Don’t Want To Read? Listen to the Podcast

Introduction

If you are trying to dive into the stock market, it can feel overwhelming.

With thousands of companies listed on the Indian exchanges (BSE and NSE), how do you pick the right ones?

It’s like looking for a hidden gem in a crowded market.

That’s where a stock screener comes in handy.

It’s a tool that simplifies your search and helps you find stocks that match your goals.

In this post, I’ll walk you through how to use a stock screener, specifically the Big Screener in the Stock Engine app (see here), to analyze your preferred stocks in a smarter way.

So let’s get started!

Why Use a Stock Screener?

Imagine you’re at a busy vegetable market, trying to find the freshest tomatoes. You wouldn’t check every single one, right? You’d look for specific qualities: bright red, firm, no blemishes.

A stock screener works the same way.

It filters thousands of stocks based on criteria you set, like a company’s size, profits, or recent price changes. This saves you hours of research.

Instead of drowning in data, you focus on stocks that fit your strategy.

Getting Started with the Stock Engine App

A new user recently started using the Stock Engine app, and for him it’s been a game-changer.

The app offers two ways to screen stocks:

- Screener Themes: These are basically pre-built (pre-coded) filters, perfect for beginners. Want to find undervalued stocks or fast-growing companies? Just pick a theme, and you’re good to go.

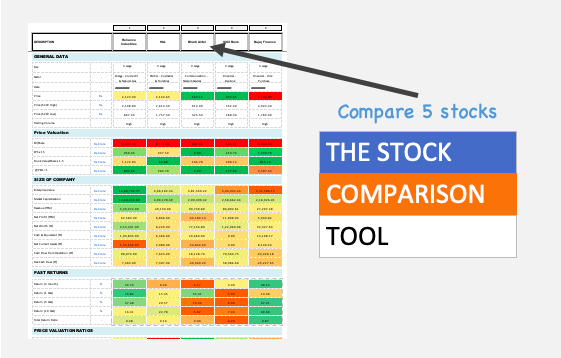

- The Big Screener: If someone wants full control, the Big Screener is where the magic happens. It lets you create custom filters using over 40 metrics.

The big screener gives a lot of flexibility in the hands of the users to screen stocks the way they want.

Exploring the Big Screener

For stock investors, the Big Screener feels like a playground.

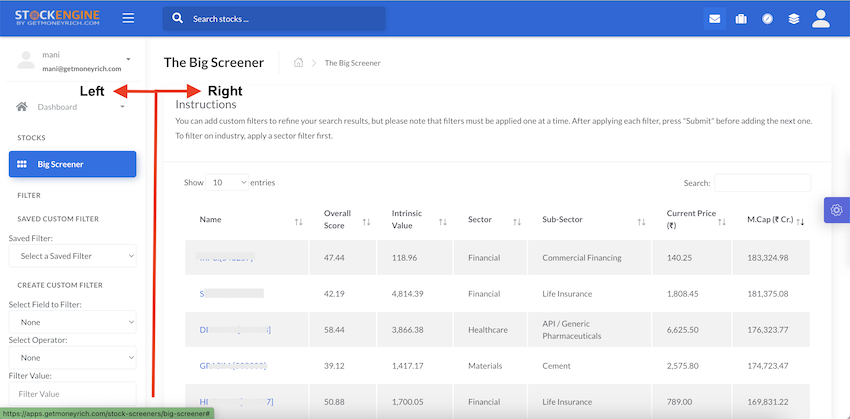

When you open it, you’ll see two sections.

- The left side is where you set your filters.

- The right side shows the list of stocks that match your criteria.

It’s clean and simple to use.

You can filter by things like market cap, P/E ratio, or even recent price drops.

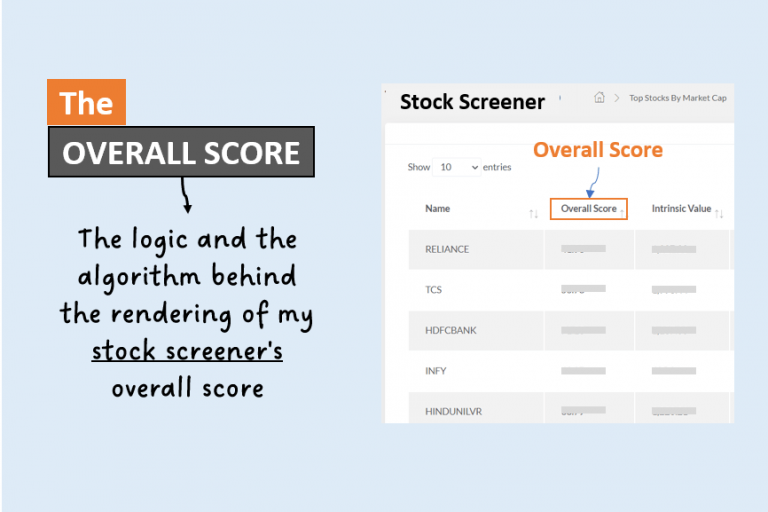

The app also gives you an Overall Score (which is a scoring algorithm out of 100) and an Intrinsic Value for each stock.

These two parameters help you judge a stock’s quality and whether it’s priced right.

How to Build Your Own Filter (In Big Screener)

Let me walk you through setting up a filter. It’s easier than it sounds.

