Interest rates have a profound impact on Real Estate Investment Trusts (REITs), influencing their valuations, dividend payouts, and overall market performance. If you’ve been tracking Indian REITs like Embassy Office Parks, Mindspace, or Brookfield India, you may have noticed how their stock prices fluctuate in response to changes in the Reserve Bank of India’s (RBI) policy rates. But why does this happen?

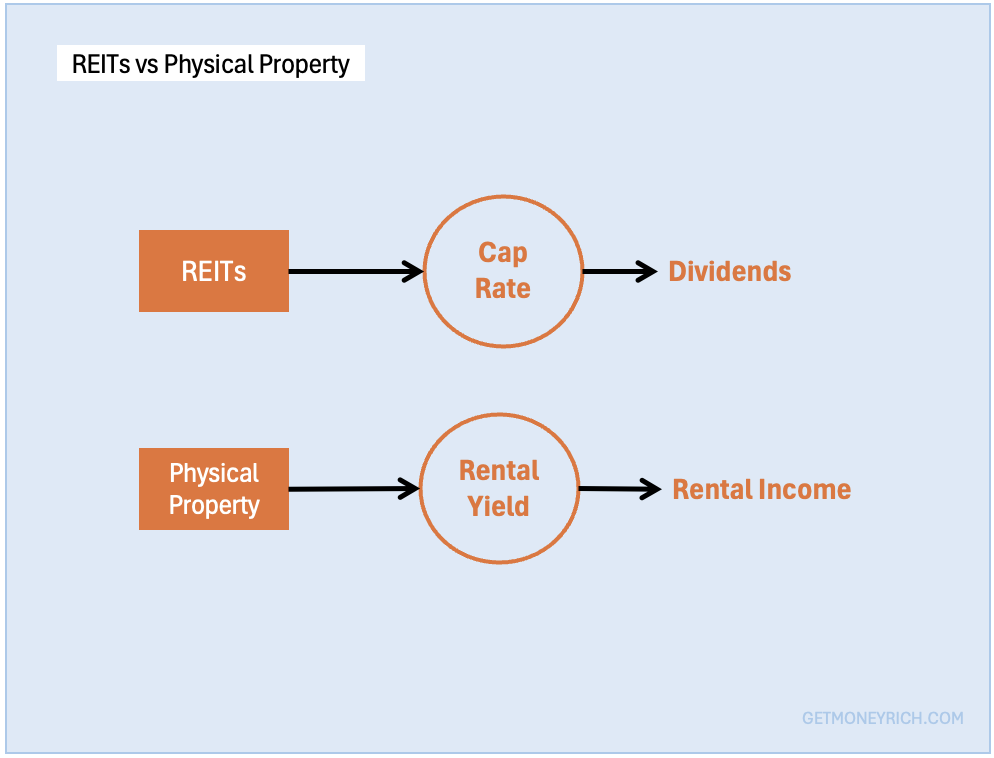

At first glance, REITs seem like a straightforward way to earn passive income through dividends, much like owning rental properties. However, unlike physical real estate, REITs are publicly traded and highly sensitive to interest rate movements.

When rates rise, borrowing costs increase, property valuations shift. This intensifies the competition from fixed-income investments. Conversely, when rates fall, REITs often benefit from cheaper financing and rising demand.

For investors looking to diversify their portfolio, understanding this relationship is crucial. So, let’s break it down in simple terms and explore how interest rate changes shape the performance of REITs.

Table of Contents

1. Cost of Borrowing

For REITs, debt (loan) is a critical tool.

Since their business revolves around acquiring and managing income-generating properties, they often borrow heavily to finance new purchases and expansions. When interest rates are low, borrowing becomes affordable, allowing REITs to buy more properties, upgrade assets, and grow rental income. With lower financing costs, they can also distribute higher dividends to investors, as their PAT is higher.

However, when the RBI hikes interest rates, the entire equation changes.

Borrowing becomes expensive, making new property acquisitions costlier and refinancing existing loans a financial burden. Higher interest payments cut into the REIT’s earnings, reducing the cash available for dividend distributions.

Some REITs may even halt expansion plans to preserve cash, impacting future growth prospects.

Example

Imagine an Indian REIT that took a Rs.1,000 crore loan at 6% interest last year. That meant an annual interest expense of Rs.60 crore. Now, with interest rates rising, the same REIT must refinance at 8%, pushing the annual cost to Rs.80 crore, a Rs.20 crore increase in expenses.

