Since HDFC Bank has faced a noticeable decline in its share prices. This decline has caught the attention of investors and market enthusiasts. The stock witnessed a 14% slide, leaving many wondering about the reasons behind this sudden drop. In this article, we’ll try to understand the reasons for the fall and future risks and opportunities associated with HDFC Bank.

The primary contributors to this decline include disappointing Q3 results, particularly in terms of flat margins, sluggish deposit growth, and lower earnings per share (EPS).

Foreign investors in particular were quick to react to these factors, resulting in a share price drop of 14%. The stock kept seeing steep correction between 16-Jan’24 and 23-Jan’24 before going flat. This decline reflects the market’s immediate response to the bank’s performance metrics.

Despite the short-term setback, financial experts and analysts view this as a potential opportunity for long-term investors. The dip in HDFC Bank’s stock value is seen as a knee-jerk reaction to the weak Q3 results. Analysts anticipate a gradual recovery, citing a shift in portfolio mix towards retail lending as a positive factor.

For people like me, who seek to understand the dynamics of HDFC Bank’s recent stock performance, I’ve decided to write this piece. I’ll mostly focus on the Q3 results and the subsequent market response. The idea is to unveil key insights into the challenges and opportunities that lie ahead.

Reasons Behind HDFC Bank Stock Decline

There are multiple factors contributing to the sharp correction in HDFC Bank’s share price. Some reasons are attributable to the current Q3 results and some to the HDFC Ltd and HDFC Bank’s merger. The steep price fall that we saw on 16-Jan’2024 and subsequently is a combined effect of both.

Allow me to explain the points one by one:

Reason #1. Fall in Net Interest Margin (NIM)

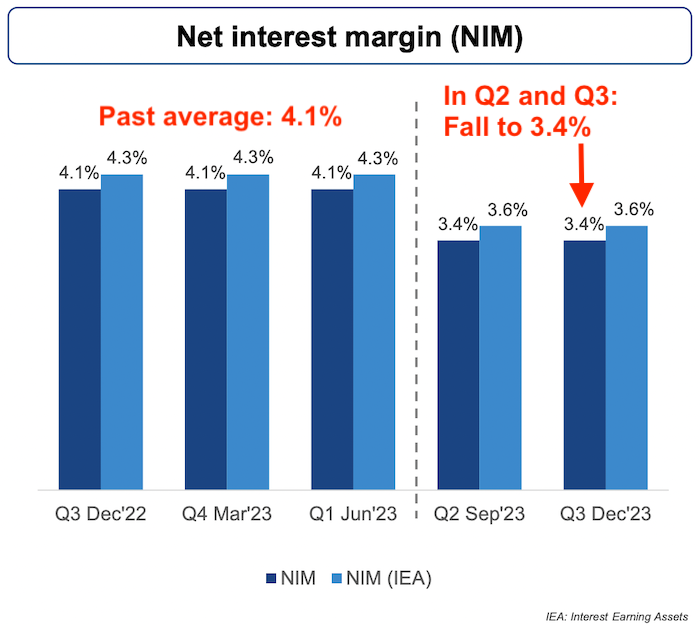

HDFC Bank reported a net profit that grew at 2.5% QoQ and 33.5% YoY. However, the market was disappointed with the Net Interest Margins (NIMs). The NIMs came in at 3.4%, which is the same as in the second quarter when a merger took place.

There were expectations in the market that the bank would show an improvement in NIMs in Q3. However, disappointment arose as the margins remained at 3.4%. The market has reacted sharply because of its higher expectations about the NIMs.

Historically, HDFC Bank maintained margins of 4.2% to 4.3% for the past 25 years. The HDFC Bank shares were accordingly valued based on their historical NIM level.

But post-merger, the NIMs (as expected) slipped to 3.4% levels. But at that time the market did not react so impulsively. Why? Because the Bank gave a soft indication that in Q3 the NIMs will start showing an upward trend.

