Summary Points:

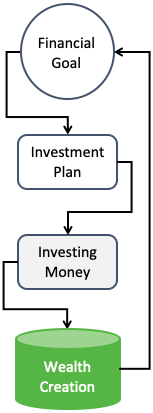

- Goal-based investing ensures that we align their financial decisions with specific, purpose-driven objectives, enhancing efficiency and long-term success. By identifying and prioritizing financial goals like building an emergency fund, purchasing a car, buying a home, securing a child’s future, or planning for retirement, investors can systematically allocate funds to appropriate instruments such as mutual funds or insurance.

Introduction

Investments cannot be effective until done with a purpose. Hence, experts always advise goal based investing. But let me ask a simple question. Why we generally invest money? Because it is the right thing to do.

Many people buy and sell investments without any specific purpose or goal in mind. For them, practicing investment is in itself is a milestone. Why it needs a further goal?

In a way it is true. Starting to invest money regularly is an important step. But it is even more important to ensure that investments should serve their purpose.

Practicing goal based investing is one of the strategies which ensure that the invested money serves a purpose. Otherwise, throwing money here and there in the name of investment is not efficient.

Why are you investing?

The way we invest money makes a difference. Hence as a beginner, it is essential to ask the right questions before starting to invest. One of the critical questions that must be asked and answered is, “why are you investing the money”?

A quick answer to the question is to make more money. But there is a better answer. I read it in one of the books. It is a one-liner that explains the need for investment beautifully.

Invest money to have the right amount of funds at the time of “need.”

Here the “need” is the financial goal.

An individual can have multiple goals. If there is a goal, there must be a financial plan to achieve it. How to execute the plan? By investing money systematically.

Hence, before one goes ahead and buy the first mutual fund unit or stocks etc, it is essential to first identify all major financial goals.

Identify and Phase The Financial Goals

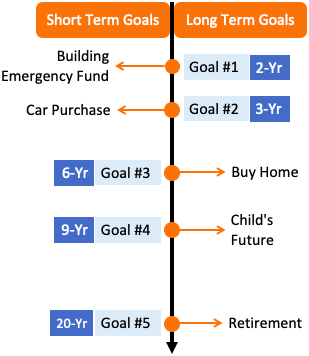

This is the time when one should start listing the priorities of life. These are such priorities that are mainly capital intensive. Few examples of typical priorities are mentioned in the above infographics.

I am sure some people might have different goals. Feel free to draw a similar time line with your goals mentioned on it.

This kind of pictorial representation sticks to our minds. It helps when we need to add more goals into our timeline. How? Because the closer is the goals from today, the more difficult will be its execution.

Allow me to elaborate a bit on the financial goals listed above. It will give an insight into how to practice goal based investing.

#1. Building An Emergency Fund

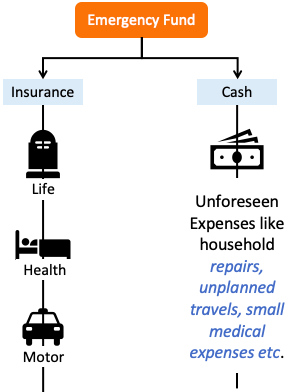

Building an emergency fund is a priority that should precede all other priorities. This is because when an emergency strikes, all funds will get diverted to manage it. So, as far as possible, we must prepare ourselves to handle it.

Building emergency fund is a financial goal that should be met as early as possible. In our example, we have considered to reach the goal in two years.

The composition of an emergency fund consists of two types of financial instruments – cash and insurance.

- Cash: It is an essential constituent of an emergency fund. As a rule of thumb, the cash component must be at least six (6) times one’s monthly income. If one’s monthly earning is Rs.1.0 lakhs, then the cash size must be at least Rs.6.0 lakhs.

- Insurance: In an Indian context, typical insurance policies necessary are life, health, and motor insurance. The larger is the size of the life and health covers, the better. But to know more about the minimum size of the insurance policies, kindly read this article.

Now, to build the emergency portfolio, one must start buying the insurance covers. Along with it, it is also essential to build cash reserves. How to do it? Cash accumulation through the recurring deposit and insurance purchase in a phased manner.

Motor insurance is a mandatory requirement. Hence must be bought first. I’m assuming that the majority of my readers already maintain this policy for the vehicles.

If I cannot do it in tandem, I’ll opt to buy a health cover before a life cover.

Read more:

- About where to keep emergency fund…

- Building Financial Literacy Kiyosaki & Dave Ramsey’s Way…

- Why to become debt free…

#2. Saving for a new car purchase

On average, an urban Indian changes his/her car every 8 years. Considering that the changeover is not happening too frequently, people can invest in risky instruments to manage this goal.

