Summary Points:

- HEG Ltd, an Indian company making graphite electrodes for steel production, saw its stock soar due to a big move in Japan.

- Japan slapped a 95.2% anti-dumping duty on China’s graphite electrodes, making them too costly and opening a 15,000-tonne market gap.

- China’s earlier dumping (cheap sales) and later export controls (since 2023–2024) squeezed supply, pushing Japan to act.

- HEG, with its 100,000-tonne capacity, could grab 3,000–4,500 tonnes of this gap, adding USD 30–54 million in revenue.

- This boosts India’s graphite industry, with HEG and Graphite India leading the charge in a shifting global market.

Introduction

Today, HEG Ltd’s share price shoot up by about 11.36% in just one trading day. And get this, some reports even say it touched 18% at one point. What about the trading volumes? They went through the roof, jumping more than 10 times the usual. When I see numbers like that, I start wondering, what’s causing such price rise? Turns out, the answer lies thousands of kilometers away, in Japan, and China’s got a big hand in it too. So, allow me share with you cause of HEG’s share price jump and a few key related details.

HEG Ltd: Who Are These Guys?

Let’s talk about HEG Ltd.

If you haven’t heard of them, don’t worry, it’s not exactly a household name like Tata or Reliance. HEG is a company from Noida, part of the LNJ Bhilwara Group, and they’re in a pretty niche business. They make graphite electrodes.

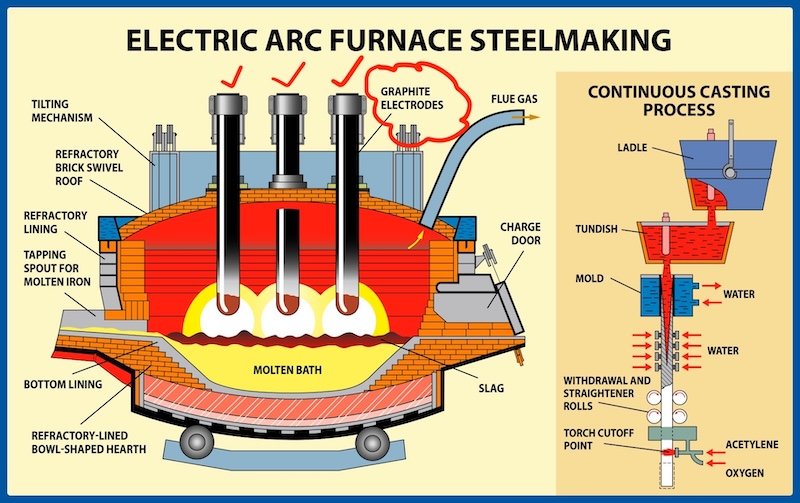

Graphite electrodes are these big, sturdy rods made of a special kind of carbon that can handle insane heat and electricity. They’re used in electric arc furnaces (EAFs) to melt steel scrap into fresh, shiny steel.

Without Graphite electrodes, there will no melting in steel plans and hence no steel production.

HEG runs the world’s largest single-site plant in Mandideep, Madhya Pradesh where the produce graphite electrodes. They produce out 100,000 tonnes of these rods every year.

And here’s the main thing, over 70% of what they make gets exported abroad to more than 30 countries.

That’s right, HEG is a quiet giant in the global market.

What’s Happening In Japan?

Something big dropped in Japan on 25 March 2-205. The Japanese government announced they’re slapping a massive 95.2% anti-dumping duty on graphite electrodes coming from China, starting March 29.

What is anti-dumping duty?

It’s basically a tax to stop countries from selling stuff too cheap and hurting local businesses. Japan’s been digging into this for a while, since April 2024. A few Japanese companies like Tokai Carbon and SEC Carbon complained that China was flooding their market with super-cheap electrodes. The investigation’s interim report confirmed it, China was playing unfair. They were selling at prices that Japanese firms couldn’t match, and it was hurting them bad.

Japan’s graphite electrode market is no small deal, around 60,000 tonnes a year. This market is worth roughly USD 600–900 million. China was supplying about 15,000 tonnes of that (25%). With this new duty, those Chinese electrodes are about to get expensive, like USD 10,000–14,000 per tonne instead of the earlier dumped prices of maybe USD 5,000–7,000.

So this way, Japanese steel makers will not buy Chinese graphite electrodes, that’s for sure. They’ll start looking elsewhere, and that’s where our HEG Ltd. comes into the picture.

