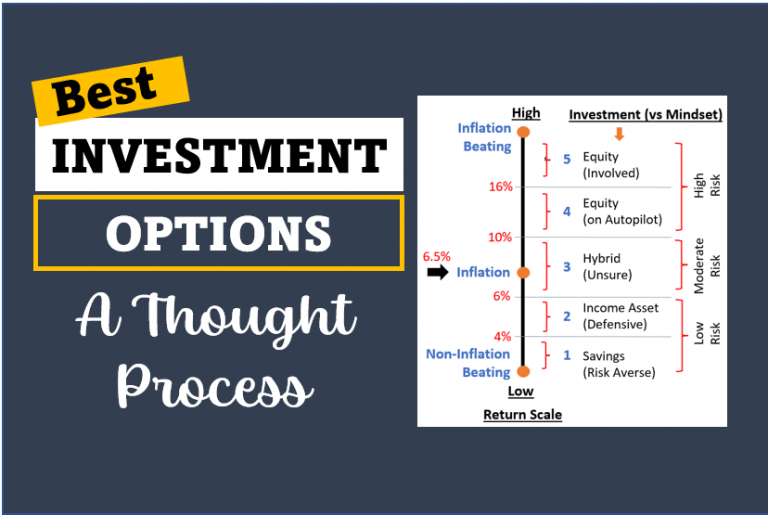

THE INVEST MODE

The INVEST mode is all about investing. The money saved, using a holistic saving mechanism in the earlier steps, is now ready for investing. A properly invested money gets the power of compounding. It grows on its own. The longer the money stays invested the bigger it becomes due to the compounding effect. In all the steps that we’ve seen earlier, all was done to ultimately enable one’s ability to invest consistently. Here the key is consistency. Had we not bought insurance, saved tax, build emergency fund, bought a house, minimized debt, consistent investment was not possible.

It is a critical step. If the FIRST STEPS were about foundation building, INVEST mode is about the superstructure construction. What’s done till step #08 was to lay the foundation for this superstructure.

Why I’m Investing?

- #09 Fix Financial Goals: Before one starts to invest the first dime, the goals must be identified. The goals could differ from person to person. So, it essential is to sit down and think about it intently. If possible take the help of family members. The purpose should be to identify the top three or four most capital-intensive goals that will come in the later years. As per a general understanding, I’ve shown three typical financial goals, child/parent plan, retirement, and wealth building.

Two typical Goals

- #10 Child & Parent Plan: The expenses towards one’s child and dependent-aged parents could be very cost intensive. The majority of us will not be able to fund such an expense right at its fag end. Hence, it is essential to preplan for it and start allocating an investment account for this cause. The child-related expenses could be higher education, marriage, etc. Starting a SIP in a multi-cap mutual fund when the child is 4-5 years of age will work. The parent-related expenses mainly originate from health emergencies. Hence, buying a suitable health policy when the parents are in their 50s will be ideal.

- #11 Retirement Plan: Planning for one’s retirement should be an uncompromisable priority. For salaried people, a major part of the retirement fund gets built through their EPF and Gratuity contributions. But often, it is not enough. Here also, one can start a SIP in a multi-cap fund right from the 20s. In the next 30-35 years, a small contribution of Rs.2,000 per month could build a corpus of Rs.3 Crore at 15% per annum ROI. Use this retirement planning calculator.

The Ultimate Financial Goal

- #12 Wealth Building: The ultimate purpose of starting financial planning in your 20s is to let you achieve the goal of financial independence. I personally execute the previous eleven steps just to enable my ability to fund my financial independence. My aim is to build a passive income-generating wealth big enough to make me independent in life. I have a separate investment portfolio marked as “FOR FINANCIAL INDEPENDENCE”. I keep adding quality stocks to this portfolio time after time. I’ve been doing it since 2008-09. Now after all these years, I can actually see my goal becoming a reality in the next years.

Conclusion

I’ve carefully picked and placed these twelve (12) steps in a specific order and priority. Though step#12 is the ultimate one, to ensure that it becomes a reality, the other preceding eleven (11) steps cannot be ignored. I wish I could reverse time and start executing such a financial plan when I was in my 20s. But at that time I was a novice. Though I started late, today I can confidently say that this journey is worth the experience. If you too ‘ve not prepared financial planning in your 20s, do not delay further. Start taking these twelve steps from today.

FAQs

Personal financial planning is a strategy to list and schedule specific tasks organized in a way to make an individual or a family achieve its financial goals. It is especially important and necessary to achieve those goals that are cost intestine. An average middle-class person can use the financial planning method to achieve goals that otherwise might look beyond reach.

The primary objective of financial planning is to enable people to achieve their financial goals. Goals may differ from individual to individual. For me, the main objective of my financial plan is to let me reach the ultimate goal of financial independence (step #12).

We all know that saving and investing are essential for wealth building. But why do only a few people become wealthy in life? Because only saving and investing is not enough. It must be done with a purpose and a goal. Financial planning acts as an integrating factor that binds and organizes all actions involving money toward fulfilling one’s life goals.

All activities (12 steps indicated above) of a financial plan has its importance at their own places. It will not be wise to highlight one activity as more important over the other. But if I’ve to take a name, I consider investing for wealth building as most important. I’ll also like to point my preference for loan prepayment (step #07) and pay yourself first (step #08).