Summary:

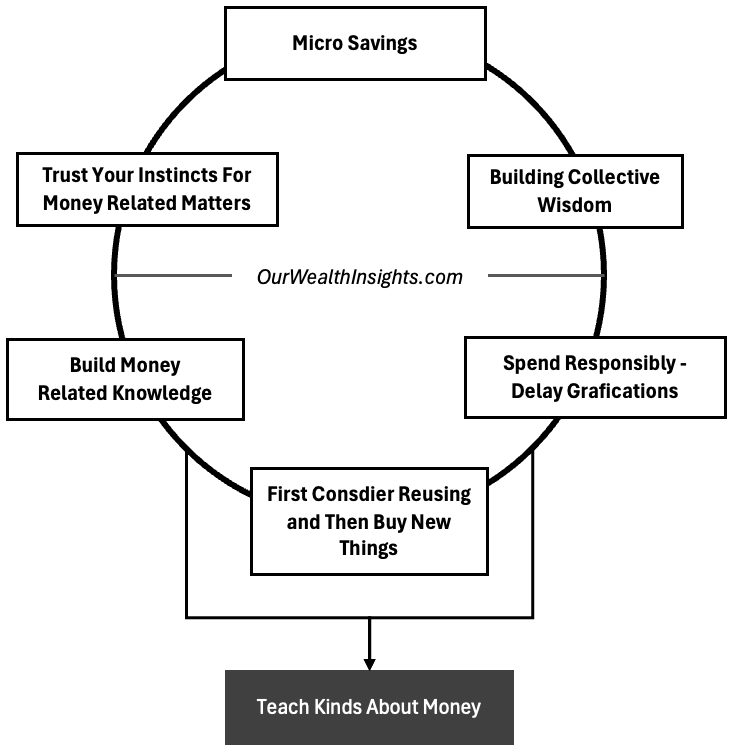

- In this heartfelt tribute, I share seven unconventional wealth-building habits my Nanaji taught me during Diwali, blending his timeless wisdom with practical financial strategies for lasting prosperity.

Introduction

Growing up in a small town, Diwali was always special for me. Not just for the lights and sweets, but for the lessons my grandfather (my Nanaji) taught me. He wasn’t rich by today’s standards. Yet, his simple habits shaped how I think about money.

His wisdom felt like gold, especially during Diwali. He used to tell me at least two stories a day (vacation time). But during Diwali, he also used to share stories of saving and planning.

Today, I want to share seven unconventional wealth-building habits I learned from him. Today, he is no more with me (he passed away a couple of years back). I’m writing this post in his remembrance.

These aren’t tips you’ll find in fancy finance talks. They’re rooted in her life, and I believe they can help you too.

Table of Contents

A Life of Quiet Wisdom

My Nanaji was an Income Tax officer, who retired from his job in 1988.

He lived in a modest house. She raised four children on government’s salary. Money was tight. But Nanaji never complained. During Diwali, my “Naniji” used to Pakwans at home instead of buying them.

He used to paint the old diyas and would reuse them, putting them on the roof of the house. For the rest of the house, there were new diyas. This was the ritual or his discipline.

His budgeting was like a science. He kept a small notebook, jotting down every rupee spent. I still remember, he sitting on his sofa chair, beside his wooden book shelf, noting and calculating expenses with a pencil.

What struck me was his mindset. He never chased quick money. He taught us that it is ok to grow slow but the growth must be steady. I think, he never dreamt to become a millionaire. But he had those habits that will help him build a secure life.

In today’s world, where apps and AI shows us dreams of instant wealth, his lessons feel refreshing. They remind me that wealth accumulated in quick time will go as early.

Our financial health is like our physical health. Crash dieting and impulsive workouts may may you look thin and fit in next 3-5 months, but it is not sustainable. What’s accumulated slowly, with discipline, let it be money or health, will last for a lifetime.

1. The Power of Micro-Savings

Nanaji had a small portfolio in the file room.

Every Diwali, he used to drop a few rupees, coins, jewellery, etc into it.

He used to tell me, this value can be anything, starting from a Rs.1 coin to whatever one can afford on that Diwali Day. He called it his “future fund.” In the later part of his life, I saw how much those funds helped him.

Those days, I used to laugh, thinking how could such tiny amounts matter? But over years, that jar funded many family activities. It paid for emergencies. It even helped house repairs, education for grand children’s, etc.

This habit taught me the power of micro-savings.

We often think savings need to be big. But Nanaji showed me that small amounts add up.

When I started investing, I apply this by setting aside Rs.100 daily. I let this money get accumulated and then, in a lump-sum, I put this liquid cash in a liquid mutual fund. This is my piggy bank. Over all these years, this value has become substantially bigger. Rs.3000 invested for 5% returns, will become Rs.8 Lakhs in 15 years.

Studies says 60% of Indians don’t save regularly.

My Nanji’s savings habit proves we don’t need a fat savings to start. Why not try dropping Rs.10 a day into a piggy bank?

2. Building Wealth Through Community

My Nanaji was a good with relationships.

During Diwali, he’d visit neighbours, sharing sweets and small gifts. But it wasn’t just about festivity. He was building trust. When he needed help, like borrowing tools or getting a discount from a local shopkeeper, people stepped up.

Once, a neighbour even helped him find an excellent contractor who used to do him house repairs when needed (I remember the contractor’s name, Tajim Bhai).

