Embarking on the stock market journey? Discover the essential principles with our “9 Golden Rules of Investing in Stocks.” Learn to navigate market uncertainties, avoid common pitfalls, and make informed decisions. Whether one is a beginner or seeking to refine strategy, these rules offer valuable insights to better our investment journey.

You are ready to start the thrilling journey of stock investing? Uncover the secrets that can transform us into a savvy and successful investor. We’ll glide through the 9 golden rules of investing in stocks.

Imagine a path where confusion vanishes, and confidence in decision-making prevails. To reach this stage, we must first learn a few basic rules of stock investing. What are these rules? These rules are forged from the wisdom of market luminaries like Warren Buffett. They work as our guiding light. These rules highlight the significance of avoiding herd mentalities, conducting meticulous research, and embracing disciplined strategies.

These are not just rules, they are a way to master the art of wealth creation.

These golden rules teach us to invest in businesses we understand. It also teaches us how to sail through the turbulent waters of emotions, encouraging resilience and strategic thinking. Generally speaking, ‘diversification‘ should be our shield and ‘information & realistic expectations‘ our compass in stock investing.

These rules can trigger a transformation within us that can propel us towards confident, well-informed, and successful stock market ventures. Let’s know more about my nine (9) golden rules of stock investing.

Topics

Rule #1: Understand the Business: Invest in stocks of companies whose business you can easily comprehend

“Never invest in a business you cannot understand.”- Warren Buffett

It is a theory that underscores the significance of having a clear comprehension of the companies in which we choose to invest. It highlights the idea that a sound understanding of a business is fundamental to successful investing.

Q1.1: Why is it important to understand the business before investing in its stocks?

Understanding a business before investing is crucial. It is much like knowing a phone’s features before purchase. Just as you wouldn’t buy a phone without checking its specifications, investing in a company without grasping its business model poses risks.

Suppose you were analyzing a company’s business, and you came to know that its primary business is making biscuits. In this case, the next logical question that will come to your mind that which other companies make biscuits? Who is the market leader in this industry?

So you can see, how knowledge about the nature of business is initiating other logical and investment-worthy questions. That is why it is said that, understanding the business (behind a stock) before investing allows informed decision-making.

Q1.2: How do I understand a company’s business?

Understanding a company’s business involves exploring its products and revenue sources. It is similar to checking if a restaurant serves pizza or burgers.

To grasp a company’s operations, we can read its annual reports. We must delve into its product offerings, and comprehend its revenue streams. It is just like investigating a restaurant’s menu to know what it specializes in.

Analyzing a company’s fundamentals provides insights into its strengths and weaknesses.

Gathering information about a company’s core activities can enable us to make informed buy or sell decisions.

Q1.3: Can I invest in a business I don’t understand?

Investing in a business without understanding it is discouraged by Warren Buffett. It is like purchasing a vehicle without knowing if it is a car or a two-wheeler. Similarly, venturing into unfamiliar businesses in the stock market without comprehension poses financial risks.

Emphasizing the importance of informed choices, Buffett reinforces that investing demands an understanding of the company in consideration. This information ensures that we can navigate the market volatility with clarity avoiding pitfalls.

Q1.4: What happens if I invest without understanding the business?

Investing without understanding a business is risky. It is. similar to investing in players of an IPL cricket team without knowing their strengths and weaknesses. Take the example of Infosys and its IT services, or Titan Company with its diverse product range. Understanding their businesses helps to make wise investment choices.

Conversely, investing blindly, like in unknown penny stocks without insight, may lead to losses. Getting a feel of how a company’s operations work is necessary to know how it makes money. As an investor, if we can understand and visualize how a company makes money, we can invest in it. Otherwise, it will be called blind investing which is not investing, it is like gambling (risky).

Q1.5: Can I invest in companies whose products I use every day?

Investing in companies whose products we use daily is a great strategy. One can consider investing in Asian Paints if you appreciate their paints. Stocks of HDFC Bank become likable if you prefer banking with it.

Just as you’d invest in a phone brand you love, understanding the company behind the products you enjoy enhances investment decisions.

