What prompted people towards gold investment? There was a time When the gold standard was used to value currencies. Every paper currency issued had a value directly linked to gold.

But in the 1970s, the US decided to shift from Gold Standard to Fiat Money. Thereon, gold became more of an investment vehicle than a world’s currency.

Why gold investment is famous when there are alternatives like shares, mutual funds, real estate, bonds, other debt plans? Except for real estate, the value of investment options is derived from fiat money.

If fiat money is strong, these investments look dear. But if the global economy starts to become weak, fiat money becomes weak. Considering such a scenario, experts advise people to diversify their investments in non-currency assets like gold, real estate, etc.

Generally speaking, any major negative factor influencing the global economic condition dampens the spirit of general investors. In such a situation, people resort to parking money in gold investment instead of traditional equity or debt-based plans.

Why Gold Investment?

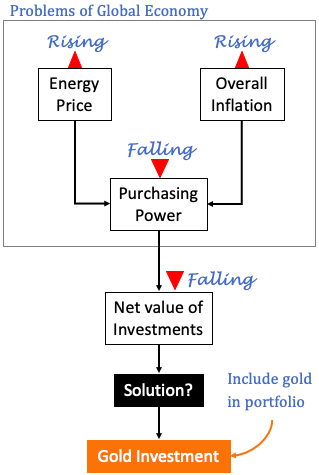

The dependency of world economics on energy is ever increasing. As of date, alternative energy sources account for only a fraction of total energy consumption. Coal-based fuels still dominate usage. This leads to rising fuel prices year after year.

For a country like India, which imports about 85% of its crude oil demand, increasing oil prices further widens our fiscal deficit. Moreover, such huge oil imports also disturb our trade deficit.

A situation of fiscal deficit and trade deficit makes an economy weak, which also shows in its weakening currency strength. A prolonged weak currency brings a disadvantage to its investors over USD or Euro investors.

For a developing nation, fiscal and trade deficit is an acceptable bargain that governments and their citizens accept as good evil. But gold investment brings all investors at par. How? Because the price of gold is the same everywhere, always.

Similarly, inflation is a phenomenon that comes as a package with Fiat money. Especially for developing nations where inflation rates are necessarily high, inflation is a huge setback for investors. Here also, gold investment brings all investors at par.

A weak economy caused by the fiscal deficit, trade deficit, and inflation lowers the purchasing power of its citizens. How to deal with it? One solution is to invest in gold and hold it for a very long time (30 plus years).

Cash Vs Gold: Performance in Last 30 Years

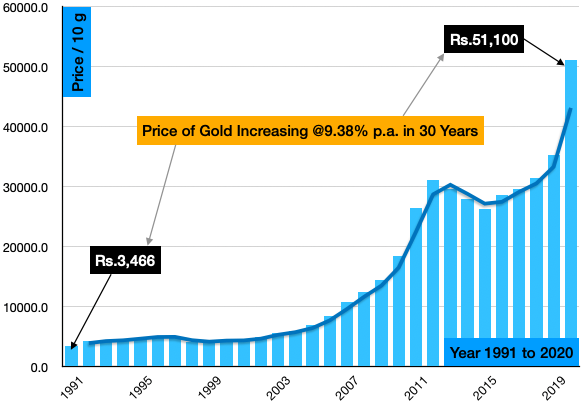

In the last 30 years (1991 to 2020), the price of 10g 24K gold has increased from Rs.3,466 to Rs.51,100. This is an annual growth rate of 9.38% per annum. What does it mean?

Suppose you had a 50gm gold coin in the year 1991 (Cost: Rs.17,330). It was kept idle in your locker for all these years. Today in the year 2020, the price of 50gm gold is Rs.2,55,500. The value of gold grew at 9.38% per annum. Please note that you had to do nothing to earn the growth rate of 9.38%.