[FYI: In the Q3 Results, ICICI Bank posted a NIM of 4.43%]

Reason #2. Loan to Deposit Ratio (LDR) at 110%

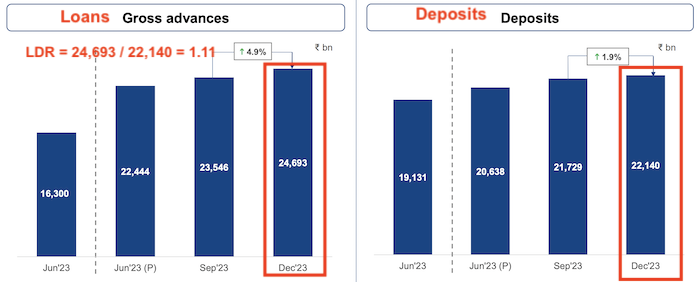

HDFC Bank’s LDR (Loan To Deposit Ratio) is high at 1.11. It says that, out of every Rs.1 taken as deposits, the bank has given a loan of Rs.1.11.

In this situation, HDFC Bank must borrow aggressively the balance of Rs.0.11 from the depositors by offering a higher interest rate. This action will further put pressure on the bank’s already falling NIM (Net Interest Margin).

Now, taking deposits is not so hard but the problem is that, generally deposits are for a shorter period compared to the loan tenures. What does it mean? The bank is borrowing short-term to lend long-term. The market (especially FIIs) does not like this situation that HDFC Bank has put itself into.

Moreover, HDFC Bank is a leader in the banking space. It can influence the cost of deposits for the entire banking system when it starts to borrow desperately at any cost.

[FYI: In the Q3 Results, ICICI Bank posted a Loan To Deposit Ratio (LDR) of 0.87 as compared to HDFC Bank’s 1.11]

Reason #3. FII Selling

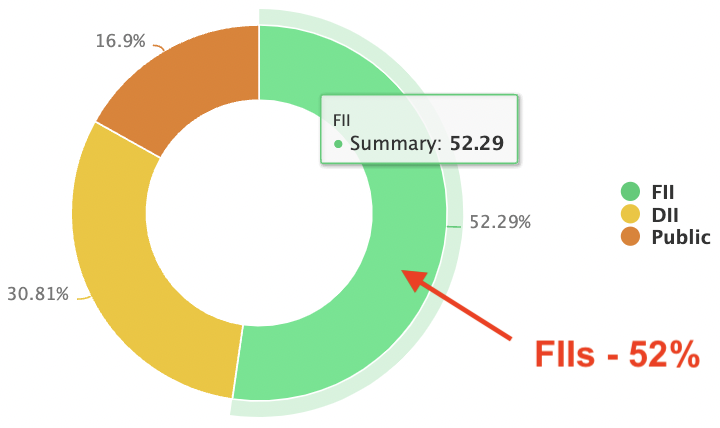

Approximately 52% of HDFC Bank is held by FIIs and 30% by DIIs. Foreign investors, in general, are selling their holdings in emerging markets. They are doing this because they are anticipating that the US bond yields will rise. So they are preparing to put their money back in the US economy (which is considered as a safer bet).

Suggested Reading: The basics of debt mutual fund investing.

This existing trend of FIIs being already in the selling mode further aggravated the HDFC Bank’s share price decline.

When NIMs will be back to 4.1%?

HDFC Bank has maintained 4.2% to 4.3% NIMs and 18% to 20% earnings growth for over two decades.

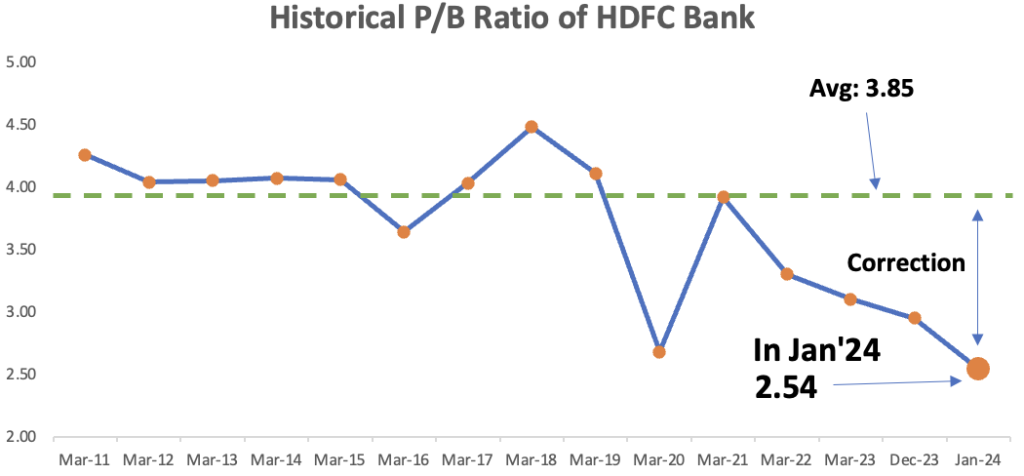

Before we go to NIMs, allow me to highlight the bank’s valuation at the current price level of Rs.1462 per share. The bank also maintained a P/B ratio of around 3.85 in the last decade. But as of 31-Jan-2024, the P/B ratio of the bank has come down to 2.54 levels. Even in Mar’2020 (the start of COVID), its P/B level was at a low of 2.68.

