Salaried people can afford a bit of mismanagement in finances. But financial planning for non-salaried people must be spot on.

Income of salaried people are predictable.

But for non salaried people (like freelancers, business men etc), income forecast can be tough.

Monthly/annual income of non salaried people are irregular.

What I mean by irregular? The tendency for income to fall below the expectation.

If the income is soaring, we do not mind this side of irregularity, right?

But irregularity leading to income depreciations is not acceptable.

For people in job, certainty of income is very high (until job-loss).

In fact receiving monthly paycheck almost become a compulsive habit.

But for business men, freelancers etc, such luxury does not exist.

They may be making decent income one month, then suddenly the money flow may start to gradually fade away.

Income depreciation may be due to several reasons:

- Below par deliverables.

- Better competition.

- Lack of innovation.

- Limitation of know-how.

- Unforeseen troubles.

- Etc.

Why I listing these points here?

To help us realise that, for non-salaried people, there are too many variables that can hit their income.

Whereas for people in job, these variables may not effect them in short term.

Allow me to explain this point more clearly. Why?

Because this blog post is based on this anecdote.

If we can relate to this anecdotal assumption, the objective of this blog post will be established.

What is the objective?

To ascertain a method of financial planning for non salaried people whose income is irregular.

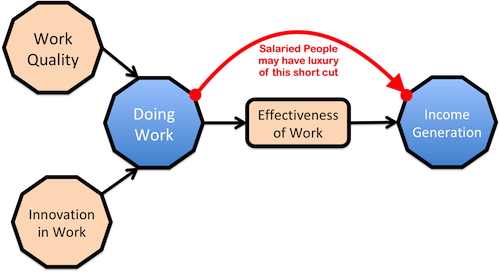

Workflow and its relationship with income…

In long term, let it be salaried or non-salaried people, the only form of assured income generation is this:

- Do your work (Maintain quality, innovate frequently, ensure effectiveness of work)

- Generate assured income.

People who are programmed to rise high in their careers will follow this workflow.

But there is a bit of consideration for salaried people. What?

In short term, they may not pay lot of attention to quality, innovation and effectiveness.

Only if they are doing regular work, their income is assured.

But for non salaried people, this consideration is minimal. How?

There is an immediate effect on income if they do not innovate, maintain quality, and ensure effectiveness.

Hence, even average people tend to perform better in jobs. Same people may not do as well in self-employment space.

What it the point? How this understanding helps in financial planning?

Non salaried people are more exposed to the risk. They are more vulnerable to the side-effects of poor workflow.

Even salaried people, they tend to take their income for granted and undermine the importance of “good workflow”.

Hence, unknowingly they also expose themselves to risks of non-salaried people.

The financial planning tips that will be shared in this blog post will help both, salaried and non-salaried.

These tips are more for non salaried people, but if salaried people also follows it, their benefits will be amplified. How?

A combination of “assured income and healthy financials” ultimately leads to riches.

Financial Planning for non salaried people…

Income of non salaried people are irregular.

This gives jitters to people who are not mentally prepared for this irregularity.

How to get prepared? Solution is to compromise? Not at all.

Preparedness is in building healthy financials.

How to build healthy financials?

- Makes a sound financial planning.

- Stick to the plan forever.

What is the plan?

Before we see the plan, allow me to repeat this important consideration again.

What ever plan we will discuss here will be on a backdrop of “uncertainty of income”.

- What happens if income falls?

- What happens if income stops?

What is the plan?