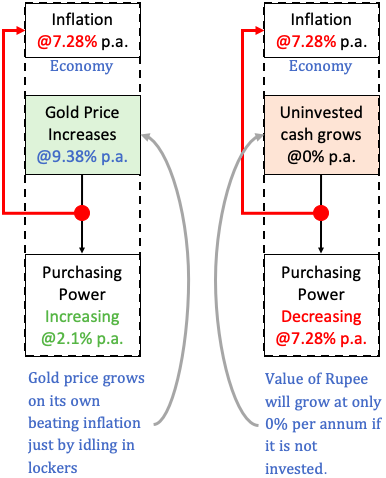

Let’s understand the performance of gold in a context. But before that, let me give you a number. In the last 30 years, average inflation in India was 7.28% per annum. Just keep this value in mind.

Suppose you had Rs.17,330 as cash in the year 1991. You decided to keep this cash in your piggy bank (A Gullak). Why did you do this? Because like gold, you thought this was the right step. You knew less about investments. Hence you decided to keep your cash (savings) with yourself.

But see what inflation (@7.28% p.a.) did to your cash in these years. In the last 30 years, the purchasing power of this cash was reduced from Rs.17,330 to just Rs.1,940. Inflation did this to the purchasing power of your cash.

In the Fiat Money Type system, to prevent our cash from becoming devalued due to inflation, we are forced to invest. We cannot afford to keep our cash locked in our piggy banks. Moreover, to earn a return of 7.28% or more in a long time horizon, a partial exposure to equity (risk-taking) is a must.

But such an investing compulsion is not there with gold. Check the below infographic.

In moments of hyperinflation

Hyperinflation is a condition where the prices of goods and services start to rise exponentially. In 2008, Zimbabwe saw hyperinflation. In its worst time, prices were doubling every 24 hours. A similar thing happened in Hungary in the year 1933, where prices doubled every 16 hours.

Let’s consider that you were in Zimbabwe in the year 2008. You saw that the Zimbabwe currency became so devalued that shopkeepers we not accepting its currency. In the year 2008, $1.25 US was equivalent to a $50 million Zimbabwe note.

In this situation, where your currency note was almost worthless, you had a 50gm (1.75 oz) gold coin. In the year 2008, the gold price was about $1,000 per oz. It means 1.75 oz was worth $1,750 US. Imagine your relief back then when even your life savings would not have bought you $1 USD.

This is the power of a gold investment. They are valuable in normal market times. But in the worst of economic scenarios, gold becomes priceless.

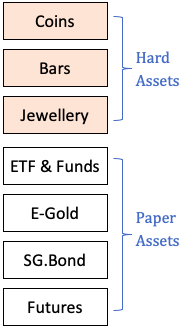

Ways to Invest in Gold [India]

Now we are aware that why the inclusion of gold as a long term asset is good. Let’s know more about different ways we can invest in gold.

Hard Assets (Gold Coin, Bar, etc.)

India saw its first Gold ETF only in the year 2007. Before that, investment was made in coins, bars, or gold jewelry.

One can buy gold coins and bars from banks. Gold purchased from banks are available in sealed covers and are of unquestionable purity. Though outlets of good jewelers across India also sell coins and bars.

Gold is often bought in India in the form of jewelry. But if one’s intention is an investment, buying coins and bars makes more sense. Why spend extra on making charges. Jewelers generally charge about 2% extra as making charges for jewelry.

Physical gold purchases have their costs. First, 3% GST is payable on every gold transaction. Secondly, if one is buying gold as jewelry, an additional 5% tax on making charges is payable. Third, if one plans to keep gold in bank lockers, there will be an additional storage cost.

Gold ETFs & Gold Mutual Funds

One of the best ways to invest in Gold for retail investors is the Gold Exchange Traded Funds (ETFs). If one buys one unit of gold ETF, it is equivalent to 1 gram of gold. Like shares, ETFs are also traded on the stock exchange.