The point is, as the NIM has come down (-17%, from 4.1% to 3.4%), the price valuation (in terms of P/B ratio) has also corrected by -34% (from 3.85 to 2.54).

| Description | Jan-24 | Dec-23 | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 | Mar-17 | Mar-16 | Mar-15 | Mar-14 | Mar-13 | Mar-12 | Mar-11 |

| Price | 1462 | 1698 | 1,608.06 | 1,471.77 | 1,491.91 | 861.97 | 2,319.23 | 1,892.04 | 1,443.59 | 1,069.80 | 1,022.96 | 749.29 | 623.70 | 520.11 | 2,342.87 |

| BVPS | 576.00 | 576.00 | 518.73 | 445.99 | 380.59 | 321.63 | 564.29 | 422.33 | 358.21 | 293.9 | 251.96 | 184.1 | 154 | 128.74 | 549.97 |

| P/B | 2.54 | 2.95 | 3.10 | 3.30 | 3.92 | 2.68 | 4.11 | 4.48 | 4.03 | 3.64 | 4.06 | 4.07 | 4.05 | 4.04 | 4.26 |

Post-merger, HDFC Bank is indeed facing some challenges. Being the market leader, its shortcomings are also getting highlighted multifold. Margins were flat at 3.4% in the latest results. There is also a challenge in managing deposits, with the bank having Rs.1 of deposits for every Rs.1.1 of loans.

Now, the question is whether HDFC Bank can regain its old ratios.

The answer is not simple for sure. The merger of HDFC Ltd. and HDFC Bank is one of the biggest mergers of all time. The merger execution is crucial, and the bank is working to deliver the best results post-merger. The synergies that will emerge due to this merger will take time to come to the surface. Till then, it is the job of the bank’s top management to manage the expectations of the market.

How much time the bank will take to bring back its lost ratios?

It will not happen in a next few quarters for sure. As the LDR (Loan To Deposit Ratio – LDR) is more than 100%, customer acquisition (depositors and borrowers) post-merger may require diluting their past standards.

At this stage, acquiring customers for HDFC Bank may impact profitability compared to pre-merger HDFC Bank customers. For a business this big, it will take them three to five years to return to its previous levels.

Home Loan Effect on NIM

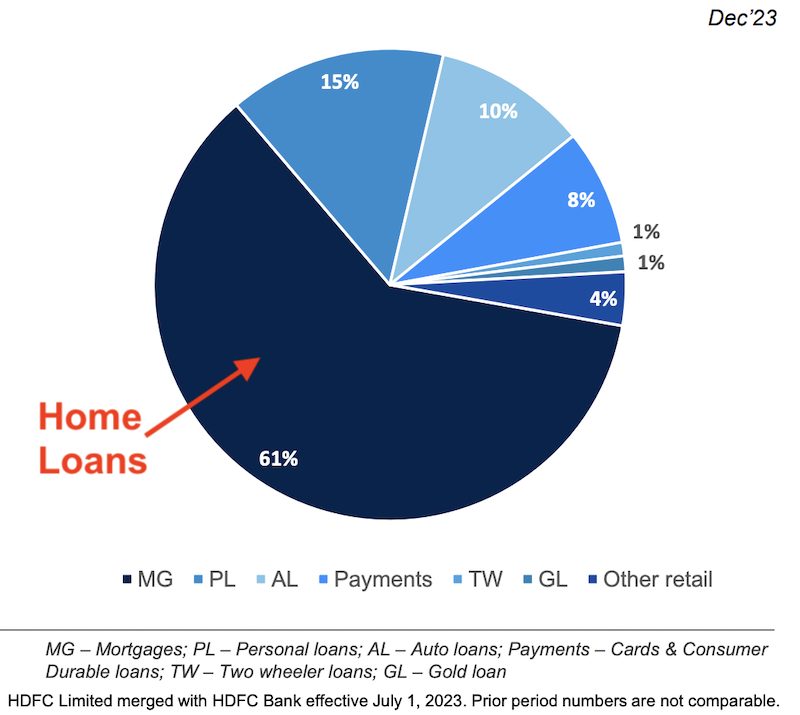

Home loans are low-margin products for a lender. HDFC Ltd’s books mostly had home loans. Now, all those home loans have come into the books of HDFC Bank. As of today, more than 60% of all borrowed money from HDFC Bank are home loans.

