Long back, I faced an issue with my health insurance policy. Our claim got rejected on the grounds of pre-existing disease. It happened in Yr-2008 when I used to work in Kolkata.

We were very unprepared for the claim rejection. Moreover, I was also unaware of the criticality of such a clause. Hence, that episode made me feel cheated. Nevertheless, I later realized its validity.

Since then, IRDAI has also updated this clause several times. I suppose, had I made that claim today, the probability of rejection is minimal.

Anyways, since then, the topic of pre-existing disease always attracts my attention.

After I left my job, we bought a family floater health cover. Not surprisingly, the sales representative had to spend extra 10 minutes explaining the pre-existing disease. 🙂

In the last couple of months, something happened which again drew our attention towards the pre-existing condition (I’ll tell you that story later).

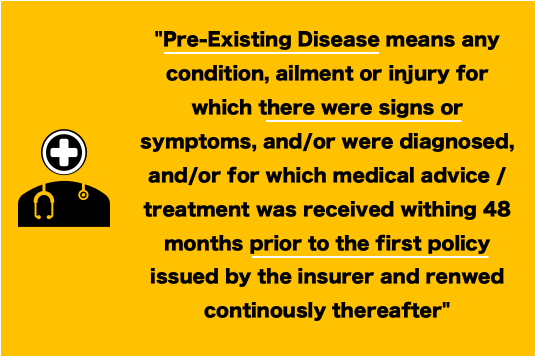

What Is A Pre-Existing Disease?

In simple medico-legal terms, a pre-existing disease means any condition, ailment, or injury for which there were symptoms in the body from 48 months before the first issue of the policy.

It means if a person got a health policy issued on 1-Jan’21, any disease in the body showing symptoms after 31-Dec’16 is treated as a pre-existing disease. Moreover, it is also mandatory to declare the said condition, if known, at the time of the application. The beneficiary cannot explicitly exclude the known disease in the policy.

So, what happens in case an ailment is categorized as a pre-existing condition?

In case a disease falls under this ambit, it will be covered under the health insurance policy only after the lapse of the waiting period (24 to 48 months).

What does it mean? Pre-existing conditions will not remain excluded from the health insurance cover forever. They will be covered after the “waiting time” is over. But it is mandatory for the beneficiary to declare any known condition at the time of policy purchase.

Any disease that is diagnosed for the first time after the policy is purchased will not be treated as a pre-existing condition.

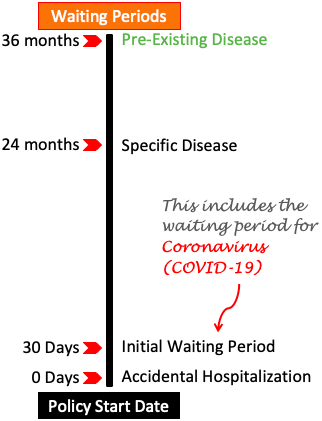

What Is A Waiting Period?

The waiting period is the time the policyholder will have to wait to claim the health benefits after the health policy comes into force.

There can be multiple types of waiting period depending on the type of health insurance policy. In this article, we will explain its four common types:

- Accidental Hospitalization: Health insurance cover offers a zero-days waiting period for all hospitalizations caused due to accidents. It means that, if a policy start date is 1st-Jan, then a valid accident claim can be made on the 1st-Jan itself.

- Initial Waiting Period: The duration of this waiting period is 30 days from the date of issue of the policy. It is the period for which the policyholder must wait before claiming any benefits (except accidental hospitalization).

- Waiting Period for Specific Disease: There is a list of specific diseases for which claims will be honored only after the expiry of this period. Generally, for all health policies, this waiting period is about 24 months from the date of issue of the policy.

- Pre-Existing Disease: Any disease which falls under this category will have a longer waiting time. Generally, this type of waiting period can fall in the range between 24 to 48 months.

Advantage of a group health insurance

Now that we know the concept of a pre-existing condition and waiting period I’ll tell you about a recent realization.

I have a friend who is working in a company. He had a health insurance cover provided by his employer. Recently, his company offered him an added benefit. The company was extending the health cover to his elderly parents, but my friend must pay an annual premium of Rs.10,000.