ETFs are not physical gold. Each unit of ETF is only an electronic form of one-gram gold. So if it is not real gold, why one should buy it? Because they are actually real gold. But the difference is, that gold is not kept in your locker but in the locker of the fund house. How?

If you buy a unit of ETF, the ETFs have a mandate (by SEBI) to hold one gram of gold coin in 99.5% purity. So we can casually say that every time we buy a Gold ETF, the fund houses have to buy an equivalent quantity of gold and keep it in their locker. It is what makes Gold ETFs safe. Every unit of ETF that we purchase represents one gram of real gold.

Buying gold through ETFs is also safe and economical. How? As gold ETFs are available in dematerialized form, it lies safely in our Demat account, bearing no storage cost. Moreover, there is no capital gain tax on ETF if units are held for a period of more than 12 months.

At the time of redemption, not all, but some gold ETFs provide the option of converting units into physical gold. But to do so, one must have at least 500 to 1,000 number units (500gm to 1Kg gold).

Gold Funds

Gold Mutual Funds are basically funds of funds. These funds invest in gold ETF. Who will buy Gold Funds? People who do not have a Demat account can invest in Gold Funds.

In mutual funds, people also have an option to invest automatically through the SIP route. But gold funds have their costs, which must be borne by the investors. For good gold funds, the expense ratio is usually between 0.5% to 1%.

You can also check our mutual fund compare tool to get a list of Gold ETFs and Gold Funds operating in India (Tip: Filter fund type as a commodity).

E-Gold

When I started doing my research about e-gold, I could make out that there are three alternatives to investing in E-gold. First, was E-Gold provided by National Spot Exchange (NSEL). The second is Digital gold offered by MMTC-PAMP. The third is SafeGold offered by Digital Gold India Pvt Ltd.

- E-Gold (NSEL): E-Gold looks like the best option to buy gold. It took me half a day to make out how to buy an e-gold of NSEL. Frankly speaking, I would rather go and buy a gold coin. Anyway, here is the procedure, it is complicated and clumsy:

- Trading A/c: Your normal share trading account will not work. Open an account with an authorized member of NSEL. Who are they? Find it out from here. Then note their contact details and call/email them for the account opening.

- Demat Account: One must open a separate Demat for E-Gold. Select your DP from the list of DPs impaneled by NSEL. Then note their contact details and call/email them for the Demat account opening.

- Redemption: One can sell units of E-gold like any units of mutual funds. Trading in e-gold can be done between 10 AM and 11 PM on working days. But if one wants delivery of physical gold against their e-gold units, it is possible but the procedure is cumbersome. Check here.

- Digital Gold (MMTC-PAMP & SafeGold): It is more convenient to invest in digital gold offered by MMTC-PAMP and SafeGold. One can use the HDFC Securities login to buy both these products. One can also use Google Pay and PhonePe mobile apps to buy MMTC-PAMP’s digital gold. Motilal Oswal’s Demat account can be used to buy digital gold from MMTC-PAMP. One can also signup to SafeGold’s website to buy digital gold offered by them.

Sovereign Gold Bond (SGB)

A sovereign gold bond (SGB) is a product of the government of India that is issued by RBI. It is one of the better forms to invest in gold. The bond considers 1 gram of 24K gold with 99.9% purity for its valuation. The current market value is considered as its price for transactions.

So it means that if the gold price moves up with time, the valuation of the sovereign gold bond also moves up at the same pace. Moreover, sovereign gold bondholders also earn an interest of 2.5% p.a. over their deposits.

These gold bonds are issued in denominations of 1 gram of gold. An individual investor can invest a maximum of 4 Kg in a year. The maturity period of the bond is 8 years. But the person can sell the bond in the secondary market at any time and book profits. If SGB is sold after 5 years, no capital gain tax will be levied.

At least one tranche of SGB is issued by RBI each month. The total of all purchases made in all the tranches in a year should not cross the limit of 4kg. Please note that for SGB, the FY starts on 01-April and ends on 31-March.