However, experts say that home loans may not affect HDFC Bank’s profitability a lot if it acquires the right customers. Why? Because Home loans consume less capital, and leveraging them for profit is also feasible.

So, coming back to the old NIM level of 4.1% may not be easy, but if the business grows (revenue, PAT, and EPS) fast enough (like post-COVID levels), the stock price of HDFC Bank may start claiming the old premiums again. But to reach there it may need another 3 to 5 years.

Final Words

HDFC Bank is a rare and valuable franchise in the banking sector. Warren Buffett says that even good businesses may face temporary setbacks. When such events happen it presents buying opportunities for potential long-term investors.

At present, the market is focusing mainly on the falling NIMs and high LDR (Loan To Deposit) ratio. We must remember that HDFC Bank has also reported the following results:

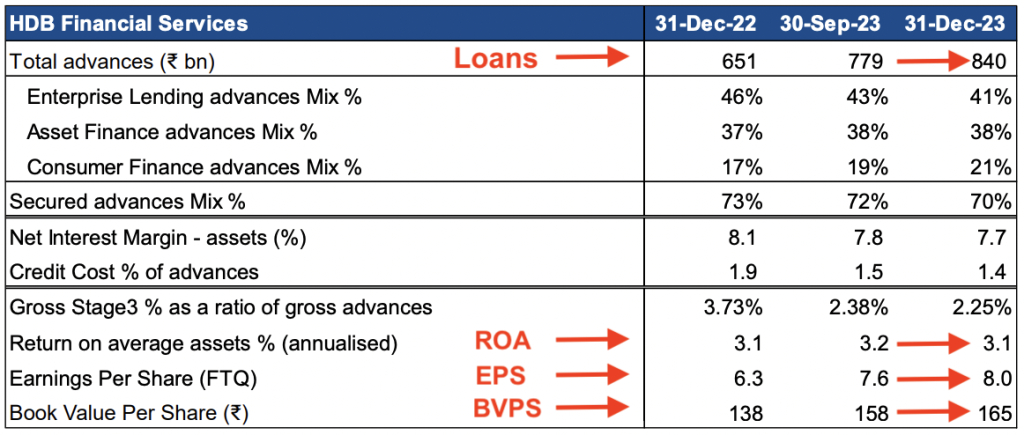

- 7.8% growth in advances/loans Q0Q (from Rs.779 to Rs.840 Bn).

- The ROA has remained in the range of 3.1 to 3.2% in the quarter.

- The EPS has grown by 5.2% QoQ.

- The BVPS (Book value per share) has grown by 4.4% QoQ.

These numbers of the Q3 results look solid and reassuring to me. I consider that the fall in NIMs is the result of a growing LDR ratio. If the bank can manage carefully the LDR, NIMs will begin to rise in times to come. The specific worry for HDFC Bank is managing deposit growth without negatively affecting the NIMs.

HDFC Bank is planning to set up new branches (about 1,000 numbers) in each FY. This will further improve the reach and brand loyalty of HDFC Bank, eventually helping it to gather more deposits at cost-effective rates.

It’s Limitation of being a popular bank

HDFC Bank is a very popular choice for investors. This becomes a challenge for the company. Why?

Because many people already own HDFC Bank stocks. Since a lot of people already have HDFC Bank shares, not many new people may want to buy more of them. This is why analysts say that the “fresh appetite” may be lacking for HDFC Bank shares.

I feel that this limitation will fade with time when FIIs will start buying HDFC Bank again. It may start happening after the upcoming general elections or later. I feel once the bank reports three continuous quarters of NIM enhancements (no matter how small it is), new investors (both FIIs, DIIs, and retail) will start pouring money into the stock.

For the moment, I’m ready to give this stock the next 3 years to reach that stage.

Have a happy investing.

Suggested Reading:

Excellent Analysis!

Thanks