Buying stocks that can generate 25% CAGR returns in 20 years is not easy. Identifying such stock is a complicated activity. This is what makes buying a stock a complex business. People who have developed this skill for themselves have seen their wealth compound with time. Want to be like one? Practice Fundamental Investing – We’ll discuss more of its philosophy in this article.

With the advent of the internet and online stock trading, buying and selling stocks have become too easy. People have started to do stock trading as a time-pass. But stock investing is complicated, it must not be practiced with a careless attitude.

What is most important in stock investing? Understanding the underlying business behind the stock is of paramount importance. I’ll give you this task to exemplify how little people know about the company behind the stocks they purchase.

In your mind, recall two stocks from your portfolio in which you have allocated maximum funds. Now, try to remember their market capitalization. I guess, 75% of all retail investors in India would not be able to recall this number. If we are not able to recall a simple well-circulated Market Capitalization number, think how little we know about its underlying business.

So what we must do? Start to record and remember important data about our holding companies. What are those data? Last financial year’s revenue, profits, margins, total debt, net cash from operations, and last but not least market capitalization.

Yes, instead of remembering the price of your stock, try remembering its market capitalization. In the next section, I’ll show you how market capitalization data can help us to get a first impression of a stock. This number will also trigger a deeper action within you.

Let me tell you more about it in the next section.

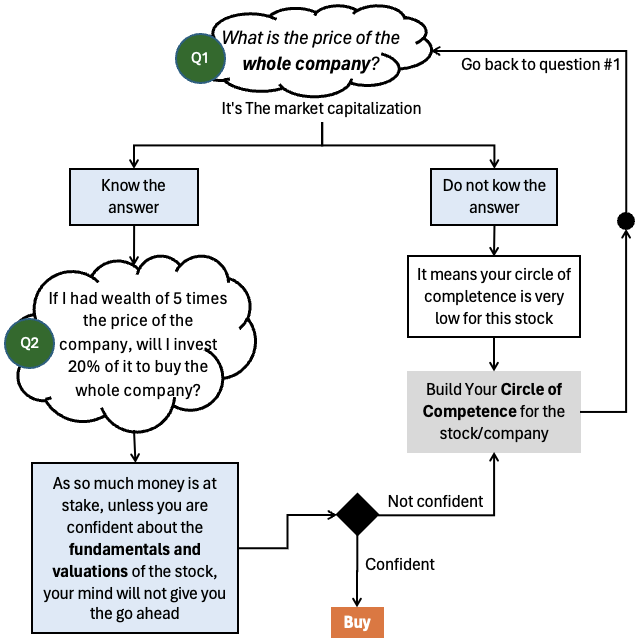

Market Capitalization and Circle of Competence

Suppose a person wants to buy stocks of a hypothetical company ABC. Even before buying a single stock of ABC, the person must answer this question first, “What is the price I’ll have to pay to buy the whole company?” The answer to this question is the market capitalization of ABC.

If the person does not know the answer to even this simple question, it is a hint that the stock is outside his/her circle of competence.

By the way, let’s assume that the market cap of ABC is Rs.8,400 Crore (about $1 Billion).

If a stock is withing is not within our circle of competence, it is ok. Even for an investor like Warren Buffett, 95% of stocks are not within his circle of competence (COC). He once said that out of all company credentials that come on his table for analysis, 97% are brushed aside. It mainly happens because most of those companies are outside of his COC. If it is so, I’ll assume that for us, retail investors, 99.5% of all companies will be outside our COC.

Now, suppose the person knows the market capitalization of his prospective stock. What next?

Ask the second question. “If my net worth is five times (5x) the total market capitalization of ABC, would I go ahead and buy the whole company?“

By the way, five times the market capitalization of ABC would mean Rs.42,000 Crore ($5 Billion). To get the perspective of what $5 Billion means, you will be in India’s top 50 rich list.

Now, try to answer the question #2. Remember, you are about to invest 20% of your wealth in ABC.

After Effects of the Above Two Questions:

At this point, your mind will start working differently. It will start asking deeper questions. If you are not able to answer it, it will tell you to research more and build your circle of competence.