That’s Rs.20 crore less for property upgrades, expansion, or dividends.

For investors, this means that REIT performance is closely tied to interest rates, and understanding this relationship is key to making informed investment decisions.

2. REITs vs. Fixed-Income Investments

For many investors, REITs serve as an income-generating asset, much like fixed deposits (FDs), bonds, or government securities. Their appeal lies in their ability to provide steady dividend payouts, often at higher yields than traditional fixed-income instruments. This makes them particularly attractive when interest rates are low. During low interest rate regimes, FDs and bonds offer relatively poor returns in such environments.

However, when the RBI raises interest rates, the landscape changes. Bond yields go up, FD interest rates rise, and debt mutual funds start offering better returns. Suddenly, investors have safer alternatives with comparable or even higher yields. Many shift their money away from REITs and into these low-risk instruments. This causes REIT stock prices to decline.

Example: In Apr’19-Mar’20, when the RBI kept lowering the rates (from 6% to 4.4%) to boost consumption, Indian REITs delivered strong returns (about 40%). The falling interest rate regimemade REIT dividends an attractive income source.

But In Oct’2020-Jan’2025, as inflation surged, the RBI responded with aggressive rate hikes. Between Oct’2020 and Feb’2023, RBI hiked rates from 4% to 6.5%, since Feb2023, it has stayed high at 6.5%. As a result, bond yields and FD rates have climbed, making them more appealing to conservative investors. REIT stock prices corrected, as funds flowed out of real estate investments and into safer fixed-income options.

For investors, this highlights an important takeaway, REITs tend to perform well in a low-interest-rate environment but face pressure when rates rise.

3. Property Valuations

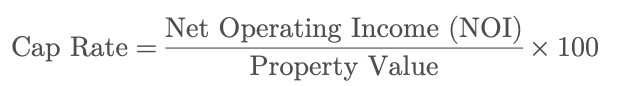

A major factor that influences the demand of a real estate property is the valuations. Investors value property bases on the income it generates. If a property is generating high income with respect to its valuation, it becomes dearer. In the real estate world, a terms called Capitalization Rate (Cap Rate) is used to measure the income generating potential of a property. Consider Cap Rate (for REITs) as something which similar to the rental yield (for Physical Properties) .

Check the below formula for the Cap Rate:

Cap Rate helps us to compare different properties based on income generation, regardless of location or price.

- It reflects market conditions—a rising cap rate signals falling property values and vice versa.

- Investors and REITs use it to decide whether a property is overvalued or undervalued.

Now, lets understand how interest rate influences the Cap Rates.

The Cap Rate rises or falls with interest rates because it reflects the expected return on real estate investments relative to other investment options, particularly risk-free assets like government bonds.

Here’s why:

- Higher Interest Rates → Higher Expected Cap Rate → Lower Property Values

- When the RBI hikes interest rates, returns on safer investments (like bank FDs, bonds, or government securities) also rise.

- Investors demand higher returns (cap rate) from real estate to compensate for the increased opportunity cost.

- To give higher cap rates (attract buyers), sellers lower property prices. It leads to higher cap rates and reduced valuations (see above formula).

- Lower Interest Rates → Lower Cap Rate → Higher Property Values

- When interest rates drop, fixed-income returns decline, making real estate more attractive.

- Investors even accept lower cap rates. Here, they are willing to pay a premium for stable rental income. Moreover, as returns on other risk-free options like FDs, bonds, etc are lower, even lower cap rates looks better valued.

- How builders lowers the Cap Rates? They have the flexibility of increasing property values up. As property values goes up, Cap Rates falls.

Let’s take an example to get an even clearer understanding. Suppose there is a commercial building (REITs) which generates Rs.10 crore annual rental income:

- At a 6% cap rate, it’s worth Rs.166.67 crore (=10/0.06).

- If rates rise and cap rates increase to 7%, the same property is now worth Rs.142.86 crore (=10/0.07).

Cap rates move in response to interest rates. This happens because investors adjust their return expectations based on alternative investment opportunities.

Lower property values mean the REIT’s total asset value goes down. This makes the stock price less attractive to investors. This is why REIT prices often dip when interest rates rise.

For investors, this underscores the cyclical nature of REITs. They tend to perform better when interest rates are low but face headwinds when rates rise.