This taught me that wealth isn’t just money in the bank. It’s the community you build.

In India, we’re lucky to have strong social networks. A 2023 study by the National Sample Survey showed 70% of rural households rely on community support during crises (read this Nabard report here).

I’ve used Nanaji’s approach in my life. I started my blog, its my way of socializing with people. I share my learnings, and read the comments of my readers. Through my blog, I have built some very valuable connections over the years.

How often do you lean on your network for financial growth? It’s a habit worth trying.

3. The Art of Delayed Gratification

Diwali was tempting. Shops were full of clothes and gadgets.

My cousins and I would beg for new things. Nanji never said no outright. Instead, he’d used distraction strategy to divert our lure for new things towards things more rewarding. He used to play cricket, badminton, matches with us. He used to take us on drives on his white Ambassador cars. I remember, one day when I was very cranky for a toy, he took me to his office for few hours.

He’d explained to me how waiting saved money. He used to say, once we can delay our buying urge, after few hours it will automatically go away. More often than not, we buy things not because we need it, but because we just want it (at that moment of time). Its more psychological, its not out of requirement.

He would say, use that money to buy books. This habit of delayed gratification stuck with me.

It’s tough in today’s world of easy EMIs and “buy now, pay later” schemes.

But waiting can save you thousands. For example, I wanted a new phone last year. Instead of buying it on launch day, I waited for 10 months. The price dropped by Rs.20,000.

Studies shows, impulsive spending is a top reason Indians struggle to invest.

4. Reusing The Existing Resources – Creatively

My Nanaji never wasted anything.

Old clothes became quilts. Leftover food turned into new dishes.

During Diwali, he’d reuse last year’s decorations, adding just a few new touches. This wasn’t just about saving money. It was about seeing value in what you already have.

He once turned an old trunk into a storage box. It saved him saving from buying a new furniture.

This habit of repurposing is powerful for wealth-building.

We often overlook what we own. I started applying this by reviewing my expenses.

I realized I was paying for unused subscriptions, like a gym membership, YouTube Premium, un-sued mobile phone number, etc. Cancelling them saved me Rs.15,000 a year. I redirected that money to an equity fund.

Statistics says, households waste 10–15% of income on redundant expenses.

Take a look around. What can you repurpose or cut to boost your savings?

5. Investing in Knowledge First

My Nanji was on a normal graduate. But he was curious. His house was full of books and newspapers.

He’d listen to DD News would read at least two newspapers each day (one at home and one in the office). He would shop in a grocery store and pick their newspapers and glance at the headline for 10-15 minutes. He always ued to read newspapers whenever he was waiting in a barber’s shop for his turn. He never kept idle, thinking in nothingness.

He’d ask question and debate on the reported topics related to markets and banks. During Diwali, he’d talk to a local goldsmith about gold prices.

This helped him decide when to buy small ornaments. His knowledge was not only from books but was also practical wisdom picked from street savvy people. It was a very practical man whose understand of the world was built over years.

I was very close to him. He taught me to invest my time in knowledge. I focused my attention of “financial” knowledge.

6. Teaching Kids About Money

Nanaji believed in starting young.

Every Diwali, he’d give us kids Rs.50 each. But there was a catch. We had to save half and spend the rest wisely. She’d check our choices, asking why we bought what we did.

Once, I spent my share on chocolates. He didn’t scold me. He just asked, “Will this make you happy tomorrow?” That question stayed with me.

Teaching kids about money is a wealth-building habit.

In India, financial literacy is low (check here for the financial literacy data by countries). A survey found that, 80% of parents don’t discuss money with their children. We often say that, “let’s keep kids out of the money related discussions.” Why?

I discuss with my son topics related to money management. I show him my flow-charts and infographics I draw for my blog posts. He also loves to draw flow charts, its his way to learn new things.

7. Trusting Our Instincts

My Nanji didn’t rely on fancy advice. He trusted his gut more.

Once, a relative pushed him to invest in a risky scheme. He refused, saying it didn’t “feel right.” Years later, that scheme collapsed. His instincts saved her.

During Diwali, she’d only buy gold which he trusted. In those days, I remember, gold was priced at Rs.5000 per 10 grams. Today, it has crossed the Rs.100,000 per 10 grams levels.

This habit is vital in today’s noisy financial world.

Apps and influencers push hot stocks or crypto. But Nanji’s gut-check approach works.

I research investments but always pause to ask, does this align with my goals? Last year, I avoided a hyped-up IPO. It crashed soon after.

SEBI also warns us informing that “90% of retail investors lose money in speculative trading.” Trusting your instincts, backed by research, is key.

Conclusion

We live in a world of AI and algorithms.

Robo-advisors and budgeting apps are great. But they lack wisdom.

My Nanaji’s habits were about discipline, community, and intuition. These are human qualities no app can replicate. In 2025, in last one year, gold prices has gone up by 34%. In the same priod, equity (Nifty 50) is only 6% up. In periods of time, equity has done better and gold’s returns were sluggish.

These type of market behavious can confused us.

Follow the nanaji’s principles, saving small, waiting smart, learning always. It will keep you grounded.

I blend his wisdom with modern tools.

Nanaji passed away a few years ago. But his lessons light up my life like Diwali diyas.

His habits aren’t flashy. They won’t make you a billionaire overnight. But they’ll build wealth that lasts, money, relationships, peace of mind.

In a world chasing quick fixes, his wisdom feels like a gift.

Have a happy investing.