What is BHIM UPI? BHIM stands for “Bharat Interface for Money”. How BHIM UPI works?

UPI stands for “Unified Payment Interface”.

BHIM UPI is a revolutionary payment system started by Government of India.

BHIM UPI is basically a Mobile APP which can be used to send and received payment in seconds.

Why its is revolutionary? Because of three reasons.

First, it makes payment in real time. Means the instant the sender’s bank account is debited, in the same moment, the receivers bank account is credited.

The payment transaction happens in a matter of split seconds.

Second, UPI is also revolutionary as it is one of its kind in the world. UPI has been developed in India by National Payments Corporation of India (NPCI).

Third, all the transactions happening through UPI is free of any charges. Means, if the sender pays Rs.500, the receiver will receive the full 100% amount (Rs.500).

This is not the case when we make payments by debit cards or credit cards. Approximately 2% is deducted as transaction fees.

A great tool to make payments – UPI.

Lets take an example to understand the magnanimity of UPI.

Most of us drive vehicles, right? Suppose you bought a vehicle when you are living in Bangalore.

After working for few years in Bangalore, you switched job to Mumbai.

What do you think, you will be able to ride the same vehicle in Mumbai?

The answer is yes, but you will have to pay a hefty road tax again in Mumbai, and will also be asked to do a re-registration.

Though we live in one Country (India), but still this discrimination exists between states.

A similar discrimination exists between Banks. Payment made from one bank to other calls for a transaction fees.

Why? This was a normal practice. It seems nobody questioned it. Hence it became a business of sorts to charge fees on fund transfers.

We generally transfer funds using NEFT, RTGS, IMPS, ECS etc.

What we used the most is NEFT. But do we use IMPS frequently? No, though we know that it transfers money instantly.

IMPS stands for Immediate Payment Service. Still we use it rarely, why?

Because payments made through IMPS attracts a nominal fee.

UPI has been developed on IMPS philosophy of “immediate fund transfer”.

UPI helps in immediate inter-bank fund transfer without any additional fee.

BHIM UPI

These days every bank has their own UPI.

One can create ones UPI id like XYZ@axisbank, XYZ@hdfcbank etc.

But BHIM UPI is developed by National Payment Corporation of India (NPCI), a Government of India enterprise.

Hence it is the safest.

#A. How BHIM UPI Works – Installation of APP?

There are 5 steps involved before one can start using the BHIM UPI

#A1. “Download BHIM APP” from the Apple Store or Google Play Store for free.

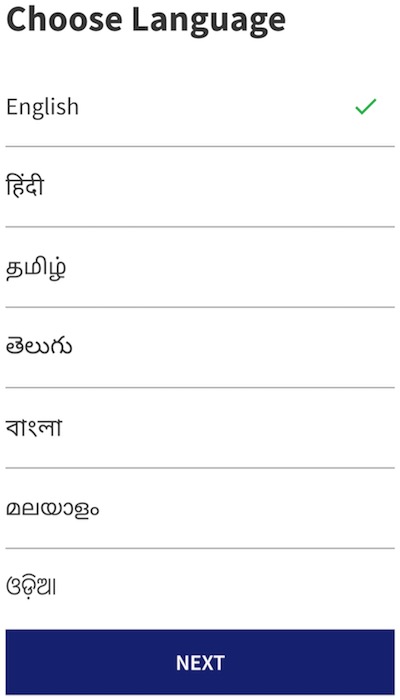

#A2. “Choose Language” from the list and click NEXT.

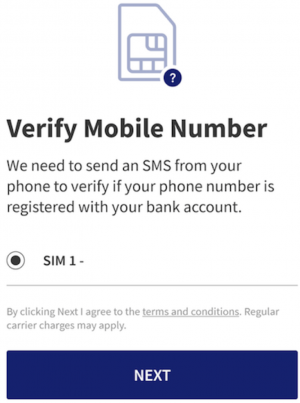

#A3. Allow BHIM APP to “Verify Mobile Number” by clicking NEXT.

#A4. Setup a “UPI PIN” to be used during transactions.

After your phone number is verified, you will prompted to set up a secure UPI PIN.

This will be a four (4) digit PIN number like we use while transacting with ATM.