4. Dividends

One of the biggest reasons investors buy REITs in India is their regular dividend payouts.

These dividends are akin to the rental income from a physical property. Indian REITs are legally required to distribute at least 90% of their net income as dividends. This is what makes them an attractive income-generating asset.

However, interest rate movements directly affect these dividend payouts. Let’s discuss more about this relationship.

When Interest Rates Rise:

- Higher borrowing costs eat into REIT profits. It reduces the next profit of REITs, hence the amount available for dividends.

- Investors expect higher dividend yields to justify staying invested instead of shifting to safer options like FDs or bonds.

- If a REIT cannot increase its payouts, investor will sell their holdings in REITs and shift to risk-free options. This will cause the stock price to decline.

When Interest Rates Fall:

- Lower financing costs allow REITs to expand and improve properties (asset based). As their income-generating assets expand, it lead to higher rental income.

- Since alternative fixed-income investments offer lower returns, REITs remain attractive even with moderate yields.

- This supports stock prices, keeping investor sentiment strong.

Example:

Consider a REIT that distributes Rs.10 per unit annually when interest rates are low (6%). When interest rates are high, REITs would not consider expanding its property (asset) base as mostly their expansion take place through debt financing. Why? Because 90% of their PAT is distributed as dividends, hence they are depended on debt-financing to funds their CAPEX.

In a high-interest environment, as their asset base is not growing, their dividend payout will not increase. This may demotivate some REITs investors and they may start consider other investment options. In a high interest environment, other options like Bank FDs, bonds, etc also offer higher interest rates, hence becomes more attractive.

The inverse happens when interest rates see a downward cycle.

This is why REITs tend to struggle in high-rate environments but perform well when rates are stable or declining.

5. Tenant Demand & Economic Growth

Let’s not focus only on REITs, lets see a bigger picture.

Interest rates don’t just impact REITs, they also affect the businesses that lease office spaces, malls, and warehouses from them. Since REITs rely on rental income, anything that influences tenant demand directly affects their profitability.

When Interest Rates Are Low:

- Cheaper financing helps businesses expand, leading to higher demand for office spaces and retail properties.

- Startups and corporations take on new leases, pushing rental prices up.

- REITs benefit from steady occupancy and rental growth, allowing them to maintain strong dividend payouts.

When Interest Rates Are High:

- Businesses face higher borrowing costs, forcing them to cut expenses and delay expansion plans.

- Some companies may downsize their office spaces or even move to cheaper locations, reducing leasing activity.

- Lower demand can result in stagnant or falling rental income, impacting REITs’ ability to distribute dividends.

Example:

During COVID-19 (2020-21), the RBI slashed interest rates to revive the economy. This led to a strong rebound in leasing demand, particularly for Grade A commercial spaces in cities like Mumbai and Bengaluru. Indian REITs saw healthy occupancy rates and rental escalations during this period.

However, as interest rates increased in 2022-23, businesses became cautious, slowing down new leasing activity. Rental growth stalled, impacting REIT revenues and stock prices.

This connection between interest rates and tenant demand is why REIT investors closely track economic cycles and RBI’s monetary policy.

Conclusion

Interest rates play a crucial role in shaping REIT performance, but smart investors know that reacting impulsively to rate changes isn’t the best strategy. Instead, it’s important to understand when to buy, when to hold, and when to reassess your investment.

When to Buy REITs?

- During high-interest rate periods, REIT prices often correct due to rising borrowing costs and weaker investor sentiment. But this can create a buying opportunity for long-term investors.

- If you believe that interest rates will eventually come down, accumulating REIT units at lower prices can be a smart move.

- Look for REITs with strong occupancy rates, long-term lease contracts, and high-quality tenants. Such REITs tend to be more resilient.

When not to Buy REITs?

Interest rates have a direct impact on REIT prices. It makes some periods less favorable for new investments. Here’s when you should be cautious about buying REITs.

- When RBI keeps interest rates at all time low levels, REITs tend to trade at high valuations because borrowing is cheap and demand for yield-based assets increases.

For investors who want stable passive income and long-term wealth creation, REITs remain a solid asset class. The key is buy when valuations are attractive and hold through market cycles.

Instead of reacting to interest rate noise, focus on quality REITs with strong fundamentals. They are more likely to deliver consistent returns over time.

Have a happy investing.