This approach aligns our investments with your preferences in daily life. This method of investing makes the stock market more relatable. It’s akin to supporting brands you trust.

For example, Trend Ltd. is a stock that operates Westside and Star Bazaar in shopping malls. If you like going to these shops for shopping, you are in a way liking the business of Trent Ltd.

Rule #2. Buy stock at a Discount: Purchase stocks when they have undergone significant corrections

“Be fearful when others are greedy and greedy when others are fearful,” – Warren Buffett

This theory of Buffett encapsulates the essence of buying stocks during significant corrections or market pessimism.

Q2.1: Why should I buy stocks when they have undergone significant corrections?

Buying quality stocks during significant corrections is like grabbing your favorite items on sale.

For instance, during market downturns, top Indian stocks like HDFC Bank and Reliance often see their prices dip. Purchasing them then is akin to buying your preferred product at a discounted rate.

However, just as sale items may have minor flaws, stocks during corrections can have risks. Yet, if you believe in the long-term value of the stock, buying at a discount can be a savvy move.

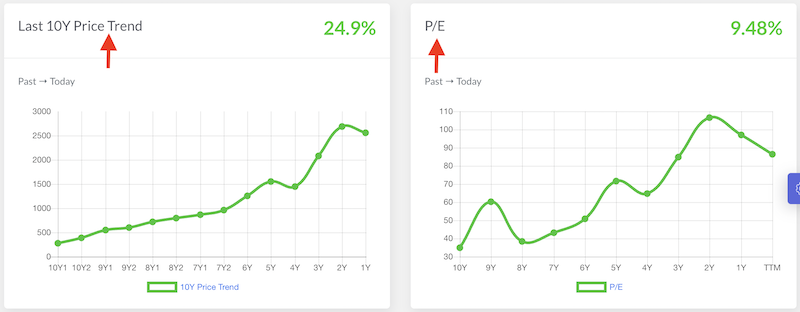

Q2.2: How do I know when a stock has corrected significantly?

To identify significant corrections, track stock prices and the PE ratio.

If the price is lower than usual, especially during a market downturn, it’s a potential buying opportunity. For instance, blue-chip stocks like Infosys and TCS may show lower prices during market corrections.

A rule of thumb is to consider buying when a stock’s price is at least 10-15% lower than its recent peak, indicating a substantial correction. This approach is akin to purchasing a mobile phone during a sale. It helps you acquire quality stocks at a discounted rate when market conditions are favorable.

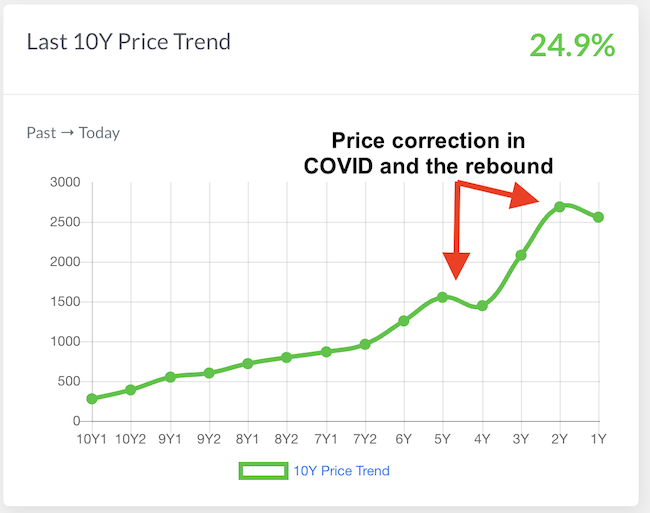

Q2.3: Can you give an example of a stock that corrected and then went up?

During the COVID-19 crash in 2020, stocks like Reliance Industries, Britannia, and Nestle India experienced significant corrections. Reliance Industries, for example, dropped around 40%, Britannia about 25%, and Nestle India approximately 20%.

However, they rebounded strongly afterward. Britannia and Nestle not only recovered their losses but also showed substantial gains.

This demonstrates that buying during corrections, when quality stocks are temporarily undervalued, can result in substantial value creation.

Q2.4: Is there a risk in buying during corrections?