I prefer putting my money in equity based mutual funds through SIP to manage this goal. When a time horizon is as long as 8 years, we can expect an average return on 12% per annum from our mutual funds.

Though in our example, the time horizon considered is only three (3) years. In this case, it is better to invest the money in a debt-based or a hybrid mutual fund scheme.

Read more:

- Zero Depreciation Car Insurance Policy…

- How much to spend on car purchase…

- When to avoid car insurance claim…

#3. Buying a home

This is one goal that we all want to achieve sooner in our life. It is both necessary, and people also feel passionate about it. Read more on renting vs buying a house.

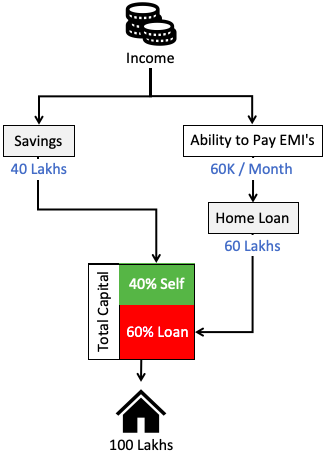

How to plan the house purchase? To execute the plan, there are two basic rules that can be followed: (a) Always buy a house within one’s affordability. (b) Always pay at least 40% of the cost of the house from savings. It means the home loan component shall be a maximum of 60%.

Once this rule is followed, the next plan should be to accumulate the 40% self-contribution corpus. How to do it? Like in our example, the available time horizon to buy the house is 6 years. Hence, one can opt for a multi-cap or large-cap mutual fund for investing.

Read more:

- How to plan a home purchase…

- Should You Pay Home Loan Early…

- Loan Prepayment – Reduce EMI or Tenure…

#4. Child’s Future

The sooner we realize this requirement, the easier will be the planning and execution. Why? Because the costs related to a child’s future are increasing rapidly. Moreover, new types of expenses are also getting included (inform of extracurricular activities).

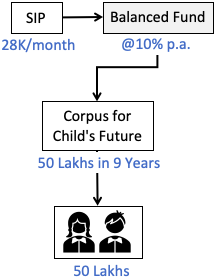

Let’s assume that a corpus of Rs.50 Lakhs is required for the child’s future. In our example, we have considered the available time horizon of 9 years. Also, considering that the corpus is required for a child, hence shall play a little bit safe. That is why investing in a balanced mutual fund shall be preferred.

As shown in the above infographics, investing Rs.28,000 per month in a balanced mutual fund will help us follow a goal-based investing.

Read More:

- Child Insurance Plan Vs Mutual Fund Investment….

- How to plan for soaring education expense of children…

- Calculate Salary of Housewife Mom…

#5. Building retirement corpus

Every individual demands his/her own size of retirement corpus. It is a part of retirement planning that must be done as immaculately as possible.

On average, a person will require a minimum of 20-25 years to build a sufficiently big retirement corpus. Hence it is essential to start as early as possible.

It is better to divert at least 5% of income towards retirement corpus building. For an employee, this is in addition to the EPF contributions. For a self-employed person, the number should be 15% minimum.

When the available time horizon is as long as 20-25 years, one can afford to invest in value stocks. If one is not comfortable investing directly in stocks, mid-cap mutual funds can be a good alternative.

Conclusions

Before investing our dime anywhere else, it is better to identify financial goals. Goal based investing has its advantages. It helps us to invest our money more responsibly. Furthermore, such investments stay put for a longer time thereby, yielding compounding returns.

I often use a SIP calculator to fix the amount of money I need to invest each month to reach my financial goal.

I keep tweaking my financial goals every year. Based on the current circumstances, some new goals gets added to the list. Some old one gets less priority, or some existing ones attract more attention.

To practice goal based investing, it is equally essential to keep reviewing ones financial goals once every year. Read more about how tough financial goals need higher investment risks…

Fixing financial goals for self, and making investments accordingly, will always keep you in control of your actions. Market movements will not scare you. You will never be confused about your decisions.

Practicing goal based investment will make you more skilful and scuttle.

Have a happy investing.

Suggested Reading: Breaking down financial independence in stages can help to achieve it…

Thank you! Great article for anyone trying to understand the goal-based investment approach. Keep up the good work.

Thanks for commenting

I Have learned many Thing in This blog.

Thankyou For providing us Knowledge About How to Invest Our

Money.

Thanks

Great content each time, please keep posting. Just a small suggestion I would like to make is to include Date of Publishing in each of the posts since a lot of advice dated long back may not be that relevant after a certain amount of time.

Thank you. Dates have been removed as it interferes with the SEO (for small blogs like mine). But I do try to keep my contents as update as possible.