Else, if your mind is confident about this company, it will tell you to go ahead and purchase its shares. Unless your mind is assured about the fundamentals and valuations of ABC it will not give you the go-ahead. Why? Because 20% of your wealth is at stake.

When your mind has given the go-ahead, at this point, you are ready to buy some 50-100 odd number shares of ABC. Of course, we are not going to buy the whole company. But the idea is to repeat this exercise before buying every stock. Why?

Because it is a clever way to force our minds to think critically and not allow us to buy shares casually.

The Concept of Stop Loss in Fundamental Investing

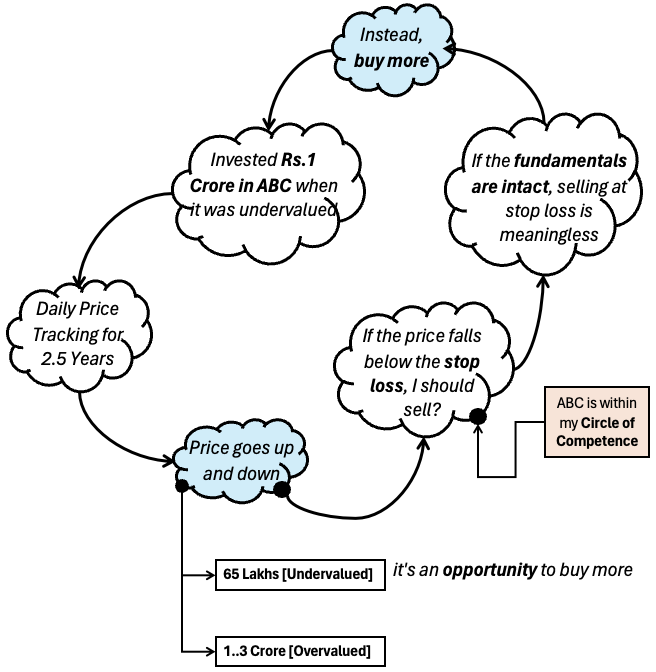

When to sell a stock? I’ve heard people talking about the concept of stop loss to answer this question. But stop loss is a concept that is useful for stock traders, not for fundamental investors.

To understand this, allow me to take my previous example further. Suppose, after necessary due diligence and deep analysis I bought stocks of the company ABC. I know that I’ve bought fundamentally strong stocks at an undervalued price level. Say, I invested about Rs.1 crore in this company.

Henceforth, I kept tracking the price of ABC daily. As the stock market is auction-driven, ABC’s stock price remained volatile due to changes in demand and supply of its shares.

I kept tracking the price of ABC for about 1.5 years. During the period for which I was tracking the price, I found the total value of my investment in ABC migrating between peaks and valleys. Once it went up to Rs.1.35 crores and one day it was also down to Rs.65 lakhs. This is what an auction-driven market can do to our money.

The Concept of Stop Loss

The stop-loss concept tells us to sell the stock after it falls below a certain price level. Let’s say for ABC, the stop loss was Rs.70 Lakhs. As its value fell below the stop loss mark (fell to Rs.65 lakhs) I should have sold it, right?

But what fundamental investing tells us to do here is to do the opposite. Instead of selling, we shall either hold or buy more.

What is the point?

As a fundamental long-term investor, I should first recall why I bought shares of ABC. I bought it because it was within my circle of competence and my analysis of it showed two positives. First, it was a fundamentally strong company and second, it was available at an undervalued price.

So, when I invested Rs.1 crore in ABC, it was undervalued. Now, when its value has gone down to Rs.65 lakhs, it has become further undervalued. So this is a point to sell or buy more? The answer is to buy more. Moreover, fundamental investing tells us to buy stocks for a very long term (I buy to hold them for 5-7 years at least), so why sell so soon?

But yes, all this will stand true only if ABC is within my circle of competence. Had I bought shares of any random company, I would not be sure about the stock’s valuations.

If I’m sure that my stock is worth more than what the market is currently valuing, selling at a stop loss makes no sense.