Yes, there is a risk in buying during correction. It is especially true when a stock’s price correction is linked to a decline in its business fundamentals.

DHFL faced a significant downfall due to financial mismanagement, impacting its stock value. Kingfisher Airlines struggled with operational and financial issues, eventually leading to its closure. Future Retail faced challenges in adapting to market changes, resulting in a downfall. Yes Bank witnessed a decline due to concerns about its asset quality and governance issues.

Investors who bought these stocks during corrections faced substantial losses as the underlying businesses deteriorated further. DHFL, Kingfisher, and Future Retail are a few extreme examples as they eventually went bankrupt. Yes Bank is still struggling.

This emphasizes the importance of the fact that we cannot blindly buy during corrections. One must thoroughly assess whether the correction is a result of temporary market fluctuations or deeper fundamental issues within the company. The idea is to buy only fundamentally strong companies during corrections.

Rule #3: Long-Term Vision: Commit to holding stocks for a minimum of 20 years

“Our favorite holding period is forever” – Warren Buffett

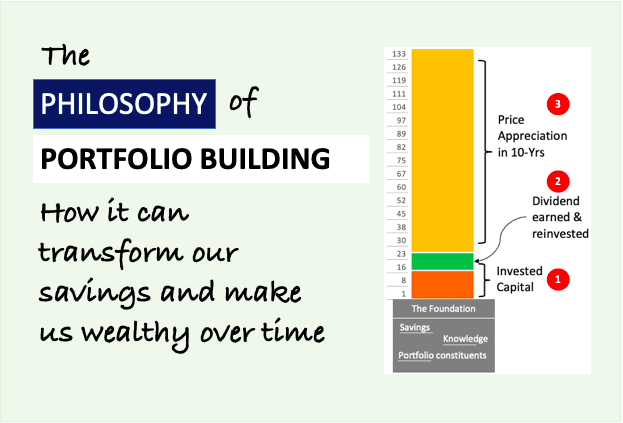

This theory from Buffett is the essence of long-term vision. It emphasizes the power of compounding and the benefits of holding quality stocks over a long period.

Q3.1: Why commit to holding stocks for 20 years?

Committing to holding stocks for 20 years is like planting a tree that bears more fruit as it grows.

Long-term holding harnesses the power of compounding. Here, tiny-tiny gains accumulate into significant wealth over time.

For instance, those who invested in Infosys in its early years and held on have reaped substantial rewards as the company grew into an IT giant. Check this interesting case study of three companies.

Like tending to a tree, nurturing your investments for the long term allows them to flourish. Your investment is also like a healthy tree that yields good outputs in the form of accumulated returns.

Q3.2: How does the power of compounding work?

The power of compounding is like a snowball effect on your money.

Imagine your money growing, and then the gains on that growth also start becoming bigger. For example, if you invested Rs.10,000 in 1999 in HDFC Bank, today it would have grown to become Rs.26 Lakhs (261 times in 25 years. It is equivalent to earning a CAGR return of 25% per annum.

Please note that, in the last 3 months, HDFC Bank shares have corrected by about 14%. Otherwise, this CAGR number would have been even bigger. Moreover, I’ve also not considered the dividend payouts HDFC Bank has given in the past 25 years. I estimate that, if we add the dividends gain here, the return percentage would touch the 27% per annum mark.

Compounding is the magic of earning returns on our returns. Over the years, this compounding effect can turn a modest investment into astounding wealth.

Q3.3: Can I make money by trading frequently instead?

While trading frequently may seem tempting, it often leads to higher risks and fees. It’s like constantly rearranging your garden; you may disrupt the growth.

Long-term investing, on the other hand, is akin to patiently tending to a garden. You allow your investment time to flourish, benefiting from the compounding effect. Frequent trading, like constant garden upheaval, can hinder the growth potential.

Opting for a long-term vision is like planting seeds and letting them grow into robust plants. This eventually yielded more significant returns over time.

Suggested: Use this online calculator to calculate how much to invest in stocks.

Q3.4: Give an example of long-term success

Consider Marico; in July 2001, it was trading at Rs. 2.81 per share. Today, it’s at Rs. 523 per share. It has showcased a remarkable growth rate of 26.02% per annum growth.

