The Indian FMCG sector is poised for a transformative year in 2025. It is one of those industries that works as a strong indicator for economic trends. Performance in this industry reflects shifts in consumer behavior, disposable income. This year, the focus is squarely on tackling challenges like inflation, dwindling urban consumption, and rising commodity prices. At the same time, companies are doubling down on opportunities in premiumization, rural expansion, and quick commerce.

Urban demand, which has been under pressure due to lower disposable incomes and rising debt levels, is expected to recover by mid-2025. However, this revival is contingent on factors like inflation moderation and possible policy interventions.

Companies are also leveraging premium products to boost margins. These products are catering to a growing segment of consumers willing to pay more for quality and convenience.

For investors and consumers alike, understanding these trends offers a roadmap to navigating India’s evolving consumption landscape.

Let’s dive deeper.

What Is Happening in the FMCG Sector?

The FMCG sector, which includes essential products like food, beverages, personal care, and household items, is undergoing notable changes.

Major players like Nestle, Dabur, Parle, etc are adapting to an evolving market.

They are working hard to to achieve sustainable growth and profitability. Recent strategies highlight a dual focus on urban demand recovery and premiumization.

- Urban demand has been under pressure due to rising inflation. It has left middle-class families with less disposable income. For example, higher food prices and increased living costs have constrained spending on non-essential items. Despite these challenges, FMCG companies are optimistic about a recovery in urban demand by mid-2025. This optimism is supported by expectations of moderating inflation and a broader economic recovery. Companies are focusing on urban markets by launching premium products, which target consumers willing to spend more on quality and convenience.

- Premiumization has emerged as a key growth driver for the FMCG sector. By introducing higher-quality and more expensive products, companies aim to increase profit margins. It caters to changing consumer preferences. Items like instant coffee, body wash, and premium snacks are gaining popularity. Consumers are now seeking products that enhance their lifestyle.

This trend indicates a shift toward value-driven consumption, even amidst inflationary pressures.

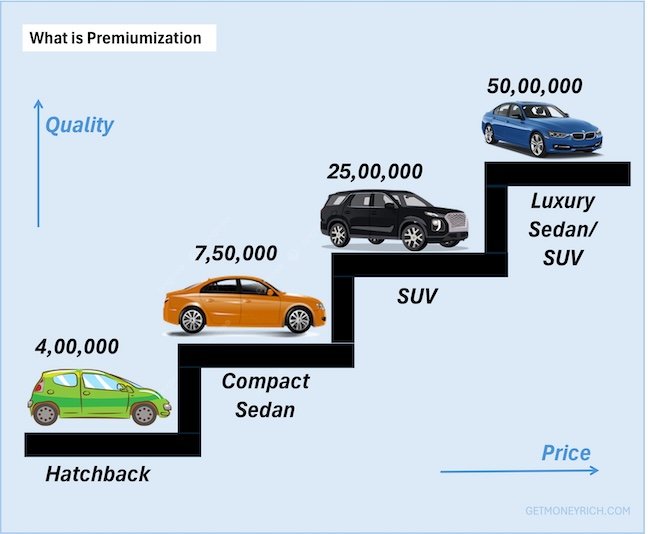

What Is Premiumization?

Premiumization refers to a strategy where companies focus on offering high-quality or exclusive products at higher price points.

The idea is to cater to consumers willing to pay extra for enhanced experiences, better quality, or the added convenience of using these products. This shift often involves replacing basic or traditional products with modern, upgraded versions.

For instance, a basic Rs.20 soap bar might now be replaced by a Rs.150 premium body wash, promising superior fragrance, better skin care, or eco-friendly packaging.

In the Indian FMCG sector, premiumization has gained momentum as consumer preferences evolve, particularly in urban areas.

- Products like instant coffee and western snacks are gaining market traction.

- Liquid beauty products such as face and body washes are leading this trend.

These items appeal to consumers who seek indulgence and a sense of luxury in their daily routines.

For example, instead of opting for regular chips, many urban shoppers now prefer premium snacks made with exotic ingredients or healthier options like baked variants.

This trend is also linked to aspirational spending. Here, consumers associate premium products with improved lifestyles and social status.

Even in times of inflation, demand for such items has shown resilience. It highlights fact that there are a few consumers who are prioritizing quality and experience over mere affordability.

For FMCG companies, premiumization not only boosts profit margins but also helps build stronger brand loyalty among consumers.

How Does Rural Demand Compare?

Rural India has been showing a stronger performance than urban areas in recent months.

It is primarily due to favorable monsoon seasons and government initiatives aimed at improving rural incomes.

- The good monsoon has led to higher agricultural yields, which in turn has boosted farmers’ incomes. It thereby translates into more spending on consumer goods.

- Additionally, the government’s push for infrastructure development has generated increased employment opportunities. This further enhances the purchasing power of rural households.

In response to these shifts, FMCG companies are adapting their strategies to tap into the growing demand from rural regions. Recognizing that rural consumers are more price-sensitive, these companies have been focusing on offering smaller, more affordable pack sizes of their premium products.

For example, Dabur, which is traditionally known for its premium products like Amla Hair Oil, has started offering smaller, more budget-friendly packs to cater to rural consumers. These smaller packs provide an affordable entry point for consumers who might not otherwise be able to purchase full-sized premium products.

This approach allows FMCG brands to capture a larger share of the rural market. where demand for quality products is steadily rising. Even though these consumers remain cost-conscious, but their aspirations are rising. By offering affordable versions of premium items, companies are effectively expanding their reach while also meeting the diverse needs of rural households.

This strategy not only helps FMCG companies grow their market but also improves brand loyalty in rural areas.