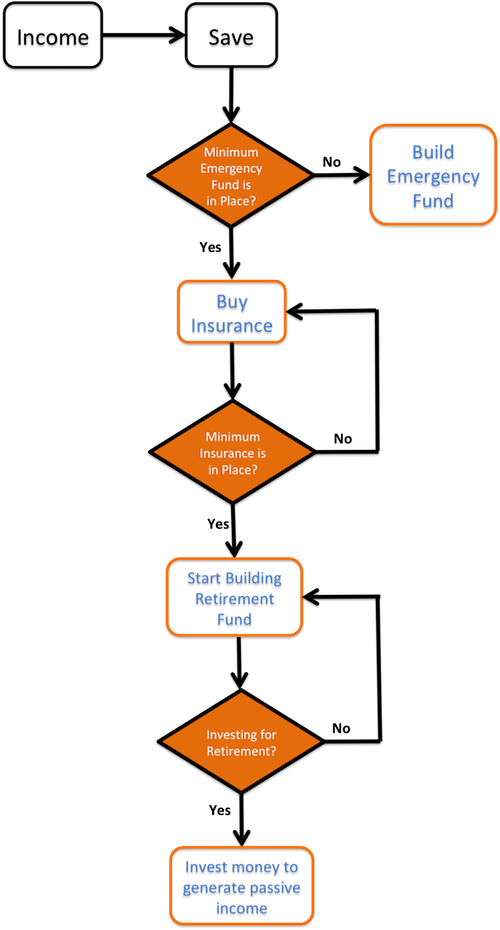

If our personal finance is an elephant, then it must stand on these four (4) powerful legs:

- Emergency Fund.

- Passive Income.

- Insurance.

- Retirement Fund.

So the plan is to strengthen the four legs of the elephant.

How to do it? Following this investment plan will help.

#A. Build an Emergency Fund…

What is the immediate answer to these two following questions:

- What happens if income falls?

- What happens if income stops?

Quick answer is, fall back on your emergency fund.

What is emergency fund? Savings safely stashed away in bank deposits (say).

How big should be the emergency fund? Bigger the better.

Keep increasing the size of emergency fund with time.

Remember, it the size of emergency fund that can make people really rich. How?

- Investments may ditch.

- Money in bank will never ditch.

Not that building investment portfolio is a waste of time, but building the minimum emergency fund should be the priority number one.

What means by “minimum” emergency fund?

Minimum Emergency Fund = 6 x monthly income.

The investor must first build the minimum emergency fund. Once this fund is in place, go to step 2.

For a salaried person, minimum emergency fund could be lower (3 x monthly income).

But for non-salaried person, as income is not as regular, 6 x monthly income will be necessary.

What is the logic? If something goes wrong, the person has at least 6 months worth of income, in savings, as back-up.

It also means that the person has 6 months time to take recovery action.

Read more about where to keep emergency fund…

#B. Buy Sufficient Insurance…

Who needs insurance more, salaried or non-salaried person?

Requirement of insurance for both will be same.

The quantum of insurance may vary based on ones standard of living.

But again, the salaried person has a distinct advantage here. How?

Generally, salaried people get some insurance from their employer:

- Life Insurance (for employee).

- Accident Insurance (for employee) &

- Medical Insurance (for family).

But for a non-salaried person, there is nobody else to take such care. Hence, it must be done by self.

Which insurance are must for non-salaried people?

- Life Cover* (minimum, 15 x annual income).

- Medical Insurance (minimum, 5 x monthly income).

* By life cover, I am referring to a pure term plan.

In case one is paying EMI for home, it will be good to buy a home loan protection insurance as well.

In case the family has children, it will be considerate to buy a child plan.

What about endowment plans? I personally see the other way when it comes to fulfilling my investment needs.

But for people who are risk averse, endowment plans are a decent “savings + investment” option.

[P.Note: Buying only insurance cover is not enough. It is equally important to pre-guide the members of the family on how to use it in case of need.]

#C. Building Retirement Fund…

It takes time to build a decent retirement fund.

What is the time horizon? 20-25 years minimum.

Hence, this is one financial goal that must start early and shall continue till income is flowing in.

For salaried people, contribution to retirement fund shall continue till one is employed (till retirement).

Please note that, this is that fund on which all fall-back plans are based for the retired life.

Hence, it is better to contribute the maximum for building a sufficiently big retirement fund.

For salaried people, EPF can generate a healthy corpus. But contributing at least 5% extra from ones pocket, to EPF fund, will be a good idea.