Preferably use a unique 4 digit PIN for BHIM UPI APP.

This UPI PIN will be used every time you are opening the APP.

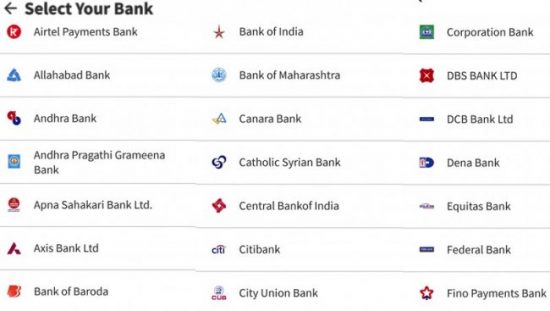

#A5. “Add your Bank account” to BHIM UPI

Almost all big and small banks are included in BHIM UPI.

The added Bank account will be used during fund transfer.

- When you receive money – fund will be credited in this bank account.

- When you pay money – fund will be debited from this bank account.

You can also watch this video to understand how to configure BHIM UPI APP on your mobile phone.

#B. How BHIM UPI Works – Send Money using APP?

How to send money using BHIM UPI?

Once your bank account gets added to the BHIM UPI, sending money is taken only seconds.

#B1. Open BHIM UPI app on your smart phone.

Once you open the APP, you will asked to enter the BHIM UPI PIN (Passcode) you set-up in step #A4 above.

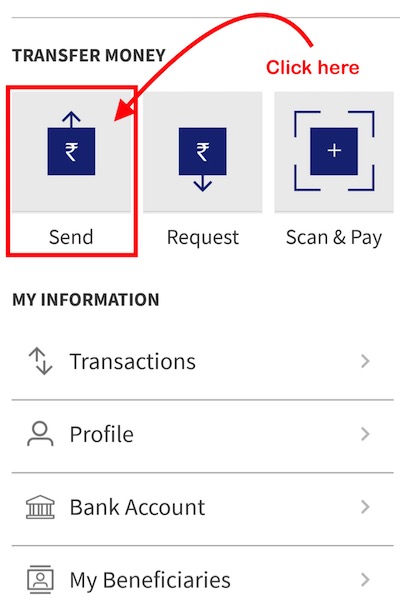

#B2. Click SEND Button.

Once the pass code is entered, a new interface will open.

To send the money, click on the SEND button as shown below:

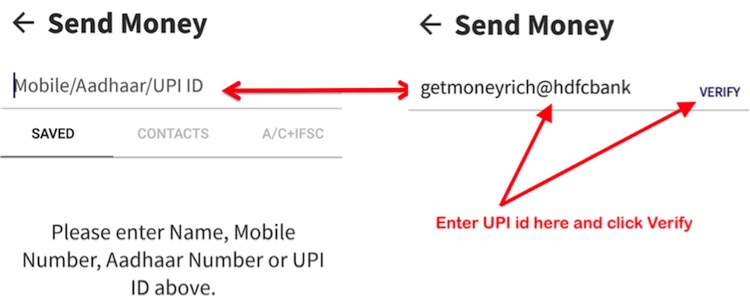

#B3. Enter the beneficiary’s UPI ID.

After you click the SEND button, a new window will open.

This window will ask you to enter the beneficiary’s (who is supposed to receive the money) UPI ID.

Do the entry as shown below and click VERIFY.

#B4. Check the beneficiary’s details.

Once you enter the UPI ID, details of that UPI ID will be automatically fetched by the UPI APP.

Check the details for any possible errors.

Generally there will be no error if the UPI ID is correctly entered.

If all details are OK, click PAY.

You can also watch this video to understand how to how to send money using BHIM UPI APP.

Conclusion

Payments made using UPI are completely free.

Here the neither the sender nor the receiver is charged even a dime extra.

To top it all, the money gets transferred immediately. So there is no waiting time.

It means, it is like cash purchase where payment and delivery of items/services can be claimed upfront.

No doubt why UPI is called as a revolutionary payment system developed for masses by the NPCI.

Can you write about its basic working mechanism?

I can do that….but can you be more specific about what you would like to read as a “basic working mechanism” of UPI? Thanks.