This substantial return over 22.6 years (July 2001 to Feb 2024) is a testament to the power of compounding. Marico’s long-term success exemplifies how patient investing can result in astounding wealth through compounding.

Q3.5: What if the stock market is volatile and unpredictable?

Market volatility and its unpredictability are part and parcel of the stock market.

Picture stock investing it like a rollercoaster ride with ups and downs. In a short span, it might seem chaotic, but over 20 years, these fluctuations tend to balance out.

Historical market trends indicate that despite short-term volatility, the overall trajectory tends to move upward. Our focus should be more on buying quality stocks at undervalued price levels. Once such a stock is in our portfolio, do not worry about the short-term volatility. Just hold on to it till its fundamentals are intact.

Q3.6: Should I not worry at all about short-term market news?

Short-term market news can be like a passing storm – intense but temporary. If we focus solely on these fleeting updates, we might miss the bigger picture.

Consider the story of Infosys. In the short term, its stock witnessed fluctuations based on various news, but over the long haul, it experienced substantial growth. Worrying excessively about short-term market news is like fretting over daily weather changes instead of preparing for the seasons. Long-term investors in Infosys reaped rewards because they remained steadfast during temporary storms.

So, while staying informed is wise, letting short-term news dictate your actions can lead to missed opportunities for long-term gains.

Q3.7: How can I start my 20-year journey in stock investing?

Starting a stock investing journey is like laying the foundation for a sturdy building. Begin by researching companies. Research the company’s financial health, consistent performance, and management quality.

Picking reliable companies is crucial to long-term stock investing. Once you’ve chosen, hold on for the long term, allowing the power of compounding to work. It is like patiently watching a building rise, layer by layer.

Resist the urge to react to short-term market noise. Keep your focus on the business fundamentals of the company. If the company is likely to do good business in times to come, ignore the short-term negative news.

Rule #4: Diversify Strategically: Maintain a well-balanced portfolio mix

“Diversification is protection against ignorance. It makes little sense if you know what you are doing.” – Warren Buffett

Q4.1: Why is it important to diversify my stock portfolio?

Diversifying your stock portfolio is crucial for risk management. Think of it like planting various crops in a field – if one crop fails due to unfavorable conditions, others may thrive and offset the losses.

Similarly, investing in different types of stocks ensures that the performance of one doesn’t have an overwhelming impact on your entire portfolio.

This way, you’re better equipped to navigate the ups and downs of the market. Keeping a diversified portfolio will minimize the overall risk and increase the potential for stable, long-term growth.

Keep this in mind, no matter how carefully we pick our stocks, some bad performers will creep in. This is why spreading our money among multiple companies is essential.

Q4.2: How do I diversify effectively?

Effectively diversifying involves allocating investments across various types of stocks.

Picture your portfolio as a garden where you plant different types of flowers.

- Large-cap stocks represent sturdy businesses. I generally keep 60% of my funds in this type of stock. This stock gives stability to my portfolio. On average, this basket of stock easily gives me 12% plus per annum returns in the long term.

- Mid-caps are those companies that are ready to become the next quality large caps. They are vibrant companies that need a leap of faith to start playing with the bigger players. I generally keep 30% of my funds in this type of stock. On average, this basket of stock gives me about 16% per annum returns in the long term.

- Small-caps: It is here the real capital appreciation takes place. In my investment journey since 2008, most of the multi-baggers have come from this basket. But the problem with this space is that you can be sure that most of your small caps will not do well in the long term. This is the reason why I only allocate 10% of the funds here. On average, this basket of stock gives me about 18% per annum returns in the long term.

This type of strategic diversification enhances stability. But the proportion can change from individual to individual. My stock know-how and experience only allow me to maintain the above allocations. I have tried to go aggressive (for certain periods) like in COVID, but my sweet space lies in the above proportions.

Q4.3: Should I reassess my portfolio mix over time?

Reassessing our portfolio mix over time is crucial. It is a process that will maintain a balance and diversity as explained above.

Imagine your portfolio as a fleet of ships, each representing a different asset class. Market conditions act like changing seas – some waters become rough, others calm down. Regularly reviewing and rebalancing is akin to adjusting the sails on each ship.