For non-salaried people, unfortunately there are no options like EPF (Employee Provident Fund).

But never mind, non-salaried people are anyways tough 🙂 (joke)…

So what a non-salaried person can do? Take equity route to build the corpus.

But isn’t it risky? Equity is risky, but it is manageable. How?

In building a retirement corpus there are 2 distinct advantages (compared to other goals):

- Available Time horizon is long (20-25 years).

- The fund will not get consumed on the date of retirement.

Hence, one can take calculated risks in building a sufficiently big retirement corpus.

How much retirement corpus is big enough? I will suggest you to read this article for better clarity.

As a rule of thumb, retirement corpus should be 35 times the gross annual income (CTC).

#D. Invest to Generate Passive Income…

This step might confuse some people. Why?

One might think, if in step #C retirement corpus is already getting taken care, why to invest more?

Step #C is taking care of “retirement”.

Step #D will take care of “uncertainty of income”.

Yes, Step #D is more applicable for non-salaried people. But I personally think that, generating passive income makes sense for everyone.

How passive income will help the non-salaried people?

Irregular income is like a perennial problem of freelancers/business men.

But it is possible to build a more stable (parallel) source of income.

This parallel income yields on its own. No intervention is required to generate this income.

This is why it is called passive income.

Note the following 3 characteristics of passive income:

- It is stable.

- It is a parallel income (side income).

- It yields on its own.

In terms of stability (predictability), passive income beats even the paycheck from job.

Hence, even salaried people must enthusiastically take steps to generate passive income.

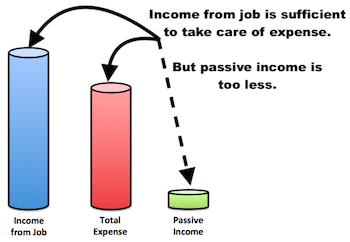

How passive income helps?

Consider this example of a person whose passive income is negligible.

What happens to this person?

To take care of all expenses of life, this person is totally dependent on the income from job.

Passive income is almost negligible.

Now suppose, income of this person is “irregular”. What happens to the “expense management”? Mayhem for sure.

What can be done? Generation of more passive income.

If passive income is sufficiently more, any variation in tradition income (job, freelancing, business) can be absorbed.

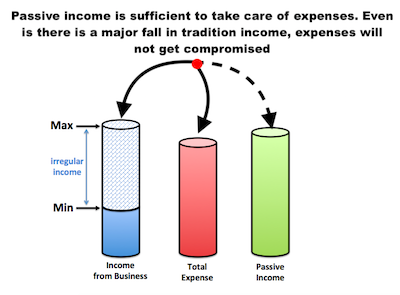

Lets see another example of a person whose passive income is sufficiently big, and traditional income is wavering:

What happens to this person?

This person is financially independent.

On one side there is a traditional income to take care of regular expenses (so what if it is irregular).

On other side, there is sufficiently big passive income to fall-back upon in times of need.

This should be the ultimate goal of all non-salaried people.

Conclusion…

Non salaried people are exposed to more risks compared to salaried people placed in safe jobs.

What is the main risk for non salaried people? Irregular income.

How to manage this risk? By effective financial planning.

A lot of hard work plus luck is necessary to keep income falling below danger level.

Hard work shall be focused on two areas:

- Effectiveness of work.

- Following a financial plan in parallel.

Though it is easy to talk about “effectiveness in work”, but practically luck also plays its role here.

Everyone is not lucky. And managing luck is also not in anyones control.

So what can be done?

- Build a financial plan.

- Follow the plan to its core.

The ultimate aim of the financial planning should be to make oneself safe.

How to be safe? Build a safety net.

The safety net includes what? Keywords. Which keywords?

These are keywords for perfect financial planning for non salaried people:

- Emergency fund.

- Insurance.

- Retirement corpus.

- Side income (passive).

A non-salaried person must aspire to build the finances so healthy that the dependency on regular income (for managing expenses) is bare minimum.

Have a happy financially independent life.