My friend was confused if he should take the offer. In fact, he was questioning if this is a benefit at all? My friend said, “the company is charging Rs.10,000 per annum. So how come it is a benefit, it is a cost to him“.

In a way, he was not wrong. But to understand the benefits we must look at a bigger picture.

One of the parents of my friend is suffering from medical conditions like minor liver cirrhosis, thyroid, diabetes, and prostate. These ailments will fall under the category of a pre-existing disease. Moreover, the age of both the parent was above 65 years.

In this situation, if my friend went on to buy a personal cover for his parent, it will be very costly. My estimate of the premium of such health insurance will be about Rs.50,000 per annum.

Moreover, there will be a waiting period clause for the pre-existing diseases. My friend also told me once that his parent needs hospitalization more than once each year.

If my friend decides to include his parents in the group insurance cover, he will see two immediate benefits:

Benefits

- Lower Premium: Considering that it is group insurance provided by the company, the premium cost for including parents is only Rs.10,000 per annum.

- Cover for Pre-Existing Disease: In the case of group insurance policies, all valid claims can be made from day one itself. It means the waiting period will be zero days even for pre-existing diseases. This is a special benefit offered by group insurance policies.

Conclusion

Group insurance health covers are great for people with pre-existing conditions. So if the choice is between personal (family floater) and group cover, then group insurance will be better.

From the point of view of the people who are insured, the waiting period is an important rule of any health cover. Why? Because it directly affects the claim settlement probability.

Here is a quick checklist of three critical clauses of any health insurance plan one must read before buying it:

- Waiting Period: People are asked to wait for a specific period before they can claim benefits from their health cover. The shorter will be the waiting period, the better. Go for a health cover that offers the shortest waiting time.

- Network of Hospitals: To get cashless treatment, one must admit the patient to few specific hospitals. These are hospitals that have partnered with the insurer to offer the cashless facility. Check the list to know if your preferred hospitals appear in the list or not.

- Claim Settlement Ratio of the insurer: The insurance provider who has the largest claim settlement ratio (CSR) is considered best. CSR indicates the number of claims settled in FY for every 100 number claim received.

| SL | INSURER | CSR | ALL CLAIMS (NOS) | SECTOR |

| 1 | New India | 92.68% | 58,64,346 | Public |

| 2 | United India | 78.03% | 33,85,660 | Public |

| 3 | National Insurance | 83.78% | 23,45,627 | Public |

| 4 | Reliance | 76.43% | 15,18,171 | Private |

| 5 | Bajaj Allianz | 92.24% | 13,05,417 | Private |

| 6 | Oriental Insurance | 93.96% | 10,98,090 | Public |

| 7 | IFFCO Tokio | 96.33% | 5,04,168 | Private |

| 8 | ICICI Lombard | 78.67% | 4,33,498 | Private |

| 9 | HDFC ERGO | 86.52% | 1,67,673 | Private |

| 10 | Tata AIG | 76.04% | 1,22,003 | Private |

| 11 | Future Generali | 82.96% | 99,462 | Private |

| 12 | SBI General | 66.08% | 95,204 | Private |

| 13 | Royal Sundaram | 81.50% | 67,957 | Private |

| 14 | Bharti AXA | 76.01% | 53,596 | Private |

Suggested Reading:

![If A Bank Closes What Happens To The Deposits? [DICGC]](https://ourwealthinsights.com/wp-content/uploads/2021/06/If-a-bank-closes-what-happens-to-deposits-image2.png)

Hi Mani(sh),

Well written article on GHI and topic covering the pre-existing disease clause. Group health insurance is done only when you are employed I suppose? Or can it be done by the siblings for their parents?

Appreciate your response.

Keep up the good work.

GOD BLESS.

Yes, group health insurance is generally for a group of employees of a company (or of any organisation).

Thanks for posting your comment.

Why is there waiting period? And some health insurance don’t cover dental problems also…

The waiting period rule benefits both (the insurer and the insured). On part of the insurer, it is beneficial from point of view of keeping the unethical claims to minimum. On part of the insured, once the waiting period if over, almost all ailments will be covered in the insurance.

Can I take this policy?

Health covers for everyone