If one asset class grows significantly, it might start dominating your portfolio, leading to imbalances.

Rebalancing involves selling a portion of the overperforming assets and reinvesting in underperforming ones to maintain your desired mix.

This process ensures that you are navigating the market changes while optimizing your overall performance.

Rule #5: Monitor Portfolio Growth (CAGR)

Tracking the portfolio’s performance based on the CAGR growth rate is necessary.

Expert and professional stock investors emphasize evaluating investments based on their long-term performance. Short-term fluctuations in our stock holdings should not worry us a lot when the CAGR of our entire stock portfolio is within acceptable limits.

To name a few, in the last few weeks/months, stocks like HDFC Bank, Polycab, Bata, etc have seen significant corrections. But does it mean that pro-investors and fund managers will sell these stocks from their holdings? Probably not. Till these short-term fluctuations are not majorly affecting the overall returns of their portfolio, they will at least not sell in such times.

I try to keep the CAGR of my stock portfolio at around 20%+ per annum levels. There were instances in the past where over-exposure to one particular stock started affecting the CAGR of my overall portfolio. In such cases, I had to sell a part or all of that stock (for example: Future Enterprise).

But in most cases, I have found that holding my stocks has only enhanced the CAGR of my portfolio. This is only possible because I try not to over-expose myself to one particular stock. Hence, small fluctuations in their price do not have a lot of influence on the CAGR of my portfolio. But the likes of Future Retail are a few exceptions. If you want to know what I thought about Future Enterprise then, read this article.

To know more about how to calculate the CAGR of our stock portfolio, read this article.

Rule #6: Prudent Selling Practices: Identify and promptly sell stocks of low-quality companies

The best stock to buy may be the one you already own, but you need to check its price, quality, and whether it has changed fundamentally. If it’s not the same as when you bought it, it may be time to reassess and possibly sell – Peter Lynch

Q6.1: Why is it necessary to sell stocks of low-quality companies?

Selling stocks of low-quality companies is essential to safeguard the value of our investment portfolio.

Low-quality companies often exhibit weak financial fundamentals, such as declining revenue, excessive debt, negative PAT, etc. Investing in such companies poses a higher risk of losses. Promptly identifying and selling these stocks allows us to mitigate the risk of a major downside trend.

The stocks that we hold are like the foundation pillars of our investment portfolio. Relying on low-quality companies to support the portfolio will be a mistake. Better is to remove that foundation pillar and replace it with a stronger one.

Q6.2: How do I identify a low-quality company?

Identifying a low-quality company involves scrutinizing key indicators. Watch out for the first few red flags such as declining revenue and increasing debt over time.

Next a time will come when the company will start posting losses and its interest coverage ratio and debt-to-equity ratio will become too high. Another sign of weak financials will be falling cash from operating activities. This is an important metric available in the company’s cash flow reports.

Before a company reaches such a stage, removing such stocks from the portfolio will be a better choice.

By recognizing these warning signs, we can act as a vigilant custodian of our stock portfolio.

Q6.3: When should I sell a stock?

We can sell a stock when the company’s performance deviates from our expectations. Prudent selling is as important as the stock buying acumen. Read more about when to sell stocks in our portfolio.

As a general rule, if a company’s fundamentals falter selling becomes a strategic move to maintain the overall health of our investment portfolio. But here we must also note that if this change is only temporary or it’s going to be there for a very long term (or worse permanent).

For example, in the year 2022, the IT sector started facing headwinds. So does it mean that we can start selling holdings of companies like TCS, Infosys, and Tech Mahindra? No, why? Because such a dip in fundamentally is most likely temporary.

In the past, we saw a similar case with other industries like healthcare, infrastructure, capital goods, PSUs, etc. But all these sectors eventually bounced back with good fundamentals.

Generally, company-level quality declines are more common. You will find fewer examples in history where the whole industry’s prospects are being talked about negatively. So, it is better to focus on individual companies and identify their weaknesses to comprehend the “sell” decision.