China’s Role: The Villain or Just a Player?

China is the world’s biggest producer of graphite electrodes.

They’ve got the raw materials (graphite mines), the scale, and the knack for keeping prices low. But here’s where it gets messy.

- Back in December 2023, China started tightening export controls on graphite products, including electrodes, saying it was for ‘national security.’ They made it harder to ship this stuff out by slapping on export licenses and stricter rules.

- Then, in December 2024, they went even further, adding more restrictions. Naturally, this squeezed global supply, and countries like Japan, who depend on these imports for their steel plants, started feeling the heat. Prices shot up because there was less graphite to go around.

But here’s the twist. Even with these controls, Japan’s probe, which kicked off in April 2024, found that China had been dumping graphite electrodes, selling them at dirt-cheap prices below fair market value, before and during the early stages of those restrictions.

It’s like China was flooding the market with low-cost electrodes to grab market share, and then pulled back supply later to flex control. Cheap dumping earlier and tighter supply later. It pushed Japan over the edge, and the 95.2% duty was their way of saying, ‘Enough is enough.’

How HEG Wins: The Numbers

How does this new development help HEG?

Japan needs 60,000 tonnes of electrodes a year. With 15,000 tonnes from China suddenly too pricey, there’s a gap to fill. HEG, with its 100,000-tonne capacity, is ready to jump in.

Even if they grab just 20–30% of that gap, say, 3,000–4,500 tonnes, it’s a big deal. At today’s prices (around USD 10,000–12,000 per tonne), that’s an extra USD 30–54 million in revenue annually. And if Japan’s duty sticks around after these four months, that number could climb to USD 50–100 million if HEG snags more market share. For a company whose revenue was INR 2,400 crore (about USD 290 million) in FY24, this is a serious boost.

The stock market saw it coming too. That 11.36% jump on March 25? It’s not random. Investors smelled opportunity the second Japan’s news hit. HEG’s share price went from around INR 438 to INR 486–490 in a day, and trading volumes exploded. Graphite India, HEG’s cousin in this game, also jumped nearly 12%. Together, these two added INR 900–1,000 crore to their market cap in hours. That’s the kind of frenzy you see when the stars align—and for once, they’re aligning for us Indians.

Why Graphite Electrodes Matter?

You might be wondering, why all this fuss over graphite electrodes?

Imagine this, steel is the backbone of everything, bridges, cars, buildings. In an EAF (Electric Arc Furnaces) of steel plants, steel scpar is melted and refined to produce pure molten steel. These graphite electrodes are like the spark plugs of these EAF’s.

These graphite electrodes carry massive electric currents, thousands of amperes, creating arcs hot enough to melt steel scrap at 6,500°C.

Japan’s steel industry, I’ll estimate, must be producing about 20–25 million tonnes via EAFs. They can’t run without them. And with China out, HEG’s high-quality electrodes will suddenly be in demand from tomorrow.

It’s not just business for Japanese steel plants, it’s about keeping those furnaces live and running. Without electrodes, the furnace will stop.

Industry’s Moment

This isn’t just about HEG or one stock. It’s about the whole industry stepping up.

We’ve got two big players, HEG and Graphite India, holding 20–25% of the world’s non-Chinese graphite electrode capacity.

Japan’s move could mean more orders, more jobs, and a stronger “Made in India” tag. Sure, there’s competition, firms like GrafTech (USA) or Showa Denko (Japan) won’t sit quiet, but we’ve got an edge, cost, quality, and a hungry export market. Plus, Japan’s not far off, shipping from Madhya Pradesh (India) is certainly better than crossing the Pacific, right?

But it’s not all rosy.

HEG’s already running at 85–90% capacity. To grab more of Japan’s market, say, half of China’s 15,000 tonnes, they’d need to stretch or expand, which takes time. And if Japanese steelmakers push back on higher prices, demand might dip.

Still, I’d bet on HEG.

Conclusion

A decision in Tokyo sent HEG’s stock soaring in India, with China indirectly causing all of it.

It’s a classic tale of trade, competition, and opportunity. As an Indian, I’m rooting for HEG to make the most of it, more revenue, more global clout, maybe even a few new jobs back home.

Will Japan’s duty stay past four months? Will HEG lock in those Japanese contracts? Only time will tell, but for now, its an opportunity for HEG worth grabbing.

What are your views on the inter-connectedness of the international markets these days? Share me your views about HEG in the comment section below.

Have a happy investing.