Here are the steps:

You start by picking a metric, like “Price to Earnings (P/E) ratio.” Then, you choose an operator, like “less than” or “greater than.” Finally, you enter a value and hit “Submit.” That’s it.

You can add multiple filters to narrow down your list.

For example, I once wanted to find undervalued growth stocks. I set three filters: P/E ratio below 20, PEG ratio below 1, and EPS growth above 25%. Within seconds, the Big Screener showed me a list of stocks that fit the bill.

It felt like I’d cracked a code.

Example 1: Finding Undervalued Growth Stocks

Let’s try a real example.

Suppose you’re looking for companies that are growing fast but aren’t overpriced.

You could use these filters:

- P/E ratio ≤ 20: This finds stocks that are reasonably priced compared to their earnings.

- PEG ratio ≤ 1: This ensures the stock’s price aligns with its growth rate.

- Income Growth > 20%: This targets companies with strong revenue growth.

Set these up in the Big Screener, and you’ll get a list of stocks that meet all three conditions.

It’s like finding companies that are both affordable and have big potential.

I tried this recently and found a few mid-cap firms in the IT sector that looked promising.

Always do your own deeper research on each filtered stock; filters are just the start.

Example 2: Spotting Quality Stocks After a Price Drop

Another strategy I love is finding strong companies whose prices have recently fallen.

These could be good buying opportunities.

For this, you might start with larger companies to ensure stability.

- Try a filter like Market Cap ≥ Rs. 10,000 crore.

- Then, add a filter for stocks that dropped 5% or more in the last three months (3-Month Return ≤ -5%).

But here’s the catch: a big market cap doesn’t always mean a quality company. So, adding filters for financial health is also necessary. Try the following:

- Debt-to-Equity ratio below 0.3 and

- Return on Equity (ROE) above 20%.

These ensure the company is profitable and not drowning in debt.

Last week, I used this setup and found a couple of pharma stocks that had corrected but had solid fundamentals.

It’s exciting to spot these opportunities.

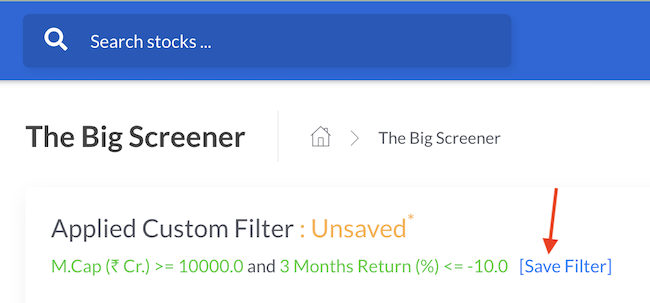

Saving Time with Custom Filters

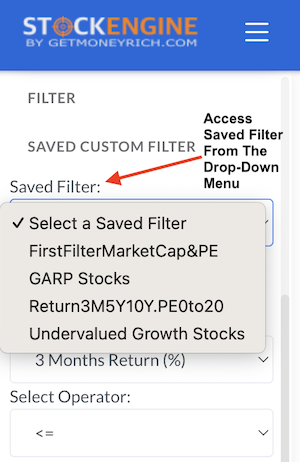

One feature I can’t stop raving about is the ability to save your filters.

Once you’ve set up a filter, like the undervalued growth stock one, you can save it with a name, like “My Growth Picks.”

The next time you log in, just load it from the “Saved Custom Filters” section. No need to rebuild it from scratch.

This is a lifesaver when you’re juggling work, family, and investing, like most of us actually do.

Digging Deeper into Your Results

Once your filters are applied, the Big Screener shows a list of stocks on the right side. For each stock, you get key details: current price, market cap, P/E ratio, and more new custom columns depending on the filters you’ve applied.

The Overall Score is particularly useful. It’s based on factors like profitability, growth, and financial health.

If a stock’s price is below its Intrinsic Value, it might be undervalued.

Clicking on a stock’s link takes you to a detailed page with price trends, financials, and a breakdown of its score.

It’s like having a research assistant in your pocket.

Why the Big Screener Stands Out

Using the Big Screener feels empowering.

It’s fast, letting you scan thousands of stocks in seconds. It’s flexible, with dozens of metrics to choose from.

It’s also user-friendly, trust me, if I can use it, anyone can.

Plus, the detailed stock pages make it easy to dig deeper before investing.

Whether you’re hunting for growth stocks or undervalued gems, this tool helps you make data-driven decisions without feeling overwhelmed.

Conclusion

Before I wrap up, let me share a couple of lessons I’ve learned.

- First, don’t rely only on filters. They’re a starting point, not a guarantee. Always check a company’s news, management, and industry trends.

- Second, start with simple filters and experiment as you get comfortable.

- Finally, keep an eye on the Overall Score and Intrinsic Value. They themselves are two complex algorithms for spotting quality stocks at good prices.

Investing is a journey, and tools like the Big Screener make it less daunting.

If you’re serious about investing, a stock screener like the Big Screener can be your best friend. It’s like having a guide in the chaotic world of stocks.

Whether you’re a beginner or a seasoned investor, it helps you find stocks that match your goals.

So, why not give it a shot? Subscribe to the Stock Engine app and play around with the Big Screener.

It might help you just find your next big opportunity.

Happy investing, and let’s make our money work smarter.