Rule #7. Stay Informed: Keep abreast of the latest news and developments related to our portfolio stocks

“Risk comes from not knowing what you’re doing.” – Warren Buffett

Knowledge and awareness about our portfolio stocks can empower us to respond effectively to market changes. This way, strategic adjustments that are required in our portfolio come naturally to us. Information can enhance the resilience and performance of our investment portfolio.

Q7.1: Why is it important to stay informed about my portfolio stocks?

Staying informed about our portfolio stocks is like to driving cars with a GPS. Just as real-time traffic updates help you choose the best route, staying updated on stock news allows you to make necessary changes in our portfolio.

For example, suppose one owns shares of an Auto manufacturing company. Now, if we learn about a new car launch, we can anticipate potential market reactions. Such timely information can empower us to make strategic decisions.

Another example, in Jan’2024 we saw a near 30% correction in stocks of polycab. The price fall was attributable to corporate governance issues (Tax Evasion). The company allegedly faced IT raids and proof of undisclosed cash sales were found. The market reacted sharply to this news. Some investors sold their holdings and some bought at the corrected price.

People who bought think that, as Polycab has a fair moat in its business line, will continue to grow fast in times to come.

Q7.2: How can I stay updated on my stocks?

Staying updated on our stocks involves adopting a routine. It is like reading daily cricket score updates.

Likewise, we can watch financial news on TV at least for one hour each day. Consider activating Google Alerts for specific stocks on your smartphone to receive real-time notifications. Even better will be to read a business newspaper each day.

By staying connected to relevant information, we can equip ourselves with the knowledge needed to make informed decisions. This can help us to anticipate the market moves, and foresee potential market movements.

Q7.3: Can staying informed prevent losses?

The majority of long-term investors face loss in the stock market due to panic selling. Staying informed serves as a preventive measure against such actions.

Long-term investors must know about the developments in businesses that run behind their holding stocks. For instance, if adverse news surfaces about a company you hold shares in, being informed empowers you to react strategically.

Rule #8. Consider Macroeconomic Factors

There is significance in considering macroeconomic factors before delving into the stock market.

Investors should monitor key economic indicators to gauge the overall health of the economy. Factors such as GDP growth, inflation rates, interest rates, and unemployment figures provide valuable insights.

For instance, a growing economy with low inflation and interest rates generally fosters a conducive environment for stock market performance.

Additionally, geopolitical events and government policies can impact markets. Investors should stay informed about fiscal and monetary policies, trade relations, and global events that might influence market sentiments.

By understanding these macroeconomic variables, investors can make more informed decisions. This is a way to align our portfolios with prevailing economic conditions.

Rule #9 Use A Stock Analysis Tool

People who are building their stock portfolio from scratch, have about 5000 number stocks to choose from. Experts say that individual long-term investors should limit their stock holdings to 20 number shares. So, picking 15-20 odd shares from an ocean of 5000 listed stocks is a massive task.

Some might say that why not pick a few big names from the market and stay invested for the long term? This strategy might look intuitive but is not so effective. Had it been so, what was the need to follow the eight rules discussed in this article?

Out of all these eight rules, the most critical of them are rule#1 and rule#2. A reliable stock analysis tool can help us execute these steps more effectively.

We’ve coded such a tool called the “Stock Engine”. This tool can be used to screen stocks. There are a few pre-built screeners that generate a list of filtered stock based on different investment philosophies. You can check our Stock Engine here.

The Stock Engine’s algorithm is also coded to estimate the Overall Score and Intrinsic Value of its stocks.

Conclusion

Stock investing is like an intricate game of chess. Success lies not merely in transactions but in adhering to fundamental principles. My journey, spanning over a decade in the stock market, has taught me that longevity in the market demands a commitment to timeless rules. The rules outlined in this article, pragmatic and proven, have been the bedrock of my investment strategy.

While numerous theoretical guides populate the internet, these rules encapsulate the essence of practical wisdom garnered through experience. They serve as a compass, steering investors away from pitfalls and toward opportunities.

In the last 10 years, my focus has shifted from only “stock picking” to maximizing the returns of my portfolio. I do this by acquiring more quality stocks at discounted prices. This is what is highlighted in Rule #1 and Rule #2.

Have a happy investing.

Suggested Reading: