We all love discounts. Whether it’s buying a new phone during a festive sale or investing in stocks after a market crash, discounts feel rewarding. But in investing, buying cheap doesn’t always guarantee exceptional returns. During my recent research, I stumbled upon an eye-opening insight: a 35% discount on a stock didn’t result in extraordinary long-term returns. The reason? The company’s growth rate was modest.

This realization underlines a critical concept in stock investing: Why Long-Term Growth Rate Matters More Than Buying at a Discount. Let me walk you through the details and explain what this means for you as an investor.

Topics:

1. Example: A 20-Year Investment Journey

Let’s consider this simple investment scenario:

- An investor buys a stock after a market crash.

- The stock jumps by 35% in the first year (due to the discount).

- For the next 19 years, the stock grows steadily at 16% per annum.

Here’s how the investment looks over 20 years:

| Year | Investment | Return | Amount |

|---|---|---|---|

| 1 | 1,00,000 | 35% | 1,35,000 |

| 2 | 1,35,000 | 16% | 1,56,600 |

| 3 | 1,56,600 | 16% | 1,81,656 |

| 4 | 1,81,656 | 16% | 2,10,721 |

| 5 | 2,10,721 | 16% | 2,44,436 |

| 6 | 2,44,436 | 16% | 2,83,546 |

| 7 | 2,83,546 | 16% | 3,28,914 |

| 8 | 3,28,914 | 16% | 3,81,540 |

| 9 | 3,81,540 | 16% | 4,42,586 |

| 10 | 4,42,586 | 16% | 5,13,400 |

| 11 | 5,13,400 | 16% | 5,95,544 |

| 12 | 5,95,544 | 16% | 6,90,831 |

| 13 | 6,90,831 | 16% | 8,01,364 |

| 14 | 8,01,364 | 16% | 9,29,582 |

| 15 | 9,29,582 | 16% | 10,78,315 |

| 16 | 10,78,315 | 16% | 12,50,845 |

| 17 | 12,50,845 | 16% | 14,50,981 |

| 18 | 14,50,981 | 16% | 16,83,137 |

| 19 | 16,83,137 | 16% | 19,52,439 |

| 20 | 19,52,439 | 16% | 22,64,830 |

At the end of 20 years, the investment grew only at an average rate of 16.88% per annum, despite the 35% jump in the first year.

2. The 35% Discount Myth

Let’s see how Sustainable Growth Shapes Long-Term Returns.

At first glance, a 35% discount seems like a golden opportunity. And it often is! But here’s the catch: your long-term returns depend more on how fast the company grows over time than on the initial discount.

This is because of a simple yet powerful concept: compounding. In the above example, even though the stock grew significantly in Year 1, the returns afterward were limited by the company’s growth rate of 16%. Over 19 years, this steady growth controlled the overall outcome.

It’s like running a race. If you sprint ahead at the start but jog the rest of the way, your average speed will remain moderate. Similarly, a one-time discount can give you a head start, but the company’s Sustainable Growth Rate (SGR) determines how far you go. Read more about the concept of Sustainable Growth Rate here.

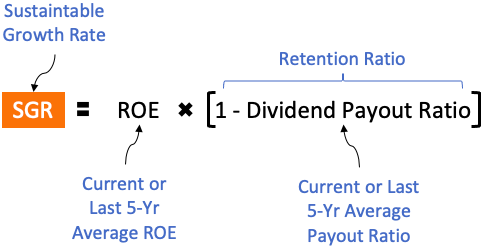

Here is the SGR formula: SGR = ROE × [1 − Dividend Payout Ratio]

3. What Is Sustainable Growth Rate and Why Does It Matter?

The Sustainable Growth Rate (SGR) is the rate at which a company can grow using its own profits without taking on debt. It depends on two things:

- Return on Equity (ROE) – How efficiently the company generates profit from shareholders’ money.

- Reinvestment Rate – How much of its profit the company reinvests instead of paying out as dividends.

For example, if a company’s ROE is 20% and it pays only 10% of its profit as dividend, its SGR is:

SGR = 20% × (1 – 20%) = 16%

This means the company can grow sustainably at 16% per year. If you invest in such a company, your returns will align with this growth rate over time.

3.1 How ROE Influences Future Growth Rate

When evaluating a company’s growth potential, one of the key indicators to look at is Return on Equity (ROE). ROE measures how efficiently a company uses shareholders’ equity to generate profits. In simple terms, it shows how much profit a company makes for every rupee of shareholders’ money invested.

3.1.1 What is ROE and Why Does it Matter?

The formula for ROE is: ROE = Net Profit / Shareholder’s Equity

A high ROE indicates that the company is using its resources efficiently to generate profits. If a company can consistently deliver high ROE, it suggests that the business model is effective, and the company can sustain a high Sustainable Growth Rate (SGR).

Example of ROE Driving Growth:

Let’s take two companies, A and B:

- Company A has an ROE of 20%.

- Company B has an ROE of 10%.

Both companies decide to reinvest 50% of their profits back into the business (known as the Reinvestment Rate).

- Company A’s Sustainable Growth Rate: SGR = 20% x 50% = 10%

- Company B’s Sustainable Growth Rate: SGR = 10% x 50% = 5%

In the long run, Company A will grow faster because it can generate more profit from the same amount of equity compared to Company B. To understand how reinvestment (retained earnings) can drive growth, read this article.

3.1.2 How Companies Use Debt to Enhance ROE

Sometimes, companies use debt to boost their ROE. This is known as financial leverage. Here’s how it works:

- Suppose a company borrows money to finance its operations instead of relying solely on shareholders’ equity.

- Because debt is not part of the equity calculation, the company can generate higher profits with a smaller base of shareholders’ equity, thereby increasing ROE.

Example of Debt-Enhanced ROE

Let’s compare two scenarios for a company:

- Without Debt:

- Assets: Rs.10 crore (all funded by equity)

- Net Profit: Rs.1 crore

- ROE = 1/10 x 100 = 10%

- With Debt:

- Assets: Rs.10 crore (Rs.6 crore funded by equity, Rs.4 crore by debt)

- Net Profit: Rs.1 crore

- ROE = 1/6 x 100 = 16.67%

By using debt, the company’s ROE increases from 10% to 16.67%.

How does high ROE translates into high return for the shareholders?

A high ROE (Return on Equity) means the company generates more profit for every rupee of shareholders’ equity invested. If the company reinvests these profits back into the business, it can grow faster and compound returns over time. This leads to even higher earnings (profit), which can increase dividends or boost the stock price, benefiting shareholders.

When the profit grows, it makes the P/E lower for the same price. It makes the stock looks better valued. On one side, profit is rising and on the other side the stock looks better valued. It is the best recipe to attract more investors. This increase in demand for the stock boosts its stock price.

Essentially, higher ROE reflects efficient use of equity, translating into higher returns for shareholders through either capital appreciation or dividends.

3.1.3 The Danger of Too Much Debt

While using debt can enhance ROE, too much debt is risky.

High debt levels mean the company has to pay interest regularly, which can become a burden during downturns.

If profits drop, the company might struggle to meet its debt obligations, which can lead to financial distress or even bankruptcy.

3.1.4 How to Assess the Quality of ROE

Not all high ROEs are created equal. As an investor, it’s crucial to check if a company’s ROE is driven by genuine operational efficiency or excessive debt. Here are some ways to evaluate the quality of ROE:

- Debt-to-Equity Ratio (D/E): This ratio shows how much debt the company has relative to its equity. A D/E ratio below 1 is generally safe; a ratio above 2 could indicate high risk.

- ROE Consistency: Look for companies that maintain stable or growing ROE over several years. Consistency indicates a robust business model.

- Return on Assets (ROA): ROA measures how efficiently a company uses its total assets (both debt and equity) to generate profit. A rising ROE with a falling or low ROA might suggest that the company relies heavily on debt to boost returns.

- Interest Coverage Ratio: This ratio shows how easily the company can pay interest on its debt. A higher ratio (e.g., above 3) indicates the company can comfortably meet its interest obligations.

3.1.4 A Balanced Approach to ROE

As investors, our goal should be to find companies with high-quality ROE—driven by operational efficiency rather than excessive debt. A company that achieves high ROE with moderate debt levels is likely to have a sustainable growth rate.

A high ROE is a strong signal of a company’s ability to grow.

However, it’s essential to ensure that this ROE isn’t artificially inflated by too much debt. Sustainable growth comes from efficient use of resources and balanced financial management. When evaluating stocks, focus on companies that deliver consistent, high-quality ROE.

By understanding this aspect of “sustainable growth rate” – which is ROE driven, we can invest smartly and build long-term wealth (with stocks).

4. Buying Cheap vs. Growing Steady

This is a key to long-term stock returns

Many investors focus on buying undervalued stocks, hoping for quick profits when prices recover. While this strategy can work, it’s not always reliable for long-term wealth creation. The real game-changer is finding companies with strong, consistent growth potential.

For example:

- Company A: You buy it at a 40% discount, but it grows at just 8% annually.

- Company B: No discount, but it grows steadily at 18% annually.

In 20 years, Company B will deliver a return of (9.41% per annum) as compared to Company B (18% per annum).

Just because the company B is able to grows sustainably for longer term, despite no initial discount, it can deliver far superior returns because of its higher growth rate.

I think, this is an important realization for long term investors on equity. Values investors focus too much on discounts a stock is available at. For a long-term investor who wants to practice buy-and-hold strategy, buying only at a huge discount is not enough.

5. Focus on Sustainable Growth, Not Just Discounts

Here’s a better approach to investing:

- Prioritize Quality Companies: Look for companies with a solid business model, efficient management, and a history of consistent growth.

- Check Growth Rates: Analyze their ROE and reinvestment strategies to estimate their Sustainable Growth Rate.

- Discounts Are a Bonus: If you find a quality company at a discount, that’s great! But the long-term growth potential is what truly matters.

- Think Long-Term: Invest with a horizon of 10-20 years. Compounding works best when given time.

Conclusion

Over the years, I’ve realized that long-term investing is less about timing the market and more about picking the right businesses. Discounts can provide a boost, but they can’t replace the power of steady growth. This is why I focus on companies with sustainable growth rates, even if they aren’t the cheapest at the moment.

Buying cheap can feel satisfying, but growing steady is what builds wealth.

The next time you’re tempted by a discounted stock, ask yourself: How fast can this company grow in the long run?

The takeaway is simple: A 35% discount didn’t lead to extraordinary returns because the company’s growth was only 16%.

As investors, focusing on sustainable growth rates can help us make smarter, long-term decisions. Remember, discounts are temporary, but growth compounds forever.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.