Challenges in Urban Markets

One of the primary issues in urban markets is inflation.

Over the past year, the prices of essential goods like food, fuel, and utilities have surged. This price rise has reduced the disposable income available for non-essential items.

As a result, urban consumers are more cautious about their spending. People are prioritizing necessities over luxury or premium goods. This shift in spending habits has led to slower growth in the FMCG sector. Many consumers are now opting for cheaper, more basic products instead of premium alternatives.

Another major challenge is rising debt.

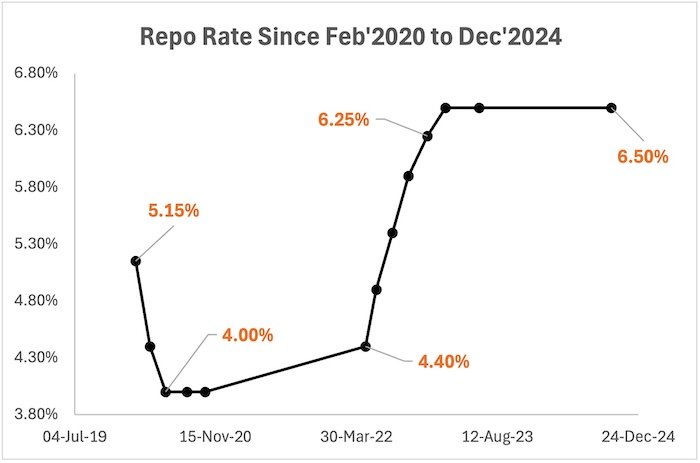

The increased loan EMI payments are becoming a pain point for consumers. The recent hikes in interest rates have made borrowing more expensive.

As a result, urban households are feeling the strain of higher monthly payments. This, in turn, is further reducing disposable incomes. It maks it harder for families to spend on discretionary items.

With the cost of living rising, many consumers are scaling back on purchases of premium FMCG products and opting for value-for-money options instead.

There is a growing consensus that policy measures may be required to stimulate consumption in urban markets. A government budget focused on providing tax reliefs or subsidies could help ease the financial burden on urban households.

Such measures would allow consumers to free up some of their disposable income, potentially driving up demand for non-essential items and boosting the FMCG sector.

Without these interventions, the urban market may continue to struggle in the short term, limiting growth opportunities for FMCG companies.

My Personal Perspective

From an investment standpoint, the Indian FMCG sector is demonstrating both resilience and adaptability.

Historically, this sector has maintained a steady growth trajectory, relatively insulated from economic ups and downs. However, over the past year, FMCG stocks have faced a slowdown. In my view, this has been driven by subdued consumer sentiment and the high valuations these stocks have commanded.

That said, FMCG stock valuations have cooled over the last 6–7 months. Yet, I believe they still haven’t entered the “undervalued” territory, making them less attractive for value investors at this stage.

Premiumization

I admire the management teams of companies like Nestlé, Britannia, and HUL for their strategic focus on premiumisation. Their ability to identify and capitalize on this trend reflects a deep understanding of evolving consumer preferences in urban areas.

Even amidst inflationary pressures, the demand for higher-quality, premium products remains robust in cities. By innovating in this space, these companies are showcasing the adaptability that is essential for long-term, sustainable success.

E-Commerce

The rapid rise of e-commerce, particularly quick commerce, presents significant growth opportunities for FMCG companies. These platforms enable them to reach a wider audience with unparalleled convenience.

Urban consumers, burdened by reduced disposable incomes and rising debt, are increasingly relying on the speed and convenience offered by online shopping. Quick commerce, which focuses on near-instant delivery, is becoming particularly popular. By leveraging this channel, FMCG companies can strengthen their presence and drive urban growth despite the prevailing challenges.

Rural Demand

The rural demand story is also intriguing and offers significant potential. While reports suggest rising rural incomes, I approach this claim with some skepticism. Is this growth a result of genuinely higher disposable incomes, or is it merely a temporary post-election phenomenon?

Having observed markets since 2008-09, I’ve rarely seen rural India drive industries like FMCG in the opposite direction of urban trends. While it’s possible, I currently don’t see strong indicators supporting sustained rural dominance.

That said, favorable monsoons and government initiatives have undeniably boosted rural demand. If these factors translate into a long-term trend, rural markets could play a crucial role in countering urban slowdowns.

FMCG Sector Outlook

FMCG stocks have always been a stable choice in my portfolio. Their strong brand equity, consistent cash flows, and resilience during market volatility make them attractive for long-term investors.

However, to assess the sector’s future trajectory, we need to closely monitor key factors like inflation, interest rates, employment trends, public and private capital expenditure, and company-specific quarterly reports. These elements will significantly influence the growth trajectory of the FMCG sector in the coming years.

For both consumers and investors, the FMCG sector offers valuable lessons in resilience, adaptability, and innovation. Keeping a close eye on evolving trends and market dynamics will be crucial to making informed decisions.

Conclusion

It’s crucial to keep an eye on companies that are strategically positioning themselves to capitalize on the two emerging themes.

On one side, it seems that the rural demand can offset a part of the urban slowdown. One the other side, there is also a premiumization that that is playing in urban India. Both these themes are working in favour of FMCG companies.

- Companies with a strong rural distribution network, like Dabur and Marico, are likely to see faster growth in the near term.

- Companies that are embracing digital-first and quick commerce strategies are also well-positioned to benefit from the changing consumer behavior in urban areas.

What are your thoughts?

Do you think premiumization is the right strategy for FMCG companies, or is it risky in a price-sensitive market like India? Share your views in the comments!

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.