Generally, there are four ways to invest in a Sovereign Gold Bond:

- Banks: Buy SGB using online or mobile banking apps. One can also visit the bank to buy SGB.

- Post Offices: This is to be done by personally visiting the post office.

- Stock Holding Corporation of India: One can invest in SGB online by visiting its website.

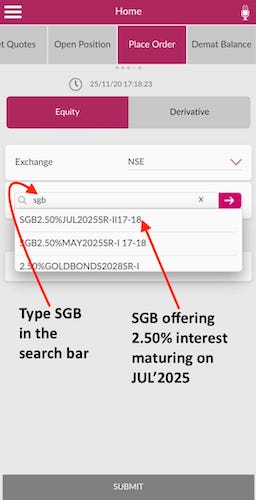

- Stock Brokers: Buy SGB using an online trading account. Just like you buy shares, type in SGB in the search bar. It will display the available bonds with their maturity dates. Click either of them to make the purchase.

Gold Futures

People who know about futures trading in the stock market can do similar trading in Gold futures as well. Commodity Exchange of India like MCX and NCDX offers future contracts in gold. The minimum trading size in MCX’s futures contract is 1 Kg gold.

Three Major Factors Influencing Gold Price

Gold is a commodity that is not used in industries a lot. Most of the gold which was ever mined in this world sits in bank lockers. So what are the drivers which make the gold price go up all the time? There are three main factors:

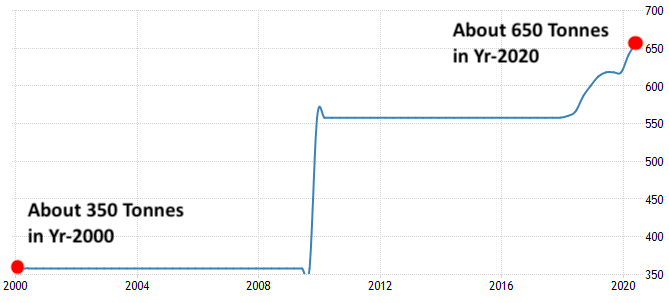

- #1. Gold Reserves of Countries: Regardless of how big or small is a country, everyone aspires to become a big gold hoarder. They do so through their central banks. Like Reserve bank of India (RBI) keeps close control of its gold reserves. In the last 20 years, RBI’s gold reserves have grown from 350 tonnes to 650 tonnes. This systematic purchase of gold in huge numbers takes the gold price up.

#2. Gold Investment: In the last couple of decades, Gold ETFs have been buying physical gold from the market in large quantities. The reason is the interest of investors in the gold ETF schemes. Earlier only central banks use to hoard gold. But now, even ETFs and E-gold gold providers have to keep physical gold as a mandate.

#3. Crude Oil Prices: Indirectly, the soaring oil prices have a big influence on gold’s market price. How? The reason is simple. Our world relies a lot on crude oil. Even if the crude oil price increases by only $1 per barrel, it has a cascading effect on the price of global products and services. In short, the crude oil price rise triggers inflation. Gold investment is considered a good inflation hedge.

Have a happy investing.

Suggested Reading:

Investing in gold has always been a wise choice for diversifying portfolios. Its stability during economic uncertainties makes it a reliable asset. Discover how gold investment can bolster your financial security in times of market volatility. Secure your future with the timeless value of gold!

hi

I have gold ornaments which are lying idle. suppose I sell them and invest the money in equity.

what are your thoughts on this.

I would hold them for myself for the sake of diversification.

ok. thank you.

how much investment should an individual make in Gold

Can you please explain how can we get Sovereign gold bond certificate if bought from secondary market. Also if we are buying SGB from secondary market, will we receive the interest in our bank accouunt?

Thank you very much for very informative article on Gold.

Through SGB, per month minimum 1g gold need to be purchased?

How to invest in Silver? are there any ETF to invest in Silver?

There are no silver ETFs. The easiest way of accumulating silver can be its coins.