Fundamental Investing is not only about Undervaluation [Also Growth]

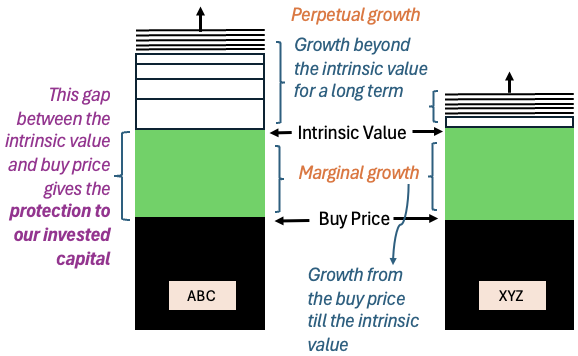

A critical question. a fundamental investor should prioritize undervaluation or growth? Both are important and have their independent utility in value investing.

Let’s understand it with the help of an example.

Suppose I bought shares of two companies ABC and XYZ. I bought both of them at an undervalued price. ABC was showing robust signs of growth while XYZ was like a slow-growing company.

What effect these two stocks will have on my investment portfolio in times to come? Two types of effects will be visible:

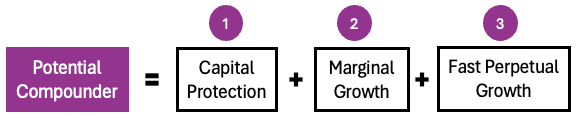

- Protect Capital & Show Marginal Growth: Both the stocks (ABC and XYZ) can protect my capital. As they were bought at a discount, the ability to render capital protection is intact. If their fundamentals are intact, even if their price falls, it will bounce back to match at least its intrinsic value levels. So, not only capital protection, marginal growth is also possible when stocks are bought at a discount.

- Perpetual Growth: Companies that can grow their intrinsic value with time are called “growth engines.” Such stocks generally operate in an industry that is enjoying the effects of tailwinds (growing demand and technological improvements). At a moment in time, such stocks can give the impression that can perpetually grow till eternity.

A combination of capital protection, marginal growth rate, and fast perpetual growth makes a stock a potential compounder.

What to buy and when to sell?

After what we have discussed about fundamental investing, let’s try to summarize and take up two basic questions related to value investing.

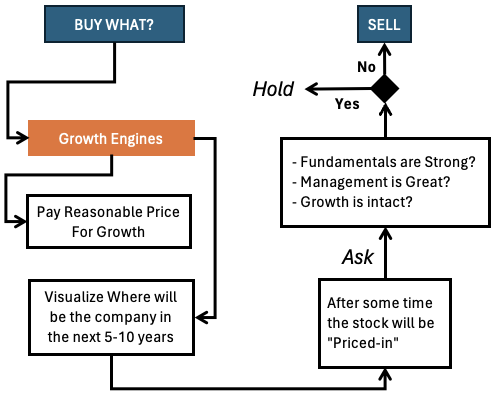

- WHAT TO BUY? No doubt, we must buy growth engines but at an undervalued price level. Why undervalued? We cannot buy a stock very expensive just because it has the potential for rapid growth. What to pay for growth shall also be justified. Moreover, to judge if the stock in consideration is a growth engine or not, we must try to visualize where this company will be in the next 5 to 10 years. This kind of visibility will come by reading the annual reports of the company, news articles, and analysis of experts.

- WHEN TO SELL? The concept of stop loss in fundamental investing is not relevant. When a quality stock is bought at a discount, after some years/months, the company will be “Priced-in” it (its price will reach and match its intrinsic value). If the stock is a typical growth engine, it will continue to enjoy the tailwinds even beyond this point. It means it will continue to grow at least perpetually. Selling now will not be wise. Sell only when the combination of these three factors gets disturbed: Fundamentals, quality of management, and future growth.

Conclusion

Fundamental investing is not just a strategy; it’s a philosophy that requires discipline, patience, and a deep understanding of the businesses in which one invests. By focusing on the underlying fundamentals, such as revenue, profits, and growth potential, investors can make informed decisions that stand the test of time.

The concept of stop loss may work for traders, but for long-term fundamental investors, it’s about weathering market fluctuations and staying true to the investment thesis.

Whether prioritizing undervaluation or growth, the key is to identify potential compounders and hold them for the long term, allowing the power of compounding to work its magic.

By adhering to the principles of fundamental investing, investors can navigate the complexities of the stock market with confidence and build wealth over time.

Suggested Reading: